[Note: Subsequent to the Reliance Future-Group deal, the company has been in a legal battle with Amazon. This legal controversy has severely hampered the long-term prospects of Future Group. The below article was written before Amazon intervened and changed the whole scenario.]

Reliance retail and future group company entered into a deal on 29 August 2020. As per the deal reliance Retail (RRVL) has acquired the retail, wholesale, logistics and warehousing business of the future group.

A lot has been written about this deal in the past. But mostly they highlight the RRVL side of the deal. In this article we will focus on the future group side of the deal. What do I mean?

What should the existing and potential shareholders of future group companies should do after the deal. At the current times, is the future group shares worth buying or holding?

To answer this question it is first important to understand two things. First, what are the businesses associated with future group companies, and what is left with future group after the deal is executed. Second, we must also know the details of the deal.

Once we can understand these two important things we would be in a position to comprehend if future group shares are worth holding or quitting.

Future Group Business (Before Deal)

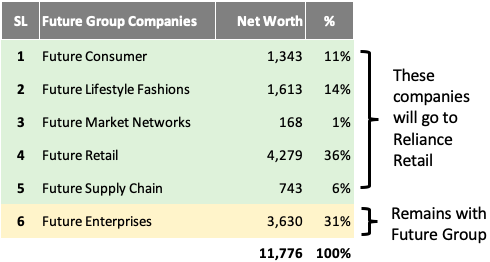

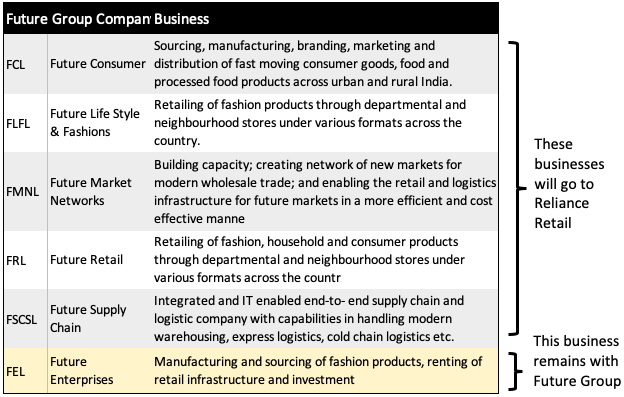

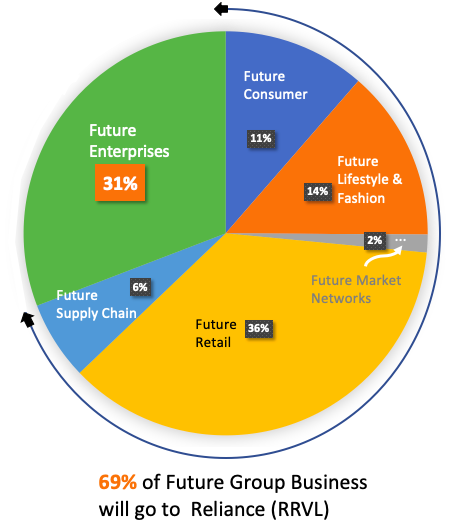

Generally speaking the whole business of future group can be divided into six categories / companies. Out of these six companies, five will go to reliance retail (RRVL) as a part of the deal. It is only future Enterprises which will remain with the future group.

We can see that as per the reliance future group deal, future group has sold approximately 69% of its business to RRVL. That means, what remains in the hands of future group is only 31% of its current business. Description of business which is going to Reliance (RRVL) is shown below:

Hence it is only fair on the part of the investors to question that whether they should hold on to the shares of future group or sell it away?

To understand what an existing shareholders should do with their future group shares we will have to get into the details of the deal.

The Deal (For Future Group Investors)

It’s a detailed and a complicated deal. But I believe the deal is complicated to understand for investors of Reliance (RRVL). For future group investors the deal is fairly simple. Out of six major group companies, only Future Enterprises Ltd (FEL) will remain in the books of Future Group.

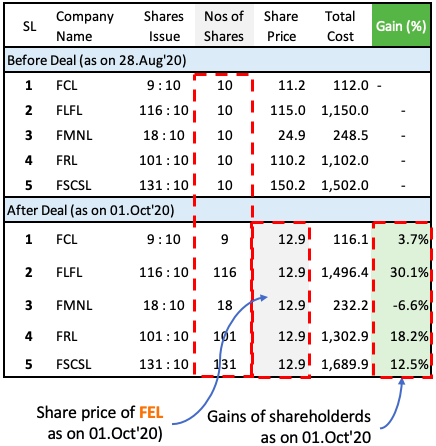

For future group shareholders it is important to understand that how this transition will take place. In the first stage, all Future Group companies will merge into Future Enterprises (FEL). Let’s see how the merger will be done.

