The focus on buying stocks at a discount has unparalleled benefits. It is especially true for people who are accumulating assets through the process of value investing.

We tend to shop more during the SALE season. Recently I upgraded my phone to a Samsung S20 FE. It’s almost a 1.5-year-old model, but considering that it’s an S-series phone, I think, I got it at a good DISCOUNT. Please note the two highlighted words, sale, and discount.

One can apply the same logic when purchasing stocks. In fact, in the stock market, buying stocks at a discount is not an option, it’s a necessity. Why? Because good stocks invariably trade at overvalued price levels.

For trained investors, the SALE in the stock market happens during corrections and a crash.

The Benefit of Purchasing Stocks at A Discount

Buying stocks at a discount reduces the risk of loss. How?

The price of mostly all stocks remains volatile. In short term, their movement is unpredictable and often unreasonable. How does it affect us? Suppose one buys stocks of a company at any available price. In the coming days, the price falls by 13%. Why? Because the FIIs and DII decide to sell their holdings due to XYZ reasons (like rising interest rates).

A person on the lookout for discounted stocks would have waited; probably. At least they will not buy stocks at any available price, without analysis.

A trained eye will buy only fundamentally strong stocks when their price is showing a falling trend. This small purchase habit reduces, substantially, the risk of loss due to price volatility.

Example

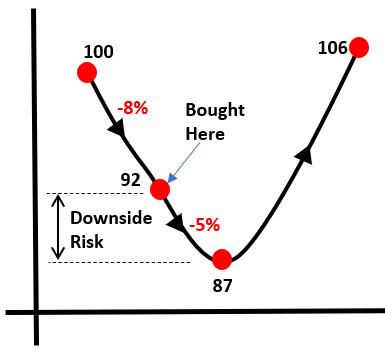

Suppose a stock is priced at Rs.100. In a price correction, its market price falls by 8%. Seeing the price fall, a person bought the share at Rs.92 per share. The falling momentum continued till another 5%. But in next coming weeks, it recovers and stabilizes at Rs.106 per share.

Just because our example person bought at Rs.92 levels, his downside risk was reduced from 13% to just 5%.

How did his risk of loss got reduced? Because the person is always on the lookout for discounts in the stock market. It is a small investment habit that’s worth a practice. The only care of should take here is to target only fundamentally strong stocks. To know the fundamentals of stock doing self-analysis of stocks is necessary.

What Does It Mean by Stock at a Discount?

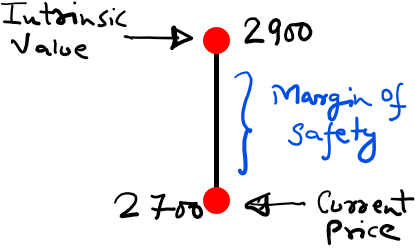

When a stock’s price falls below its intrinsic value it is said to be trading at a discounted price.

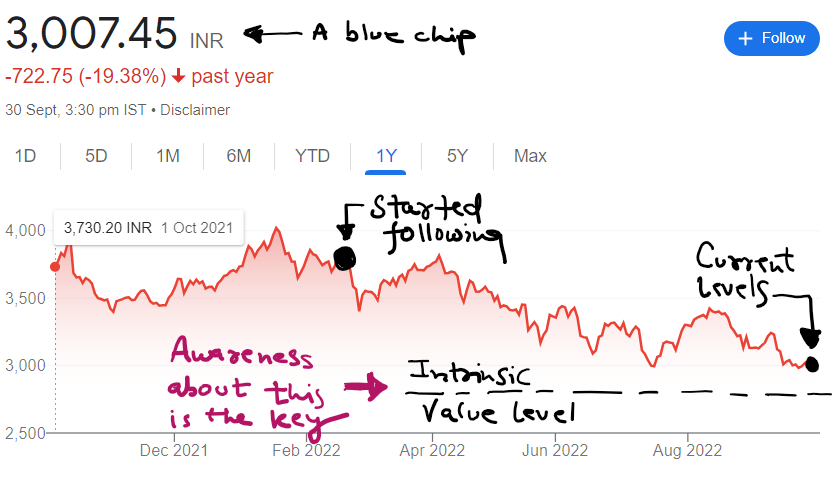

Suppose you started following a blue-chip stock when it was at Rs.3,800 levels. You’ve done your analysis and found that the intrinsic value of that stock is between Rs.2,500 and Rs.2,900 levels. In the next 6-12 months, the stock’s price kept falling and came close to Rs.2,900 levels.

