In our series of articles about stock basics, we talked about the economic moat of a company. A wider Moat gives an edge to the company over their rivals. Such companies operate with high margins. But how to identify moat companies?

In our previous article, we’ve talked mainly about the qualitative factors that give moat to companies. But it is also possible to identify moat companies by looking into their financial results.

In this article, we will try to find a way to quantify a set of parameters that will point us towards a company with a moat.

Companies With Wide Economic Moat in India

Updated: 20-Sep-2024

| SL | Name | Industry | Price | Market Cap(Cr) | ROE (TTM) | OPM (TTM) | RevenueG (5Y) | D/E (TTM) | FCF margin (%) | GMR Score |

| 1 | NATCOPHARM:[524816] | Drugs & Pharma | 1,481.45 | 26,546.84 | 27.96% | 43.61% | 27.96 | 0.03 | 2.90 | 89.88 |

| 2 | ABB:[500002] | Switching Equipment | 7,708.95 | 1,63,304.40 | 26.99% | 16.02% | 20.84 | 0.00 | 3.99 | 89.77 |

| 3 | POLYCAB:[542652] | Wires & cables | 6,559.65 | 98,683.43 | 22.00% | 12.03% | 28.83 | 0.02 | -0.81 | 89.60 |

| 4 | INGERRAND:[500210] | Pumps & Compressors | 4,066.20 | 12,835.54 | 39.73% | 23.13% | 22.25 | 0.00 | 7.78 | 89.45 |

| 5 | COALINDIA:[533278] | Coal & Lignite | 491.25 | 3,02,559.99 | 43.54% | 28.05% | 15.53 | 0.07 | -0.01 | 88.98 |

Parameters To Identify Moat Companies

Warren Buffett loves companies with a strong competitive advantage. He has his ways to identify such a company. But how we, laymen, can identify companies with an economic moat?

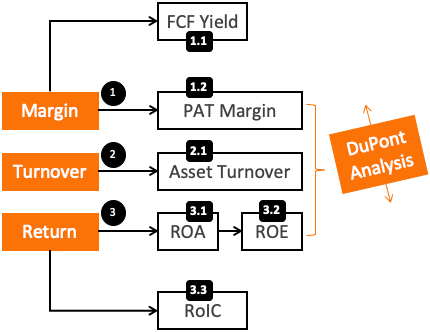

The economic moat gives three visible advantages to a company. Based on these three advantages, experts have formulated rules to identify companies with a Moat.

What are the three advantages?

- Margins: One of the first characteristics of a company with an economic moat is its high margins. In a sector, the company will display profit margins substantially higher than its competitors. Read more.

- Turnover: There may be a case where the sector itself is too competitive. Companies in such a sector cannot display high margins. But moat companies of that sector will display higher turnovers. Read more.

- Returns: A company with an economic moat has high margins or higher turnovers or a combination of both. These two factors make it yield a better return on its capital. Read more.

#1 Margins

For a company, expressing the margin can be done in terms of their net profit (PAT). But more effective metric will be free cash flow (FCF). The Companies with a moat have an uncanny ability to yield higher margins than their competitors. Let’s know more about FCF and PAT yields for a typical moat company.

#1.1 Free Cash Flow Yield

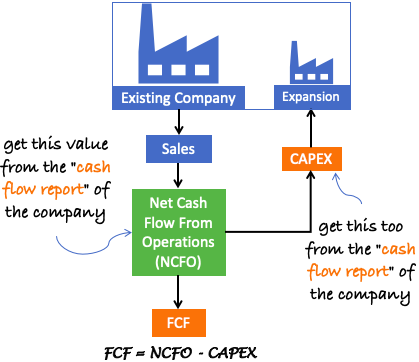

Companies with an economic moat will yield above average free cash flow (FCF). It is a typical characteristic displayed by all moat companies.

But investors need to note, what is FCF? It is the cash generated from the company’s operations minus the CAPEX. What is CAPEX? The money used to expand its capacity (purchase its new property, plant, and equipment).

“Net cash from operations” and “CAPEX” numbers are available in the company’s cash flow report.

Now, how to know if the free cash flow (FCF) generated is enough or not? What should be a typical value for a company with a moat? We must express FCF as a percentage of sales (FCF Yield = FCF / Sales).

