The prices of even the best stocks fall when the whole stock market is on a falling spree. In such times, investors with a long-term mindset buy such stocks. But how to invest in a high market? The answer to this question is not simple. Why? Because a simple solution will be to do nothing when the market is high. But unfortunately, we do not have the luxury of not investing. Why? Suggested reading: Timing the market vs time in the market.

Because to make our money compound, it must stay invested. Only the invested money can work for us. The longer the money stays invested, the more it works, and the faster it multiplies (the power of compounding).

So, it is true that, if wealth building is the target, we must also learn to invest in a high market. But saying it is one thing, but practicing it is another thing. For sure it is not easy. Hence, there must be planning that will guide us on how to invest at all times, in high, low, and flat markets.

Topics

Integrated Investment Planning

One must frame an integrated investment plan that will enable investing in all kinds of markets. Why integrated? Because separate planning for high, low, and flat markets will eventually fail. The stock market changes its mood very frequently. Switching plans with the mood of the market will be impractical. Hence, an integrated plan is required that works in all situations.

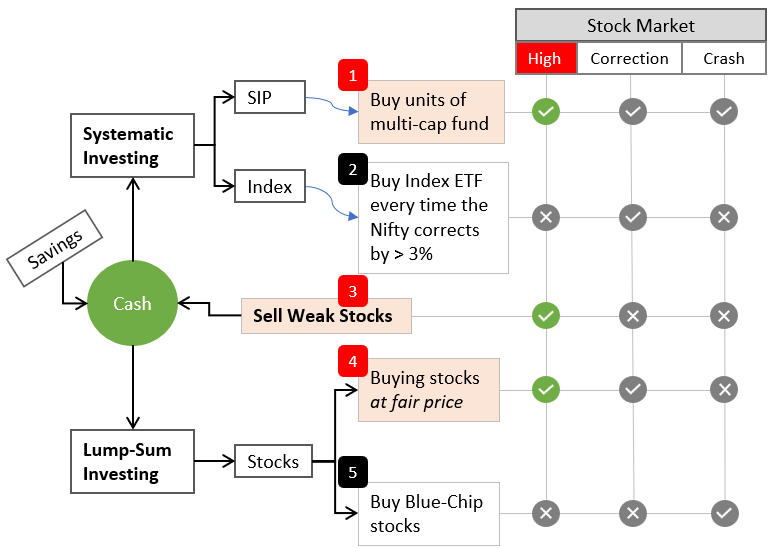

What you see above is an infographic that is symbolic of an investment plan executable in all situations. Allow me to explain it in some detail.

#1. Cash Planning

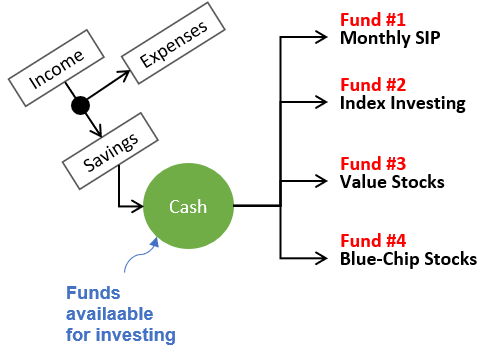

Even before one can start investing, cash planning is a must. The most essential ingredient of ensuring cash availability is savings. Till one is saving enough money, a credible investment plan cannot be executed. So, it all starts with income planning, spending as per the expense budget, so that enough money is saved for investments.

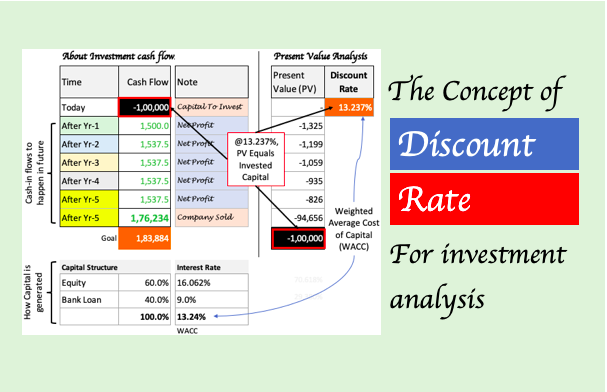

Once the cash begins to flow in, it must be segregated into four (4) types of funds as shown above. The integrated investment plan shown above is asking for separate pockets of funds for SIP, index investing, value stocks, and blue-chip stocks.

Each fund category must be used for its own purpose. Under no circumstances, the funds meant for one task shall be consumed for the other. Let the cash accumulate in each pocket. When a suitable time comes for investing, like a crash, use the funds for its desired purpose.

P.Note: A market crash comes nearly after every decade. It means that the cash allotted for it must stay idle for those number of years. Is it ok? Yes, because it is only a part of your total savings. The other money is getting invested. They are not kept idle. Read about the 2008-09 crash.

#2. Investment Style

Most retail investors invest their money either systematically or in lump-sum. Both styles have their own benefits and limitations. A careful investor will incorporate both styles in an integrated investment plan. The combination helps in taking maximum advantage of a volatile market.

- Systematic: Mutual funds provide the best form of systematic investing. The variety of mutual funds that are available for investing makes it suitable for all types of investors. Though the above plan is designed more for the high-risk appetite investors.

- Lumpsum: This form of investing is not executable always. It is especially true when the money is directly invested into stocks. Here, the final buy calls must be thoroughly researched. Having said that, it is also true that no matter how high is the risk, the potential for higher returns is also here.

#3. Investment Alternatives

Considering that the plan is meant for high-risk appetite people, the cash would be mainly diverted into equity. In this section, we’ll see the investment alternatives where the money could be invested in.