Step #1: Merger

- FCL (Future Consumer): Shareholders of this company will get 9 shares of Future Enterprises Ltd (FEL) for every 10 shares held by them.

- FLFL (Future Lifestyle): Shareholders of this company will get 116 shares of FEL for every 10 shares held by them.

- FMNL (Future Market): Shareholders of this company will get 18 shares of FEL for every 10 shares held by them.

- FRL (Future Retail): Shareholders of this company will get 101 shares of FEL for every 10 shares held by them.

- FSCSL (Future Supply Chain): Shareholders of this company will get 131 shares of FEL for every 10 shares held by them.

What does it mean for the shareholders? Let’s see its mathematics:

Let’s understand it using a hypothetical example. Suppose there is an investor who holds 10 nos shares of Future Retail Ltd. (FRL). He purchased his shares on 28.Aug’20 citing news of take-over by Reliance. He bought shares at a price of Rs.110.2 per share. Hence his total investment was Rs.1,102.

After the merger of FRL with Future Enterprises (FEL), his 10 nos shares became 101 nos (101:10 share issued – see here). What does it mean? It means that he now own 101 nos shares of FEL.

As on 01.Oct’20, each share of FEL was priced at Rs.12.9 per share. It means, the value of 101 nos shares will be Rs.1,302.9 (101 x 12.9). This is a gain of 18.2%.

So, even before FRL becomes FEL. Even before Reliance (RRVL) takes over Future Retail, just because of the deal, the investor of Future Retail has already made a gain of 18.2%.

Please Note that, the calculation of 18.2% was done based on current price of FEL @Rs.12.9 per share. if This price goes up, gain percentage will also go up.

So now the bigger question is, will the price of FEL go up in future? Considering that Future Group has sold its’s 69% business to Reliance (RRVL), why FEL price will go up?

To answer this question, we will have to first understand the Step #2 & step #3 of the deal

Step #2: Cash Flow

On the face of it. Future Group is selling about 69% of its business to Reliance (RRVL). In terms of volumes, the size of Future Group will go down as indicated in the below infographics. What will remain is only about 31%.

But what is this 31%? It’s what will remain and be called as Future Enterprises Ltd. (FEL). For sure, FEL is losing 69% business, but what FEL will gain from the deal? Immediate gain will be two folds – cash-in flow and debt reduction. Long term gain will be “future business growth” – which we will see in step #3.

Cash-in Flow

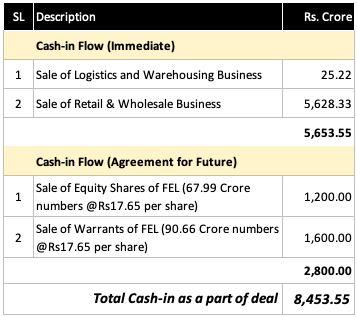

As Future Group is selling its business to Reliance (RRVL), it will earn some cash from the deal. The cash earning will be in tune of Rs.8,453 Crore. The break-up of this cash flow is shown below:

What FEL will do with this cash? For a company of the size of FEL, immediate working capital of Rs.5,653 Crore may prove extremely beneficial.

This amount of cash can take care of the company’s present and future (say for next 6 months) current liabilities. This will be a big push to bring back the operation live and running post COVID (read step #3).

[P.Note: We must also not forget that RRVL is also likely to buy shares and Warrants of FEL worth Rs.2,800 crore. This fund will also provide good liquidity to the company. But on downside, it will also increase the number of shares outstanding of FEL, thereby diluting its earnings per share (EPS).]

Debt Reduction

Total declared value of the deal is Rs.24,713 Crore. This value has been declared in the press release of RIL.

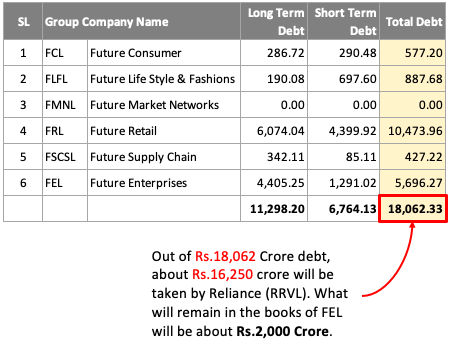

But the cash-in flow shown above is only for Rs.8,453.55 Crore. The balance is about Rs.16,250 Crore (Rs.24,713 – Rs.8,453). So what happens to this Rs.16,250 crore?

