Knowledge about how to build a stock portfolio is perhaps as essential as the stock analysis itself. Though the former looks more daunting to me.

There are processes and financial models (like DCF) in place, using which one can analyze a business. But when it comes to stock portfolio building, there is no established process.

A portfolio that might look apt for me might not work for someone else. But there are few basic rules for building a stock portfolio. One can apply these rules and build a customized portfolio for themselves.

In this article, I’ll write about those basic rules. These are rules which I’ve grabbed through reading and application to build my stock portfolio.

Good Vs. Bad Stocks

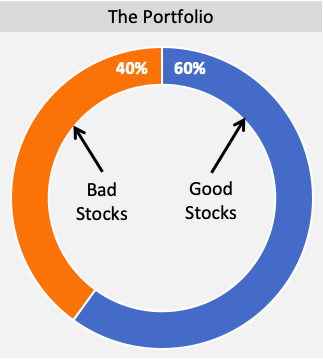

Out of all the stocks that one picks for his/her portfolio, only about 60% will perform as intended. So if some shares are not doing well, it is acceptable.

But what differentiates between good investors and others is the proportion of money parked in good (60%) versus other stocks (40%). Achievers tend to weigh heavy on the 60% side.

So even while adding stocks to the portfolio, good investors tend to segregate them into two categories, 60%-Group versus 40%-Group. Based on the available opportunity, more money should flow into stocks in 60%-Group, compared to the 40%-group.

What are Good Stocks?

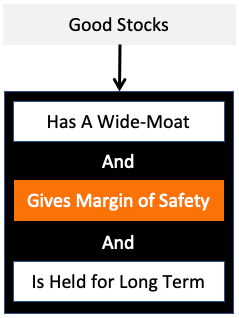

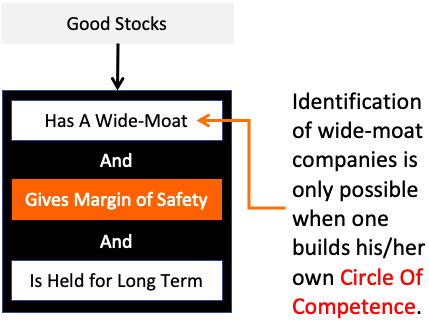

What makes a stock good? The following three factors together can make stocks great:

- Wide Moat: One of the first determinants of a profitable portfolio is the inclusion of wide-moat stocks. These are stocks of great companies. What makes these companies great is a combination of factors like a quality product, market share, management quality, brand value, etc.

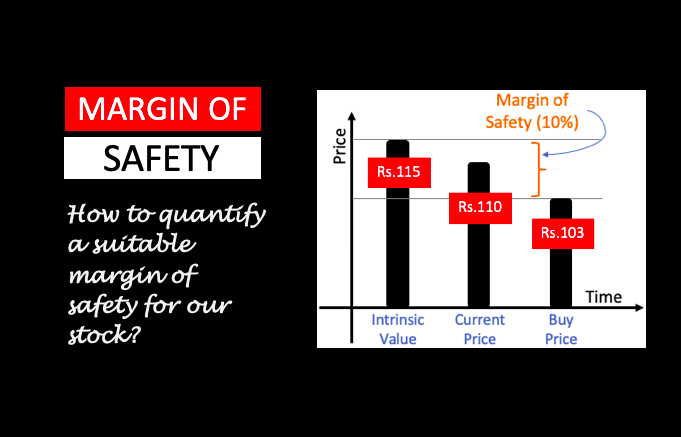

- The margin of Safety: If we buy a stock at a discounted price below its intrinsic value, we are maintaining a margin of safety. Generally, good stocks trade at overvalued price levels. So buying a good stock at a discount is like catching a plane before its take-off.

- Hold For Long Term: The return generated by a stock portfolio is also dependent on the holding time. Stocks of great companies tend to yield higher profits over time. Why does this happen? It happens because of the power of compounding.

A combination of the above three factors can make a stock portfolio incredible. A wide-moat stock, bought at an undervalued price and held for a long-term will yield higher returns.

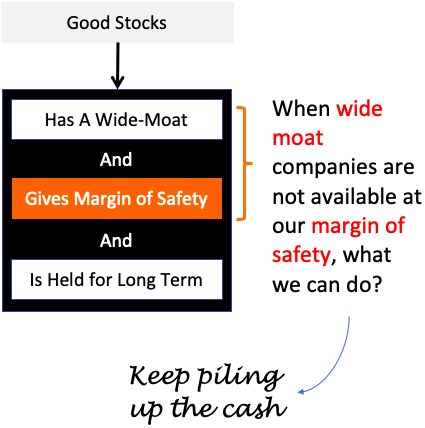

What if Good Stocks Are Not Available?

