We will learn about the importance of time in the market versus timing the market using index investing. The same theory will apply to a portfolio of stocks, a basket of fundamentally strong stocks. It only reiterates the significance of staying invested for a very long term, with examples.

What does it mean by timing the market? Buying when the market has bottomed and selling when it is at peak.

But there is a flaw in its execution strategy. In hindsight, it might look easy to execute. But looking forward, there is no way to know when the market will bottom or peak. Only God can say it and by all means, we are only mere humans.

So, timing the market is only a marketing gimmick? Not really. Timing the market to perfection may have fallacies, but surely we can benefit from corrections and crashes. The examples used in this article will explain it further.

Topics

- Timing the market – Introduction

- Example #1 – Market highs

- Example #2 – Systematic investing (SIPs)

- Example #3 – Crash & corrections

- Example #4 – Lumpsum investing

- Conclusion

Timing The Market – Introduction

There are a few things that go against timing the market. When we invest with this mindset, we are investing money with an idea to buy and sell as the situation demand. This is a traders mentality, frequent buying and selling of stocks, etc.

But in equity investing, what works best is the buy and hold strategy. Holding longer makes it safer. Moreover, it allows the money to compound over time.

Frequent buying and selling are also inefficient. Why? Because fees and taxes are levied on each transaction as mandatory expenses. In percentage terms, these costs may look insignificant. But a collection of several transactions increases their quantum.

Moreover, as frequent buying and selling does not allow the money to compound, it adds to the loss.

People who worry too much about timing the market are ones who have entered the market during peaks (when everyone is buying). For them, the next peak is their opportunity to book profits. They cannot miss it as they’ve entered the market with a traders mentality. In one example, we’ll see how even these people can make decent returns by just holding on to their investments for a very long term (see here).

What Experts Believe In?

Listen to the interviews of champion investors like Warren Buffett, Radhakishan Damani, Rakesh Jhunjhunwala, etc, they will radiate a common theory. They all believe in long-term investing. None of them will talk about examples like doubling the money in days or months. Instead, they will market the concept of long term investing.

It is not that they do not like to time the market, but they know that the majority of their portfolio size is attributable to their time in the market instead of their ability to time the market.

Suggested reading: How to become rich?

Example #1 – Investing During Market Highs

In this example, we’ll undertake a worst possible scenario. It is an example of a person who repeatedly failed to time the market (his purchases). But what he did next made him still earn a decent return.

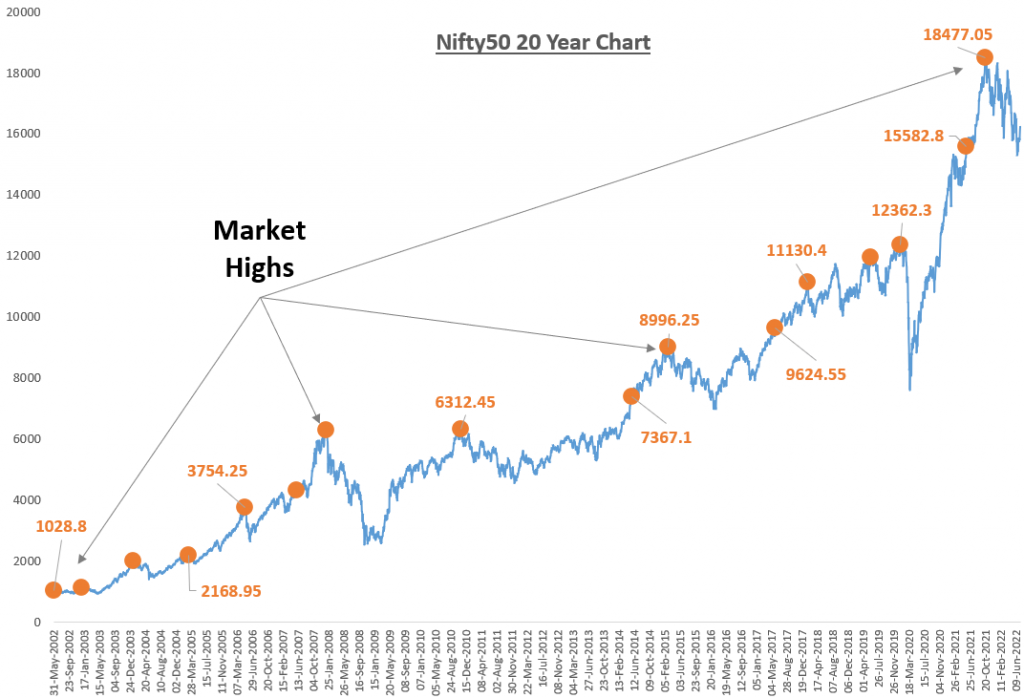

What’s highlighted in the above Nifty-50 price chart are sixteen (16) instances of market highs where the index peaked. These 16 number peaks happened in the last 20 years, between 2002 and 2022.

