The question, how to build ten crores by investment is vague. It only talks about the end goal. But how to reach there? That is what we will answer in this article. Also Read: How to become rich.

Before we can answer the question, we will have to ask a few more questions to remove the vagueness. The next important question that must be asked is, how much is the person’s investment capacity?

Suppose we are talking about a middle-class person whose monthly income is Rs.1,00,000. At the rate of 10% savings, the person’s investment capacity will be Rs.10,000 per month.

We will need to ask another question before answering how to build ten crores. The next question is, how much time one has to build 10 crores? Considering that the amount is big, let’s take a longer time horizon of 25 years.

Further Reading: How to build wealth in 30s

The Investment Plan

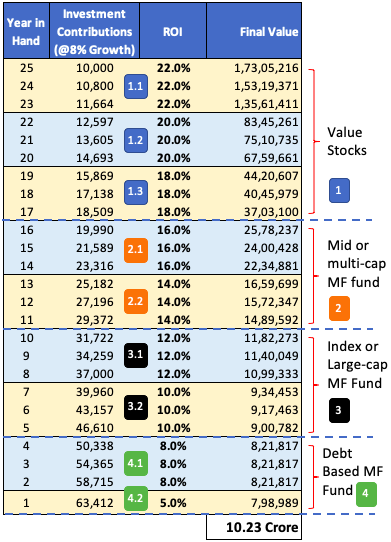

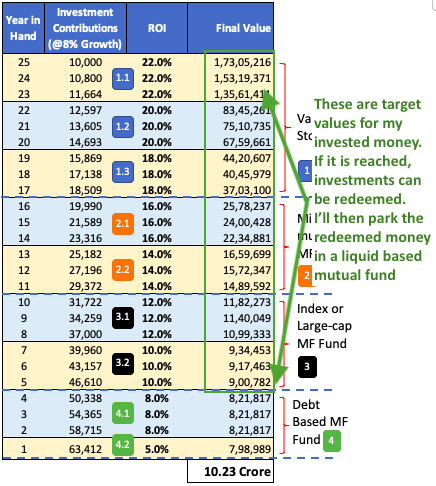

I’ll also like to add a ‘growth factor’ to our investment plan. Let’s fix a nominal growth rate of 8% p.a for the investment contributions. With these details known, a summary of our investment plan looks like this (see below):

What is the plan? A person whose present income is Rs.1.0 Lakhs/month will divert 10% of it (Rs.10,000/month) towards investments. Moreover, The investment contributions will grow at a rate of 8% per annum.

The time horizon in hand is 25 years. It means, during this period, the value of the investment must grow to become Rs.10 Crore.

How to Build Ten Crores in 25 Years?

What you can see above is detailed planning of how to build ten crores in 25 years. The whole planning has been segregated into four stages. Within each stage, there are substages.

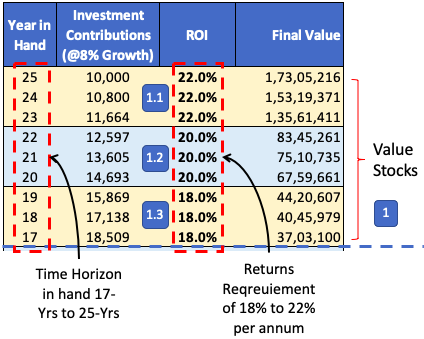

- #1 Stage: This is a critical stage. Why? Because return expectation in this stage is the maximum (between 18% to 22% p.a.). Hence care must be taken while picking the investment vehicle. For middle-class people like us, the best way to earn such high returns will be value stocks. We’ll discuss it later in this article.

- #2 Stage: From this stage onwards, we have the liberty to go with mutual funds. No need to take the risk of picking individual stocks ourselves. Why? Because the return expectations are not so high. Expected returns are between 14% to 16% per annum. Read more…

- #3 Stage: With the return requirement falling with time, we need not take higher risks. At this stage, we can afford the safety net of index funds and large-cap funds. These options can render returns of 10% to 12% per annum. Read more…

- #4 Stage: Here, returns of 5% to 8% per annum will be enough. Investing in debt-based funds or bank deposits will suffice the requirements. As time in hand is not large, the invested money requires minimum risk exposure. Read more…

Allow me to explain each stage in more detail. It will give us a feel about it and how to handle them as it comes.

#1 Stage – Picking Value Stocks

Someone might ask how wise it is to expect a return of 18% to 22% from stock investing? I agree that the return expectations are on the higher side. But I’ve taken this liberty only because the available time horizon is 17 to 25 years. In such extended time horizons, good stocks can give even higher returns. But critical is to find such stocks and stay invested in them for very long periods.

Suggested Reading: Effect of Bonus Shares & Stock Splits on Returns (see the video)

How I’ll pick such value stocks for myself?

