I was reading a chapter of The Intelligent Investor and what I found was irresistible. I could not contain myself from blogging about it. I’m sure, smart investors would already have figured these out. But for me, reading these points was like a reaffirmation of the importance of a few known investment rules.

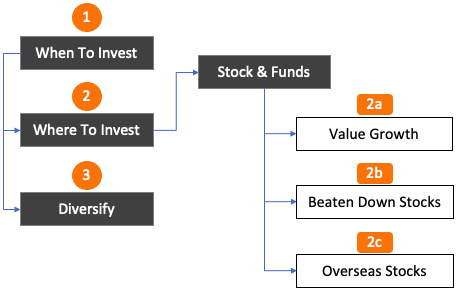

There were three rules that were discussed in the chapter. While I was reading, it look repetitive and boring. But upon finishing the chapter, the combined effect of all three rules was rewarding. Why? Because it is a way to build and maintain a rewarding investment portfolio.

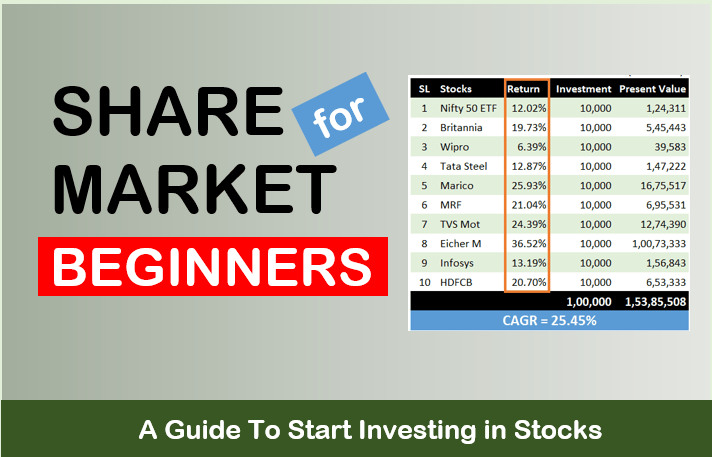

A representation of the combined effect of the chapter

Why do I say that smart investors would not share these rules with us? Because they know that, even if they do, it’ll be perceived as boring and known. So instead, they keep it to themselves and apply for self-benefit.

Smart Investors Never Forgets It…

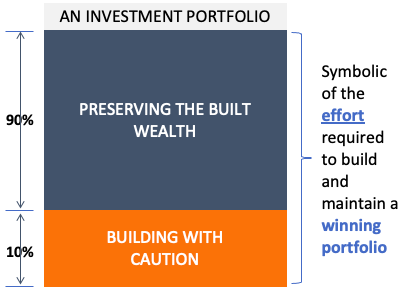

It requires a great deal of boldness and great deal of caution to make a great fortune; and when you have got it, it requires ten times as much wit to keep it.

– Nathan Mayer Rothschild

Two words that stand out from the above quote are “caution” and “keep”.

- Build with caution: While building an investment portfolio, the investor must do it with a great deal of caution. Carelessly adding and removing stocks in the name of trading is not advisable.

- Keep The Wealth: Building a portfolio is only half job done. We cannot end up spending it to buy liabilities. The temptation to spend the accumulated wealth on desires is strong. Hence, the investor must be witty to override it and stay invested.

If one can note and remember these two things, the first step to building a winning portfolio is taken.

With this premise, we can now read the three (3) rules used by smart investors towards portfolio building.

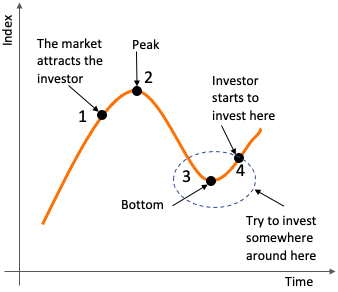

#1. When To Invest – Timing The Market is Impossible

Strategy to time the market is a great idea, but the problem is, it’s impossible. Why? Because nobody knows when the index will peak and when it will bottom.

The book I was reading, gave examples of how even pros get the market timing wrong, most of the time. So it will be needless for lay investors, like us, to try doing it.

So what we can do? Three things. First, understand the trend of the index which repeats in cycles. Second, realizing how the investment behavior of untrained investors, in a cyclical market, leads to losses. Third, knowledge of how we can benefit from such trend reversal.

Cyclical Trend Of The Index

- Point #1: Mostly new investors get attracted to stock market when the index is near its peak. Majority stocks at this stage is already poised for a trend reversal (downward movement).

