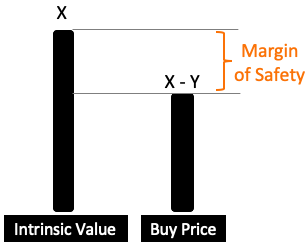

People who know about value investing will be familiar with the term called “margin of safety”. Generally, people prefer to apply a rule of thumb when it comes to the margin of safety. A stock trading at two-third of its estimated intrinsic value can be said to be available at a good margin of safety.

But I have experienced that the application of the two-third rule, uniformly for all stocks, is not practical. Quality stocks always trade at overvalued price levels. Even if their price corrects, they never come even close to my estimated intrinsic value. So expecting them to trade at a two-third level is impractical.

This is why I’ve structured my own method to implement the concept of margin of safety for the stocks in my watch list. In this article, I’ll try to exemplify my method.

But before that, a bit about the margin of safety.

Why Margin of Safety is Essential?

Estimating the intrinsic value of stocks is like interpreting a holy book. Everyone who reads the book can interpret it differently. We can say, intrinsic value estimation is a similar process. There are no formulas. It is done based on logic, assumptions, and interpretation of numbers.

Hence, for the same stock, if there are ten analysts, it might give way to ten different intrinsic value numbers. It is also a fact that, out of the ten, some will be wrong, and some will be close to accurate. It is understandable, right? Like our mathematical problems.

But the problem with intrinsic value is that, because it can only be estimated based on assumptions, even for the best of investors, the end number can be wrong. How to account for this miss?

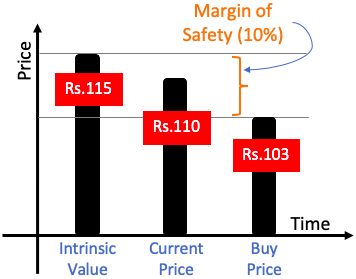

This is where the concept of margin of safety comes in handy. Suppose a stock is trading at a market price of Rs.110 per share. You have estimated its intrinsic value as Rs.115. It means the stock is trading at a 4.3% discount on its intrinsic value.

On the face of it, the stock looks like an immediate buy (undervalued). But…

Even Warren Buffett cannot be 100% sure of his estimated intrinsic value. Even he has acknowledged his mistake. So he will always discount his intrinsic value number. By what factor? It depends. This is what we will discuss in this article (how I do it?)

So what Buffett will do?

He will wait for the stock price to fall further down below the current level of Rs.110. Let’s say, he decided to keep a margin of safety of 10%. Hence he will wait for the stock price to fall to Rs.103 before making the purchase.

For some stocks, Buffett will accept a margin of safety of 10%, but for others, a 35% margin might look appropriate. How to select the right value? Allow me to explain the way I do it for my stocks.

Quantum of Margin of Safety

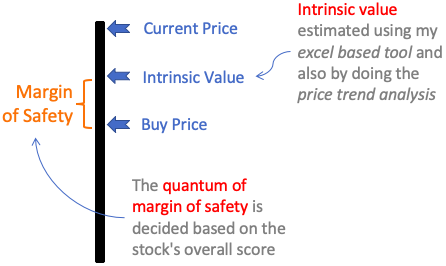

Before deciding the quantum of the margin of safety that can be applied to a stock, I do the following:

Two Steps

- Step #1 (Feeling Of Intrinsic Value): I use my excel based tool to compare between the stock’s current price vs its intrinsic value. This comparison gives a first feel about its fair buy price. I also do the price trend analysis of the stock. How? By looking at the price chart. It is from here that I get a second feel about the buy price. More here.

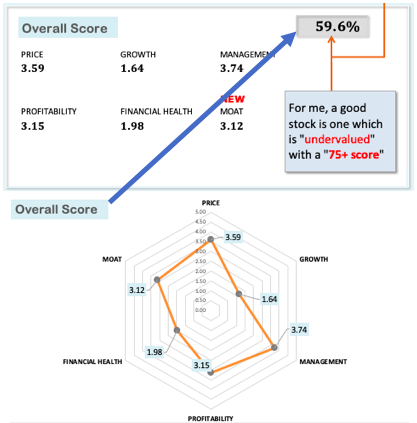

- Step #2 (Company’s Fundamental Strength): I again refer to my tool to get an overall score for the stock. If the score is high, like above 75% then a smaller margin of safety might also work. More here.