Firstly, allow me to tell you where I look for my value stocks. It is especially true when I desire to hold a Stock for a very long time horizon (like 17 to 25 years). I will look inside the list of quality mid-cap stocks. I would pick those mid-caps Stocks having the potential to become mega large caps (RIL’s and TCS’s) of tomorrow.

Check for the ‘best stocks’ in my ‘stock screener.’ Use the sub-screener to filter-in the ‘Mid-Cap’ stocks. You can also get a ‘list of Mid Cap Stocks’ from here that I’ve downloaded from the AMFI website.

In this screener, I get my potential mid-cap stocks. They are stocks of profitable businesses. Also, maybe these Stocks are trading at attractive price levels (low P/E and low PEG).

Once I’ve my list of potential mid-cap stocks ready, I’ll use my stock analysis tool to do a fundamental analysis of the company. I’ll like to buy stocks of the most profitable and financially healthy companies trading at undervalued price levels. Read – Utility of Stock Analysis Worksheet.

Understanding The Numbers (Stage #1)

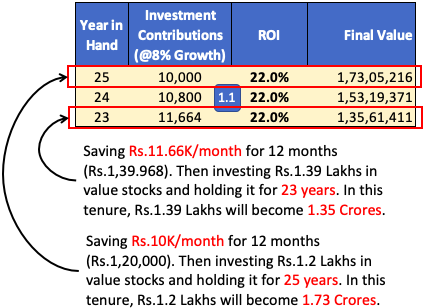

In Sub-Stage #1.1, I’ll first start saving Rs.10,000 per month. I’ll continue doing it for the next 12 months. This will help me to build a savings of Rs.1.2 Lakhs after the twelfth month. The money accumulated will be used to buy about 3 to 5 value stocks (as explained here). These stocks are then held for 25 years. In this time horizon, Rs.1.2 Lakhs will grow at 22% per annum to become Rs.1.73 Crore.

I’ll repeat the same step for all other holding periods 24 years, 23 years, 22 years, etc. In this stage, 80% of the total corpus (of Rs.10 Crore) will get executed. Hence, it is essential to pick value stocks diligently.

Read – How Warren Buffett Thinks About Stock Investing?

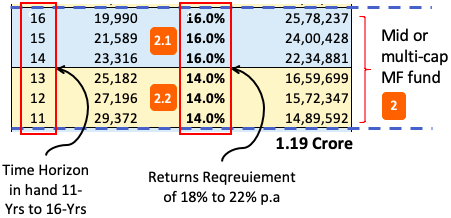

#2 Stage – Picking Mid Cap and Multi-Cap Mutual Funds

Stage #1 consisted of nine consecutive years of value stocks picking. It is not an easy task for common men. But it is also true that its potential-reward makes it worth an effort.

From Stage #2 onwards, the effort required to research investments considerably reduces. Why? Because in this stage, investments will happen within the ambit and protection of mutual funds. Here, I’ll no longer do extensive research. The Mutual Fund manager does it for me. I’ll only contribute my money to the pool.

What are the control points? Investing in mutual funds is easy, but it is also essential to follow a few rules. I’ve observed that these small rules help me to get fractionally more returns. Read more about compounding returns.

Rules

- No SIP: I’ll not go for SIP in mutual funds unless I need to keep my investments on autopilot. SIP is a useful tool if the person has no spare time to study investments. Read this article about SIP Returns.

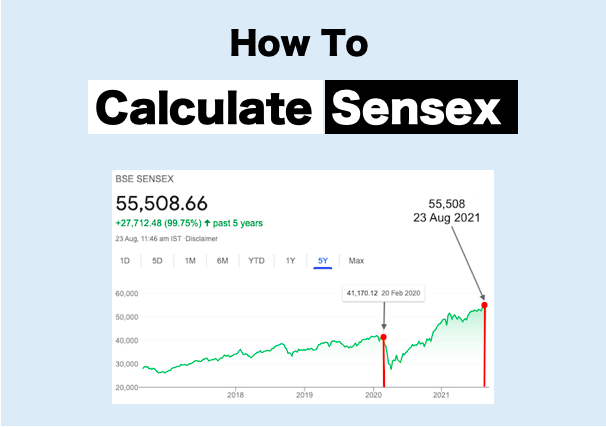

- Buying on dips: The stock market is never one-way traffic. It will go up for a period, and then it will correct itself. Buying mutual fund units during moments of correction is a good strategy. Whenever I see my benchmark index falling by more than 3% to 4%, I prefer to buy its mutual fund units.

- Star Rating and AUM: I’ll prefer to adopt a strategy of investing in mutual funds having a high star rating. Also, investing in mutual funds with high AUM (Asset Under Management) makes me feel safer. This is especially true because the investment holding time is long (11 to 16 years). Check this mutual fund screener.

