When it comes to the use of jargon, probably the world of equity investment will be among its heavy users. Two commonly used words of this field are Alpha and Beta. The term beta is in use for a long time. But the trend of alpha is more recent.

What are alpha and beta? Alpha is the measure of performance of a portfolio with respect to an index. Beta is the measure of volatility of a portfolio compared to an index.

If you are still not sure what is Alpha and Beta, do not worry. I will exemplify it later in this article. But before that allow me to explain why I’m writing an article about it.

Talking about alpha and beta is like giving a lecture to the students of finance. If I’ll do it, it will get boring, right? Instead, if we can learn about alpha and beta more practically, it will be great.

So what I’ll do is this, I’ll create a hypothetical investment portfolio and then we will calculate the beta and alpha of it.

Why do this exercise? This way we can remain aware of if our portfolio is underperforming or outperforming the market. We would like our portfolio to outperform, right? How to measure it? This is what we will know in this article

Understanding beta (β)

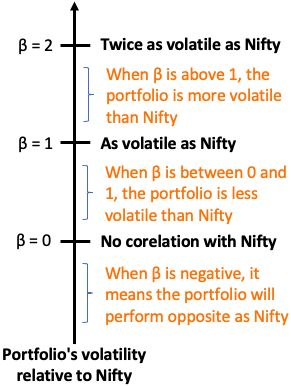

The beta quantifies the volatility of an investment portfolio. But it is not an absolute number. It is expressed relative to the market’s index. Suppose Nifty moved up by 8% in the last 3 months. A stock whose beta is 1.2, will move up by 9.6% (20% more than 8%).

The higher is the beta number, the more volatile is the stock or a portfolio (like a mutual fund). This makes the stock riskier for investing. But on the positive side, high beta stocks or funds can also fetch higher returns if their fundamentals remain intact.

Beta can range from a negative number to a positive one. Generally, for stocks and portfolios, the beta number hovers around one (1).

Understanding alpha

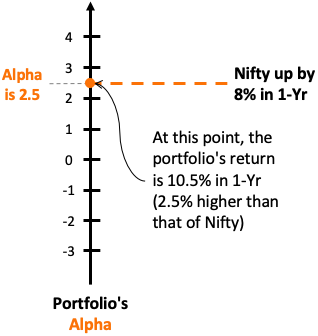

When we read the alpha number, we are actually reading a relative return of an asset. But it is relative to what? It is relative to index performance. Let’s check this example.

Alpha is often expressed as a positive or a negative number. When an Alpha is said to be 2.5, the portfolio has outperformed its benchmark by 2.5%. Suppose there is an equity mutual fund whose benchmark index is Nifty-50. In the last 3 months, suppose Nifty-50’s total return is say 8%.

If the equity fund posts a return of 10.5%, two and a half percent higher than Nifty-50, its alpha will be 2.5. Similarly, if the equity fund posts a return of 7%, one percent lower than Nifty-50, its alpha will be -1. If a fund posts a return of 8%, its alpha will be 0 (zero).

Calculating Alpha – CAPM Formula and use of Beta (β)

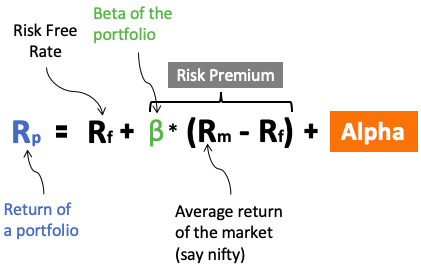

The alpha calculation can be done using a formula. The origin of this formula is from a concept called Capital Asset Pricing Model (CAPM). If you want to read more about CAPM, kindly check the link.

As per CAPM theory, a portfolio must generate a return following the below formula.

Allow me to explain the use of the formula. Suppose there is a portfolio whose beta (β) is 1.4. In the last 12 months, the nifty has moved up by 20% (Rm). During the same period, the average risk-free rate (Rf) was about 7% per annum.

Considering these values, the expected return of the said portfolio can be calculated as below:

Rp = Rf + β * (Rm – Rf) + Alpha

Rp = 7% + 1.4 * (20% – 7%) + Alpha

Rp = 25.2% + Alpha

Suppose, the actual return generated by the portfolio (Rp) in the same 12-month period is say 28% per annum. In this case, the alpha of the portfolio will be:

Alpha = Rp – 25.2% = 28% -25.2%

Alpha = 2.8%

Calculating Alpha and Beta of a stock portfolio

Till now whatever we have learned about alpha and beta gives only a taste of their academic use. But now we will use this information to calculate the beta and alpha of a stock portfolio.

Why we will do this calculation? There are two main reasons:

- First: We must know the beta (β) of our stock portfolio. A portfolio with a high beta is risky. So, in case the market corrects, the valuation of such a portfolio will fall more drastically. If an investor knows this fact, in case of correction, he/she will not panic and start selling.

