If you are in a dilemma about whether to invest or prepay the home loan using your spare cash, then you are not alone. This dilemma happens to a majority of people.

When people climb-up the income ladder, they begin to generate more free cash. If the focus is on improving one’s financial health, wise utilization of free cash is always a priority. How to use the cash wisely?

There are two ways of doing it. Either invest the free cash or use it to prepay the home loan (loan prepayment). But which alternative is better – investing or becoming debt free? The pick will vary from person to person.

The majority choose investment over paying off the loan. Why? For two reasons. First, a general understanding runs in favor of investment. It is one of the correct ways of handling money. Second, loan prepayment is something that is not as popular. Why? Because banks and the government want their people to stay in debt and, if possible, take more debt.

Are you surprised? Yes, this is the reality. Banks will hesitate to suggest you the option of loan prepayment. They will immediately recommend the alternative – investment. Why? Because banks do not want us to get out of our loans.

“Always carry some loan” – Banks & government want it this way…

The first hint of this reality comes when the government offers income tax benefits for people who carry the loan. The interest paid on home and education loans can be claimed as a tax deduction. Read: Why we pay tax?

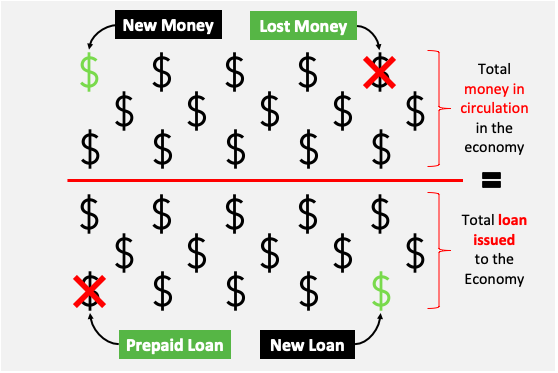

It is one way of incentivizing people to continue to remain in debt. They want us to carry some form of a loan or the other. Why? Because in the modern world, the creation of ‘new money’ happens whenever a bank issue a loan. Read more about a flawed banking system.

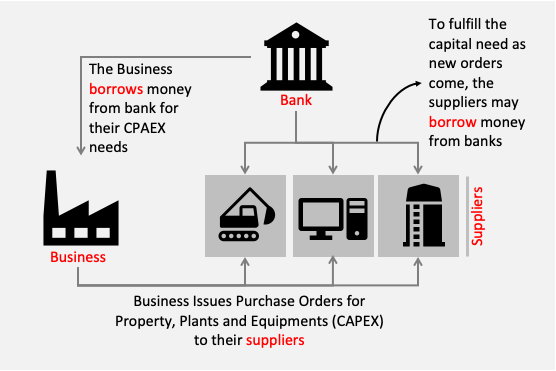

It further triggers a spending stimulus for others, resulting in higher Gross Domestic Product (GDP). How more spending gets triggered? Check the below infographics. It shows how a business borrowing loans can initiate a spending spree for its suppliers.

So we can see, when loans are issued, it creates money. So what will happen when we prepay our loans? It will deplete the money supply in the economy.

It means the total money in circulation in an economy is always equal to the total amount of loan issued to the business and individuals. If everybody makes their loan balance zero, there will be no money in the economy.

So in a way, when we prepay our loans, we in a way hamper our economy. But how? Think for a moment. How can a ‘good deed’ become a deterrent for the economy? That is why I believe that there is a flaw in our banking system.

The point is, do not be surprised when you meet people who will discourage your loan prepayment intentions. Those people are part of the flawed system. Just go ahead and do what is right for you (becoming debt-free).

Why people avail loans?

Allow me to explain why people or businesses avail loans? It will help us to see the problem of being debt-ridden also from a personal perspective.

There can be two broad reasons why loan is taken:

- Lack of liquidity: It especially happens in the case of businesses. In terms of their net profit numbers, they can afford the purchase, but the money is not liquid. It is stuck as account receivables. In such a case, the business opts for short term loans. It is acceptable.

