Book value of shares gives us a ‘rough idea’ about the stock’s ‘true value‘ (Book value & other details of top Indian stocks).

What is true value? True value is that price of a stock, which an investor must pay to buy it.

But why book value gives only a rough idea?

Because it considers only shareholders equity’s weight in estimation of true value.

In actual scenarios, there are several other positive and negative factors influencing a stock’s true value.

In this article, let’s see all aspects of book value of shares from perspective of a stock investor.

What all we will see:

- 1. What is book value of a company?

- 2. How to calculate book value of shares in India?

- 3. Significance of book value per share for investors.

- 4. Book value per share formula.

- 5. Factors effecting book value.

- 6. Price to book value ratio.

- 8. Forecasting from book value.

- 9. Impact of ROE on P/B ratio of stock.

- 10. Digging deeper into book value.

1. What is book value of a company?

There are two ways of understanding ‘what is book value’. Let’s see it from two different perspectives:

- Source of Fund: Book value is a source of money using which company’s can buy assets. These assets in turn produce goods and services for the company.

- Net Assets: Book value can also be called as ‘net asset’ of a company. What is net asset? Value of ‘total assets’ of the company minus its ‘long term debt’ is the net asset of the company. Read more about Net Current Asst value of shares.

2. How to calculate book value of shares in India?

Open the balance sheet of the company (or check it in moneycontrol).

The networth indicated in the balance sheet is the ‘book value’.

If you would like to do the calculation yourself, add the Equity share capital and Reserves indicated in the balance sheet [(BV = SC + R) – see above].

You can also calculate book value by deducting total long term debt from companies total assets. Read more about debt free companies.

This also can be done by using moneycontrol’s balance sheet report. Check the below figure for the working calculation.

3. Significance of book value for investors

There are two type of investors who are looking at the book value. First type are those investors, who has already bought its shares (existing investors).

Second type are those investors, who are going to buy its shares in future (prospective investors).

Lets see the significance of book value for both these investors:

- Existing Investors: Suppose there is a company whose total assets are worth $10 million. The company also owes a debt of $3 million. For this company, its book value is $7 million. If this company goes bankrupt and is liquidated, $7 million will be proportionately distributed among the existing shareholders. Read more about stock which value investors avoid.

- Prospective Investors: For prospective investors, book value alone means nothing. Hence, they compare the book value with its market value (market capitalisation). If the ratio of ‘market value’ and ‘book value’ is below 1.5, it is a hint of undervaluation (good buy). We will read more about it when we will discuss P/B ratio below.

4. Book value per share formula

It is easier to use ‘book value’ of shares when we convert it to “book value per share”.

How to do it?

You can use this simple formula to calculate book value per share.

5. Factors effecting book value

Book value of a company is a dynamic number.

It can both increase and decrease depending on the type of performance and decisions made by the company.

Let’s see few factors:

- Net Profit: Whenever the company makes a net profit, it will increase the book value. How? Because the net profit of the company gets transferred from company’s profit and loss accounts to its balance sheet. The profit so transferred gets added to the company’s ‘reserves’. Read more: detailed analysis of profit margin.

- Net Loss: When a company makes a loss, it means, ‘net profit’ is in negative. Hence, when the same is transferred to the balance sheet, the reserves is reduced. This eventually lowers the book value. Read more: Reduce loss by diversification.

- Dividend: The dividends are paid to the shareholders from the company’s reserves (book value). Hence, every time the dividend is paid, book value is reduced. Read more about dividend paying stocks.

- Shares Buyback: There are times when the company decides to buyback its own shares from the market. The money used to buy its shares are adjusted in accounts by reducing the company’s “reserves” (book value). Read more about share buyback.

6. Price to book value ratio.

I’ve come across people who asked me questions about book value like:

What is a good book value per share?

What is high book value per share?

Book value on its own says very less about the stock. But if the book value is made to combine with its market price, it starts to make more sense. How?

The ratio of ‘price’ and ‘book value per share’ gives us one of the most utilised financial ratio related to stock investing. Read more about value traps in stock investing.

We better know it as P/B ratio (price to book value ratio).

How an investor can use P/B ratio to check-out good stocks?

As per legendary value investor Benjamin Graham, if P/B ratio goes beyond 1.5, means the stock is becoming overvalued. Why 1.5 is crucial?

Because according to Ben Graham, if an investor pays about 1.5 times of book value, to buy shares, chances of making a loss comes down drastically.

This is one way of investing within the margin of safety – MOS (this is a very simplistic example of MOS). Read more about margin of safety.

7. Forecasting from book value

What we are trying to forecast here? Future performance of a stock.

Lets see how to use book value for this purpose?

Suppose a company X has book value per share as Rs.1 in year 2003.

By year 2013 its book value has appreciated to Rs.6. This is a CAGR of 20% per annum in 10 years. Check stocks of fastest growing companies.

Generally, the market price of shares, grow at a similar rate as its book value per share.

[P.Note: Here we are talking about ‘book value per share’ and not ‘book value’]

Hence tracking book value per share growth (like EPS growth), is a very reliable indicator for predicting future performance of a stock’s price. Read more about why stock price fluctuate.

Caveat

Book value per share growth is a reliable tool to forecast future performance. But it is also important to buy stocks at correct valuations.

What does it mean?

If a stock is bought at overvalued price levels, its price growth may not match its book value per share growth rate.

Hence, the rule of thumb of buying stocks at a price of 1.5 times book value is a necessary rule to follow.