- Point #2: By the time new investors actually start to invest, the index is at its peak. Buying stocks or mutual funds at this point will be a mistake.

- Point #3: This is the bottom of the index. It is impossible to time the bottom. Better will be to start investing when the index has reached the zone indicated by the dotted-line (see above image). Generally, I get interested when the index has corrected by at least 10% from its peak.

As an investor, we must observe the current trend of the index. If the index is bullish, stay away from the market. If the index is falling, check how much it has already corrected from its last peak. The thumb rule is, 6%-12% correction calls for action.

In the hindsight, we can see when the index peaked and bottomed. It will also tell us when we should have bought and sold the stocks. But we cannot let it fool us into thinking, we can do the same for the future.

In the financial markets, hindsight is forever 20/20, but foresight is legally blind. And thus, for most investors, market timing is a practical and emotional impossibility.

– The Intelligent Investor

#2. Where To Invest

In the previous point, we understood when to start investing in the market. Now we will check where to invest the money.

2a. Value Growth Stocks

But what to buy when the time is right? Easy advice, buy growth stocks at the right valuations. Easier said than done, right? Yes. But frankly speaking, it is the only way. I’ll share some insights into the concept of growth investing. First things first…

A great company is not a great investment if you pay too much for the stock.

– The Inteligent Investor

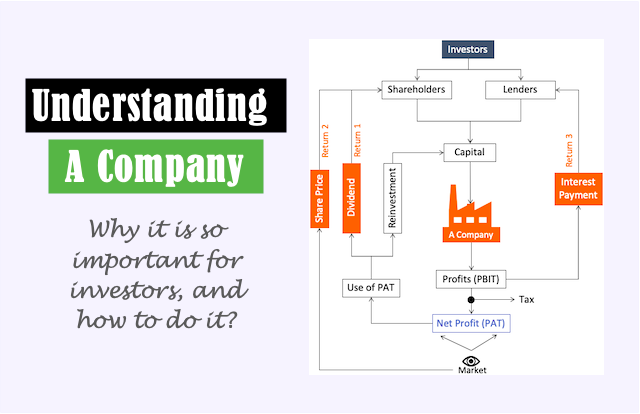

- Which is a great company? A company that can grow its earnings fast (growth stocks).

- Paying too much means buying an expensive stock.

Fast-growing companies are an investor’s paradise. These companies attract attention because of the pace at which their earnings grow. But because it is in the limelight, its share price sees a steep rise. And when the share price starts to grow faster than the company’s profits, it becomes expensive. This phenomenon can be understood from the below chart of EPS vs price.

There are three aspects of growth stocks that we must remember:

- #1. Earnings Drive Price: Price of a stock is driven by the fundamentals of its underlying business. In a long term horizon, earnings (profits) is the most dominant factor influencing the price. If the earning slows down, price rise will eventually follow the trend.

- #2. Size Lowers Growth: A company cannot always grow at a fast rate. As it grows and become bigger, slower it can grow. Why? An Indian company can expand its market to other countries and grow faster. But where a MNC like Apple of Microsoft will seek growth?

- PE Ratio: It is common for growth stocks to trade at high PE multiples. But how much PE is acceptable? To understand this, we must remember the rule of PEG ONE. Buying stocks trading at PEG ratios over 1.2 shall be avoided. Why?

What is PEG? It is a ratio between a companies PE and EPS growth rate. When a stock’s PEG is one or below, the price is complimenting its growth. As a rule of thumb, PE above 15 makes a stock expensive. So for this stock to have a PEG of one, its EPS growth rate must be 15% per annum.

Now, suppose a growth stock is trading at a PE multiple of 60. How likely it is that its PE will grow at 60% per annum? Why 60%? To make its PEG one. A company growing at 60% per annum is rare. Very unlikely.

How I make assumptions about growth?

- Blue Chip Stocks: In long-term they will grow at a rate that is fractionally higher that the country’s GDP growth rate. I’m assuming that, India’s GDP will grow at a rate of 8% per annum for the next 10-years. It means, quality blue chip stocks can grow at 12% in the same period (growth premium of 4%)

- Smaller Companies: Using the same rational, quality smaller companies has capabilities to grow faster. For such company, a growth premium of 10% will not be farfetched. Neverthless, current fundamentals and price valuations dictates the quantum of the growth premium. But my cut-off will be a growth premium of 10%.

