First, I’ll explain what prompted me to explore the idea of index funds vs ETFs. Both are very similar products. But I wanted to know that for people like me, who like stocks, ETF is the first choice. But what is the logic behind this preference? I wanted to record it in black and white, hence this article.

Before we can compare index funds vs ETFs, let’s talk a bit about index investing. People who prefer investing directly in stocks generally do not invest in an index.

But consider a scenario.

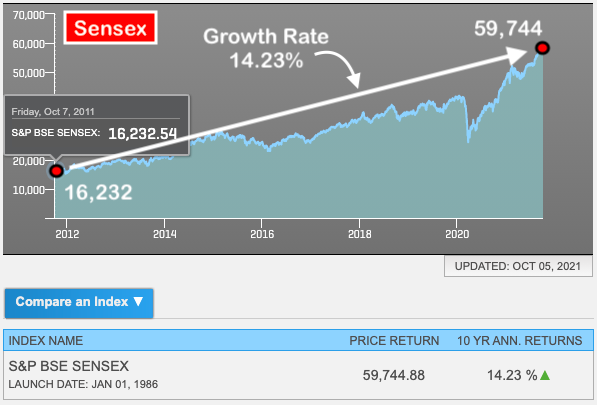

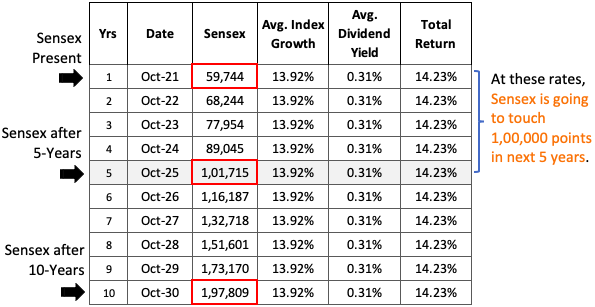

As shown in the above image, in the last 10-Yrs, the Sensex grew from 16,232 points to 59,744 points. It is a price rise of 13.92% per annum. Let’s add to it the dividend yield of Sensex-30 stocks. The total return will be 14.23% per annum.

Suppose, in the next 10-years, Sensex-30 stocks would grow at a similar rate. At this rate of total return, Sensex will touch 1,00,000 points in the next 5-years (YR-2025). Check the below table:

This impressive Sensex number (1,00,000 points) rings a bell inside. Right? It gives clarity about where the index is heading in the next five years. While the index is moving that way, its yield is about 14% per annum. As index investing yields passive income, a 14% p.a. return is phenomenal.

How to practice index investing? Index funds or index ETFs are the available options. So, out of the two which is better? Let’s search for the answer.

#1. Index Funds Is For A Mutual Fund Mindset

People who invest primarily through mutual funds will have a preference for index funds. Their minds are tuned to buy and sell mutual funds units. Hence, for them buying ETFs will be a new thing.

Why I’m calling ETF a new thing? Because ETFs trade in the stock market like shares. One will need a trading account and a Demat account to buy and sell ETFs. A mutual fund investor who does not have these accounts might see ETF as an unnecessary hassle. For them, investing in index funds will be seamless.

Moreover, investors having a mutual fund mindset primarily buy units through the SIP (Systematic Investment Plan) route. Only index funds come with the SIP facility.

#2. Trading Index Fund Is More Cost Effective Than ETFs

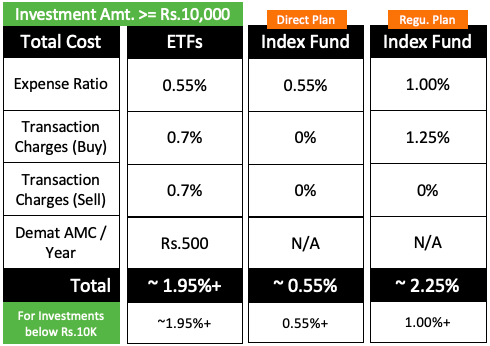

Another point that goes in favor of index funds is the total cost of investment. Investing in a direct plan of Index funds is most cost-effective. One will pay only the expense ratio. Regular plans have both expense ratio and transaction charges. For investments above Rs.10,000, regular plans are less cost-effective than ETFs. Check the comparison shown above.

The total cost of ETF trading is high. It is high as each transaction has an extra charge. Moreover, ETF needs a Demat account. Hence the investor must also bear the Demat’s annual maintenance charge (AMC).

- Transaction Charges: ETF trading accompanies charges like brokerage, security transaction tax, stamp duty, GST on brokerage, and cess. All these charges amount to about 0.7% on each transaction. It’s applied to both buy and sell orders. It will lift the trading cost to 1.4%.

- Demat Account also has a cost. First, there will be a one-time account opening charge of about Rs.200. Second, there will be an annual recurring charge under the head Demat A/c AMC. For portfolio size below Rs.200,000, AMC will be Rs.100 per year. For portfolios of bigger size, AMC charges can range between Rs.300 to Rs.700 per annum.