But these days, good shares are hard to get at P/B multiple of 1.5. What to do? Look beyond “PB1.5” rule. How?

Compare the stock with its peers (stock of same sector/business). What to compare? Their P/B multiple.

Example: “Mahanagar Gas”. I found that its P/B ratio is 3.27. This was too high. Hence I decided to compare Mahanagar Gas stock with its competitors.

The result was as below:

Upon comparison, I could see that though Mahanagar Gas had a high P/B multiple, but still compared to its competitors, its prices looks reasonable.

How? Because P/B ratio of other stock are even higher (except for ONGC).

8. Impact of ROE on P/B ratio of stock.

There are some stocks which consistently trade at high P/B ratios, and some trade at low P/B ratios.

What is the cause of this differential treatment by the investors?

What is the differential treatment?

Investors are still buying one stock irrespective of their high P/B ratio, while they are not doing the same for other stocks.

Let’s understand this using an example.

There are two stocks operating in the same sector. One stock B has P/B ratio of 1.32, while stock A has P/B of 8.26.

Why people are not buying B even though it’s P/B is so low?

Why people are buying A even though it’s P/B is so high?

The answer to these questions lies in the ability of the company to make MORE profits.

How to know about this ability of the company? ROE. Read more about how to calculate ROE.

Return on Equity (ROE)

Higher is the ROE, more will be the tendency for the stock price to go higher – making its P/B ratio also high. Why?

Because high ROE stocks has more demand in the market. Why? Because high ROE means – the business is very profitable.

Example:

- TCS: It has a ROE of 36.2%. What does it mean? It means that, every Rupee of TCS’s ‘book value’ is generating 36.2% net profit.

- FIRSTSOURCE: It has a ROE of 15%. It means that, every Rupee of Firstsource’s ‘book value’ is generating 15% net profit.

Because TCS’s equity base is generating more profits (per Rupee) than Firstsouce, hence TCS’s stocks can trade at high P/B multiples and still be in demand.

Point is, market loves profitable companies. Hence they get applauded in terms of high P/B, P/E etc multiples.

Read more about ROE and ROCE – How to use them for stock valuation.

9. Digging deeper into book value

It is not enough to buy stocks of a company just because its P/B ratio is low.

At such point of time, it is essential to ask more questions before tagging the stock as a good buy.

One such question is related to ROE (discussed in #9 above).

Other questions that must be asked are related to the following:

- Manufacturing Companies: They have a very asset intensive business. For them the higher is the book value, more profits it will make (higher ROE & ROA). But assets of such companies (machinery) also depreciates with time. Though they are producing, but still after a time-span their value becomes lower (book value falls). In such case, P/B of such companies may become high. But this does not necessarily means that the company is overvalued.

- Banks: Major assets of banks are like deposits, loans, investments etc. Such assets are “Rupee” based assets, hence they do not depreciate with time. This is why, you will often find that P/B ratio of such stocks consistently trade at moderate levels (compared to manufacturing companies). Hence, comparing these two companies for its book value is not fair.

- Visualising Book Value: As a stock investor, it is always better to visualise book value as ‘net asset’ (asset minus debt). Why? Because higher will be the net asset (book value), more profits the company can generate. Read more about how company’s use retained earnings.

- Use of Earnings: How the company is using its earnings? If a company pays all its net earnings as dividends, shareholders will be immediately happy. But some company’s retain its earnings. They use this money to grow its “net assets”. The asset growth in turn, generates more income – which ultimately benefits shareholders in long term. How? In form of FAST market price appreciation over time. Read more about Free Cash Flow and use of Capex.

Conclusion

Judging stock’s true value based on its book value is a common practice. How people do it? By use of price to book value ratio (P/B).

But it is also important to note that a stock’s true value is built upon several other metrics.

Hence, if one try’s to estimate true value based on book value alone, it can lead to erroneous result.

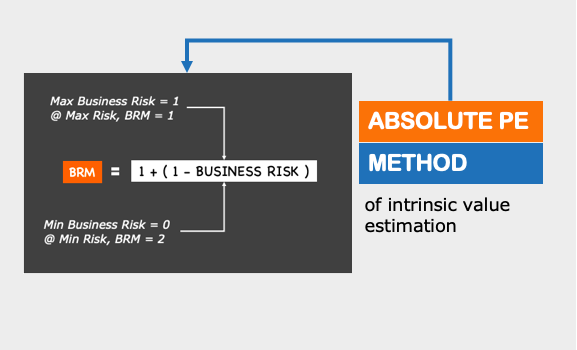

What is the alternative? The best option is to estimate intrinsic value of stocks, instead of relying only on book value.

But if one does not want to go into the complication of intrinsic value calculations, using the above discussed 9 points can help.

These 9 concepts gives enough clarity to decipher book value in enough detail, so as to estimate true value of stock with reasonable clarity.

Indian Stocks with highest book value

(Updated as on 22-July-2019)

- BV: Book Value in Rs.Crore.

- BVPS: Book Value Per Share (Rs.)

- P/B: Price to Book Value Per Share Ratio.

- BVG(5Y): Book Value Growth in Last 5 Years.

- ROE: Return on Equity (%)

| SL | Stocks | BV | BVPS | ROE (%) |

| 16 | Tata Motors | 60,179.56 | 209.26 | -37.19 |

| 17 | ITC | 59,140.87 | 46.58 | 23.80 |

| 18 | Kotak Mahindra Bank | 58,281.80 | 302.20 | 13.15 |

| 19 | Grasim | 57,361.85 | 846.11 | 9.97 |

Check book value per share details of more stocks here