Here is the concept of self-financeable growth. I first read about it on Harvard Business Review (HBR). The write-up was interesting. Hence I thought to write about it, in my words, for my readers.

How I landed up on HBR? Recently Indian stock market is buzzing with IPO’s. Most of the IPO’s attracted the attention of all classes of investors. Why do these IPO’s look so attractive? Because of their potential to grow fast in times to come.

But for growth, all companies need capital. Even if it is a new or an old company, capital for growth is an uncompromising requirement. Companies must keep a check on their cash balance while it is growing. Otherwise, it might become cash-starved if it tries to grow too fast.

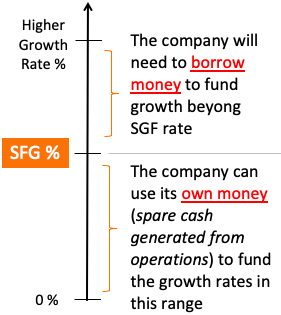

There is an optimum growth rate below which a company can grow seamlessly. Companies can use the spare cash generated from its operation to finance its growth. It need not borrow money (loans) to fund this growth rate. This rate of growth is called self-financeable growth (SFG).

Before we know more about self-financeable growth (SFG), allow me to share few basics about the growth itself.

Capital Requirement For Growth

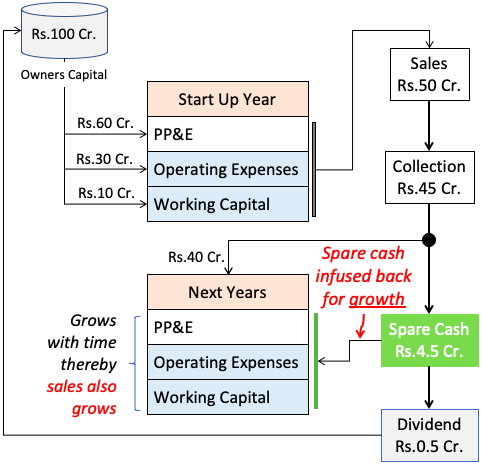

Suppose you are a prospective entrepreneur. You have about Rs.100 crore capital for investment. You have a nice business model ready in front of you. Hence, you’ve decided to set up a business. Following will be your capital requirements for the start-up year and beyond.

The initial capital of Rs.100 Crore (owner’s money) will fund the following expenses. This initial investment is what’s called “setting up the business.”

- (a) Property, Plant & Equipments (PP&E) – Rs.60 Crore.

- (b) Operating Expenses – Rs.30 Crore.

- (c) Working Capital – Rs.10 Crore.

Post establishing the company, it can start selling its products and services (Rs.50 Crore – See the above infographics). The cash-in flow begins (Rs.45 Crore). From what is collected, Rs.40 crore is set aside for the upcoming operating expenses and working capital. The balance (Rs.5 crore) is spare cash. Infusing a part of the excess cash (Rs.4.5 crore) back into the business will be good. The remaining (Rs.0.5 core) is kept as a dividend by the owner.

An Operating Cycle

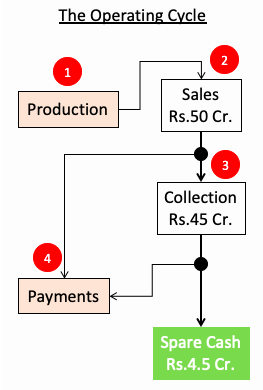

One Operating Cycle will be the sum of the time consumed for production, sales, collection, and free cash generation. A company can grow faster in two ways: (a) By generating more free cash and (b) by making its operating cycle run faster.

Example: Suppose a company whose operating cycle is 180 days. In these 180 days, it generates Rs.4.5 Cr free cash.

In one year, it will execute 2.02 number such “operating cycles.” It means, in a financial year, the company will generate total free cash of Rs.9 Crore (Rs.4.5 x 2.02).

Two things will make a business grow faster. (2) The quantum of the free cash and (b) the number of operating cycles in one financial year.

Calculate Self-financeable Growth Rate (SFG)

The majority portion of the cash inflow gets consumed by the operations. If the company is growing (CAPEX), it will consume more cash.

If a company tries to grow too fast, it might start consuming more cash than it can generate. It is a situation that must be avoided. How to do it? By being aware of the self-financeable growth rate (SFG).

There is a way to calculate this growth rate. Following are the steps:

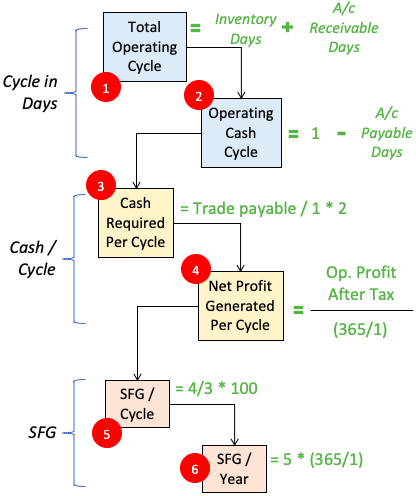

#1. Calculate Total Operating Cycle (in Days)

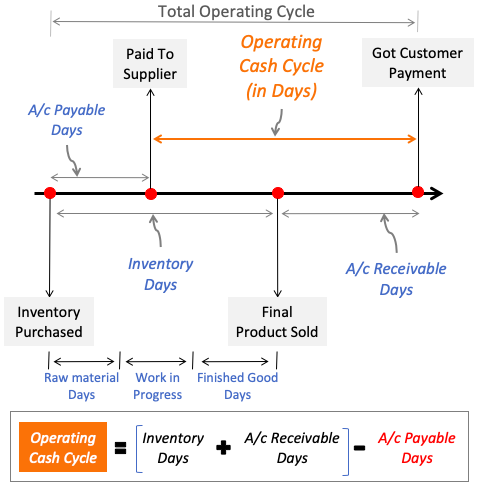

The total operating cycle is the period between inventory purchase and receipt of payment, for the sold product/services, from the customer.

