It will not be wrong to say that Philip Fisher was one of the first influencers who promoted the concept of fundamental analysis of companies.

He also wrote a book called Common Stocks and Uncommon Profits way back in 1957. But the book is as relevant today as it was ground-breaking during its first publication.

The focus of this book was to teach people how to analyze business for its ability to yield future profits.

He started his own company in the year 1931, Fisher & Co. He continued to manage this firm for the next seven decades till 1999. In Yr-2004, Philip Fisher died.

Today the person is best known as the founder of ‘growth investing.’

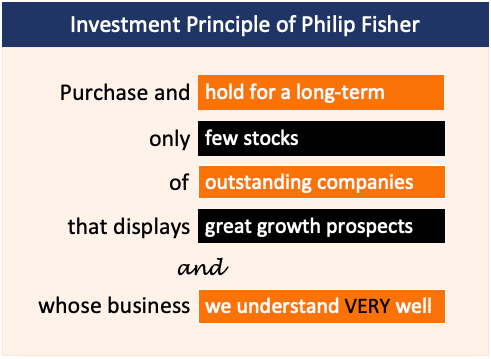

Investment Principle of Philip Fisher

Above is a simple sentence that touches almost all aspects of Philip Fisher’s investment style. It answers a few basic questions that we all investors ponder while investing.

- Which Stocks To Buy? Fisher believed in the purchase of stocks of only outstandingly managed companies which has good future growth prospects.

- How Many Stocks To Buy? Fisher believed in having a concentrated portfolio consisting of only a few stocks. Diversifying too much by purchasing random shares must be avoided.

- What Investment Strategy To Follow? For Fisher, like all great investors, practicing long-term investment is essential. Buying stocks and holding them for insanely long periods is the best strategy.

- How To Identify Good Stocks? To identify them, we must first know about the stock basics. But more importantly, we must understand the business VERY WELL in which we are investing. How to do it? It can be done by mastering the art of fundamental analysis.

Investment Principle

Philip Fisher used to categorize his companies into two types: large caps and small caps.

In a time horizon of 10-Years, good large-cap stocks could yield a return of about 15-18% per annum. At this rate of growth, the invested capital can grow five times in 10 years.

But to experience the benefits of multibagger stocks, Fisher used to venture into the dreaded zone of small caps. These are growth stocks in the real sense. Let’s take an example.

Havells, in the year 2008, was a small-cap stock trading at 15 Rupees levels. By the next decade, Havells entered the elite zone of large caps. By this time, its price was at Rs.600 levels. It also issued bonus shares of 1:1 (June 2010) and had done a stock split of 5:1 (Yr-2014).

Considering all of these factors, the 10-Yr rate of return of Havells was 82% per annum (between 2009 and 2019). It is a capital appreciation of 400 times in 10 years.

What does the above example say? Investors who can hold stocks for a longer time horizons, like 10-years, should buy stocks of good NEW companies.

Identifying Good Stocks In Philip Fishers Style

Fisher was always on the lookout for growth stocks. In his book, Common Stocks and Uncommon Profits, he writes about few ways to identify good stocks for investing. Here are Fisher’s fifteen stock screening criteria:

#1. Product & Services

For a business, it all starts with what they have to offer to their customers. Unique products and services catering to a growing demand will automatically emerge as a winner in the long term.

#2. Management’s Drive To Develop Products and Services

No products or services can continue to remain useful forever. That is why the offerings of companies must continue to evolve with time. Top management must realize it and shall continue the drive the team to continuously develop and innovate new and existing products.

#3. Research & Development Infrastructure

A company which wants to grow must do their own research and development. To do it, they must have a decent infrastructure to practice R&D functions.

#4. Sales Force

The majority of products and services in this world will not start selling on their own. There must be a sales team with a sales strategy in place. Moreover, to continue to sell more and more offerings, there must be a master sales plan.

#5. Profit Margin

A company may be selling millions of products, but if its profit margin is meager, it will report only subdued net profits. Hence, for a company, it is of most importance to build a reasonably large profit margin. The target should be to better the industry’s standard.