Build Cash Reserves. If pro-investors are not investing, they are piling up cash to make them available when investment opportunity comes.

There will be instances where one may not find opportunities to buy stocks. There can be two cases:

- The investor is not able to identify a wide-moat company. People who do not know how to analyze stocks may never locate a good share. It is a limitation. Such people can learn the process of fundamental analysis of stocks. If they do not have time, they can use a shortcut – my stock analysis worksheet.

- The Stocks are available at overvalued price levels. First, buy only undervalued stocks. Second, gather Stocks by maintaining a margin of safety. These two sub-rules make stock purchases a RARE activity even for experts.

So it means, most of the time, experts sit idle and do nothing. Why? Because the opportunity to buy good stocks is rare. So what these people do in their idle time?

Warren Buffett says he mostly spends time reading annual reports of companies. It is his way to identify wide-moat stocks.

There is another thing that happens automatically during idle time (periods of non-investment). What is it? Accumulation of cash. I allow my spare cash to accumulate using recurring deposits.

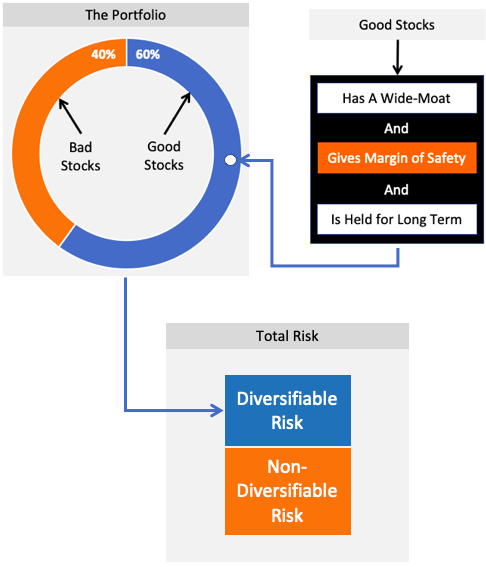

Diversifiable and Non-Diversifiable Risk

Investing money in one company is not advisable. Similarly, keeping shares of a lot of companies in one’s stock portfolio must also be avoided.

We must spread our money in multiple stocks (companies). It will minimize the risk of loss.

But there is a limit to risk minimization. Broadly speaking, there are two types of risks in stock investing:

- Diversifiable Risk: This is the risk of loss associated with the company itself. If the company makes a loss, its stock price will also suffer. Such a risk can be minimized by including multiple stocks in our portfolio. It is called investment diversification.

- Non-Diversifiable Risk: This is the risk of loss caused due to reasons not attributable to a company. Examples of it can be a bad economy, sector downturn, etc. Such reasons affect all business coming under its ambit. For example, a Yr-2008-09 like global economic meltdown will affect all companies across the globe.

What does it mean? Out of the total risk associated with stock investing, we can manage only the diversifiable risk.

So, how many stocks shall be included in the portfolio to get a good diversification? The more, the better? Not really.

Maximum Number of Stocks in A Stock Portfolio

It is possible to manage only the diversifiable risk. Even 1,000 number stocks in a portfolio will not reduce the non-diversifiable risk. So we must not waste our efforts trying to eliminate the non-diversifiable risk.

So, how many stocks to include to reduce the diversifiable risk? The limit should be about 15 stocks. Why?

To understand this, we must see it from two perspective

- Potential Returns, and

- Portfolio Management Rules.

Why limit the stock to 15 numbers max? The more stocks in a portfolio, the better it’s diversified. It is true. But in this case, the returns generated by the portfolio will only match the market’s average (like 12% per annum). Similar returns are possible by investing passively in an index-based mutual fund or an Exchange Traded Fund (ETF). But if one wants to earn returns more than the market’s average, only a concentrated portfolio will help.

Experts believe 90% diversification benefits can be achieved through 15 stocks only. Moreover, owning too many shares in the portfolio induces a practical problem. How? Too many stocks mean less time for individual companies. When we hold stock in a portfolio, we must read their related news, quarterly performances, and annual reports. If there are many stocks, it means we can track our holdings only superficially.

