Generally, for banks and lenders, the asset coverage ratio (ACR) is one way to check the loan-friendliness of the company. Investors can also use the concept of ACR to check two things about the company. First, they can check if the company is risky due to a high debt load. Second, they can also check the price valuation of shares.

This article is mainly about the use of ACR as a valuation tool. Nevertheless, we will first cover the basics of asset coverage ratio (ACR) and then jump into the valuations.

The use of ACR as a price valuation tool is simple and understandable. Hence, I thought to share it with my readers. Though I’ve not used it in my stock analysis worksheet, I apply it personally to evaluating my stocks.

The concept of ACR as a valuation tool is similar to NCAVPS Financial Model. My worksheet uses NCAVPS. But before I knew about the NCAVPS model, I was already using ACR as a valuation tool for my analysis. I still use it because it gives me a deep feeling about the stock being expensive or cheap.

Asset Coverage Ratio (ACR): Basics

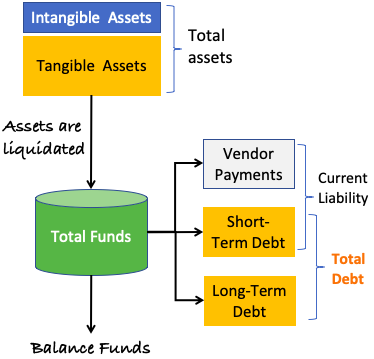

The ratio highlights the solvency, the ability to pay debts, of a company. It considers the worst-case scenario. Suppose a company goes out of business due to impending losses. In such a case, the company can file for bankruptcy. This way, it is declaring its inability to meet any liabilities. It means they cannot pay their vendor, bills, loan interest, etc.

If such a thing happens, how will the lenders get their money back? If necessary, the court can order banks to sell the assets of the company (liquidation). The ‘proceeds of liquidation’ are used to pay all the liabilities (bills, vendors, and loans).

Asset Coverage Ratio (ACR) highlights if the company has enough assets to meet the debt obligations in case of liquidation. In terms of the formula, the asset coverage ratio (ACR) looks as below.

Asset Coverage Ratio Formula:

Explanation of the formula

- Assets: Consider only tangible assets for liquidation. It included land, building, machinery, vehicles, inventory, office items, cash, advances, among other things. Intangible assets like patents, brand-names are not considered for liquidation.

- Current Liability: Before the lenders can claim the debt from the liquidated assets, payment of current liability is a priority. Hence, subtract current liability from total assets.

- Short Term Debt: Deduct it from current liability. Why? Because the numerator quantifies what portion of the total asset is available to service the total debt. Total debt includes long and short-term debt.

- Total Debt: A large numerator in the formula is better. Why? Because it can more easily service the denominator (total debt) in case of liquidation of assets.

ACR Calculation – Example

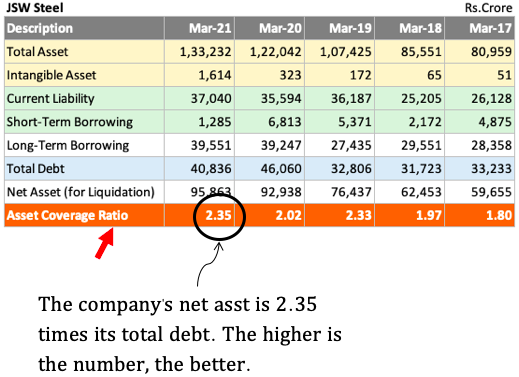

We will calculate the ACR number for our example company, JSW Steel. I’ve picked the numbers from the balance sheet. Then we will calculate ACR using the above formula. Check the below infographics. Here the ACR calculation is done for the last five years.

In Mar’21, the asset coverage ratio (ACR) of the company comes out to 2.35. It means the net asset (see formula) is more than twice (2.35) times its total debt. The total debt is Rs.40,836 crore, while the net asset available for liquidation is Rs.95,863 crore. Hence, ACR will be 2.35 (=95,863/40,836).

How to make sense of the ACR multiple? By looking at a standalone year’s ACR number, we cannot conclude. But when we start comparing it with other numbers, it starts to make more sense.

How to do it? See the below two examples.