- Second: We must know if our stock portfolio has an alpha or not. A portfolio with no alpha is as good as an ETF. If we are not able to generate any alpha, why to put the effort of investing in individual stocks? Better will be to buy and index fund or ETF and enjoy passive income.

So to calculate the alpha of a stock portfolio, we must first do the beta calculation for the portfolio.

How to calculate beta of a stock portfolio

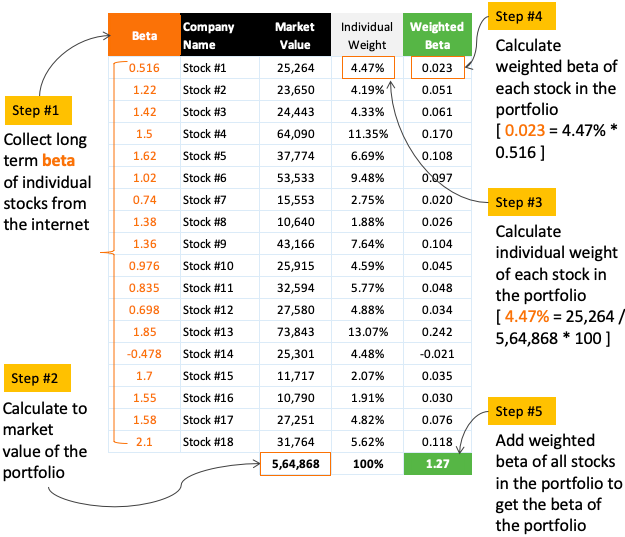

Above is an example of a portfolio that has 18 number stocks as its constituents. Our goal is to calculate the beta of this portfolio. How to do it? It can be done in five easy steps:

- Step #1 (Collect Beta): For this portfolio we must collect beta of individual stocks and put it in the first column. To get the beta values you can visit any stock portals like (business standards, etc) to get the numbers.

- Step #2 (Calculate market value): Suppose you have 2 stocks of a company whose current price is Rs.100. In this case the market value of this stock, for your portfolio, is Rs.200 (2 x 100). Like this, calculate market value of each stock in your portfolio. Sum of market value of all stocks will give you the market value of your portfolio.

- Step #3 (Calculate individual weight): To calculate individual weight of a stock in a portfolio, use this formula = Individual weight / market value of portfolio * 100. You must calculate individual weight of all stocks in the portfolio. The sum of weight of all stocks must come as 100%.

- Step #4 (Calculate weighted beta): Calculating weighted beta of each stock is easy. Multiply individual weight of each stock (step #3) with the collected beta value in step #1. Repeat this step for all stocks in the portfolio.

- Step #5 (Calculate portfolio beta): Sum of weighted beta of all stocks will give the beta of the overall portfolio.

How to calculate portfolio’s Alpha?

The alpha calculation can be done using the formula explained above.

Alpha = Rp – Rf – β * (Rm – Rf)

The calculated beta (β) of our example portfolio is 1.27. Let’s assume the following and then we can calculate alpha for this portfolio:

- Rp = Average capital appreciation displayed by the portfolio in last 1 year = 24%

- Rf = 10-Yr Government Bond Yield = 7%

- β = 1.27

- Rm = Performance of Nifty in last 1 year = 20%

We will use the above example numbers to calculate the alpha.

Alpha = Rp – Rf – β * (Rm – Rf)

Alpha = 24 – 7 – 1.27 * (20 – 7)

Alpha = 0.49

The alpha of our investment portfolio is 0.49

Limitations of Alpha

For people whose portfolio predominantly consists of equity (stocks or mutual funds), alpha awareness gives them a deeper understanding of returns. But for people whose portfolio is diversified between equity, debt, real estate, gold, etc, the alpha calculation becomes challenging.

While calculating alpha, it is also important to select the right benchmark. Suppose you have a portfolio consists of a mix of all types of stocks (large, mid-cap, and small). For such a portfolio, selecting Nifty-50 or Sensex as the reference index (for Rm) will be wrong. A better benchmark index, in this case, will be Nifty-500 or S&P-BSE-500 index.

Similar care must be taken if the portfolio is predominantly exposed to any specific sector. Suppose, your portfolio has stocks only from the Pharma sector. In this case, a suitable benchmark index for alpha calculation will be the Nifty-Pharma index.

Conclusion

There are two unique characteristics of any investment portfolio. First is their constituents, and second is the weightage of each constituent item in the portfolio. Both these factors build a beta for a portfolio. Now, depending on the beta of a portfolio, the risk premium of a portfolio is decided. The higher will be risk premium, the higher will be the overall return.

But some investors are capable of earning something extra, higher than the risk premium. This extra earning is what is called “alpha”. [Check this formula for alpha]. Ideally, we as an investor should build (or invest in) a portfolio that can render maximum alpha.

Money sir, u r GREAT

I am ready your all articles which helps me to understand market.

I am one of reader of your articles last 10 years. Your way of presentation is awesome. Even lay man can understand quickly. All the best.

Thanks. Feedbacks means a lot.

Great post, the simplicity of the explanation is truly marvelous.

Thank you