In this case, a better alternative will be to own stock indirectly through mutual funds.

If one wants to build a stock portfolio for self, then investing within one’s circle of competence is a must. Owning too many stocks is a sign of stock ownership beyond this circle. It is very risky.

Weight of Individual Stocks in a Portfolio

Limiting a portfolio to about 15 number stocks is one step. But equally important is to know how much weight must be put on the individual stocks. From what I’ve read about portfolios, I’m not sure if there is a rule. So I’ll speak from what I’ve learned from practice.

Ideally, we must be overweight in stocks that have more chances of doing well in the future. How to do it?

When I analyze my stocks, I do several things at a time. The first I do is get a first impression of the company. I use my stock analysis worksheet. It estimates the intrinsic value, gives it an overall rating and also generates its 10-Yr snapshot. It gives me a general feel about the stock’s strengths and weaknesses.

Once I’m impressed by the stock, I start reading all news feeds about the company for at least 6-7 days. Once I’ve saturated myself with it, I download its latest annual report and read at least the first 30 pages.

After doing this exercise, I try to build an impression about the company & its stock. I try to categorize them into the 60%-Group or 40%-Group. If the stock fall’s in the 60%-Group, I start buying its stocks. Sometimes, I start with as low as Rs.5,000 per trade. But I make sure that a stock’s weight does not go beyond 5% of the total size of the portfolio. For stocks falling under 40%-Group, I make sure that their percentage does not cross 1% till my impression change about them.

Buy Less, Sell Even Lesser

You have already seen the definition of good stocks.

“These are wide-moat stocks, bought at discounted price levels, and held for a very long term.”

In this case, the realm of the long term can also be 15-20 years. So you can see, the holding time is VERY long. When holding time is so long, people do not seem to sell their holdings. As Warren Buffett says, buy stocks to hold them forever.

Moreover, wide-moat stocks are rarely available at discounted price levels. Hence, for the investors, the buying opportunity is also less. During these times of inactivity, make sure to build your cash reserves.

Wide-moat companies are harder to buy. So, once we have them in our portfolio, we must not think to book profits too soon. Why? Because we may not get another opportunity to buy such wide-moat stocks, at those price levels again.

Building A Circle of Competence

All great long-term investors have their preferences and biases towards a few sectors and companies. For sure, they like these companies, and that is why they keep buying and holding their stocks.

For people like us, more important is to know what makes great investors like a company. Generally speaking, great investors will only buy stocks of companies with a wide moat. We already know this right?

But it is not easy to identify a wide-moat company. There is no magic formula that will tell us that a company has a wide moat. We can only estimate their Moat based on assumptions.

But big investors like Warren Buffett follow a better strategy. They build a ‘circle of competence’ about a sector/company. It is nothing but a process of developing a deeper understanding. How to do it? By reading more about the company. Contents like news, annual reports, quarterly reports, and analysis of experts.

While I was in a job, I have mainly worked in Steel and Power sectors. Hence, compared to other industries, my visualization of the Steel and Power sector is better. Hence, if I try to build my circle of competence in these two sectors, it will be better.

One can also expand their circle of competence to other sectors by doing the same type of exercise.

Why build the circle of competence? Because bigger will be our circle of competence, we will be able to locate more wide-moat stocks.

Why Only Stocks? Can We Include Mutual Funds in The Portfolio?

Taking support of mutual funds can be a good strategy. Generally, an individual’s circle of competence is limited to only a few sectors. But it is only natural to get tempted to buy stocks from sectors beyond our circle of competence. How to do it? We can invest in such stocks through sector mutual funds.

Suppose we are in India, and we want to buy stocks of companies in the USA. In this case, we can take the help of mutual funds to buy those stocks.

Conclusion

Building a stock portfolio that complements the strategy described above will generate returns higher than the market average.

Remember to build a circle of competence wide enough to maintain 15 stocks in the portfolio. Make sure to buy them by maintaining a margin of safety.

If one wants to diversify beyond one’s “circle of competence,” including mutual funds will be a good idea.

Companies enjoying wide economic moat are often my first choice when it comes to investing. The growth present in these companies are often sustainable and can be replicated over a long time period.

wow, very knowledgeable article for making a stock portfolio …keep sharing these types of informative articles with us ..

Dear Sir

Am ur subscriber and have both software’s.

My request that in the second software the stocks which score over 75% may be classified into a separate group for us to do further study.

SARDHA CROPCHEM MAY INCLUDED.

GUIDANCE