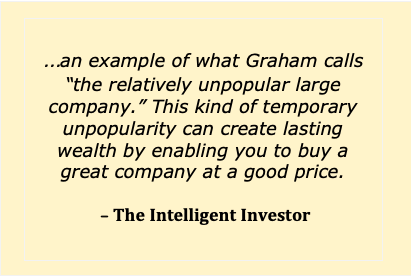

How to find a quality growth stock? I’ll search for what Benjamin Graham calls “the relatively unpopular large company“.

- I keep a list of industry leaders trading at high PE ratios.

- I’ll not buy a stock from this list when prices are bullish. I’ll wait for a bad news.

- When a stock’s price corrects, by about 10%, it becomes attractive.

- Such price correction, gives even industry leaders the room for growth.

2b. Beaten Down Stocks

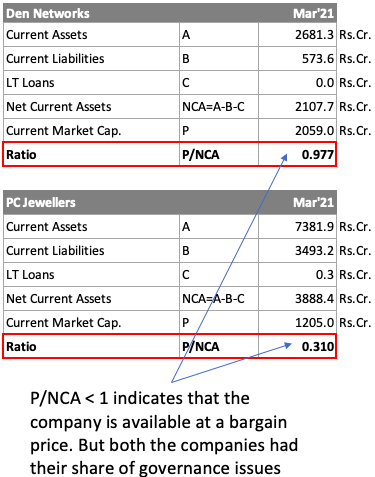

Benjamin Graham has indicated a method in his book to identify a bargain (beaten-down stocks). On the same concept, there is a valuation model called Net Current Asset Value Per Share (NCAVPS). To know more about the model, please check the link.

[P. Note: Net Current Asset is called net working capital.]

I’ve tried several times to use the NCAVPS model to identify bargains. To date, I’ve not found any quality business trading at a discount to its NCAVPS. What filter do I use to find such a stock? Market capitalization is lower than net working capital. Even today there are small-cap that are selling at such a low price, but they all have a weak business.

A few days back, I build a list of companies selling at three (3) times is NCAVPS. Not even one company I liked.

Let me give you two examples of such a company, Den Networks, and PC Jewellers.

As per Graham’s Net Working Capital theory, both the companies are bargain buys. But I’ll avoid both of them. Why? Den Network’s business model is of Cable Television. This is a dying industry. The future is of Netflix’s and Amazon’s. As an exception, people who do not subscribe to these OTT platforms will opt for Tata Sky or Airtel DTH.

Similarly, PC Jewellers is a company marred with the issue of insider trading back in 2018-19.

But I still use the NCAVPS model to compare the valuation of companies in the same industry. A company with a lower P/NCA (see the above image) ratio will qualify for further analysis.

2c. Overseas Stocks

In the 1980s, the Japanese stock market rose at a rate of 21.2% per annum, for 10-Years. Its performance was even better than that of the United States. At that time, people thought that nothing can go wrong with this market. The result was that the majority of Japanese citizens put all their money in the home market.

In the next 10 years, in the 1990s, the same market went down to one-third of its value.

The lesson is, smart investors should never keep all their money at home. Use overseas mutual funds and park at least 30% of your funds here.

This is part of the diversification strategy that we will discuss next.

#3. Always Diversify

The concentration of money in only a few stocks has the potential to make fortunes. Hence, some experts say that diversification is not necessary if we know the company supremely well. But the fact is, we do not know a company so well. So, smart investors will surely keep their portfolios diversified.

Out of all the companies appearing in the Forbes 400 list of 1982, only 16% of them could make it in the list of 2002. To make it to the Forbes 400 list of 2002, the 1982 companies were only required to grow at 4.5% per annum. But still, they could not make it.

What does this data tell us? It is very likely that out of all stocks in our portfolio, only few will remain investible after 20-years. So smart investors will keep their money diversified into several asset types, including multiple stocks.

Conclusion

- 10-90 Theory: If it takes one (1) unit energy to build and investment portfolio, it will take nine (9) units to maintain it. So buying shares is only the beginning. Portfolio management is a bigger task (read here).

- Timing The Market: There is no point wasting energy to time the market. A better alternative is to start investing soon after the index has sufficiently corrected (read here).

- Where to invest: Growth stocks, beaten down stocks, and overseas funds are the areas of interest. I’ve explained how to identify such stocks. SIP in an overseas mutual funds will do (read here).

- Diversify: Smart investors would not ignore keeping their investment portfolio sufficiently diversified. The historical data explains why it is so (read here).

I hope you liked this article.

Keep reading and have a happy investing.