As a rule of thumb, an FCF yield is more than 5% is considered good. But check this value for the last 5-10 years in a row. A consistently 5% or higher FCF Yield means you have found a great company.

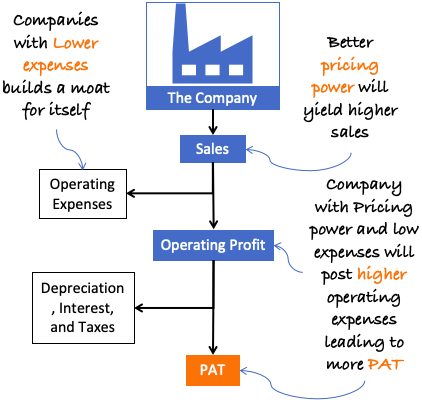

#1.2 Net Profit (PAT) Margin

PAT margin is a way of expressing the profitability of a company. A company that generates higher PAT per Rupee of sales is good.

How to generate more PAT per Rupee sales compared to its competitors? To do this, the company must have two advantages:

- Low Cost: A company that can produce similar products at a lower cost has an advantage. This advantage can come from a variety of ways. Either the overheads of the company are low or, they are sourcing cheaper raw materials.

- Pricing Power: A company can sell the same product at a higher price. How? Because of the pricing power. Quality products coming from a reputable brand will have pricing power over their competitors.

So, a company with the above two advantages will have a higher profit margin.

Now, how to know if the net margin is high or not? We must express PAT as a percentage of sales (Net Margin = PAT / Sales).

As a rule of thumb, a net margin of more than 15% is considered good. But even better will be its consistency for a period of 5-yrs or more.

But it is also true that a company that does not operate with higher margins can still post higher net profits. How? We know about this while discussing DuPont’s Formula. In fact, as per experts, an investor must always see Net Margin and Turnover in unison. DuPont Formula can give us this visibility.

#2. Turnover

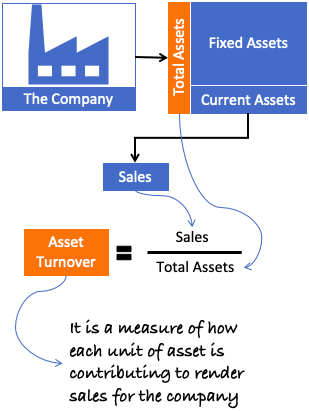

Companies buy assets to build their operating capabilities that, in turn, will render sales. But only rendering sales is not enough, it must be done efficiently.

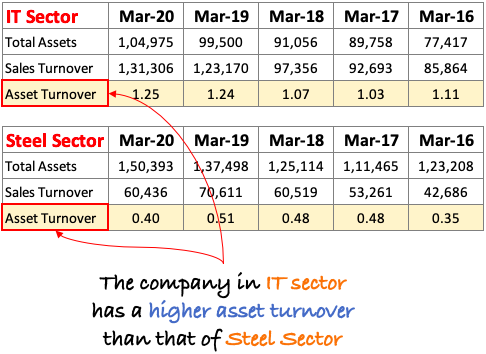

To understand this, let’s take a hypothetical example. Suppose two companies are operating in the IT and Steel sectors. Their asset turnover (=sales / total asset), is shown in the below infographics.

The company in the IT sector has a higher turnover than that of the steel sector. It means an IT company can render more sales per unit asset. You can see that the asset turnover of an IT company is constantly over one (1).

But comparing the asset turnover of two companies operating in different sectors is not advisable. To gain a better perspective, one must compare the asset turnover of companies of the same Sector. Example:

As a rule of thumb, a company having an asset turnover of 0.67 is considered good. Asset turnover greater than one (1) is like tending towards excellence.

But it does not mean that all low asset turnover companies (below 1) are not good. First of all, we must not compare asset turnover of different sectors. Secondly, within the Sector itself, more critical is a combined effect of asset turnover and margin. We will know more about this while discussing DuPont’s Formula.