What are peaks? These are the highest points of the index beyond which the market goes into a bear phase (index falls). Investing at these times is one of the worst fear for any investor.

Suppose we are looking at a hypothetical investor who happened to buy the index at each of these 16 instances. He started buying the index from the year 2002 and continued doing it till 2022. Unfortunately, every time he bought the index, it was at its peak. But he never sold his holdings during this tenure.

As the person has invested only on the peaks, the potential return of his investment will be minimum.

Let’s calculate the return on investment (ROI) for this investment. The details are shown below. The ROI calculation is done using the XIRR formula in Excel.

There is one bad and one good point. Bad: Index bought at peaks (16 times). Good: Investments held for 20 years (from Mar’02 to July 22). Even though the buying happened at the worst possible times, just because of the long holding time, the ROI is a decent 12.32% per annum.

Inference: One shall not panic in case the market is currently falling. No need to sell the current holding even if they were bought at peaks. There will be more new peaks in times to come. The strategy shall be to continue holding the investments for very long periods. As long as our holding time is very long (like 20 years), an index fund/ETF will yield a minimum return of 12.0%+ per annum.

Example #2 – Investing Systematically (SIP)

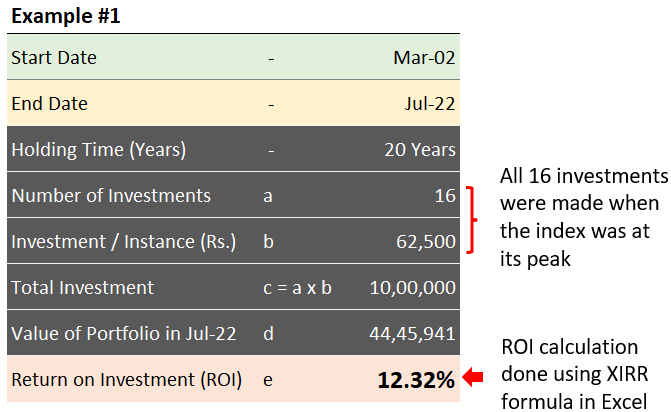

In example #1, our hypothetical investor ended up buying the index every time at its peak. In this example, the investor has decided to keep his investments on autopilot. He started buying the index using a Systematic Investment Plan (SIP) on a specific date each month.

The Investor continued buying the index using SIP starting from the year 2002 till 2022. He remains unperturbed by the ups and downs of the market in these 20 years. He let his SIP run on all months for these 20 years. As a result, he bought the index at all times. He bought during the highs and also during the lows.

As the person has invested at all times, the potential return of his investment will be averaged.

Let’s calculate the return on investment (ROI) for this investment. The details are shown below. The ROI calculation is done using the XIRR formula in Excel.

Inference: For defensive investors who would like to invest in equity, SIP is the best way forward. The only rider here is to continue the SIP for a long time (like 20 years). These investors shall not panic when the market is falling. Just stay invested and continue the SIP as usual. As long as our holding time is very long (like 20 years), there is nothing to worry about. An index fund/ETF will yield a minimum return of about 12.5% per annum.