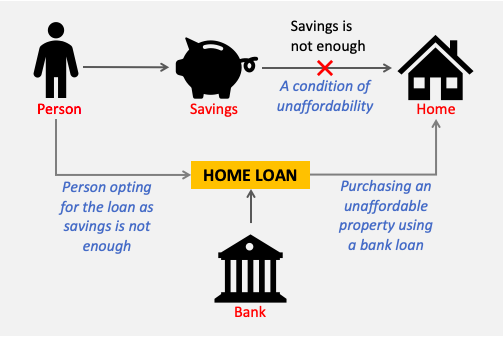

- Lack of affordability: It ultimately leads to overspending. It’s often the root cause of majority loan borrowings. It has become a new normal for people to buy things beyond their affordability simply because they can get a loan.

More generally speaking, people take loans to buy goods and services. But we do not take loans to buy everything. We take a loan to buy expensive items (like cars, property, higher education, vacation, among other things).

Expensive items are generally beyond the affordability of our savings. Why? Because we do not plan their purchase. More often than not, they happen as an ad hoc purchase. The result is, we make up for the deficit by taking a loan.

What are the risks of carrying a home loan?

Now we have understood two main reasons why people fall into the debt trap.

- First, our banks and government market bank-loan as a product which is good for people. They have a vested interest in doing so. Banks are keen on giving loans for a reason.

- Second, people also get lured into buying expensive things, using loans, which otherwise are unaffordable for them. It means, we personally are also responsible for falling into the debt trap. Our lack of psychological assertiveness is a big reason.

Even if we can ignore the hidden motive behind incentivizing loans and our psychological weakness, we cannot ignore the risk of being under debt. Let’s understand this using the example of a home loan.

The concept is simple. Home loans are risky because it has a claim on our income and also on our asset. How?

- Claim on Income: When we take a home loan, we must also sign an ECS mandate allowing the lender to auto-debit the EMI’s every month right from our salary account. Try not to sign the ECS mandate. Either you’ll face resistance or a hike in the offered interest rates.

- Claim on Asset: If one is not in a position to follow the EMI repayment schedule, banks have the right to put the mortgaged property on auction. The sale proceeds of the auction are used to clear the loan balance (with penalty). The balance amount (if any) is returned to the borrower.

Suggested Reading – What happens when one does not pay back the personal loan?

So you can see the risks? First, they will claim a part of your income. Then, if you are in a problem, they are able to sell your property even if you are not in favor of the sale.

Think of it. Why all of it is happening? Because you decided to go beyond your budget and buy an expensive house. If my affordability is Rs.25 Lakhs, I cant decide to buy Rs.100 lakhs property. Just because a bank is ready to issue a home loan, I cannot overspend. It is a grave mistake.

Loans are avoidable if we remain within the ambit of our affordability. But when everyone around us is using loans to make extravagant purchases, loans become tempting. At that time, try to follow a rule. Always buy the thing with at least 50% self contribution. Balance can be a loan.

Invest or prepay the home loan?

Loan Prepayment

Suppose one took a loan of Rs.60 Lakhs at 7% per annum for 20 years. The loan EMI will be Rs.46,518 to be paid each month. It means a total payment made by the borrower in 20 years will be Rs.1,11,64,305 (=46,518*20*12).

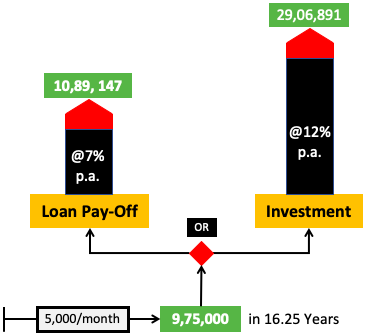

Now suppose, the person decided to make a prepayment of Rs.5,000 each month from the first month. This way, in the next 196 months (16.33 years), the loan balance will become zero.

In these 196 months, the person would have made a total prepayment of Rs.9,75,000. These prepayments would have affected an interest savings of Rs.10,89,147. Check this loan prepayment calculator.

Investment (SIP)

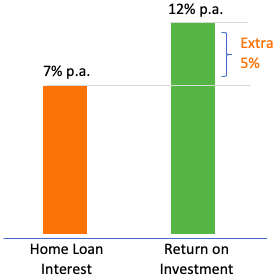

Consider the alternative. Instead of making prepayments, the person decided to invest Rs.5,000 per month in an equity mutual fund through SIPs for the next 16 years. Considering that the time horizon is so long, assuming a 12% p.a. return is reasonable. This way, the person will build a corpus of Rs.29,06,891.

