[Dated: July 2017] How difficult it was for people to understand the EPF withdrawal process?

In good old days, EPF withdrawal process was known only to the employer.

Hence it was not uncommon to find ex-employees being harassed by the employers for their EPF withdrawals.

But the cases of harassment was a smaller problem. The bigger issue was lack of control in hands of the employees.

After all, EPF money is the employees hard earned money. Employees should be in control of their money withdrawal, not the employer or the EPFO.

Till the person is doing a job, he/she keeps contributing unconditionally to the EPF account. But when the employee leaves his job and wants to withdraw the EPF fund; he was bombarded with procedures.

Withdrawal of EPF was a herculean task in the past. This was almost evil.

But thankfully the Government of India has streamlined the EPF withdrawal process to almost perfection.

The present EPF withdrawal procedure is easy and transparent.

There has been several complaints in the past. As a result, to improve the EPF portability and EPF withdrawals, in favour of the employees, EPFO & Finance Ministry decided to implement the concept of UAN (Unique Account Number).

Under this scheme, every EPF account will be linked with a UAN.

It will help in portability of EPF account in case the person is switching jobs without any intervention of the past employer.

Individual will have the same UAN active throughout his carrier.

Even if the person is switching companies or is changing states, the same UAN number will encompass all new PF accounts.

Now lets see how one can withdraw EPF money after retirement or even premature retirement….

#A. Check you EPF Balance before applying for the withdrawal

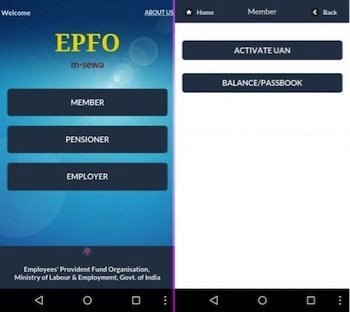

Once can download the EPF mobile APP and check the PF balance

#B. Common UAN is beneficial?

How a common UAN benefits the EPF withdrawal process for the employees?

The best benefit of having an unique UAN is that, one can by self (online), transfer EPF fund from one account to other.

This is applicable for those needy people who changed jobs but have not ported their last companies PF balance.

Earlier the procedure of EPF transfer was not online. Hence people were only dependent on employers to get the EPF fund transferred.

But now Indian government has give the charge in hands of employees themselves.

It is also logical, after all EPF saving is employees hard earned money.

In case the person has left the Job permanently (premature retirement), in this case as well, the person can withdraw the EPF balance to ones bank account.

In this blog post, we will know about the online EPF withdrawal process applicable from year 2017.

But one critical point in online withdrawal of EPF is knowing ones UAN. Ones UAN number will look like this: 100XX XXX XXXX. Its a 12 digit numeric number.

#C. What to do if you do not know your UAN?

EPFO has allotted unique UAN for everyone who carries a valid PF number.

The details of the linked UAN has been posted to the respective employers by EPFO.

So, to know your UAN, one can approach the company HR and ask for it.

In case the company is delaying the disclosure of your UAN, do not worry.

Get your PF number from your salary slip. Use this link to self-check the status of your UAN.

You will need only PF account number to know your UAN.

#D. What is the online EPF withdrawal process 2018?

If one has taken retirement (even if it is premature), one can withdraw their EPF fund by filing and submitting Form-19 (UAN) to ones regional EPFO office.

In case one want to partially withdraw ones EPF fund, this is also possible. In this case one has to fill Form-31 (UAN).

It is essential to indicate the right reason for partial EPF withdrawal.

The reasons for partial withdrawal is already listed in the Form-31. One has to select the reason only from the provided in this list.

If correct reason is not provided, the partial withdrawal request will stand rejected.

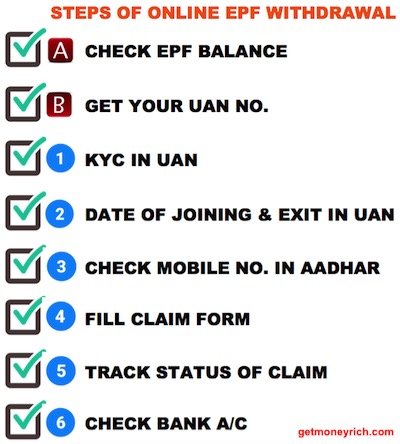

Steps required to apply for online EPF withdrawal process is as below:

Step 1: Ensure KYC details are seeded in UAN account

Visit Epfindia.gov.in website and login to your account.

Once your are logged in, go to Manage > KYC.

Here the following documents must appear in the Approved KYC tab (bottom of page).

- Bank Account,

- PAN and,

Employee can also self-upload these documents for approval. The uploaded documents will appear in the Pending KYC tab.

Once the Employer approves these submitted documents from his login, the documents will be visible under Approved KYC tab.

Once all these 3 documents are seeded, now one is ready to claim their EPF.

