REITs are a relatively new investment product for India. It was launched with Embassy REIT in Mar’2019. But for more mature markets like the USA and UK, REITs are in existence since the 1960s.

In case you want to know more about what is REIT and its basics, I’ll suggest you kindly read this article first.

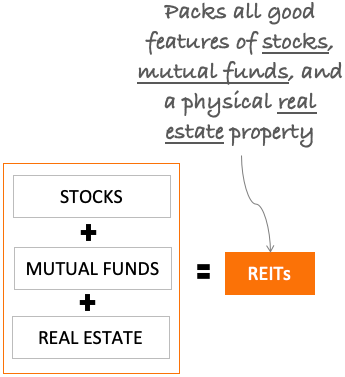

When we think about investment, we mainly go for stocks or mutual funds. People who can explore more also opt for real estate or gold.

In addition to the four alternatives mentioned above, REITs can become our fifth reliable investment vehicle. Though REITs have roots mainly in the real estate sector, there are differences. It will not be wrong to say that REITs is a product that packs good features of stocks, mutual funds, and real estate.

Similarity of REITs with Other Investment Vehicles

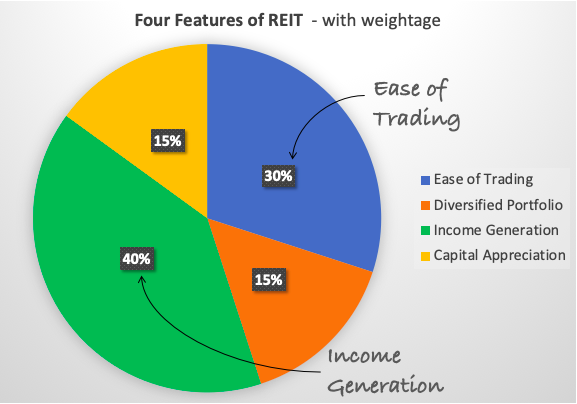

- Stocks: What is the unique feature of stocks? It is possible to buy and sell them quickely without any formalities. Even day trading is possible in stocks. Compare it with the hassels of buying a physical property, you will get the point.

- Mutual Funds: A unique feature of mutual funds is its diversified assets. An equity based fund has various types of stocks in its portfolio. This kind of diversification makes it comparitively less risky than individual stocks.

- Real Estate: What makes a real estate property unique is its ability to generate regular income, like monthly rent (Read about passive income).

A common feature of all the above three investment vehicles is their ability to yield long-term capital appreciation.

REITs are a type of investment product that packs all the above-listed four features within itself. The most prominent ones being its ability to generate income.

How REIT is a Reliable Income Generator?

REIT is an investment vehicle that is tailor-made for people seeking regular income from their investments. Regulators have conceptualized REIT in a way that will ensure regular income.

Here are the following points about REITs that works in favor of the investors:

- PAT Distribution (90%): It is mandatory for REITs operating in India to distribute 90% of its PAT to shareholders as dividends.

- Completed Projects (80%): REITs portfolio consists of commercial properties like office space, retail outlets etc. It is mandatory for REITs to keep at least 80% of their portfolio consisting of such properties which are rent or long-term lease ready. Under-construction property must be limited to a maximum of 20%.

- Rental Revenue (51%): It is also mandatory for REITs to generate at least 51% of its revenue from rents or long-term leases.

These three factors make REITs the best income-generating investment option for investors.

Why Invest in REITs (Returns)

Broadly we have already discussed the benefits of REITs. Let’s reiterate its advantages in slightly more detail here.

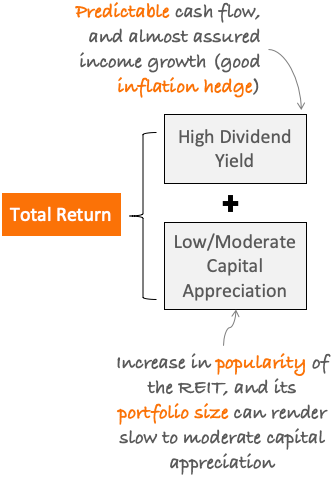

REITs become attractive for small investors because of high total returns at a comparatively lower risk. The total return is a combination of high and predictable dividend yield and decent long-term returns.