I’m assuming that the this money will not be paid in cash to Future Group (FEL). Instead, Reliance Retail (RRVL) will take-over the debt of equivalent value in its balance sheet from Future Group.

I’ve checked the current debt balance of the future group companies, and the values are as shown below:

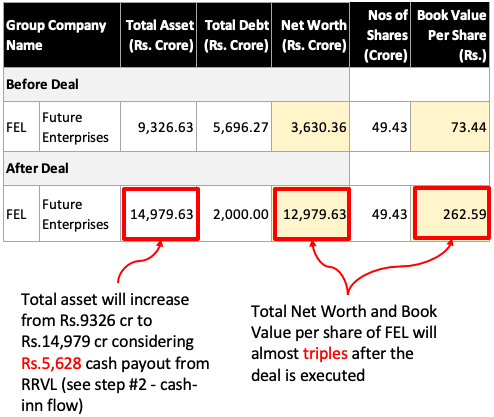

Looking at this data, we can say that Reliance Retail (RRVL) is taking over five businesses of Future Group along with is total debt obligation. Moreover, the the deal will also help FEL to reduce its debt from Rs.5,696 crore to about Rs.2,000 crore.

This debt reduction will benefit FEL in terms of improvement of its Net Worth. After the deal is executed, net worth of FEL is likely to triple. Please see the comparison between current and after-deal scenario shown below.

So with my limited understanding of the business, I’m assuming that share of FEL will see a similar price appreciation in times to come.

But this is not all. I feel that there is more juice to Future Enterprise Limited (FEL) than its mere enhancement of Net Worth. This is opposed to the popular perception that, after Big Bazaar, FBB, Foodhall etc will move out of Future Group, the business of Future Group is almost dead.

For sure, the Kishore Biyani’s favourite creation was Retail, which is now in hands of Reliance (RRVL). But what remains with FEL has potential of future growth. Let’s discuss this in Step #3.

Step #3: Future Growth of FEL

After retail, wholesale, logistics, and warehousing business moves out of Future Group, the core business of FEL will be as follows.

FMCG

FEL has facility to develop and manufacture FMCG products. Their products include brands like Golden Harvest, Tasty Treat, Karmiq, Voom, Desi Atta, Think Skin, kara etc. FEL has its in-house Food Park in Tumkur where it can do its food manufacturing & processing.

Currently these products are sold by Future Group in existing network of 1,650 stores (Big Bazaar, Easy Day, Aadhaar & Nilgiris) across India. As per the Reliance Future Group deal, FEL can continue to sell its products in these spaces. Moreover, their products will also find place in Reliance Stores as well.

The biggest potential is Digital Distribution of products through Jio Mart Platforms. But for sure, only time will prove this fact.

Apparels

FEL has a strong sourcing, in-house manufacturing, third-party manufacturing capability of garments.

Currently their branded apparels are sold in FBB, Central, and Brand Factory stores. These three stores are now going to Reliance (RRVL), but FEL’s apparels can still be sold in these stores. Moreover, FEL’s products will also find shelves in Reliance Trend’s stores.

Insurance:

Future Group operates in Insurance market through its JV with Generali Group. In Indian market, they operate as “Future Generali”. They provide both General Insurance (Motor, Health, Travel etc) and Life Insurance.

Considering India being a very insurance starved country, future growth prospects of FEL through its Insurance vertical looks promising.

Cons of the deal which FEL investors should note

FEL’s distribution and selling is now completely dependent on Reliance (RRVL) stores. This is at least true for the first few years of operation (post-deal). Till FEL builds its own distribution and sales network, it’s dependency on Reliance Retail (RRVL) for its majority sales looks risky.

It will not be wrong to say that, if Reliance (RRVL) wants to play tough, FEL will have to dance to their whims and fancies.

But I’m assuming that, the details of the deal might be taking care of this potential danger as well. We should not forget that Kishore Biyani is also a proven business man.

Conclusion

If things goes as planned by Kishore Biyani, I think FEL has a potential to become the next small multibagger. Give it at least 3-5 years, and FEL can churn out good value for its stakeholders.

