During this Adani-Hindenburg saga, there is a concern that the LIC Investment portfolio is over-exposed to Adani Group company’s stocks. I think this concern looks misplaced. Out of the total capital of LIC, only 17% (INR 60.6 lakh crore) is invested in stocks. My estimate is that, out of these 60.6 Lakh crores, LIC’s exposure to Adani stocks is below 0.8% (less than 43,000 Crore). Read more on where LIC invests its money. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

Life Insurance Corporation of India (LIC) is a state-owned insurance company and the largest life insurance provider in India. As per the annual report of LIC for the financial year 2020-21, the company has invested its funds in various assets to generate returns and fulfill its policyholder obligations. In this write-up, we will uncover the LIC Investment Portfolio.

LIC’s investment portfolio is managed by its investment department. It is a team of experienced fund managers. The portfolio of LIC is well-diversified and consists of various asset classes, including government securities, shares, the infrastructure sector, real estate, etc.

In this article, we’ll start by exploring how LIC’s total funds are allocated. Then, we will also uncover how the investment portfolio of LIC is structured.

“LIC is known for its conservative investment approach and long-term holding strategy in the stock market.”

– Dhiraj Relli, Managing Director & CEO, HDFC Securities

So let’s start exploring the details:

#1. Total Capital Available With LIC

According to the annual report of LIC for March 2021, the total capital sourced by the company is a combination of equity and liabilities. The sources of capital are as follows:

- Shareholder’s funds: The shareholder’s funds include the company’s paid-up equity capital, statutory reserve, and other reserves that amounted to INR 6,98,324 lakhs.

- Borrowings: LIC also raises funds through borrowings, which include debentures, bonds, and term loans from banks and financial institutions. This amount is INR 366.5 lakhs.

- Policyholder’s funds: The policyholder’s funds represent the funds generated through the sale of insurance policies. This amount is approximately INR 37,39,41,422 lakhs.

Therefore, the total capital sourced by LIC as of March 31, 2021, is the sum of the shareholders’ equity, borrowings, and the policyholder’s funds. This total amounts to INR 37,46,40,446.83 lakhs.

You can see that 99.81% of the total capital is sourced from the policyholders. In this article, our main objective is to explore how the policyholder’s money is used by LIC.

#2. Usage of The Total Capital

As per the annual report of LIC for March 2021, out of the total sourced capital of Rs.37,46,40,446 lakhs, 93.4% is parked under the head “investments” and 0.9% under the head “assets held for linked liabilities” (which is also an investment).

It means, that 94.4% of the total capital of the LIC is parked as an investment. This is different from how capital is used by other companies (say manufacturing). The major portion of the capital of other companies gets locked under fixed and net current assets. But in the case of LIC, only about 2.8% is allocated under these two heads.

This is what makes the business model of insurance companies unique. This is also one reason why, we retail investors, can take learnings from how LIC’s portfolio is structured.

Investments – Shareholders & Policyholders

In the annual report of LIC (March 2021), in the balance sheet, under the application of funds, there are two line items called Investments Shareholders and Investments Policyholders.

- Investments Shareholders: It refers to the investments made by LIC using its shareholders’ funds. These investments are made with the goal of generating returns for the company and its shareholders. Out of the total investment portfolio size, only 0.01% (Rs.42,640 Lakhs) is allocated here.

- Investments Policyholders: It refers to the investments made by LIC using the funds collected from its policyholders. These investments are made with the goal of generating returns for the policyholders and fulfilling the obligations of the policies. Out of the total investment portfolio size, more than 99% (Rs.34,98,44,073 Lakhs) is allocated here.

Portfolio Policy

LIC’s investment policy is designed to ensure that the company’s investment portfolio is well-diversified and aligned with its investment objectives. The allocation of funds is based on the following parameters:

- Safety: LIC gives utmost importance to the safety of the invested capital. Hence, the company invests the majority of its funds in government securities and high-rated bonds.

- Liquidity: LIC also gives importance to the liquidity of its investments. The company invests in assets that can be easily liquidated in case of any emergency or need.

- Diversification: As the top priority of the LIC’s invested money is safety and liquidity, most of its money is parked in fixed-income assets. But it also makes sure to keep the portfolio well-diversified. It not only reduces the risk of concentration but also helps to keep the yield at acceptable levels.

- Long-term perspective: It is also essential for LIC to follow a long-term investment perspective. Hence, it invests in assets that have the potential to generate stable and consistent returns over the long term.

- Policyholder Obligations: We have seen that 99.81% of the total capital available with LIC is the policyholder’s money. Hence, its primary objective is to fulfill its policyholder obligations. The company uses its funds to fulfill the claims and pay out the maturity benefits of its policies. In FY 2020-21, the claim settlement (maturity & death) of LIC was INR 2,38,681 Crores (at a claim settlement ratio of about 97%).

#3. LIC Investment Portfolio

Here are some of the ways that LIC uses the money collected as premiums from the policyholders:

As we’ve seen in the usage of the capital section above, LIC has invested INR 35,31,84,209 Lakhs in various investment options.

