Financial intelligence is not developed in young people when they are in school. People who’ve it, got it from self-study and practice. But, in the midst of our daily chores of life, self-learning may look like a burden, extra effort. Hence majority skip it.

Our education system is not formatted to include money-related lessons in the curriculum. As a result, when we enter the real world, the only thing we know about money is income and expenses. But there are three more aspects of money – assets, liabilities, and cash flows.

In the endeavor to build our financial intelligence, we must look at all five aspects of money in tandem. How to do it? This is what we’ll see in this article. The concepts explained in this article are inspired by how Robert Kiyosaki thinks about money.

People in their 20s must build this understanding of money. Why? The goal is to attain financial independence and ultimately become rich. To reach this goal, the concept of money relative to income, expenses, assets, liabilities, and cash flows must be understood clearly.

Suggested Reading: Why personal finance management is important.

Introduction: Where To Start

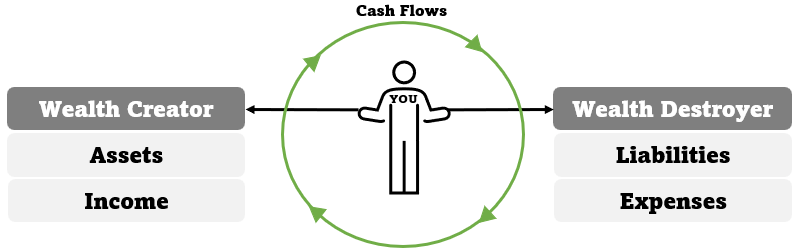

As a starter, one shall remember that money management is not only about managing income and expenses. It is also about asset building, liability management, and controlling the cash flows.

Financial intelligence is in first knowing & acknowledging that handling money is about simultaneous management of all these five aspects of money. One cannot expect success by managing one aspect better than the other. Why? Because no aspect can be ignored.

A beginner must stop seeing money as a currency note or as a bank balance. They must start visualizing money as shown in the above infographic: Income, expense, assets, liabilities, and cash flows.

Every time you earn a Rupee (income), tell yourself how you are going to manage the further cash flows. This income can be used to buy an investment (expending on an asset). It can also be allowed to buy a gadget (expending on a liability).

Purpose: Wealth Building & Financial Independence

What is the purpose of money management? Wealth creation in a long-term is the bigger purpose. To build wealth, all six aspects must be handled together. Each one is as critical as the other. It is kind of a balancing act between assets vs liabilities and income vs expense that leads to wealth creation. Financial intelligence is in knowing the fact that one needs to create a balance.

It is logical to assume that money must be handled in the right way. In fact, everything that we do in our life must be done in the right way. In matters of money, the right way can help one to amass more wealth over time.

Specifying a purpose for wealth creation acts as a reminder. It reminds us that we are taking extra care to handle our money because it serves a bigger purpose.

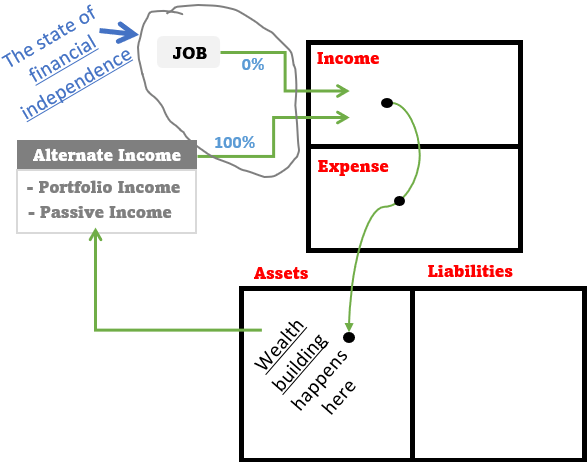

Now, someone might ask why to create wealth? I do it to attain financial independence. Why is financial independence essential? Because it can free one from dependency on a job/work for income. Below is the representation of the state of financial independence (Kiyosaki’s way).

Investors Mindset

Transforming the mindset from one of an employee or a businessman to an investor is the goal.

Every person who does a job needs may not be limited to an employee’s mindset. Similarly, just buying a few stocks or mutual funds does not ensure an investor’s mindset.

So, a person must first focus on building an investor’s mindset before investing the first penny.

What is an investor’s mindset? Knowing the fact that all people in this world fall into either of the four categories (quadrants). Check the above infographics. People in the first quadrants are the ones doing jobs. The second quadrant represents people who are self-employed. The third quadrant is for businessmen. People in the fourth quadrant are one with the investor’s mindset.

If the goal is to become rich, one has to transform self from the first two quadrants (E and S) to the second two quadrants (B or I). If the goal is to attain financial independence, it can happen only in the fourth quadrant (I).

Financial intelligence is in realizing which is your quadrant today. So, depending on your goal, you must accordingly transform yourself to Quadrant-B or Quadrant-I.

