A business that operates in an industry (sector) having fierce competition cannot display a competitive advantage. But a company dwelling as a monopoly (like Microsoft) will have an exceptional advantage.

So, a sector with too many competitors in it is not good for its companies.

As a customer, we would like to buy products of companies operating in a competitive sector. But as an investor, we would like to buy stocks of a monopoly-like business.

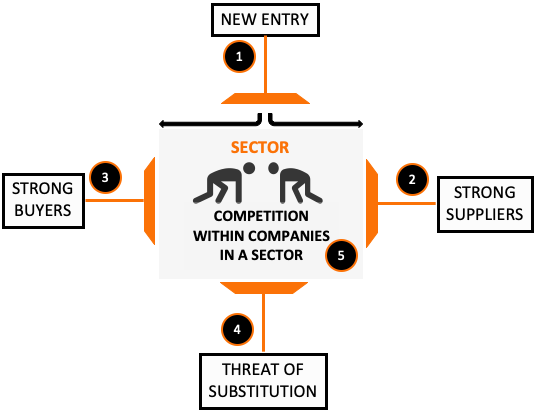

Finding a company with a monopoly is easier if we can first identify a sector that is not so competitive. How to do it? By using five rules as proposed by Harvard Business School professor Michael Porter. They are called Porter’s Five forces.

But before we know about Porter’s Five Forces, let’s understand what it means by competitive advantage.

What is Competitive Advantage?

It is a favorable position earned by a company. It is a position from where it can operate at an advantage over its competitors.

How the company earns the position? By building an economic moat for itself. What is the advantage? Such companies display profitability much higher than their cost of capital.

A company that can offer something unique to its customers gives it its first advantage. But it is also true that the offering must be scalable (sales growth). A combination of scalability and uniqueness provides the company a competitive advantage.

Uniqueness need not be a driving force to attain an advantageous position. What is more important is to keep the competition to a minimum.

One example of such a company is Coca-Cola and Pepsi. Their offering (soft drink) is not so unique, but they have kept a minimal competition. How? By taking-over of their rival brands across the globe.

Porter’s Five Forces To Study Competitive Advantage

Pro-investors keep a watch on their ‘company’ and also on other businesses of that sector. But only tracking the actions of all companies may not be enough.

Hence Michael Porter provided a five-point scale based on which a sector is rated for its degree of competition. More fierce is the competition, less likely that any company will enjoy a competitive advantage.

Here are the five parameters provided by the Porter’s Rule:

#1. How difficult it is to enter a sector/Industry

Some sectors/industries make it easy for new companies to enter and do business. It is favorable for prospective businesses, but it is not great for existing companies (and their investors) in those industries. They are likely to lose their market share and profits due to new entrants.

The sector which makes entry difficult for new business, in a way, gives a competitive advantage for the existing companies. An investor would like to buy stocks of companies that operate in such a sector.

What can make entry difficult for new businesses?

- High Capital requirement: For a capital-intensive business, it’s less likely that a new entrant will try its luck in that sector/industry. Think of an integrated steel plant like that of Tata Steel, JSW, JSPL, etc. Due to the high cost of setting up an integrated steel plant, fewer people venture into that sector.

- Strong Brand Identity: Customers buy some products just by looking at their brand names. This example is viable in the mid-luxury car segment. For many years, only a few players operate in that industry. BMW and Mercedes are two dominant companies. People who can afford a BMW will not go anywhere else.

- Low Cost: Tata steel has been a low-cost steel producer of steel in India for decades. What makes them so cost-effective? The location of their plants, rich know-how, size, distribution network, etc. A new steel producer will find it almost impossible to produce steel at Tata Steel’s cost.

- High Volumes: Suppose a company wants to enter into an FMCG sector that makes biscuits. The new entrant will not only face competition from big brands (like Britannia and ITC) but also in terms of volumes. To survive the competition, the company must produce in high volumes. It will make their products available on shelves of all retail outlets, besides their key competitors. But manufacturing in those volumes is a huge challenge.

- Government Restrictions: There are such sectors that need government licenses to do business. For example, not everyone will be allowed to enter into industries like airlines, telecom, liquor, multibrand retail, banking, insurance, etc.

#2. How powerful are the suppliers of the sector/industry?

Powerful suppliers have enhanced bargaining power. Such suppliers can increase their prices at their own free-will leading to reduced profitability for the company. Investors would like to buy stocks of companies whose suppliers are not as powerful.

How to judge the supplier power of a sector/industry?