Total Operating Cycle = inventory days + account receivable days.

The operating cycle is a representation of the total business cycle of the company. To know more about the operating cash cycle (OCC), read about the utility of OCC in working capital management.

By the way, a schematic representation of the total operating cycle is shown in the below infographics.

#2. Calculate Operating Cash Cycle (in Days)

Generally, suppliers sell products and services at a credit (like payment after 30 days). The average credit period for all purchases made by the company is expressed as “account payable days.”

To calculate the operating cash cycle, deduct account payable days from the ‘total operating cycle.’ Check the infographics shown above.

Operating Cash Cycle = Total Operating Cycle – A/c Payable.

#3 & #4. Calculate Cash Required / Cycle & Profit / Cycle

In the above two steps, #1 and #2, we’ve become aware of two things. The first is the duration of the operating cycle, and the second is the ‘cash cycle’ durations. Once this is known, the next step is to know about the cash.

- (a) How much cash is required for each cycle. Cash Required = Trade Payable / Operating Cycle * Operating Cash Cycle]

- (b) How much cash-profit is be made in each cycle. Profit = Operating Profit After Tax / (365/Total Operating Cycle]

#5 & #6. Calculate SFG/Cycle and SFG/Year

Reinvestment of the ‘profit per cycle’ generated in step #4, back into the company’s operations, is good. Read more about the retained earnings.

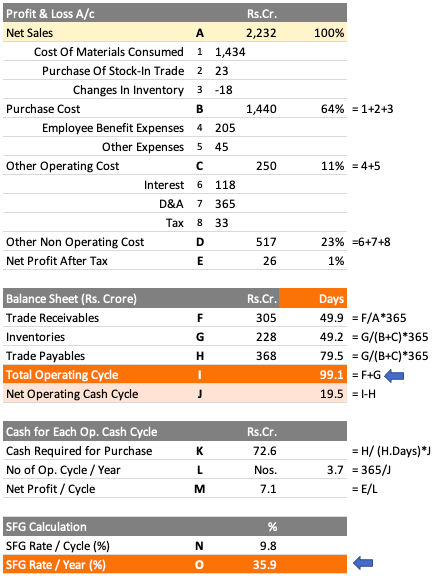

To better understand the calculation of self-financeable growth (SFG) allow me to use the numbers of an example company (typical ancillary supplier of the Auto sector).

The example company is generating Rs.7.1 crore net profit per cycle. The cash requirement of each ‘operating cycle’ is Rs.72.6 crore. Thereby, infusing an extra Rs.7.1 crore in each ‘cycle’ will render a growth rate of 9.8% per cycle ( = 7.1/72.6).

The duration of each operating cycle is 99.1 days. It means that there will be 3.7 numbers such cycle each year ( = 365/99.1). Every cycle, the company can grow by 9.8% by reinvestment of its profits. So in a year, the company can grow by 35.9% per annum ( = 9.8 * 3.7).

This value of 35.9% per annum is the self-financeable growth rate (SFG).

Self-Financeable Growth Rate – Example #2

In this example, we have considered a big player in the steel sector.

To get a deeper understanding of the company, let’s look at the break-up of its ‘total operating cycle’:

- Trade Receivables Days: 9.6 days only. Such a low number indicates that the company supplies its finished goods only after receiving the full payment in advance (or after 9.6 days after supply).

- Inventory Days: 88.4 days. It is the average number of days it takes for the company to convert its inventories into a product that is finally “sold.”

- Trade Payable Days: 89.0 days. It is the average number of days the company takes to pay its vendors.

- Self-Financeable Growth / Cycle: 160% per cycle.

The point to be noted here about the company is the following:

- The “short trade receivables days” and “long trade payable days.” These two factors make its operating cash cycle very short (just nine days). Though the ‘total operating cycle’ is 97.9 days long, its net of trade payable days (operating cash cycle) is only nine days.

- The profit per cycle of the company is Rs.1,594 crore. Its ‘operating cycle’ is 97.9 days long. Hence, the company can generate a profit of Rs.1,595 crore 3.7 times every year.

Probably these are the two key factors why the steel business is lucrative. Though it is an extremely capital-intensive business, it can still afford to operate at almost debt-free levels.

Conclusion

What does the self-financeable growth rate (say 35.9%) say about the company? If the company grows at a rate below this rate, it can self-finance its growth. It will not need external financing (loans) to fund its CAPEX plans. What is the explanation? At growth rates below 35.9%, the company will generate more cash than it is consuming.

Hi

thanks for the explanation,

however there are several mistakes in the maths calculations:

eg: 1) Number of Op Cash Cycles per Year: L = 365/J

In examples:

> Top: L= 365 / 19.5 = 18.7, not 3.7?

> Bottom: L = 365 / 9 = 40.5, not 3.7?

So I don’t understand how you get 3.7 Op Cash cycles per year, for example.

When the 365/J calculations are done,

you get 18.7 and 40.5, so where is the 3.7 coming from ?

Thanks

Kev

Those two values have flipped, but the final answer will be similar with L=18.7 (SFG/Year).

Very helpful article, but I am having trouble with the examples and the formulas, for example, for the calculation of L (No Op Cash Cycle/Year) it says to do 365/J, but when doing that calculation, the number comes back different as to what is shown on L for each example.

Well explained and knowledgeable !

Nicely written….