Personal finance is a specific term used to describe the process of money management for an individual or a family. In personal finance, one studies all good practices leading to good money management. In general, it tells people how to achieve one’s financial goals through better management of income, expenses, and savings (read more here)

Few tools that can assist in personal finance management are the following:

- Budgeting tools, expense trackers,

- Net worth calculator,

- Loan prepayment calculator,

- Stock screener, etc.

Why am I Blogging About Personal Finance?

Why did I think to blog about the topic of personal finance?

In the last couple of months, I’ve been traveling a bit. I met a few old and new people. Some of them were not aware that I’m a blogger on the topic of personal finance. Almost everybody whom I met was familiar with the term personal finance. But after talking to them I could feel that this term needs more explanation and clarity of the concept. Hence, I thought of blogging about it.

The Need for Personal Finance

Anybody who is handling money must be aware of the main principles of money management. What is the need? Not knowing about these basic principles might lead to misery and stress. People who are aware of it, handle their money well, which leads to the attainment of the ultimate goal of financial independence.

So we can say that one must master the principles of personal finance to achieve financial freedom. For a capitalistic society, becoming financially independent is the epitome of success. Read more on how to become rich.

In other words, we can also say that the study of personal finance is necessary to ensure a basic standard of living we desire to maintain for ourselves, without the need to undergo a stressful life.

What’s Managed Under Personal Finance?

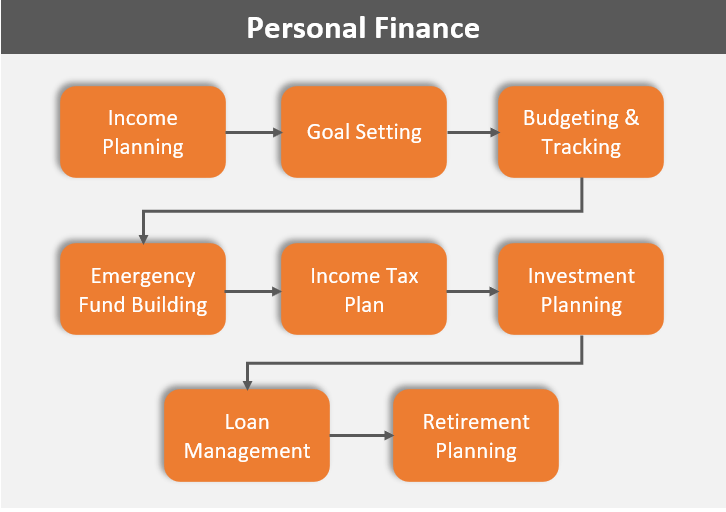

It is a wide topic. Almost every personal activity that accounts for a money transaction comes under the purview of it. But all these activities can be categorized into eight heads:

- Income Planning.

- Setting up goals.

- Expense budgeting and its tracking.

- Emergency Fund management.

- Income Tax Planning.

- Investment planning.

- Loan management.

- Retirement Planning.

When I was new to personal finance management, it was tempting to give more weight to income, tax planning, and investments. But now in my 40’s I can say that each of the eight topics is as important as its peers.

Out of all the eight heads described above, which is most critical?

Some topics will become more critical than others at different times in life. For example, in time of a medical emergency, the priority of insurance planning will stand out. In moments like the 2008 mortgage crisis or the 2020 covid crash, equity investment will look most interesting.

I’ve personally found the activity of expense tracking as most rewarding. For the last 10+ years, I’ve recorded every penny that was spent. Over the years this habit has helped me to practice tighter control over my spendings.

I also use the Pay Yourself First concept as a part of income and investment planning.

These are the two life-changing activities I know about. Had I not ventured into the personal finance domain, I would have stayed ignorant about them.

Good Practices Of Money Management

The topic of personal finance management is so wide that multiple books are written about it. I have a collection of books that I keep referring to time and again. So, as a small blogger on this topic what I can suggest as good practices?

- Keep a Monthly Budget & Record All Expenses: Before spending a dime, there must be an expense budget in place. The budget must include well-defined expense heads and monthly spending limits. How to ensure that spending stays within budget? Start recording all expenses. To read more about how to build a budget read the 50/30/20 rule.

- Build an Emergency Fund: Keeping sufficient cash and an optimum insurance cover is essential. When an emergency strikes, it is the biggest wealth destroyer. How to manage it? Though emergency fund building.

- Invest in Equity For Long Term: Distant financial goals like a house purchase, child planning, retirement planning, etc are capital intensive. One must invest long-term in equity to manage them. Why long term? Because only the power of compounding can build huge wealth over time.

- Prepay Your Loans: The idea of personal finance planning is to keep one’s loan dependency to zero. But at the same time we must realize that for capital incisive purchase, the loan is often unavoidable. How to best manage loans? We must prepay the loans.

Conclusion

The root of personal finance is rooted in this saying, “Living below the means is the path to financial freedom.” What does it mean by living below the means? It means spending less than what one is earning.

This one habit will generate savings. No financial planning is possible without savings. Hence, if one wants to improve the financial position of the self, starting to live below the means is the starting point.

Try to use all tips and tricks to save money each day. The bigger will be the saving, the faster will be the attainment of financial independence.

I’ll suggest my reader read this article on the concept of affordability. A deeper understanding of this concept has the power to transform lives.

![If A Bank Closes What Happens To The Deposits? [DICGC]](https://ourwealthinsights.com/wp-content/uploads/2021/06/If-a-bank-closes-what-happens-to-deposits-image2.png)