Before we get into index investing, we must know about the stock index. An index highlights changes in the collective value of a group of stocks over time. It is an indicator that highlights the performance of the entire market or a specific portion of the market (sector, theme).

If there is a group of stocks, like a portfolio, the price of its components is volatile. This volatility will cause the value of the overall portfolio to fluctuate. Similarly, the price movements of the individual constituents cause the index to fluctuate.

Our Indian stock market has two main indices, Nifty and Sensex. The Nifty has 50 number constituent stocks, and Sensex has 30. These two indices are the indicators of the overall stock market.

Another index is Nifty-Bank. It highlights the changes in the valuation of the overall banking sector.

S&P BSE 100 is another index that has one hundred constituents. It also highlights the changes in the overall stock market. As the constituents are more, the value of BSE 100 is derived more deeply.

The Utility of Indices

The purpose of stock indices is to serve as a benchmark. This benchmarking helps to judge the performance of other assets. How? By comparative analysis.

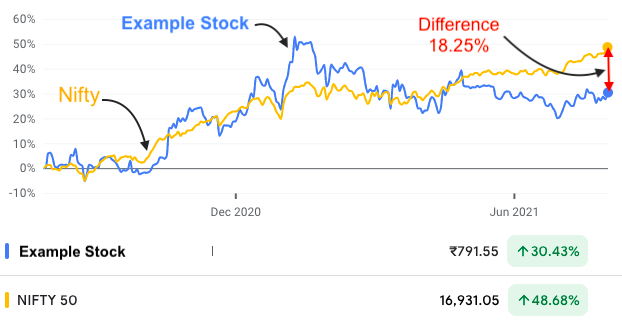

For example, suppose a stock grew by 30.43% in one year period. In the same period, Nifty grew by 48.68%. Hence, we can conclude that, though the stock’s performance is good, it still underperformed the index by 18.25%. So comparatively, the share has not done well.

Even better utility of index as a benchmark is when it is dealth with mutual funds. The comparison of the index with mutual funds or ETFs highlights their relative performance in a better way. Why? Because both (indices and funds) have a group of securities (like stocks) as their constituents. It is like comparing apple to apple.

Here is the performance of a mutual fund compared to Nifty. The mutual fund’s NAV grew by 52.82% in the last year. In the same period, Nifty rose by 48.68%. The mutual fund overperformed the index by 4.14%.

A more practical utility of indices, for we retail investors, will be to use them for index investing. It is not possible to invest directly in an index, but alternate methods are possible. Either we can invest in index funds or index ETFs.

If one is ready to explore further, building a stock portfolio by self will be a good idea. How? We can take clues from the indices like Sensex and Nifty (check this video).

It is the kind of index investing that I followed during my starting years in the stock market.

Index Investing

Middle-aged people and senior citizens relate to my blogs. But the majority of my readers are below 35 years of age. Why I’m counting the age? 🙂

It is because no matter whatever is one’s age, index investing is suitable for everyone. It is particularly apt for people who have just started investing in stocks, beginners.

Why the index investing is suitable for beginners? Because it is simple to understand and even easier to implement. Moreover, tracking the investment is also a piece of cake.

In short, if the question is, how a beginner should start investing in equity, index investing is the way to start the journey.

Rule #1 of Investing (Health)

The first rule is to buy stocks of only financially healthy companies. How to judge a company’s financial health? A person who knows the process of fundamental analysis can do it. But how a beginner/novice can identify a healthy company?

They can avoid the step of fundamental analysis. How? Because stocks can be picked from the constituent list of the index. Which index to refer? Major indices like Nifty, Sensex, S&P BSE 100 will be good.

When I was completely new to the market, I used to regularly view the portfolio of major indices. This exercise made me familiar with the big names of the stock market.

These days I self-prepare my watchlist and do an analysis of those stocks in excel. But during my earlier days, the listed shares of the indices used to be my watchlist.

Here are the quick links to the constituents of major stock indices of India:

Rule #2 of Investing (Valuation)

If the stock selection can be done so easily why do people care to learn stock analysis?