Having said that, investors should also question the current situation of Future Group companies. Why it had to sign a deal with Reliance (RRVL) wherein it is selling almost 69% of its business.

This situation has come because Future Group Companies had too much debt. How such huge debts accumulated? Probably because they went too aggressive with their expansion plans.

In this situation (high debt burden), COVID-19 happened in India in Feb/Mar’20. The cash flow stopped and Future Group started faltering debt payments. Probably, Kishore Biyani found best to take this step, rather than dragging the company till bankruptcy.

Now, after the deal, Future group can actually see clear skies in times to come. It is still a long way to go, but I feel Kishore Biyani’s fans (investors) would stick with him.

In your BEFORE and AFTER deal table, you need to consider the increased number of FEL shares, since various subsidiaries will be given comparative ratio FEL shares in the merger.., So the Book value per share will also change.

HI Manish

I clearly understand the deal after reading ur article.Thanks

I just have one doubt,please clarify,

is it really worth FEL RS.17/- per share post merger?.So many in social media saying 24 times dilution

Greetings Mr Manish !!

In the comparison between current and after-deal scenario you have mentioned the total no of shares as 49.43 crores .. I understand that the number of shares will increase and the net value will be lesser .. I do not have the actual calculations as the number of shares shown on diff portal are different . I would like to understand from your side how much exactly will be the total number of shares and the valuation of FEL ??

Dear Manish Bhai, I just have one word to say – Excellent. God Bless you.

Tow points, Investors should keep in mind

1- If Current FEL Price ~10 Then After a Deal It will be around – @17.65, So around 70% Gain in one year the most, It may take to complete the deal if so happen. Secondly, on top of that Swap Ratios will give additional Gain say 40-50% once all clear. The stk price will go up very fast.

2- After dilution / increasing the Share Nos, The base price will be around @8

3- So those who have patience and eagles eye can gain alot.

Regards Nitin Jain

Dear MANI[sh],

Please confirm if we can still buy these group stocks & get said additional allocation of FE share when deal is finally executed?

Brilliantly written article, since the deal is now on hold & prejudice due to Amazon plea. Can you still buy these group stocks & get said additional allocation of FE share when deal is finally executed?

Why dilution in fel is missed out? If all the subsidiaries are merging into fel .. in vestors of subsidiaries will be issued new fel shares right? How much dilution is going to happen?

Really liked the way effort was put in the analysis to make readers understand in a simple manner. However second what Roopa mentions that post merger there will be a dilution which is not considered. No of shares will increase from 49.63 to ~1237cr(Incl reliance stake of 13%) which will drop the book value per share to ~8rs per share.

Terrific analysis. Easy to read and understand. Thank you.

Thanks a lot for such an awesome article….I was always confused about the deal but you cleared my doubts

Good evening Mr. Mani(sh),

Now that Amazon has initiated a legal proceedings, do you still feel and advise investing in Future would be beneficial?

Amazon’s step was unexpected. But I think it will be handled adequately by the legal team.

By the way, I just share my views on my blogs. None of it shall be taken as investment advice (disclaimer)

Good afternoon Mr. Mani(sh)

Yes, I do understand that it is your views and not an investment advice.

Keep up the good work. God Bless.

Brother, All you have mentioned is really good… But you have added FCL as assets under sale to RRVL…FCL though merged with FEL…but none of FCL assets or business of FCL is sold to RRVL

It is still work-in-progress. After the court’s final rulings, the deal (mergers and acquisitions) will get executed.

Hi Sir, Thankyou for the analysis, I just have 1 question in mind- suppose today i buy flfl shares then still i am eligible to get fel shares means is there any deadline or no?

There is no reason why new investors will not be eligible for FEL shares upon merger.

Good evening Mr. Manish,

Excellent and detailed write up. Please keep up the good work.

Thanks

Hi Mani,

This article is very clear and provides lot of information on the merger deal.

Few clarifications needed:

1. Suppose an investor holds 10 FLFL shares, which translates to 116 FEL. But is this applicable for shares bought as on before the RIL and Future deal of August 28 or Applicable for shares purchased after Aug 28, September?

2. After the conversion of FLFL shares to FEL shares, does the investor has to sell it as FEL in market or RIL will swap shares with FEL? Eg: 1 RIL share for 200 FEL shares, since the FLFL is part of RRVL business now ?

FLFL will become FEL after the Merger