- Benchmark Index: I would prefer investing in mutual funds following a benchmark index called “Nifty MidSmallcap 400“. I’m keeping my bets on mid and small-cap stocks. Why? Considering that the holding period is still long (11 to 16 years) and a safety net of mutual funds, relying on them sounds reasonable.

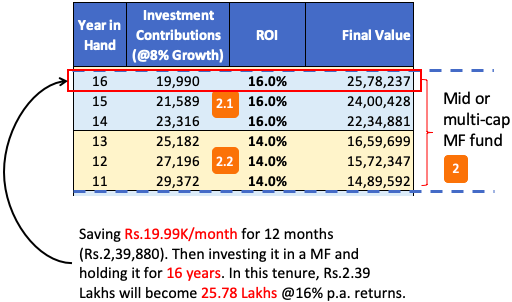

Understanding The Numbers (Stage #2)

In Sub-Stage #2.1, Start is done with savings of Rs.19,990 per month. Continue saving this amount for the next 12 months. This will help to build a savings of Rs.2.39 Lakhs. The money so accumulated is used to buy MF units (as explained here). Units are then held for 16 years. In this time horizon, Rs.2.39 Lakhs will grow at 16% per annum to become Rs.25.78 Lakhs.

I’ll repeat the same step for all other holding periods in Stage #2 (15, 14 years & others). In this stage itself, 12% of the total corpus (of Rs.10 Crore) will get executed.

Suggested Reading – Investing in direct plans of mutual funds will yield more returns.

#3 Stage – Picking Index Funds

Both stage #2 and #3 are very similar in terms of the rules of investing. But when one is investing in index funds that are imitating an index (it is not just a benchmark), the safety net becomes more robust. How?

Like a mutual fund portfolio, indices are also composed of a basket of stocks. But how the portfolio is built makes the difference. Suppose there is an index of NSE. Framing its composition is the responsibility of NSE. It is a more dependable body than a mutual fund manager.

Allow me to give you the historic returns generated by few indices of NSE.

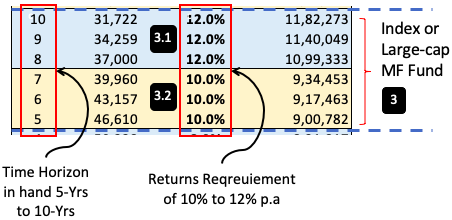

Please note that the available time horizon at hand in stage #3 is between 5 to 10 years. Also, the return expectation is between 10% to 12% per annum. In the Indian context, earning these returns within the time horizon of 5 to 7 years is possible.

I’ve done some study on indices of NSE. I would invest in either of the above mentioned six indices. For a time horizon as big as 5 to 10 years, an index like Nifty100 or Nifty200 would be my choice.

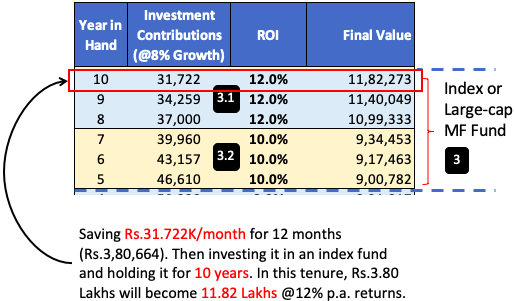

Understanding The Numbers (Stage #3)

In Sub-Stage #3.1, Starting is with a savings of Rs.31,722 per month and continuing to save this amount for the next 12 months. This will help to build a savings of Rs.3.80 Lakhs. The money so accumulated is used to buy units of index funds (as explained here). The units are then held for 10 years. In this time horizon, Rs.3.80 Lakhs will grow at 12% per annum to become Rs.11.82 Lakhs.

I’ll repeat the same step for all other holding periods in Stage #3 (9, 8, 7 years & others). In this stage, 6.1% of Rs.10 Crore will get executed.

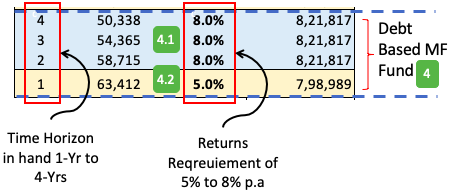

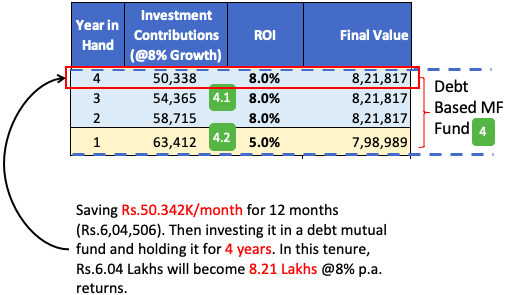

#4 Stage – Investing in Risk-Free Debt Mutual Funds

In this stage, the investment time horizon at hand is less than five years. Hence, I would like to keep my investment as risk-free as practically possible. Debt-based mutual funds (a hybrid of equity + debt) can work.