This is the point when you shall prepare yourself for a commitment. Why? Because the stock is now treading close to discount levels.

How much discount is sufficient?

As soon as the stock’s price will come below the intrinsic value levels, it can be called as one trading at a discount. The higher the discount better will be the margin of safety. Benjamin Graham would wait to buy his stocks till their margin of safety extends to two-thirds levels.

Buying stocks with a sufficient margin of safety will further reduce the risk of loss due to price volatility. Why maintaining a margin of safety is essential? It factors in the fact that one’s intrinsic value (IV) estimates may not be fully accurate. Hence, allowing stocks to slip further below their IV, before making a purchase, can further reduce the risk of loss.

Which Stocks to Buy at a Discount?

In one of my blogs, I’ve written about stocks for defensive investors. It is suitable for investors looking for stock screening criteria. These are the rules I learned from the book called The Intelligent Investor by Benjamin Graham.

As an investor, we should stay away from stocks of weak companies and buy only strong companies. Stock of strong companies bought at discounted prices is an ingredient of long-term wealth creation.

How we can know which company is strong and which is weak? It can be done in two steps. The first step is screening good stocks from others. The second step is a detailed fundamental analysis of the business. The subject of fundamental analysis is vast. But it is also unavoidable. It is recommended that all long-term stock investors should know it. But mastering fundamental analysis takes time.

Hence, my stock analysis tool offers these two steps for its subscribers.

Step #1: Stock Screening

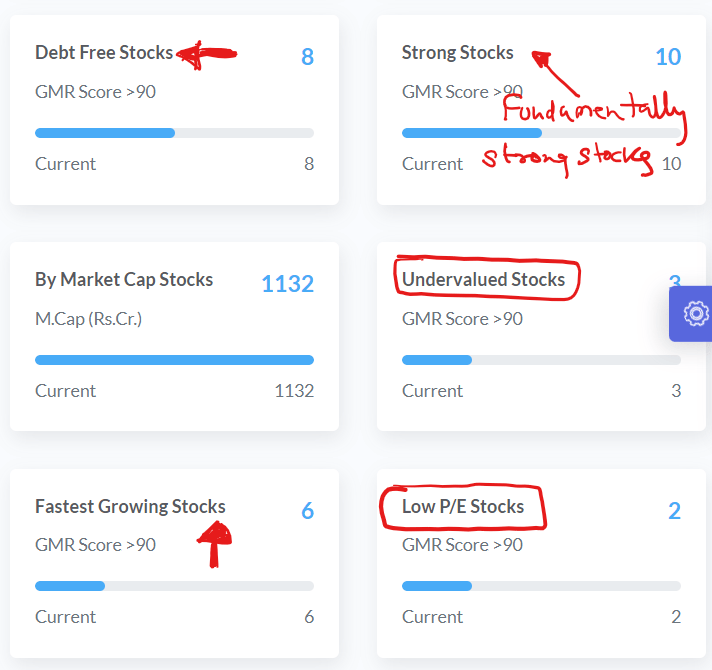

To make it easy for my readers, our Stock’s Engine offers pre-built stock screening themes. Even an untrained person can use it to filter quality and undervalued stocks with the click of a button.

There is 15+ number pre-built screeners. Out of them, few are coded to highlight strong stocks at available at discounted price (themes like undervalued stocks, low-PE stocks, etc).