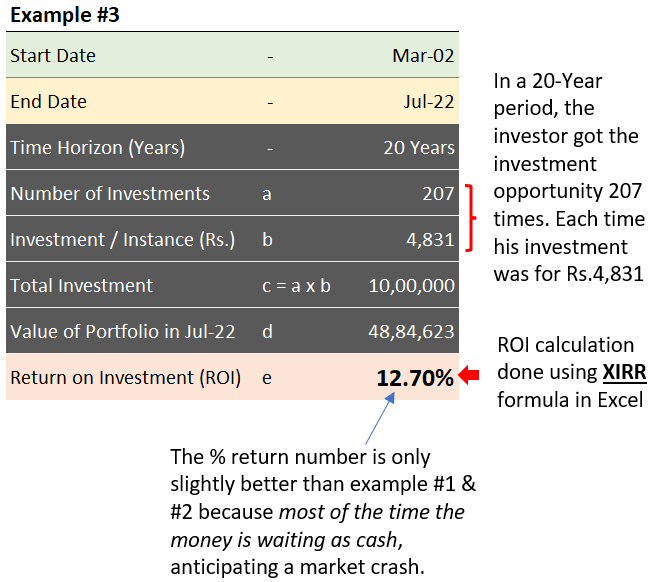

Example #3 – Investing During Market Crash/Corrections

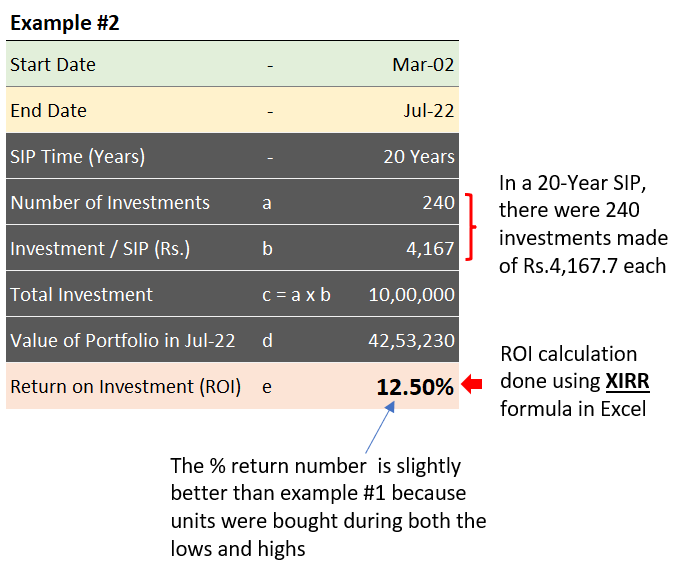

The Nifty50 price chart highlights two market crashes seen between 2002 and 2022. The first one happened in 2008-09 due to the subprime mortgage crisis in the US. The second is a more recent one, the 2020 covid crash.

Many of us believe that investing during these specific periods will yield higher returns, right? But let me tell you that the numbers will not be dramatically higher. It will still be a modest number.

Let’s calculate the return on investment (ROI) for this investment. The details are shown below. The ROI calculation is done using the XIRR formula in Excel.

Inference: So much watching the market, waiting, and anticipation leads to a return of only 12.70% per annum. The SIP, investment in auto mode, also gave a return of 12.5%. All the stress and focus only to earn an alpha of 0.2%. Not worth. Even though the person has invested during the market crash, his returns are only average. Why? Because most of the time the money is waiting as cash, anticipating a crash.

Timing the market was a priority. Hence, the person rarely invested. Most of the time his money remained idling. As a result, the money did not got enough time to compound, as the time in the market was low. Though the person was able to time the market well, but still due to the above reason, the net return was only average.