We must also remember that these four years is also the time of possible redemptions. How? Allow me to explain

In all the stages preceding to stage four, the money has been invested. Some of those monies are likely to reach their target values (final value) by the time it reached the stage four. Hence it can be redeemed. The money so redeemed will then be parked in a liquid fund.

Understanding The Numbers (Stage #4)

In Sub-Stage #4.1, Savings of Rs.50,338 per month will continue for 12 months (6.04 = 50.338 x 12). The total savings of Rs.6.04 Lakhs so accumulated is used to buy units of debt funds (as explained here) for 4 years. In this time horizon, Rs.6.04 Lakhs will become Rs.8.21 Lakhs at 8% per annum.

The same process is repeated for all other holding periods of this stage (3,2, and 1 years).

Conclusion

For a common man building a corpus of ten crores is a difficult task. It demands a systematic approach. Moreover, as the time horizon is very long, perseverance is a must on the part of an investor.

It must always be remembered that the heart of the whole plan is stage #1. Picking the right value stocks is most critical. Stage #1 is also the longest stage of all. It continues for nine years in a row.

In stage #2 and stage #3, we are mostly dealing with mutual funds. Compared to direct stocks, investing in mutual funds is comparatively less risky.

In stage #4, the focus is mostly on redemptions. The idea is to keep the redeemed money safe in liquid mutual funds.

I hope you will like the simple approach explained here. It is about how to build ten crores in 25 years. As you can see, it is a lengthy process. To keep the time horizon shorter, one can contribute more savings towards investments (especially in stage #1).

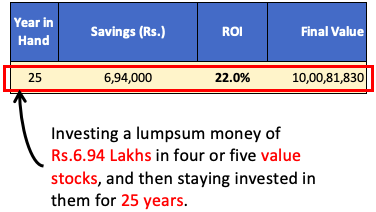

Quick Tip

There is also a comparatively less-cluttered approach about how to build ten crores in 25 years. How to do it? By investing in lump-sum. It will be a one-time investment (Rs.6.94 Lakhs) and then waiting to see the money grow for 25 years. Here, I’ve assumed that the money will grow at a rate of 22% per annum. This will take us to our target amount of Rs.10 Crores.

Redemption of huge amount at the end & investing in liquid funds . Isn’t RBI or state bonds better!

All calculation is speculative & depends past performance .

Commom Man , 22% CAGR serioulsy , even the richest man on planet gets 19-20% and this is when he reads 4 hours a day. Investing in stocks means sticking to your laptop screen , forget about your social life , watching Quaterly and Financial results , watching weekly news and still there is no gurantee that your shares will generate these kind of returns. Stick to small and Mid Cap MF , get 14-15% CAGR and live your life fully.

Picking few good companies at undervalued price levels and holding on to them for a very long time can also do the trick. No need for “sticking to one’s laptop screen”

1)Whenever I see my benchmark index falling by more than 3% to 4%, I prefer to buy its mutual fund units.

2)Benchmark Index: I would prefer investing in mutual funds following a benchmark index called “Nifty MidSmallcap 400“.

could you please elaborate on above two points.Do I need to manullay monitor on each day for the above two things.

What is the best way to invest by considering above two points.As of now I am investing in SIP mode on a monthly basis.

Do I need to monitor the Market on a daily basis to satisfy the points 1 and 2?Currently I have account with grow.

Hi Mani,

Thanks for sharing the wonderful article. is it possible to share an article to reduce the tax outgo? I know you have shared the article. however, it would better how much money should be allocated. For instance: Retirement products like EPF, NPS. Goal based products like mutual funds, corpus like index funds investing.

Thank you for the feedback. I’ll try to update my article on income tax soon.

Commendable effort, painstakingly compiled. You should charge for your articles itself,worth it !

Thank you

I like your article and approach which is considering real life problems. You said no to SIP route in Mutual fund option as you don’t want to put on auto pilot mode but i hear till date that SIP is best option as when the NAV drops you gets more unites and when NAV rise you get price appreciation which is a win-win situation then why Lumsum?

You are right. SIP benefits people by giving them the advantage of Rupee Cost Averaging. Check the link to know more about it. I’m sure you get my point about SIP vs lumpsum investing.

Thanks for posting your comment.

Your articles are amazing. I just have a curious counter question. If I have 10 years and need to make 10 crores by either of the methods, can u suggest the route and mode of investment and the amount. I can go upto 50K/month investment

I’ll suggest you to do the mathematics taking a clue from the calculations shown in this article.

By the way, investing Rs.50,000/month, in an investment plan which yields 16% per annum returns will build a corpus of about Rs.1.5 Crore in 10 years. Please check this mutual fund calculator for more iterations.