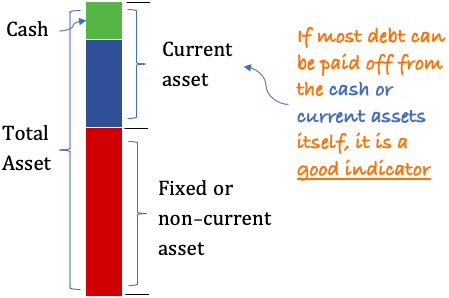

#1. Compare Total Debt vs. Cash

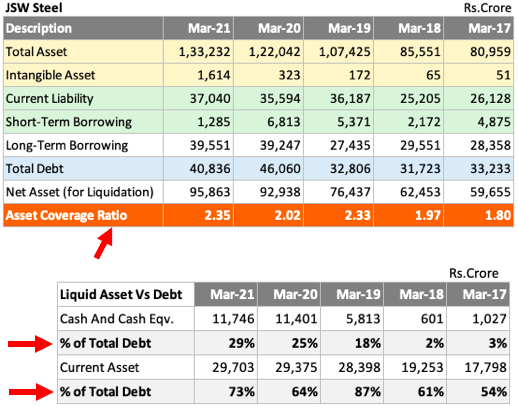

Compare the cash reserves of JSW Steel with its total debt load. For March’21, 29% of the total debt can be repaid from its cash reserves only. All current assets of the company can pay 73% of the total debt. For the balance of 27% debt repayment, lenders will sell the fixed assets.

Let’s see the same comparison with one of JSW Steel’s competitors (Tata Steel).

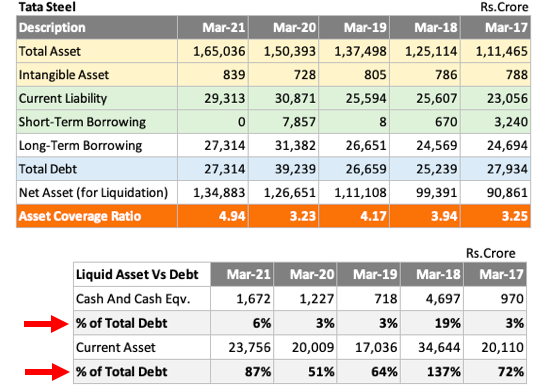

For March’21, cash reserves cover only 6% of the total debt. But all current asset covers 87% of the total debt. For the balance of 13% debt repayment, lenders will sell the fixed assets.

Such a comparison between cash, current asset, and total debt is effective. Do it before calculating the ACR. It will give an idea of how many liquid assets themselves can serve the company’s debt obligation.

#2. Compare ACR Between Companies and see the 5-Yr Trend

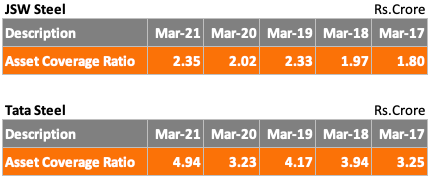

The asset Coverage Ratio (ACR) of a standalone year does not give good visibility. But if we can see a five-year trend, it will speak a lot. Let’s take the example of the below two companies:

Both the companies are operating in the same industry. One has an asset coverage ratio (ACR) of 2.35 in FY 20-21, and the other has an ACR of 4.94 in the same period. The latter looks less debt-laden.

Even the ACR growth of both companies has dramatically improved in the last five years. JSW’s ACR has gone up from 1.8 (Mar’17) to 2.35 (Mar’21). Similarly, Tata Steel’s ACR is up from 3.25 to 4.94. In terms of a trend, both are at par.

The Concept of ACR as a valuation tool

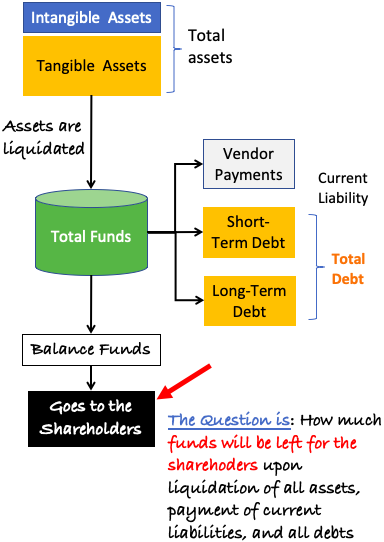

The root of this valuation concept is this query. The shareholders will get how much money upon liquidation of the company’s assets? Why doubt the availability of funds for the shareholders?