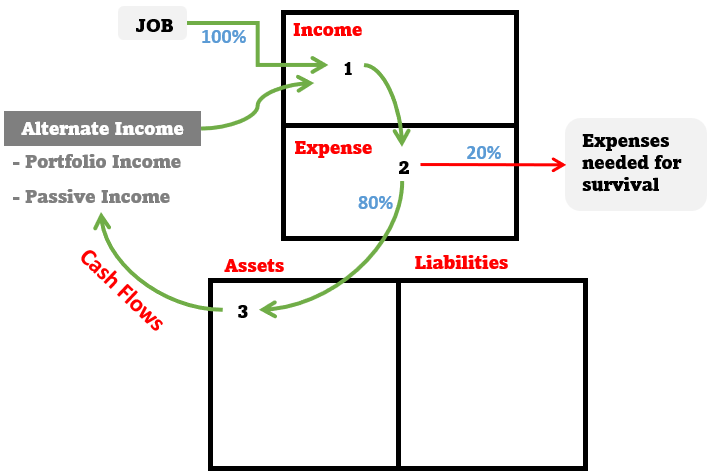

Start Buying Assets – Building Alternative Income Source

A person in their 20s, who has just had a job, has at least 7 to 8 years before going the family way. This is a great period for investment. The aim should be to spend about 80% of one’s income to buy assets. The cash flow representing such a transaction is shown in the below infographics.

The purpose of asset purchase should be to build an alternative income source. When we work, there is only one source of income, our job. But assets create another source of income. It can either be portfolio income or passive income.

- Portfolio Income: Assets appreciate in value over time. In financial terms, we call it capital gain. Until we sell the assets, these gains create no cash flows. In a way, as once my friend said, they are only “virtual gains”. Such type of income is classified as portfolio income. One example of portfolio income is price appreciation of the holding stocks, mutual funds, ETFs, bonds, etc. The rate at which the portfolio income grows over time beats inflation.

- Passive Income: When assets create cash flows, it is passive income. A few examples of passive income are dividends from stocks, rent from a property, interest income from deposits, etc. The yield of passive income is below portfolio income, but it is real income (not a virtual gain).

The more assets we accumulate over time, the bigger will be the alternative income. The day, the income from an alternative source is big enough to support our standard of living, we’ll be financially independent.

In our endeavor to accumulate assets to build alternative income sources, we must be careful. Care must be taken in picking our assets. Everything that people around us call assets, is not actually assets.

Suggested Reading: The idea of business.

What is an Asset

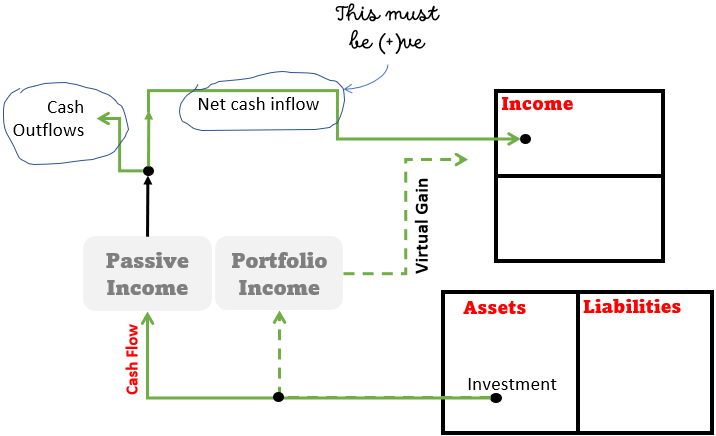

Any investment that adds money to our pocket (positive net cash flow) is an asset. When we say add money, we mean it in the literal sense. This becomes particularly true for cost-bearing investments.

For example, a real estate property has a cost, like property tax, maintenance, other fees, etc. Any investment that can bear its own cost is an asset. If a real estate property can raise enough income to pay for its tax, and maintenance expenses, it is an asset. Otherwise, it is a liability.

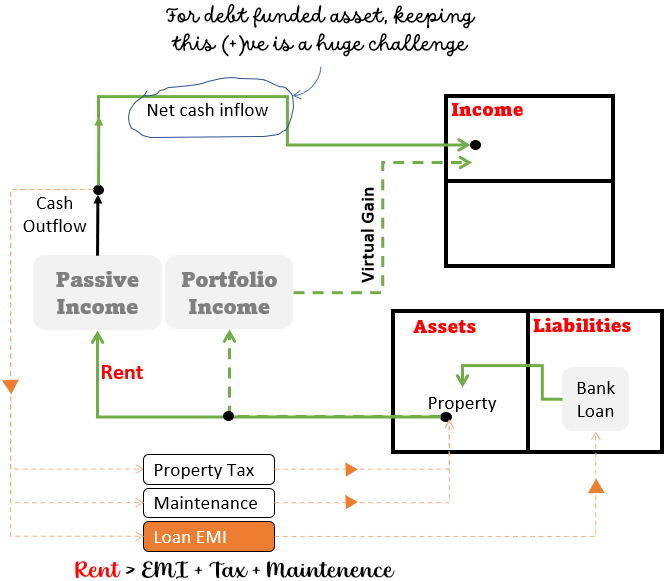

A typical representation of an asset is shown below.