Step 2: Ensure that “date of joining and exit” is provided in UAN

Visit Epfindia.gov.in website and login to your account.

Once your are logged in, go to View > Service History > Detailed View.

Check the following dates if they are available or not:

- Date of joiningand

- Date of exitis available or not.

If the dates are not available, ask your ex-employer to indicate the same in your UAN.

An employer is obliged to update both the dates at the earliest.

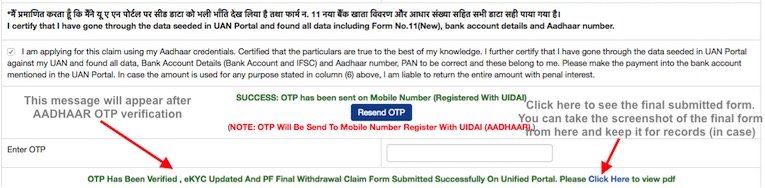

Step 3: Check the mobile number provided in Aadhar Card

To do this I will suggest you to perform a small test.

Visit the uidai.gov.in website and verify your mobile.

The idea should be that, the mobile that you are carrying while filling the EPF withdrawal form should be the same as indicated in the Aadhar database.

Generally when people are in job, the give their official mobile number in Aadhar data base. But after leaving the job they carry a different mobile.

Why this is important?

Your Aadhar linked mobile number will be used to authenticate your EPF withdrawal application through OTP.

The OTP has the following utility:

- OTP authentication is required just before the EPF withdrawal CLAIM FORM (step 4) is finally submitted for processing.

- OTP will be sent to the Aadhar linked phone number.

- Once the person enters this OTP, the claim form gets finally submitted.

Step 4: Fill the CLAIM FORM

One can apply for EPF withdrawal only after completion of waiting period of 2 months from the date of leaving the job.

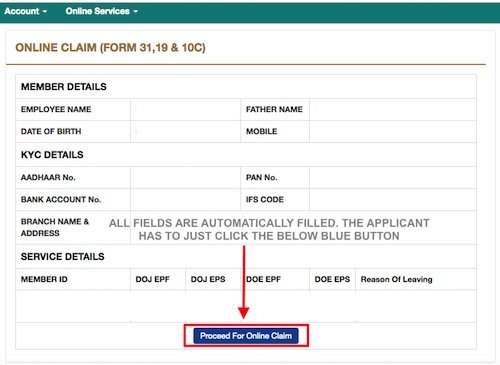

Visit Epfindia.gov.in website and login to your account.

Once your are logged in, go to Online Services > Claim.

Click the CLAIM tab and you can all your KYC details. Check these details once more.

Once this check is done click the tab “Proceed For Online Claim”.

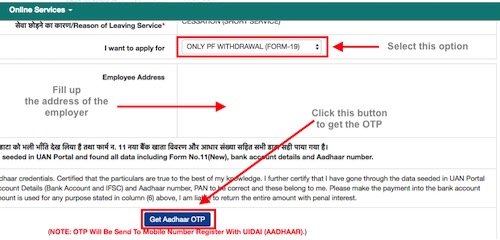

In the CLAIM form, search for “I want to apply for” field. Then select the right options from the drop down menu.

The drop down menu will have three options. Select your option like:

- Partial EPF withdrawal (form19),

- EPS withdrawal (form 10C), &

- Partial EPF withdrawal (form 31).

Once you select your right form, the detailed form will open. It will be just a one page form.

Fill in all the details and authenticate using OTP (explained in step-3 above).

This will submit your EPF withdrawal claim to EPFO.

Step 5: Track status of your EPF withdrawal claim

Visit Epfindia.gov.in website and login to your account.

Once your are logged in, go to Online Services > Track claim Status.

Generally it may take between 1-4 weeks for your claim to be processed.

But these days, there has been cases where the EPFO has transferred the funds within the first 4-5 working days itself.

Step 6: Check your bank account

Once your claim is processed, the EPF money will be credited online to your back account.

This will be the same bank account which you have provided in UAN in Step-1 above.

Income tax liability linked to EPF withdrawal

EPF withdrawals can sometimes be taxed and sometimes get exemption.

Following the conditions explained in brief:

Case 1: EPF withdrawal is tax free, when:

- EPF withdrawal is made after serving for more than 5 years in a company.

- When EPF is transferred to another account due to change of company (job).

- When employee lost job (before 5 years of service) due to serious illness, company closure etc.

- EPF is withdrawn before 5 years of service, but the amount is less than Rs.50,000.

Case 2: EPF withdrawal becomes taxable, when:

- EPF is withdrawn before 5 years of service, but the amount is more than Rs.50,000. In this case TDS will be deducted @10%.

I have regine my job.I need money to purchase my new home.

I have regine my job.I need money to purchase my new plot

I have settled epfo 1 year back does my uan still exists