Direct plans of index funds are more cost-effective. To buy an index fund, the use of the MF Utility website will be ideal. This website has only direct plans. A group of Fund Houses (Asset Management Companies) under the watch of AMFI manage it.

[P.Note: I’ve assumed the same expense ratio for ETF and Index funds. Generally, ETFs have a lower expense ratio than index funds. But there are index funds whose expense ratio can go to 0.2% levels. Selecting a lower expense ratio fund/ETF is the key when it comes to index-investing.]

#3. ETFs will Yield Higher Returns Than Index Funds

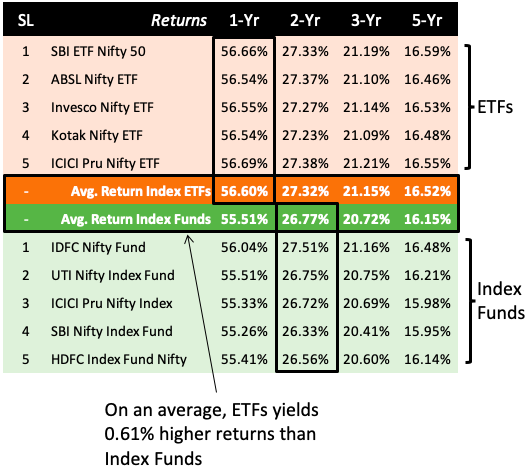

Check the returns generated by multiple ETFs and index funds over 1-Yr, 2-Yr, 3-Yr, and 5-Year periods. On average, ETF’s yield is 0.61% higher than that of index funds.

The cost of investing in an ETF is high compared to index funds. This relatively higher cost gets partially adjusted by the high yield of the ETF. Nevertheless, the cost-adjusted return of a direct plan index fund will still be better.

Ideally, both index funds and ETFs should yield identical returns. But due to tracking error, index funds returns are lower compared to ETFs. Why does it happen? There are two reasons:

- #a. Redemption Request: Index funds do not invest 100% cash to buy stocks. Some portion is left idle as cash. Why? To meet the daily redemption requests of existing investors. In the case of ETFs, share transfer takes place between a buyer and a seller. The fund house is not involved in the process. Hence for ETFs, keeping a cushion of cash is not necessary.

- #b. Minimum Cash Deployment: Index funds buy individual stocks in the same weight as the benchmark index. Suppose, to buy stocks as per the index weight, the minimum cash requirement is Rs.20 lakhs. But so far only Rs.18 lakhs has been collected from new investors. In this case, till the balance of Rs.2 lakhs is collected, the fund manager would have to keep Rs.18 lakhs idle.

Due to these two limitations, the tracking error in an index fund is more visible. It eventually leads to lower returns. Hence, investing in a popular index fund whose AUM is substantial can help. Such funds tend to have a lower tracking error.

#4. Comparison: Index Funds Vs ETFs

| SL | Description | ETF | Index Funds |

| 1 | Liquidity Concern | For some ETFs | No |

| 2 | Price | Varies during trading hours | Changes only once at the end of the day (EOD) |

| 3 | Expense Ratio | Low | Higher than ETFs |

| 4 | Trading Charges | High | Low |

| 5 | Total Cost (Expense Ratio + Trading) | High | Low |

| 6 | SIP Option | Not Available | Available |

| 7 | Dividend Payout | Credited into bank a/c | Reinvested |

| 8 | Taxation | 15%-STCG, 10%-LTCG if gains are above 1.0Lakhs | 15%-STCG, 10%-LTCG if gains are above 1.0Lakhs |

Conclusion

ETFs are mainly for traders. For long-term investors index funds seems to be a better choice. The main reason behind this conclusion is the cost of investment. Though the expense ratio of ETFs is generally lower than that of Index funds, it still proves costly. How? Because of the other charges (brokerage, STT, Stamp duty, GST) applicable on ETF trading.

To invest in an index, the choice of an index fund is better.

The use of the trading account and Demat account to invest in an index is not as cost-effective as index funds.

But to invest directly in stocks, one will need a trading account and a Demat account. The potential return from individual stocks is higher than an index. Hence, the extra costs associated with trading and Demat accounts looks justified.

Have a happy investing.

Do we have Any ETF in india which pays dividends?

Yes, all index funds pay dividends as and when received.

The analysis may need to factor that most investors have brokerage accounts with players like Zerodha, Upstox etc which offer zero brokerage charges. So, investor may not be paying 1.4% which you have considered in the analysis.

Hi Mr. Mani, thanks for this article. I am primarily inesting index mutual fund. If you make another article arcticle about the various index mutual funds such as nifty 50, nifty next 50. midcap index fund, small cap index fund etc. Instead of anlayizing and monitoring the all large cap, mid cap, small cap stocks for direct stock investing, if I focus and invest only these three type of index mf funds (nifty 50, midcap index, small cap index), will I be able to success in long term without and get better return? if you could make article in any form to cover these various index funds, it will be good learning about various type of index funds.

Average returns of a combination of indices (Nifty, Midcap, and SmallCap) will be decent. But the only criteria will be to hold the units for a very long time. Investing in lump-sum during index corrections will also be a good idea.