To get an idea of the quantum of dividend yield and capital appreciation from REIT stocks, allow me to present to you some real numbers:

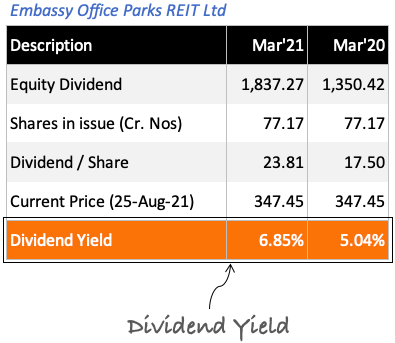

- Dividend Yield: I’m taking an example of Embassy Office Parks REIT. It was launched in Mar’2019. It was the first REIT for India. As visible in their P&L Accounts, Embassy has reported Equity Dividend in Mar’2020 and Mar’2021. Here is the calculation of its dividend yield. On an average (2-Yrs), this REIT has yielded a return of 6%. For existing investors, the yield will further grow beating the inflation.

- Long Term Capital Appreciation: It has only been two years since launch of REIT. Hence, I do not have any Indian data source to present you as an example. But it is a fact that REITs can only yield low to moderate capital gains. In Indian terms, low returns will be 6.2% (yield of 10-yr govt. bond). REITs can yield a slightly better return than this bond.

So in terms of total returns, a combination of stable dividend income and moderate long-term returns is good (about 12% p.a.). It is the main reason why we can consider investing in REITs.

Why Invest in REITs (3 More Reasons)

- Liquidity: REIT stocks are also as tradeable as any other common stocks. We can purchase and sell REIT stocks at any time we want. It makes REIT a reasonably liquidy asset.

- Corporate Governance: REIT operates like a company. On onc hand it has its directors, manages, financers who operate it. On the other hand REITs come under the ambit of SEBI (a reliable regulator). Comparing it with a property developer or a society association, REITs will emerge a highly professional. It is worth noting that only a selected few developers can become eligibile for REIT.

- Diversification: Generally, REITs have a low correlation with the stock market. This is the reason including REIT in our investment portfolio will make it more diversified.

Two REITs & One Real Estate Investment Trust Operating in India.

As of Aug’2021, there are two REITs operating in India. Following are their details (numbers are in Rs.Crore):

| Mar’20 | Embassy REIT | Mindspace REIT | Brookfield RE Trust |

| Sales Turnover | 851.90 | 613.30 | 956.71 |

| Operating Profit | 758.01 | 605.70 | 593.63 |

| Net Profit | 481.40 | 583.40 | 15.12 |

| Equity Dividend | 1,350.42 | 283.50 | 0.00 |

| Shares (in lakhs) | 7,716.70 | 5,930.18 | 652.03 |

| EPS Ratio | 6.24 | 9.84 | 2.32 |

| Current Price | 347.40 | 295.10 | 254.90 |

| P/E Ratio | 55.69 | 30.00 | 109.92 |

| Dividend Yield | 5.04% | 1.62% | 0.00% |

Hi Mr. Mani, After reading this article, I was exploring and analyzing the embassy Riet. However, the fundamentals are so weak, the Dept Equity ratio is high, promoter pledged 80% of their shares, ROCE is less than 3%….. while looking at these fundamental datas, do you think this is right pick for long term investment. Also, I could not find this stock in your stock analysis work sheet. Even I tried to update, it is not appearing. Please give your insights on this.

Hi Mani,

I have been investing into stock market fundamentally strong share since last year after investing much time finding good stocks. But I have started to notice that my portfolio is not even able to catch up to the Nifty50/Sensex index. For example yesterday when NIFTY gained 1.14% my portfolio was somewhat at 1.04%. I have heard that if you are not able to beat the indices then there is no use of toiling hard and instead invest in index mutual funds.

DO you think such short term absolute return comparison make sense or should I wait for 3-5 years to see actual beating gains in absolute return. Why because, it is not that I invested entirely lumpsum but over the period. In such case how to calculate and compare the XIRR of Indices and be sure that I am on right track.

Please make a blog on this. “Tracking XIRR of portfolio and comparing with Index performance.”

Please check this article. It might give some insights.

My Practice: Pick good stocks at price corrections and wait long. Watching the portfolio, again and again, will only cause panic.