One of the best investment tips for beginners in India is to follow investments consistently and with purpose.

Consistently, why? Because irregular investments eventually gets spent.

Purpose, why? Because goalless investments also gets spent.

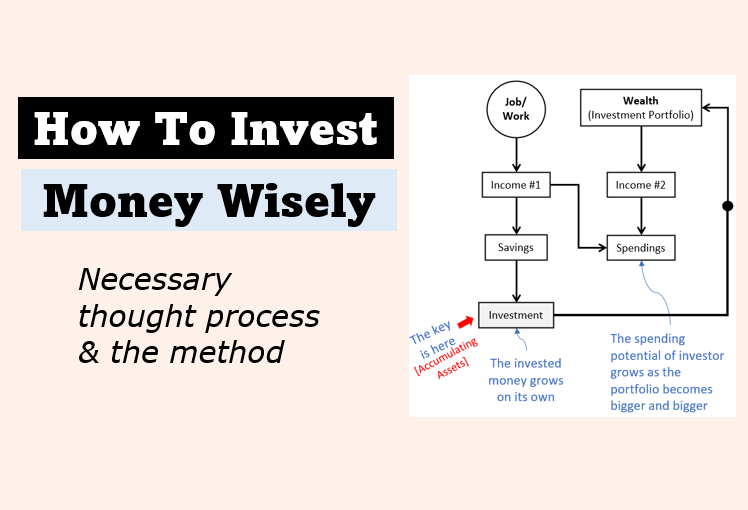

What is the purpose of investment? Wealth creation over time.

But if the investment gets liquidated and spent, the purpose is not met.

Hence for beginners, the keywords to wealth building is a combination of following phrases put to one:

- Invest money.

- Do it consistently.

- Assign a purpose to investments.

People often see investment of money in isolation. Hence less people can invest money efficiently.

“Investment, consistency, and purpose” must be dealt with all together.

In the process of wealth creation, one feeds the other.

It is essential for investors to keep it this way. Otherwise, it will not work.

If investment is not done consistently, and is without purpose, it cannot render the desired results.

Investment is a tool that can make one a millionaire, if followed properly.

But if one does not follow investment properly, benefits will only be mediocre.

I am sure, we do not want our investments to perform mediocrely.

#1. How Beginners can start investment?

Beginners must venture carefully into investments. Why?

Because what we are dealing with here is money, our hard earned money.

We do not have the luxury of losing it.

Instead, we invest our money to make it grow, not for losing, right?

So what are the tips for beginners?

The tip is simple, “learn to deal with money first“.

Yes, it is essential to learn this skill. Why? Because our skill is nearly zero when it comes to dealing with money.

How to deal with money (money management)?

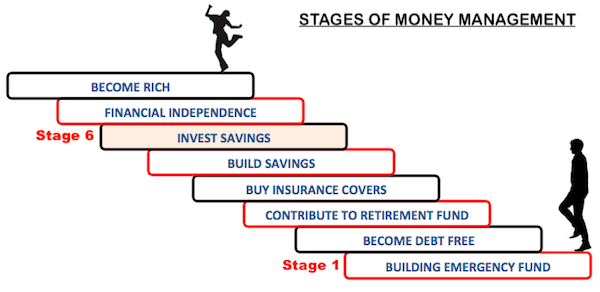

There are several stages when it comes to money management.

Investing money is one of the “advanced stages“.

So it is only logical to first learn and master the “initial stages”, and then jump onto investments.

What are the initial stages?

So now we know what is “stage one”.

“Building of emergency fund” must be done first thing.

Investment of money is stage six (6).

It means, before one starts to invest money, there are 5 stages that needs attention first.

Complying with all the stages in this sequence, can be called as “correct dealing with money“.

Why people (specially beginners) must follow this sequence?

Because it works like a preparation for “investment”.

Why investment needs preparation? Because profitable investments are often risky.

If a person falls prey to the risk, he must know how to come out of it.

Such a preparation helps the investors to survive such risk-strikes.

But not all investment options are risky, right? So why I am calling investments as “risky”.

Because for me, stocks are best investment vehicle for beginners.

Lets read more…

#2. Where beginners can invest money?

I personally think that beginners (young people) must consider stocks as their preferred investment vehicle.

People, who have followed the above listed “stages of money management”, can afford to invest fearlessly.

But fearless investing must be backed with “wise investment decisions”.

When people invest in stocks, I call it fearless investing. Why?

Because investment in stocks is risky, and when people invest in stocks anyways, I call them fearless.

But there are two types of fearless stock investors:

- Value investors.

- Traders.

Both are fearless, but they are not same.

Traders invests more on basis of technical analysis. Technical analysis deals with price momentum, trends etc.

Value investors buy/sell stocks more on basis of fundamental analysis.

This type of stock analysis cares more about inherent strengths/weakness of a business.

What’s the difference? Technical analysis is superficial. Fundamental analysis is very detailed.