No doubt, stocks listed in major indices have strong fundamentals. But as they are so visible, they almost always trade at overvalued price levels. Buying an overvalued stock will render only subdued returns even in the long term.

So, how to manage this problem? There is a solution but first, look at the below 20 year Sensex chart.

Milestones of Sensex in Last 20 Years

- #1 Yr-2000-2001: Between this period, the Sensex peaked at 5,700 points in Feb’2000. At this point, the majority must have thought that the market is overvalued. Buying at these points will not be good. They were right, the market corrected, and the Sensex fell to 2,800 points in sep’2001. But it again rose and reached a new peak (Yr-2007).

- #2 Yr-2007-2009: In Dec’2007, Sensex peaked again with 20,000 points. I started investing during this period. Everyone thought the market was super expensive. But it crashed (mortgage crisis) and bottomed at 8,600 points on Jan’2009. But as the crash was inevitable, the rebound was also sure. The Sensex reached another peak (Yr-2015).

- #3 Yr-2015-2016: From bottoms of Yr-2009, Sensex rose back to 29,000 points in Feb’2015. Then it again corrected to 23,700 points till Feb’16. Again came a big rebound (Yr-2020).

- #4 Yr-2020 Covid Crash: In Jan’2020, the Sensex peaked again at 41,600. At these levels, people were sure that the market is expensive. Retail investors were staying away, waiting for the crash to happen. Then Covid came, and the market tumbled anyways. Within a couple of months, Sensex bottomed at 28,000 points (Apr’2020).

Where is the market today? At 57,000 points. Does it feel overvalued? Yes. Similarly, it felt overvalued in 2000, 2007, 2015, 2020, and today (Aug’2021).

What is the point?

No matter how overvalued the market might look, two facts are universal. First, the market will crash. Second, it will reach newer heights in the coming years.

So what should be the investment strategy of a novice/beginner?

An investor can follow two strategies:

- First: They can follow the route of systematic investing (SIP) – gradual investing.

- Second: They can wait for corrections and then invest – in a lump sum.

Rule #3 of Investing (Apply The Knowledge)

From what we have read till now, we know two things. Firstly, major indices include only fundamentally strong stocks as their constituents. Secondly, no matter how expensive the index might look today, it will crash and touch newer higher in times to come.

This is only a theory. How to apply this knowledge to invest in stocks?

- Exchange-Traded Funds (ETFs): ETFs are the best way to practice index investing. I track the index chart as shown in rule #2. When the market dips, I make sure to buy the shares of ETF in lump-sum. Why ETFs? Because they can be bought and sold like stocks. They are from a family of mutual funds but work like stocks. Their expense ratio is similar/lower than index funds. Check this link for the types of ETF’s available in India.

- Index Funds: People who do not invest in the share market can opt for index funds. It is a mutual fund whose portfolio mimics a particular index (like Nifty, Sensex, Nifty-Bank, etc). If I had to invest in index funds, I would use the SIP strategy. It will help me gather some units of index funds every month. Though lump-sum investing is also possible, during the dips, a novice can avoid it.

- Own Stock Portfolio: I used to practice this method. I used to refer to the indices and prepare my watch list. Whenever there was a price correction of about 8-10% from my set price, I used to buy it. I was sure that I was buying stocks of a healthy company. Moreover, as I was buying only on dips, I was maintaining some margin of safety. You can also check this video explaining how Sensex can be used to practice index investing.

Conclusion

For a newbie, investing in an index fund will be a good idea. Select an index fund whose expense ratio is the lowest. Picking an index fund with a low-tracking error will also be better. A combination of low expense ratio, low tracking error, and a high AUM (Asset Under Management) will eventually help you pick a reliable index fund.

I like to trade in individual stocks. Hence, for me, ETF’s sounds like a better alternative than index funds. Like we buy stocks using our stock trading account, we can buy ETFs.

During times like stock market corrections or a crash, investing a lump-sum amount in an index ETF is like fool-proof investing. The returns will also be decent in the long term (above 12% per annum).

Great Article again !

I have been investing in direct equities and got decent gains. My folio composed of mostly large caps.

Do you think I should still invest in (flexicap) mutual funds or should I redeeem and manage my folio on my own?