On the other side, at the end of the 16th year, the loan outstanding will be about Rs.18 Lakhs. The person can make the prepayment from the accumulated corpus of Rs.29 lakhs. After becoming debt-free, the person would still have Rs.11 lakhs as savings.

Unique Goal – “Freedom From Debt”

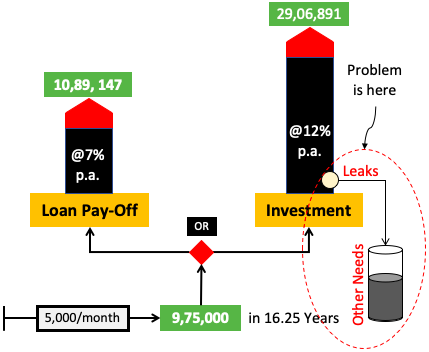

After reading the above two stories (prepayment versus investment), undoubtedly, investment looks like a better alternative. But is it the right conclusion? Yes, but it has some limitations. The limitation arises from the potential “leaks” that can happen in the investment portfolio.

There is a simple reason why I love loan prepayments. Every Rupee that I put in there gets locked forever. The monies made as a prepayment can never get reversed. The objective is met instantaneously as soon as the prepayment amount gets debited from my account. I love this certainty of reaching my goal.

On the other hand, my investment portfolio is also a rich source of inspiration. But its biggest drawback is the possibility of “leaks.” What do I mean by leaks? Digging into the corpus and withdrawing some or all of it for some other needs.

In this example, I was accumulating funds (through investment). The idea was to build a corpus for making a lump-sum prepayment. The bigger purpose was to become debt-free. In between, another priority became daunting, and hence I dug into my investments to meet the need.

As a result, neither I could become debt-free, not I had those Rs.29 Lakhs in my investment portfolio. Why it happened? Because of the leaks in the portfolio.

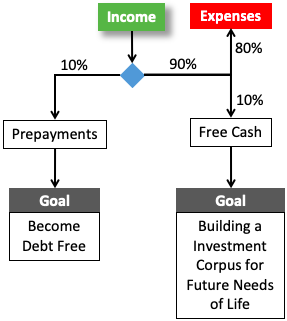

I’m sure many of you must have faced the same situation. What is the solution? Do both. How?

Do Both – Prepay Home Loan and also Invest

Yes, it is possible to do both. Though I will do differently for myself (becoming debt-free first). But in this investment frenzy world, proposing to my readers ‘not to invest’ might not sound-wise. So, the middle path is to do both. How to do it? The plan is shown below.

It is essential to keep the loan prepayment plan on Autopilot. Hence, always diverting at least 10% of income towards loan prepayment is ideal. Moreover, investing another 10% towards investment portfolio building will also keep the ball rolling.

Conclusion

So if you’ll ask me whether I’ll invest or prepay the home loan, I’ll opt for the latter. Check my Personal Finance Plan.

But for everyone, becoming loan free might not be such a big priority. What will be the right action for such people? They can do both – invest and also prepay the loan.

“Doing Both” is a simple understanding of what can be done with spare cash. But while doing it, the following must also be kept in mind about the concept of bank loans:

- Banks & Government want us to carry some loan – always. Why? Because these days, the issuance of new loans creates new money in the economy. More liquidity triggers spending, and hence GDP of the country grows.

- Why do people take loans? People take loans to suffice their lust for expensive items leading to overspending.

- Carrying loans (like a home loan) is risky. What is the risk? They have a claim on one’s income and also on the collateral.

Suggested Reading:

This blog is great check it out

Invest less and pay debt more should be the solution.

Explained very well about invest or Prepay The Home Loan

Thank you Mani for a very nice article. In 2011 I withdrew money Mutual funds to minimize the house loan borrowing from bank . I withdrew around 7 lakhs, may be it would have given me handsome yield if I had it for 10 years. However I now debt free but also my mutual funds are of zero holding now. However I would want accumulate quality stocks over the period of time.

Being debt-free is a great milestone to achieve. I’m sure, post the debt burden, the priority of investing gets its due importance.

Thank you for posting the comments.

Very nicely explained, cheers!

Keep doing the good work

Thank you

Dear Manish,

Excellent write up. Well explained and a wonderful solution according to the current situation.

Well done. Keep up the good work.

Appreciate if you could throw some light on the investment options and opportunities for the NRI’s returning to India.