What is the point?

Traders invest in stocks more like gamblers.

While value investors invest in stocks like careful scientists.

Yes, stocks must be dealt with care. Why? Because they are risky.

The risk associated with stocks comes from its price volatility. But the bigger risk comes because of lack of know-how of investors about stocks.

If investors has not learned to handle stocks, it is like walking on explosive mines.

It is of paramount importance to first develop the know-how of stocks and then invest.

#3. How beginners can invest in stocks?

Investment in equity (stocks) is best done when handled by oneself.

If handling investment by self is not possible then seeking professional help is better.

For beginners, indirect investing in equity is a good alternative.

But why indirect investing?

Because none of us want to land up in a situation where our invested money is lost due to bad decisions.

This situation can be avoided by maintaining a correct balance between risk and return.

Higher the risk, better will be the returns. But unnecessary risk is not right.

How to deal with this situation? Rely on mutual fund managers.

Expert fund managers of mutual funds know how to manage risk and returns.

#3.1 Direct investing in stocks must be done based on information…

It is always better to be a informed investor than a sorry investor.

Information is essential when we invest in stocks directly.

Investment options like bank deposits, debt funds etc are not so information sensitive.

These options are safe investment vehicles.

While stocks, equity linked mutual fund are riskier form of investment.

So why to invest in risky options? Because potential to earn higher returns is more here.

But before one selects a high return option, it is important to learn to manage the risk of loss.

How to manage? By staying informed about stocks.

How to stay informed? By answering following basic questions related to stocks:

- What are shares?

- Why share price fluctuates?

- How share investment give high returns?

- Are the share in question, fundamentally strong?

- Is the share in question undervalued or overvalued?

- What is the objective of buying shares?

- How much money can be invested in shares?

- How to hold these share for next 5 years, no matter what comes?

- Has the share paid consistent dividends for last 5 years?

- Has the EPS of the share grew in last 5, 10 years time horizon?

- The shares in question has been listed in stock exchange for more than 10 years or not?

- Are the Top management of company good?

- Who are the competitors of the company in question?

- Does the company/sector in question has good future prospects?

These are few key questions related to stocks, which must be answered before buying.

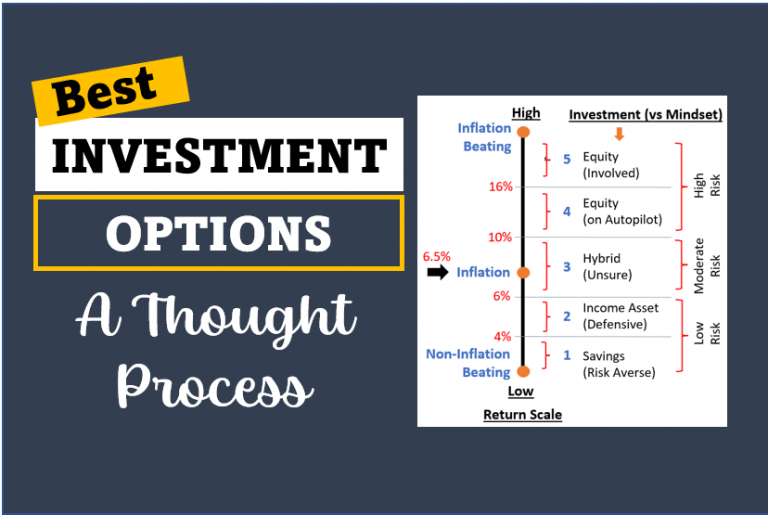

#4. Beginners must gauge risk and reward?

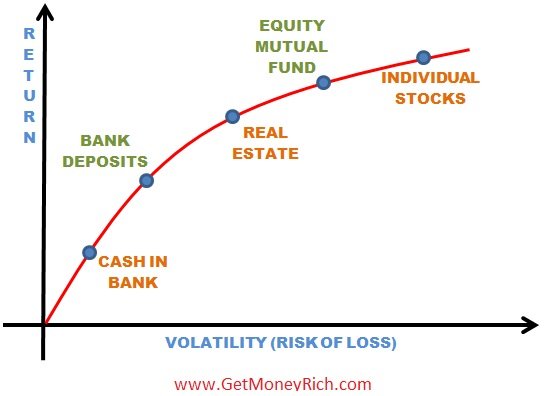

Investors must evaluate other investment options before picking stocks.

With all investment options, comes inherent risk and reward.

Before buying one, a knowledgeable investor researches each option for its risk and reward potential.

Investment options that has higher risks, can give higher returns in long term.

The investment options that has lower risks will give lower returns.

Why high return investment options are risky?

These options are risky because of its short term price volatility.

Even though the options are risky but still investors invests in them, why?

Because, if investors can hold them for long term, the risk can be converted to reward.

The reward is enjoyed by investors in terms of risk premium.

So the trick to invest in riskier investment option is, hold them for long term.