- Few Suppliers: Suppose there are only a handful of suppliers of a product or services in a sector. Such suppliers will display higher bargaining power. A company will have less control over its prices and quality of supply.

- Unique Product: A company purchases many items from outside. In terms of cost, some purchases will be critical. Now suppose, that purchase originates from a supplier of a unique product. For example, mobile phone manufacturers purchasing processors from Qualcomm. Suppliers of such distinguished products are powerful.

- Sector Dependency: Some suppliers who supply their offerings only to a specific sector. Such suppliers have minimal control over their customers. As an investor, we would like to buy stocks of companies whose major suppliers are tied only to that sector.

#3. How powerful are the buyers of the sector/industry?

Buyers (Customers) can also affect a sector/Industry’s competitive advantage. If the buyers have too much bargaining power, the sector will have to operate with low profitability. Why? Because the customer will essentially squeeze the company for low prices.

How to judge the buyer’s power of a sector/industry?

- Volume Buyers: Suppose only a few buyers purchase the total production of the sector in large volumes. What do you think, what kind of control these buyers would be enjoying on the company? Such companies will show a minimal competitive advantage.

- Easy Switching: Buyer power also becomes enhanced when the offering of the company is not unique. It takes no cost for the buyer to switch from one product to another. To keep such buyers glued to their product, the company will sell at cutthroat price levels.

- Price Sensitive Buyers: If the majority of buyers of a sector are too price-sensitive, it creates clout for the suppliers. Price sensitivity comes when the buyer’s profitability numbers are low. Such buyers buy items at hugely discounted price levels.

- Non-Critical Item: If the sold product is non-critical for the buyers, they will care less about its quality. When the focus is less on quality, people purchase at cutthroat price levels.

The above four factors give too much power in the hands of the buyers. When customers dominate the sector/industry, its companies will display low return on capital (ROC) numbers. As an investor, this is a clear sign of a weak competitive advantage.

#4. The Danger of Substitution

We have already discussed this point in the buyer’s power topic above. But the danger of substitution will loom around even if the buyers are not very powerful. For example, an individual has virtually no buying power over the company. But the behavior of a collection of individuals can become problematic. How?

If the product of the company is not unique, those individuals can easily switch choices. Such companies have low pricing power. They cannot sell their products at a premium price. Moreover, the product will need extensive marketing to create a niche for itself.

A combination of low selling price and high marketing costs will reduce the profitability of the company.

#5. Stiff Competition from fellow companies

Though this topic is coming as fifth, it is the most powerful point. If there are too many companies operating in the same sector/industry, no one will get an edge (competitive advantage).

It becomes even more problematic if the quality of the produce of these competing companies is similar. Hence, to make its way, the companies give high discounts. These companies will also have to spend more on sales and marketing of their products.

It is the reason why good businesses focus on developing new unique products time after time.

Conclusion

As an investor, it is critical to know about the competitive advantage of a sector/industry. It is also essential to know about the economic moat of the individual company.

It is difficult for us small investors to identify good companies for long-term investing. Hence if we can follow the below tips, we can better structure our search for quality companies:

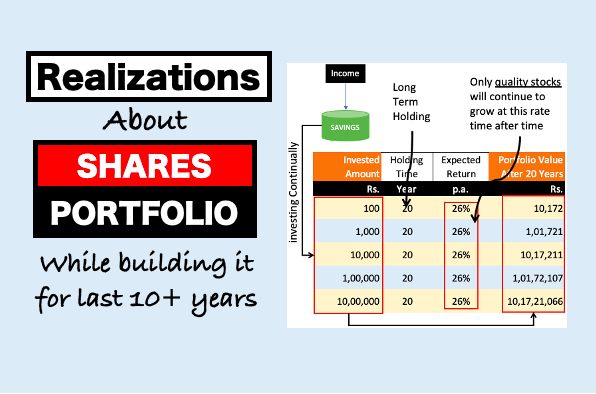

- Sector Study: Based on Porter’s five forces explained above, we can first study the sector/industry as a whole. The target should be to identify a sector that is inherently less competitive. Good companies under such sectors will operate at better profitability levels.

- Company Study: Individually, we would like to invest for the long term in a company which has a moat. It is the moat that gives a company its pricing power. Such companies display above-average returns on capital.

- Valuation Study: It is of paramount importance for investors to buy stocks at undervalued price levels. The stock will be good only if it satisfies the valuation criteria during its selection.

Have a happy investing.

Next >> Identify Moat Companies

Very informative articles.

Thank you!

Thanks

Very appropriate and detailed explanation, easy to understand and the Visual Diagram helped in understanding also, Good Work.

Thanks