The investment is yielding two types of income, portfolio, and passive income. The passive income from the asset is able to take care of the associated cost (cash outflows). Here, the net cash inflow is positive. Moreover, the asset is also appreciating in value. Such a type of investment becomes an excellent asset.

The passive income is the monthly rent if the above investment is a real estate property. The rental income can be used to pay for the property tax, maintenance costs, fees, etc.

Debt Funded Asset

When an investment purchase is funded using debt, being net cash inflow positive is a huge challenge. In 90% of cases, the net cash inflow will be negative. Long-term capital appreciation may be positive, but in the near term, cash will flow out from the pocket. Hence, such an investment will become a liability.

But anyways, pro-investors can still find such investments. Hypothetically speaking, suppose you’ve bought a property whose rental yield is high. The yield can take care of all associated costs like loan EMI, tax, maintenance, etc. Moreover, there is also capital appreciation happening behind the scenes. Wouldn’t this investment be great? Sure it is. A typical representation of such an investment, an asset, is shown below.

For a common man, a debt-funded investment generally remains a liability. So unless one has really understood the maths well, buying leveraged investments must be avoided.

Debt Funded Asset – Kiyosaki’s Way

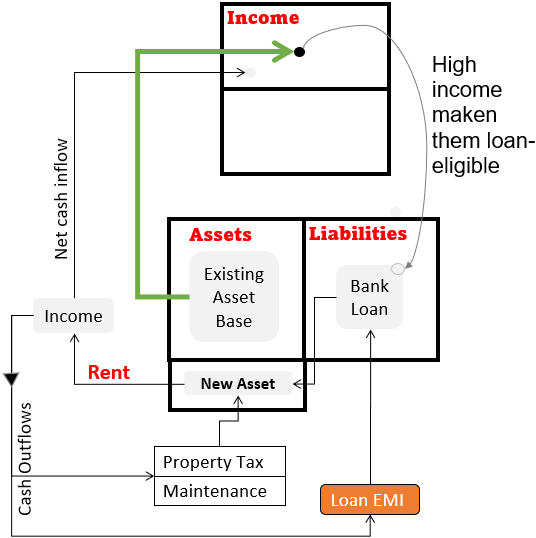

Robert Kiyosaki loves debt. Why? Because they can afford it. For all ultra-rich people, debt is a tool to accumulate more assets. In the infographics shown below, high income makes ultra-rich people loan-eligible. They get a loan and buy’s an asset (say a rental property). The property is so undervalued that its rental yield is sufficient to fund its associated costs. Plus, some extra money also gets added into the investor’s pocket (net cash inflow).

There are three important things happening here for Robert Kiyosaki. First, is his financial intelligence, ability and experience to find such undervalued assets that can fund its cost.

Second, his high income keeps him loan-eligible most of the time. Thirdly, even if the banks are not ready to finance him loans based on his income, he can use his current asset base as collateral.

So, people like Kiyosaki can use debt to their advantage. But for starters in their 20s, debt-funded asset purchases may never satisfy the required maths.

Build A Safety Net

One cannot go on buying investments incessantly. There are also other important things going around in life. We must also prepare for them when the need arises. I’m talking about emergencies of life. The purpose of planning for an emergency is that, when it strikes, we need not dig into our investments for money. Investment is all about compounding. One must hold the investments for a very very long time to see its true power.

But when an emergency strikes, and we do not have a back-up, we may end us selling our holdings, the investments. So it is extremely critical for us to build an emergency fund before venturing into the new and risky world of investment. I’ve written a separate article on the emergency fund. Please check the provided link to know more about it.

Conclusion

The majority of us are not born with financial intelligence. It is a skill that can be built over time by study and practice. But the problem here is that it is not taught in schools. Children move out of high schools and colleges as complete novices in money management. This is a risk. Why? Because when such people, in their 20s, start to earn money, they do not know the right ways to handle it. By the time they understand the necessity of personal finance management, a good time is lost.

In this article, I’ve shared what I’ve learned about money and its management.

The most important lesson is to stop seeing money as a currency note or deposit in a bank account. We must see it the Kiyosaki’s way. How? In terms of cash flow, income, expense, assets, and liabilities – all at once. How to do it?

This is what has been discussed in this article. I hope you’ll like it and pick a new point of view.

Have a happy investing.

Every good article, educative and eye opener

More please

Thanks