It is because of the potential high risk premium, that experts suggest investors to buy shares.

So buying shares is good. But one must know how to deal with it.

I use my stock analysis worksheet to understand few intricate details about potential stocks.

#5. Beginners must know about the “liquidity factor”…

Like risk, liquidity of invested funds also influences the level of returns.

In case the return is low, it means either:

- The risk involved is low, or

- The liquidity is high.

Lets take example of Bank’s Fixed Deposits.

Deposits gives comparatively lower returns. Why? Because bank deposits are risk-free option.

What about the liquidity of invested money? Liquidity is not as great. How we can say that?

Suppose one has a deposit with a lock-in period of say 1 year.

Suppose the investor decides to break the deposit before maturity. What will happen?

There will be penalty levied for premature withdrawal.

Imposition of penalty on FD makes it a “low liquid” investment option.

So what we know about bank deposits?

- Its a risk free option.

- Liquidity of invested fund is poor.

What we can conclude from this understanding? Return from deposits will only be moderate.

| Risk | Liquidity | Return |

| Very Low | Moderate | Moderate |

Now, lets do the same exercise with Savings Account.

Money kept in savings account is both risk-free and liquid.

Hence return from savings account will be low.

| Risk | Liquidity | Return |

| Low | High | Low |

Lets do this exercise with stocks…

- Returns from stocks are unpredictable.

- People must hold stocks for long to generate higher returns.

Hence return from stocks will be very high.

| Risk | Liquidity | Return |

| Very High | Very Low | Very High |

Risk Vs. Liquidity Vs. Returns analysis of few investment options…

| Investment Option | Risk | Liquidity | Return |

| Stocks | Very High | Very Low | Very High |

| Equity MF’s | High | Very Low | High |

| Real Estate | High | Very Low | High |

| Gold | Low | Low | Moderate |

| Bank Deposits | Very Low | Moderate | Low |

| Savings A/c | Very Low | Very High | Very Low |

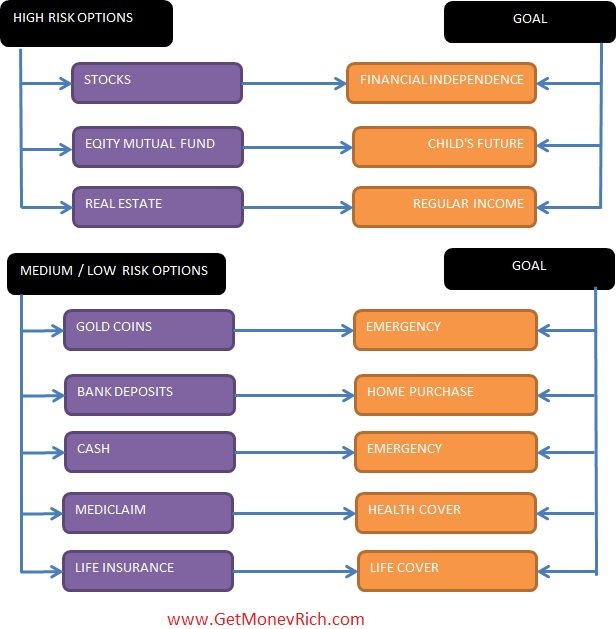

#6. Think in term of building a “diversified investment portfolio”…

What does it mean?

Keeping ones invested portfolio full of only stocks is good?

For a beginner, it is not a good idea.

What one must do? Keep the portfolio well diversified. Why?

It helps to negate the potential risk of loss.

What it means by diversified portfolio? Having a mix of non-related investment options.

Example: real estate, gold, stocks, bonds, and cash makes a perfect ingredient of a diversified portfolio.

Mapping each constituent of portfolio with personal financial goals is also important. Why?

This way one keeps reviewing each item held in portfolio. It also gives a purpose to every constituent of portfolio.

This is what is called as practising goal based investing.

A typical investment portfolio can look like this:

Depending on the personality of investor and desired goals, suitable investment options can be selected.

A investor who by nature is aggressive, can accumulate riskier options.

A investor who is by nature is conservative, shall invest in debt plans, gold, deposits, insurance etc.

Suggested Reading:

Depending on the personality of the investor and desired goals, suitable investment options can be selected. Money kept in a savings account is both risk-free and liquid. A very well-written piece with good information for any starter.

Hello Mani,

awesome blog.

I wanted to get some advice on some shares of LIC of India that my mother in law has. It has been more than 30 years that she bought those .

As she has the paper originals,who and how can she sell those shares. Your input will be greatly appreciated.

Thanks

Hi, I am not sure but I think you have already missed the deadline for conversion of share certificates into demat form. But you can try to send the email here (info@nsdl.co.in) to get more info.

HOW TO TO FIND UNDERVALUED STOCKS.

You may find this blog useful. Please have a look. Thanks for asking.

A very well written piece with good information for any starter.

Thanks Mani!

Thanks Abhinav for posting your comment.