Step #2: Detail Report of A Stock

The Stock’s Engine can deeply analyze over top 850+ number stocks and presents a report. In addition to other data, it presents two important numbers. They are the Intrinsic Value (IV) and Overall Score (OS) of the stock. A high overall score highlights the high fundamental strength of the business. A low intrinsic value, compared to the current price, represents a discounted stock price.

In the first step (Screening), we narrow down our potential list of stocks to a manageable number. Then in the second step (analysis), we perform the fundamental analysis of the shortlisted stocks.

In the second step, apart from IV and OS, the report presents the following data as well:

- Balance sheet numbers (10-Year),

- Profit & loss account numbers (10-Year),

- Cash flow report (10-Year),

- Financial ratios (10-Year),

- Peer Analysis (Comparison)

- Trend analysis of key financial data like sales, profit, EPS, price, etc.

Looking at all these data together, immediately, gives a lot of insights about the company. For investors, it becomes a critical decision-making tool.

Self-analysis to identify strong businesses

There may be people who may not want to subscribe to a tool like The Stock’s Engine for the analysis. For them, here are a few steps they can follow to filter the best stocks on their own.

| Screening of Fundamentally Strong Businesses | |

| Business |

|

| Financial |

|

Business

- Companies whose business model is cluttered can be avoided. Why? Because if the model is not simple and understandable to you, it will likely be the same for its management. As there are other profitable and simple business models available for investing, we can avoid the clutter.

- There are more than five thousand businesses listed in the stock market. But only a few of them can be called Respectable. Why? Because they do the business with utmost transparency, principles, and ethics. A long-term investor must invest only in honest companies. Over time, such companies gain the respect of the government, customers, peers, suppliers, and employees. Such companies can deliver above-average results over a long-time horizon.

- For some companies, the name of their products becomes more famous than their brand name. For example, Fevicol and M-Seal are products of Pidilite Industries. Closeup, Surf, Vaseline, Horlicks, etc are products of HUL. When it happens, it is a sign of a product that people love to use over and over.

- In all the Sectors/Industries, multiple companies operate. But within each sector, only one or two company serves the majority market. They are the companies with an economic moat. They beat their peers and dominate the sector.

Finance

- A company that can increase its operating profit and margins over time, attracts attention. Why the focus on operating profit? Because to increase it, a company will have to do two things in tandem. First, they will have to focus on operating revenue growth, Second, they will have to focus on eliminating all wasteful expenses. Please Note: Only a handful of companies can boast of margin growth on the long-term horizon.

- All companies need capital to operate their business. There are two sources of capital, equity, and debt. Equity is sourced from shareholders and debt from lenders. For a company to be tagged as profitable, it must display a high ROE and ROCE. ROE is a measure of how profitable the company for its shareholders is. ROCE is a measure of how efficiently the company is using its total capital, equity plus debt, to yield profits.

- For the owners of companies, neither operating profit (OP) is important nor net profit (PAT). Why? These are numbers useful for financial reporting. OP and PAT do not reflect how much cash the company is generating for its owners. The owners like to see the Free Cash Flow (FCF). FCF is the cash balance with a company after it has paid all its dues. When I say all dues, it includes interest payments, income tax, dividends, working capital needs, and financing the CAPEX.

Conclusion

If you’ll get a chance to meet pro investors like Peter Lynch, Warren Buffett, etc, they all will advocate the need of buying stocks at a discount. For them, buying discounted stocks is simple; relatively. Why? Because they know how to estimate the intrinsic value of businesses. But for common men, the moments of stock market corrections and crashes provide them this opportunity (The SALE!).

Waiting for SALE to buy stocks will give one the necessary margin of safety. Stocks bought with this safety net tend to possess much less risk of loss.

People who are not conversant with basics about stocks and fundamental analysis can use our offering, The Stock’s Engine to learn about potentially good companies. It’s a two-layered analysis tool, stock screening, and then detailed reporting of good stocks.

People who wish to do the analysis themselves can follow the plan shared in this article.

Thanks for reading my article through.

Have a happy investing.

Hello Mani, your content is always great.

Happy Blogging.

Thanks