Step #1: Feeling Of Intrinsic Value

Before we can apply the margin of safety, we must first estimate the stock’s intrinsic value. When I was a beginner, I used Ben Graham’s formula to estimate intrinsic value. But it has its limitations. So I started to do it manually in excel.

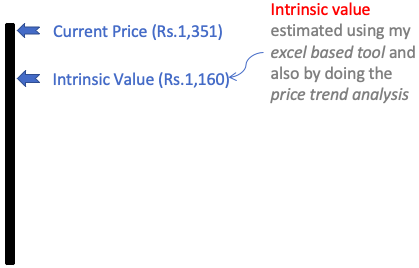

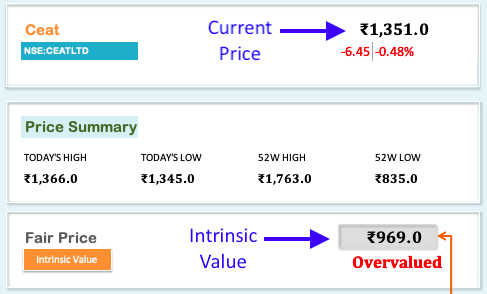

Over a period of time, that excel sheet has evolved to become an automatic stock analysis worksheet. It is from here that I get a first impression of the stock’s price valuation (overvalued or undervalued). Check the screenshot.

The screenshot shows that the stock price needs to correct almost by 28% to come down to the estimated intrinsic value. In the present market times, it looks unlikely that a stock like Ceat will correct so much. Though in Covid correction it fell to Rs.835 levels, check its 52W Low price.

As 28% price correction looks almost impossible, this prompts me to check the price chart. I will use the price chart shown by Google Finance.

Step 1.1: Price Trend Analysis

The pre-covid price level of the stock was Rs.1040. After the price crash (Mar’20), it rose steadily to Rs. 1660 levels (Feb’2021). Since that peak, the current price level is Rs.1,350. It is already 18% below the peak.

But for me, the current price level is still not good enough. I’ll wait for the price to correct further till Rs.1,160 levels. So for me, the intrinsic value based on price trend analysis will be about Rs.1,160

[Note: My price trend analysis has set a considerably higher intrinsic value (Rs.1160) versus the intrinsic value estimated by the excel tool.]

Step #2: Company’s Fundamental Strength

For me, a stock that can fetch an overall score of 75% or more represents a strong business available at a fair price. In the case of Ceat, the overall score is 59.6%.

This is an example of a stock whose business fundamentals are not as per the set benchmark. For such stocks, I would prefer to keep a higher margin of safety. Here is a general rule that I follow to quantify the factor of safety for my stocks:

See Table

How to read this table? Suppose there is a mid-cap stock whose overall score is 80%. For this stock, a suitable margin of safety for me will be 8% or more.

Our example stock (Ceat) which falls under the upper spectrum of small caps, earned an overall score of 59.6%. For Ceat, a suitable safety margin will be 22% as per my table.

Conclusion

For investors, the margin of safety works as their safety net. In case the intrinsic value estimation is wrong, the margin of safety will help in minimizing or even eliminating the potential loss.

I personally like doing fundamental analysis of companies. Such companies which I’ve been following for a long time, I tend to understand their price movements better. For example, even an 8-10% sudden correction in banking stocks makes them worthy of deeper analysis. In most cases, they turn out to be a decent buy proposition (upon application of the margin of safety as explained above).

I like to prepare stock watch lists every 6 to 12 months. Based on my assumptions, I allot them a buy price (my intrinsic value see step #1 and step #2). When these stocks start to trade at a suitable discount to the buy price (margin of safety), I buy them.

This way, using a margin of safety concept, I was able to book profits even with not so fundamentally strong stocks. 🙂

Nice. Well researched article.

worth reading article .meticulously briefed & beneficial

thank you sir

Thanks

Sir good analysis for useful to investors

Thamks