- Out of this, 92.29% is distributed between government securities, shares, and the infrastructure sector.

- Moreover, 66.7% is invested alone in government securities like bonds and treasury bills.

- About 17.18% is invested in the shares of listed companies.

LIC Investment in Stock Market

Equity investments form a significant part of LIC’s investment portfolio. As per the annual report of 2020-21, LIC had invested INR 6,06,63,051 Lakhs in equity shares. The company invests in blue-chip companies with a long-term investment strategy.

A few stock holdings of LIC are listed below:

| SL | Name | LIC’s Holding in % | Market Cap (Rs.Cr.) | Portfolio Size (Rs.Cr.) | Portfolio Weight (%) |

| 1 | RELIANCE:[500325] | 6.53% | 1,580,947.38 | 103,235.86 | 19.93% |

| 2 | ITC:[500875] | 15.29% | 492,400.63 | 75,288.06 | 14.53% |

| 3 | TCS:[532540] | 4.41% | 1,175,745.65 | 51,850.38 | 10.01% |

| 4 | SBIN:{500112] | 8.75% | 474,519.58 | 41,520.46 | 8.01% |

| 5 | LT:[500510] | 12.50% | 323,330.31 | 40,416.29 | 7.80% |

| 6 | IDBI Bank:[500116] | 49.24% | 50,643.93 | 24,937.07 | 4.81% |

| 7 | HDFC:[500010] | 5.00% | 502,951.74 | 25,147.59 | 4.85% |

| 8 | ONGC:[500312] | 9.75% | 200,022.87 | 19,502.23 | 3.76% |

| 9 | BHARTIARTL:[532454] | 4.25% | 446,110.01 | 18,959.68 | 3.66% |

| 10 | COALINDIA:[533278] | 11.00% | 137,767.79 | 15,154.46 | 2.92% |

Check here for more stocks in LIC’s portfolio

Impact of LIC’s Investments on the Indian Capital Markets

LIC is one of the largest investors in the Indian capital markets and has a significant impact on the market. The company’s investment decisions can affect the prices of the assets it invests in. For instance, if LIC invests a large amount of money in a particular stock, it can push up the stock price. Similarly, if LIC decides to sell a significant amount of shares, it can lead to a decline in the stock price.

- Finance To Government: 96% of LIC shareholding is of the Government of India (GOI). Hence it is only logical that it should come in handy for the GOI. Its investment in government securities and bonds provides stability to the Indian capital markets. The company invests a significant portion of its funds in government securities and high-rated bonds, which helps in financing the government’s fiscal deficit. LIC’s investments also provide liquidity to the bond market and help in setting the benchmark yield for the bond market.

- Stock Market’s Confidence: As reported in the March 2021 annual report, about 60.2 Lakhs Crore worth of LIC’s capital is invested in the Indian stock market. Its investment in equities also has a positive impact on the Indian capital markets. The company’s investment in blue-chip companies helps in boosting investor confidence and liquidity in the stock market.

“LIC is a major player in the Indian stock market and its investment decisions have a significant impact on the market.”

– Rakesh Jhunjhunwala, Indian Investor

Conclusion

As a public sector insurer, LIC plays a significant role in promoting social and infrastructure spending in the country. As of March 2021, about 8.38% of the total capital of LIC was invested in various government schemes and bonds. These schemes were aimed at promoting infrastructure development and supporting social welfare programs.

The LIC investment portfolio is well-diversified and consists of various asset classes, including government securities, bonds, equities, and real estate. The company’s investment policy is designed to ensure that its investment portfolio is well-diversified and aligned with its investment objectives. LIC gives utmost importance to the safety of its investments, liquidity, yield, diversification, and long-term perspective.

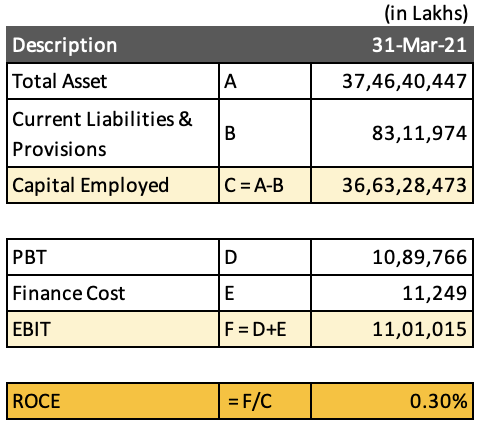

LIC uses its funds primarily to fulfill its policyholder obligations, pay out claims, and provide maturity benefits. In the March 2021 annual report, the company reported an “income from investment” of Rs.2.95 lakhs crore. LIC’s EBIT was 1.101 lakhs crore. At an employed capital of Rs.366.32 lakhs crore, the return on capital employed (ROCE) for LIC is about 0.3%. It is estimated that the Weighted Average Cost of Capital (WACC) of LIC is about 6%. Hence, a ROCE of 0.3% is too low. As an investor, I would personally avoid investing in such an unprofitable business.

Have a happy investing.

Please help me by leaving a comment below. It will help to get traction for my blog in the search engines.