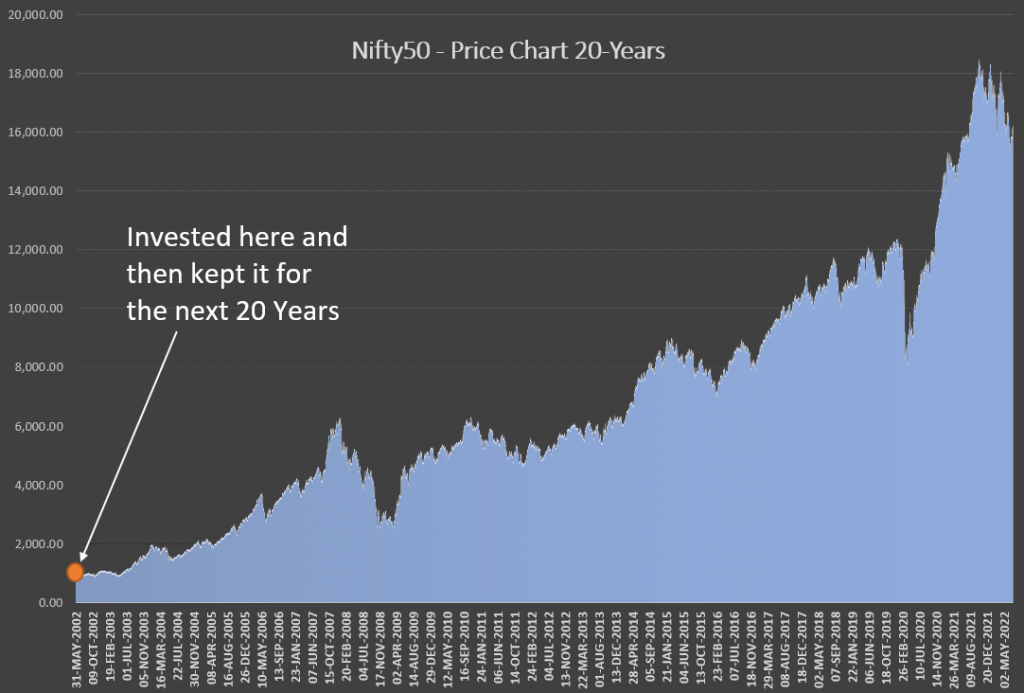

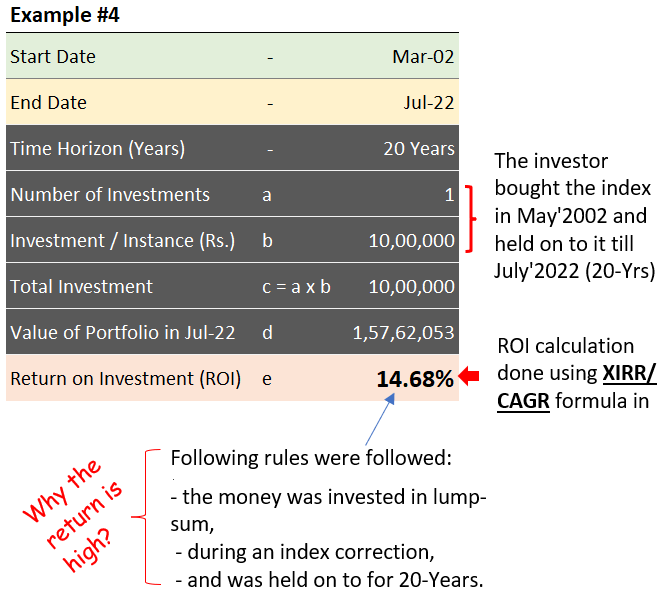

Example #4 – Investing in Lumpsum

It is also a type of no-worry investment like SIP. The only care that one shall take here is not to invest in lump-sum when the market is at its peak.

How to keep this control? Check the last 52-Week high. Invest only when the index is at least 8-10% below its 52-Week high. Once the investment is made, hold on to the index for the next 20 years. The power of compounding money will be most visible.

One such example is shown in the above price chart.

Let’s calculate the return on investment (ROI) for this investment. The details are shown below. The ROI calculation is done using the CAGR formula (the XIRR formula will also yield the same result).

Inference: For retail investors, this is the best compromise between an involved investing (example #3) and careless investing (example #1). It also yields good returns. The only care one shall take is not buy the index when the market is at its peak. How I will do it? I’ll wait for the index to correct by 10% from its previous high. Then, buy the index in lump-sum and stay invested for next 20-years. This process, though not as simple as SIP, can yield about 14% per annum returns (in India).

Conclusion

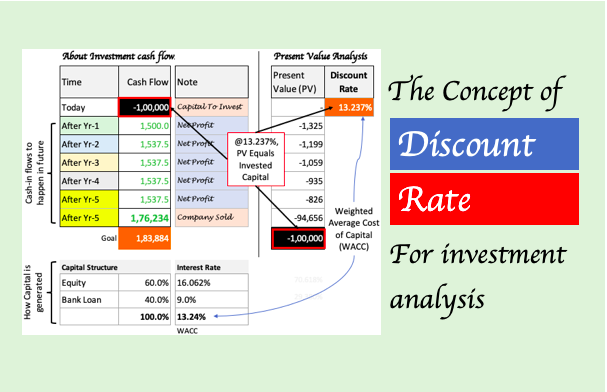

If one wants to earn above-average returns, timing the market becomes unavoidable. But only timing will not work. The invested money must also get the time to compound.

How to do it? By keeping it invested for a long time. In the above examples, I’ve kept the holding time as high as 20 years. Why? Because such a long time period completely eliminates the risk due to volatility.

Retail investors like us, with a limited understanding of equity, can benefit just by holding equity for the long term. Even the big mistakes get nullified when the time horizon is so long (see example #1).

Direct Stocks Vs Index Investing

Timing the market is easy when it comes to Index investing. Why? Because here, one need not worry about the constituents of the index. The companies included in the index are by default fundamentally strong companies. If any company does not meet the requirements, it will be removed and a new company will take its place.

But in direct stock investing, one must have knowledge of stock analysis. If not, there is a risk that we end up investing in a bad company. What is a bad company? It can be of two types:

- First, a company whose stock is very expensive.

- Second, a company whose business is weak.

To solve these two limitations, one must learn fundamental analysis and price valuation of stocks. But it must be learned. Moreover, even for experts, doing such analysis is time taking. Hence, for retail investors, index investing is most suitable.

One way to reduce the risk of direct stock investing is to diversify the stock portfolio. How to do it? By spreading the money into 15-20 number high-quality stocks. Hence, instead of investing in one company, we have a portfolio of companies. As this portfolio is more focused, as compared to index funds, the potential return is also higher. Suggested reading: Risk profile assessment and investing accordingly.

Please check our Stock’s Engine. It makes the process of stock analysis comparatively easier. It is a web-based tool that does fundamental analysis of the top stocks of the market. Plus, it also screens the stocks, thereby making the stock comparable, hence more useful.

Investing the amount for long term is the key here. As has been pointed out many investors before, more money has been lost trying to wait for crash than in crashes themselves.

Excellent Analisys Mani. Keep it up!