#6. Profit-Margin-Growth Focus

Profit margins of the past will dictate today’s price. But the future price will be dictated by future profits and its margins. A company has to work tooth and nail to maintain its profit margins. More effort is required to improve the margins. Cost reduction, pricing power are two tools using which a company can control its margins.

#7. Employee Focus

There can be two yardsticks to evaluate the focus of the company on its employees. A team of satisfied employees can take the company a long way. Promotions and salary revisions are two immediate things that come to mind that can render employee’s satisfaction.

#8. Talent Development

A company that identifies talents and then grooms them for future leadership positions is always future-ready. Hesitancy to delegate responsibility to younger managers is a sure sort recipe of self-enforced stagnation.

#9. How Company Is Tracking It’s Costs?

As we have seen in #5 and #6 above, profit margin and margin growth are critical. One way to achieve higher margins is through cost control. The company can keep its costs under control by tracking all pay-outs. Generally, an ERP system will do this task. Diligently booking all expenses into the ERP system will give a visualization. Top managers will know the where are the major cash flows happening, and hence can keep a check. A company with a robust ERP system will flourish.

#10. What Is The Company’s Success Factor?

All new companies operate in their own core sectors/industries. To triumph in a Sector, a company must follow a success path (a winning strategy). The key is to identify and formulate this success path. Companies that have found their ‘winning strategy’ will have more chances to grow faster in times to come.

#11. Focus on Long Term Profits

Some companies focus too must on their quarterly numbers. They are too concerned about how the market will respond to their numbers. This hesitancy makes them defensive, and such companies often grow at a slow speed. Why? Because they focus too much on current operations avoiding future growth plans (CAPEX). On the contrary, companies that handle both current operations and CAPEX plans at the same time will always remain profitable.

#12. The Company Has Cash or Borrowing Capacity?

For listed companies, raising funds through the equity route is easy. The gap between ‘issued capital’ and ‘authorized capital triggers equity financing. The company sells its shares to raise funds. Such companies may increase their profits over time, but such profits get liquidated by the increasing shares outstanding. Companies that remain creditworthy will not have to raise money through the equity route. They can borrow money from banks. Shareholders of such companies will see growth in terms of increasing EPS.

#13. How does The Company Report During Troubled Times?

It is a natural first instinct to hide our mistakes and bad performance. But for a listed company, hiding facts from its shareholders is not legal. Good companies remain transparent at all times. Reading annual reports of companies can give this idea. An annual report, which is only boasting about its achievements, is like a red flag.

#14. Quality of Management

A company run by excellent managers can become exceptional. No matter how good are the numbers, sales and profits, but if it does not have quality managers, investors will eventually start avoiding its stocks.

#15. Addressing Labor Grievances

There will be times when the issues of the employees will escalate. Reasons can be accidents, loss of job, penal actions, etc. How a company will address these issues can make a big difference. Asap resolution of labor grievances is the key. A company cannot afford to fight these cases in courts all the time.

Final Words

Philip Fisher was a forward-looking investor. Even people like Warren Buffett takes clues from his investing style. In his book, Common Stocks and Uncommon Profits, Fisher talks about three common mistakes that we retail investors make while practicing investment:

- Display of herd mentality: We often buy stocks that everyone else is buying. The best strategy for long-term investors is to buy top stocks of that sector which are already bruised and battered. Such shares may not revive soon, so buy and hold them for a very long time. Eventually, above average capital appreciation will happen. The idea is, no sector will remain distressed forever.

- Over diversification: People who do not know what they are buying keep purchasing all sorts of stocks coming their way. It leads to over-diversification. A more profitable strategy is to build a circle of competence and buy stocks within its limits. The idea is to buy stocks of companies that we understand well.

- Opportunity Lost: Stocks of outstanding companies hardly see major price corrections. It may happen, but only due to external factors like COVID, subprime mortgage crisis, etc. When such corrections happen, one must grab this opportunity asap. At those times, we must not mind paying 1-2% extra to buy such stocks.

These are few learnings from Philip Fisher which can greatly benefit us, retail investors. I thought of sharing it with my readers. I hope you like it.

Have a happy investing.