#3. Return

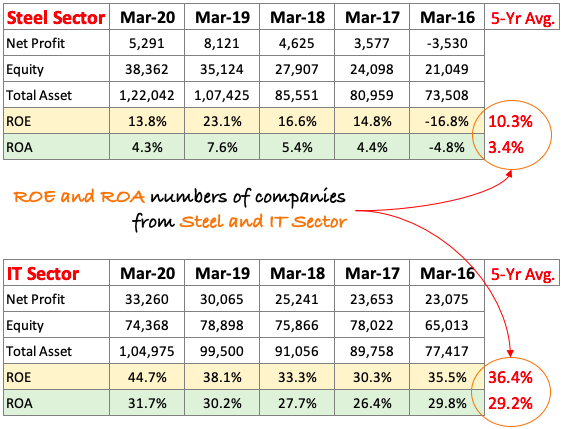

When we say return, we are figuring out the profitability of a company. The moat companies display higher returns compared to their rivals.

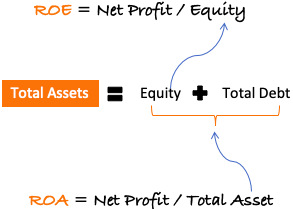

Two parameters we can use to measure the “return” of a company. First, Return on Equity (ROE). ROE measures the profitability of a company compared to its equity base. In terms of formula, ROE = Net Profit / Equity.

The second parameter we can use is called Return on Asset (ROA). It measures the profitability of a company concerning the company’s total asset base. In terms of formula, ROA = Net Profit / Total Asset.

To get better visibility of ROE and ROA, check this formula:

So we can say that while measuring ROE, we consider only shareholder’s funds (which is a part of the asset base). But while calculating ROA, we are considering the total asset base.

Now, how to know if the ROE and ROA numbers of a company are good or not?

As a rule of thumb, the moat companies will have ROE larger than 15% and ROA above 10%. But the company must display these numbers consistently for at least 5 to 10 years at a stretch.

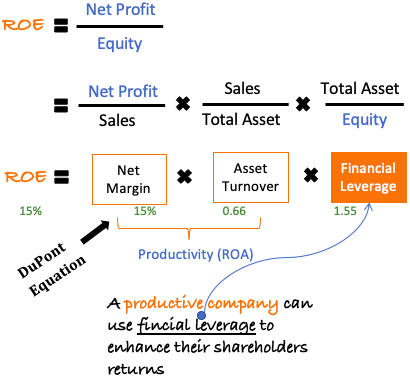

Understanding ROA and ROE using DuPont Equation

DuPont equation is a different way to see the formula of ROE. This equation separates and highlights the key drivers of ROE.

ROE expressed as DuPont equation tells its investors what a company is doing good or bad to achieve their ROE.

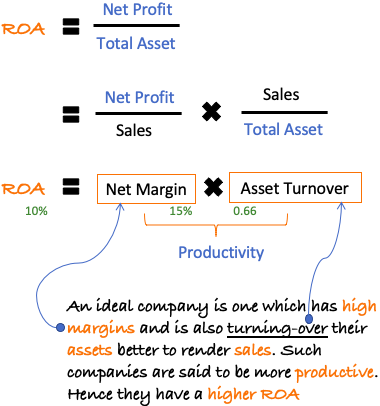

#3.1 ROA Formula

But before we see the Dupont equation, let’s understand its analogy using ROA. Expressed like Dupont equation, ROA formula can be represented as shown below:

What does it mean? Ideally, the company with a moat will have a high net margin. The company will also be turning over its assets better to render sales. Such a company is said to be more productive, hence displays higher ROA.

Applying our rule of thumb assumed in sections #1 and #2 above, a ROA number of 10% or more can be considered ideal for a company. Check the formula shown above.

Quick Tip: Next time, when we will see a high ROA stock, we will ask ourselves two questions. First, the high ROA is because of the high net margin or high asset turnover? Second, how the ROA numbers (margin + turnover) of the company fair within its own sector?

#3.2 ROE Formula

When we are studying the ROA formula in DuPont terms, we see the company in its entirety. But let’s become a little selfish and observe the company only from the perspective of a shareholder. To do this, let’s express the ROE formula as DuPont equation:

What does this formula represent? For a company to generate higher returns for its shareholders (owners), it must first ensure that it is productive. How? By the efficient use of its assets to render sales (High ROA). Secondly, the company can also use financial leverage to better its ROE.