- SIP in Multi-Cap Fund: Why SIP? Because it helps us to take advantage of an investment strategy called rupee cost averaging. SIPs help us to keep our investments on auto-pilot and enable all-time investing with minimum risk. Why Multi-cap fund? As SIP operates on autopilot, as an investor, we’ll feel safe when the invested money stays well diversified. Multi-Cap funds offer a good compromise between diversification and high returns.

- Index ETFs: One can afford to invest passively in them. To know more about index investing, read this article. But to fetch better returns, I’ll avoid SIPs in index funds. Instead, I’ll prefer buying the index whenever there is a bigger correction. Exchange Traded Funds (ETFs) give us the advantage to buy indexes, just like stocks. I personally feel more in control in dealing with the index through ETFs.

- Value Stocks: Good stocks trading at undervalued price levels are value stocks. But the key to finding such stocks is a detailed fundamental analysis. How do I do it? I use my Stock’s Engine to identify value stocks. How? Companies that obtain an overall score of 75% or higher are fundamentally stronger. Moreover, if such stocks are also undervalued, trading at a price below their intrinsic value, makes them preferable.

- Blue Chip Stocks: My Stock’s Engine can filter blue-chip stocks from other stocks. But these stocks normally trade at overvalued price levels. So, one must wait for the right opportunity to buy these stocks.

Investment Scheduling

Till now what we’ve seen is the pre-execution part of the integrated investment planning. Now we’ll discuss the scheduling and execution. Why does one need to schedule? Because except for the SIP, no investment alternative can be left to execute on auto-pilot. For example, different execution strategies will work when the market is high compared to the other times.

In integrated investment planning, I’ve considered three types of market scenarios:

- High Market: This article was written with the purpose to explain how to invest in a high market. But treating a high market scenario in isolation is not practical. There must be an integrated plan which takes care of all types of market conditions. Hence, to learn about investing in a high market, one must also learn to deal with other market scenarios.

- Market Under Correction: There is a separate article on market corrections. I’ll suggest you read it separately. It will build your perspective about corrections and how to take advantage of them.

- Market Crash: For an untrained eye, major corrections and a crash are almost indecipherable. But there are signs that differentiate a crash from a correction. A crash offers better long-term investment opportunities compared to a correction. Hence, during a crash, one can buy those equities that otherwise look out of reach. To know more about how to invest during a crash, check this article on the bear market.

Schedule #1 – Invest in a High Market

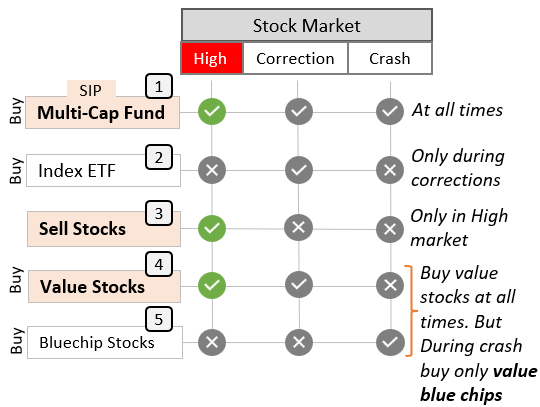

There are five activities that occur in repetitive loops depending on the situation of the market. Out of the five activities, only three are active in a high market.

- SIP in Multi-Cap Mutual Funds: Buying units of this mutual fund takes place even in a high market. Why not stop it? Because this form of purchase is kept on auto-pilot. It continues to buy at all times. During these times the focus must be on the other two activities.

- Sell Weak Stock: In the process of buying stocks, some weak companies also creep in. A high market is a time when we can sell them. How to identify stock to sell? Very high PE stocks, with weak fundamentals, are my first choice. Second, companies with a consistent negative PAT can also be sold.

- Buy Value Stocks: I use my Stock’s Engine to identify value stocks. The fundamental analysis tool helps me identify stocks with a high overall score and priced at bargain levels. During a high market, fewer companies pass its algorithm, but there is always something available of interest.

Schedule #2 – Invest in corrections or a crash

Corrections are better times to buy equity compared to a high market scenario. So, one can focus on a few key activities during these times. During corrections, buying the index through ETF is my first choice. Furthermore, one can also look more aggressively for value stocks during these times. As usual, the SIP in multi-cap funds shall continue. During corrections, SIPs will garner more units.

A Crash is a time when the majority of my focus is on buying blue-chip stocks. Why Blue-chips? Because there are the best stocks in the market. They are the ones that will continue to compound year after year. If one can accumulate these stocks at bargain price levels, the compounding becomes even faster.

In normal times, the valuations of blue chips remain expensive. But when the whole market is crashing, their prices also fall and brings them at buy-levels.

Even SIPs become empowered during the crash. It is especially true for multip-cap funds as the prices of mid-cap and small-cap stocks fall more drastically in a crash. Hence, during these times, SIPs can accumulate large numbers of units.

Conclusion

Why worry about investing in a high market? We must avoid investing in such times, right? Yes, investing when the market is at its peak shall be avoided. But how to know if the peak is reached? In a hindsight, it is easier to point at the peak. But looking forward, it is impossible.

So, if we cannot tell if today is the peak, how to take the stop decision? Frankly speaking, it is not an easy decision. This is the reason why an integrated investment plan is discussed above. It takes care of all kinds of market scenarios. It helps us to continue investing at all times.

Why invest at all times? Because it is important to spend more time in the market than timing the market. Suggested reading: Timing the market vs time in the market.

Avoiding peaks is a fair choice, but we also do have the choice of not investing. For a long-term investor, whose investment horizon is 10+ years, the earlier equity is bought, the better. Why? Because our money takes time to compound.

Have a happy investing.

Its really very helpful thanks