Such a fund will first clear all current liabilities like vendor payment, utility bills, short-term debts, etc. Once done, the next step will be the clearance of dues of long-term loans.

The funds that remain after these two payments will be shareholder’s money.

Companies that have amassed excess debt, when they are liquidated, probably less or nothing may be left to distribute to the shareholders.

From a shareholder’s point of view, the higher are the “Balance Funds” as indicated in the above infographics, the better.

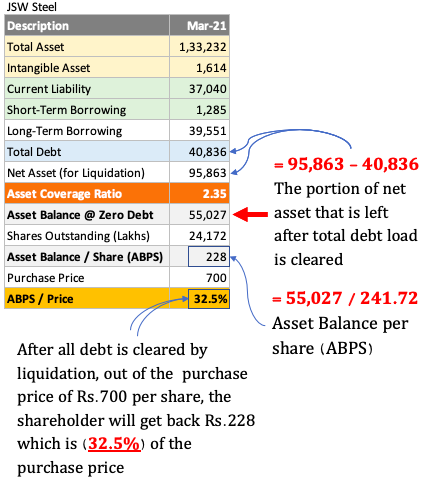

Let’s use this concept to do share price valuation for our example companies JSW Steel.

Here are the steps:

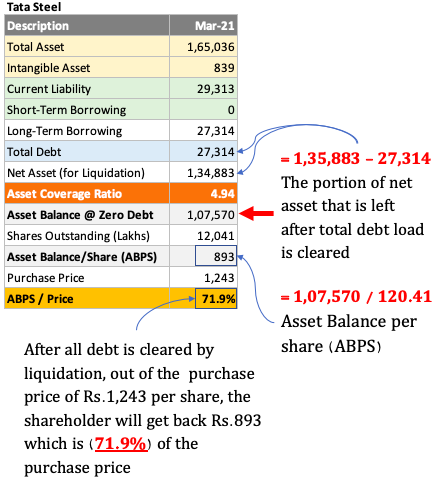

- Step#1: Calculate the asset which will remain balance after payment of all current liabilities and all debts. Let’s call it “Asset Balance @zero debt.” In the case of our example company, this value is Rs.55,027 Crore. Check the calculations shown above.

- Step#2: Calculate Asset Balance per share (ABPS). In the case of JSW Steel, it is Rs.228 per share. Calculate it by dividing the “asset balance” number (Rs.55,027 Crore) by the number of shares outstanding in the market (Rs.241.72 Crore).

- Step#3: Calculate the ratio of ABPS and current share price. For JSW Steel, it comes out as 0.325 (32.5%). It is calculated by dividing ABPS of Rs.228 and the current share price of Rs.700.

How to interpret the ABPS/Price ratio? For JSW Steel, 32.5% indicates that, after all the debt is cleared by liquidation, out of the purchase price of Rs.700 per share, the shareholder will get back Rs.228. It is 32.5% of the purchase price.

Ideally, shareholders would like to see a number higher than 100%. But in all fairness, a value higher than 50% is good. The lower is this number, the riskier is the company for investing.

Here is the ABPS/Price ratio calculation for Tata Steel.

In terms of the ABPS/Price ratio, Tata Steel’s stocks look better than JSW Steel.

Conclusion

Asset Coverage Ratio (ACR) is a good metric to judge the company’s solvency. If we can also apply ACR to value the stock’s price, it doubles its utility.

There is a limitation of the use of ACR to judge the solvency of a company. We have considered the liquidation of assets of the company at the book value. But generally, for distressed companies, some assets may get sold at a considerable discount to their book value. Why? Because the sale is done in a kind of hurry-worry environment.

What does it mean? The size of funds we estimate upon liquidation, seeing the book value, might not be received. Hence, for valuation purposes, it is better to consider the sale of assets at a discount.

I hope you like the ACR concept.

Have a happy investing.

Such a nice explanation Mani!

You make economics look simpler.

Thanks

In money control webite that data is not matching which u mentioned above.

It can differ between websites.