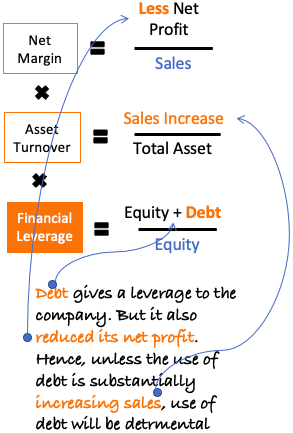

But the use of financial leverage is not so easy. The company must handle Leverage with extreme care. Allow me to explain:

Every company cannot use debt to enhance the ROE. Why?

There is no doubt that debt gives leverage to the company. But the debt also has a cost (interest expense). Hence, a company availing debt will see its net profit reducing.

Then why opt for the debt?

They will do so only if their asset turnover is an exception (more than one). For such companies, debt gives a substantial boost to their sales, hence improving their ROE.

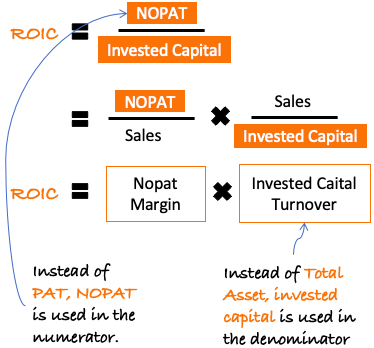

#3.3 Return on Invested Capital (ROIC)

Another litmus test to identify companies with a moat is to calculate their ROIC. It is similar to ROA but with some changes. These changes make the formula more apt for highlighting the realistic profitability of the company.

Let’s first note the difference between ROA and ROIC.

- NOPAT: Net profit is in the numerator of ROA. But in ROIC, NOPAT is used. NOPAT is a better indicator of a company’s profits. Why? Because Net Profit also considers the “Other income” component to deduce profit. But NOPAT considers only “operating profit.”

NOPAT = Operating Profit X (1- effective tax rate)

- Invested Capital: A sum of total equity and total debt is “total assets.” But not 100% portion of the ‘total asset’ is working for the company. The money kept as cash in the bank does nothing. Hence we cannot account for it as ‘Invested Capital’. Also, the account payable must be reduced from the total asset. Why? Because that portion of Capital is invested in the company by the suppliers.

Invested Capital = Total Asset – Cash & Cash Equivalent – A/c Payables

Companies whose ‘other income, cash, and ‘account payables’ is a small value, their ROA and RoIC will value will be similar.

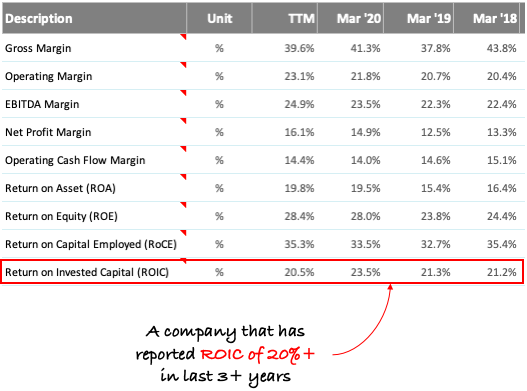

Now, how to know if the RoIC numbers of a company are good or not?

As a rule of thumb, the moat companies will have RoIC above 15% for a consistently long period (like 7 to 10 years).

Conclusion

It is not easy to identify Moat companies. So, how experts do it?

They study the market by observing the customer and competitors’ behavior towards the company and its products. It will not be wrong to say that finding moat companies is essentially qualitative work.

But in this article, we have seen some numbers which can give a strong hint about the moat. The two strongest parameters are FCF yield and RoIC, as explained above.

Thank you for reading, and have a happy investing.

Next >> Quality of Management

Hello Mani – Thanks for the article. I don’t get the Total Assets part?

Total Assets = Fixed Assets + CWIP + Cash + Other Assets..

How come Debt is included in the Total Assets? Debt is part of Liabilities though?

By the simple definition of ROE = PAT/ Total Equity.. Debt is no where related in ROE equation and it is just purely based on Equity not on Debt?

‘Total asset’ can also be expressed as:

Total Asset = Total Debt + Total Equity

sir i am following you from last one year and have also read your book on art of stock investing from bse2nse.com but sir i have a query, how do you earn from this system of employment of generating content for blogs where there is no ads.

if you find it reasonable to answer, please reply