The purpose of this article is to formulate a rule using which one can do the affordability analysis for oneself. The majority of us are not clear about our affordability factor. We are lured into believing that we can buy a thing that is actually not affordable. The idea is to understand the concept of affordability so that we can prevent overspending. For quick answers, read the FAQs.

Introduction

In today’s world of instant gratification, it’s easy to get caught up in overspending habits. However, to stay financially secure and maintain a stable budget, it’s crucial to understand and implement the concept of affordability.

By conducting an affordability analysis, we can assess our spending habits and make informed decisions to avoid loans and maximize our budget. In this comprehensive guide, we’ll explore the importance of affordability analysis and how it can help prevent overspending and reach financial goals.

The idea of affordability states that an item is considered affordable if its price is low enough for us to purchase it. It’s important to note that affordability is determined by two factors, not just the cost of the item. While cost is one aspect, the other is the buyer’s ability to pay.

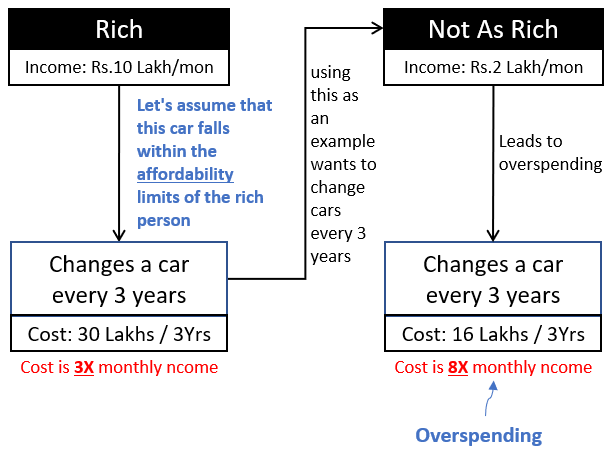

For example, consider two people earning Rs.10 lakhs per month and Rs.2 lakhs per month respectively. The richer person buys a car for Rs.30 lakhs every three years. Let’s assume that this purchase is within the person’s affordability limits (Car cost = 3 x monthly income).

Taking this as an example, the other person also changes his car every 3 years. He buys a car that costs him Rs.16 lakhs. In this case, the person is overspending. Why? His car cost = 8 x monthly income.

The point is, people often get confused about their ability to afford a thing. In the above example, the other person could have bought a car worth 3 times his income. But he ended up spending 8 times.

In this article we’ll formulate a rule to judge affordability. We’ll also use this rule in examples to better understanding and onward implementation in day to day life.

Video

A Rule of Affordability

Boosting our ability to pay for expensive items can make them more accessible. Affordability is determined by three factors: income, savings, and borrowing capacity. To simplify the decision-making process, I’ve established a set of rules for determining affordability.

- Rule#1. Income vs Cost: For example, if my income is Rs.100 and I want to buy an item that costs Rs.25 (25% of my income), the rule states that any item whose cost exceeds 10% of my income is considered unaffordable. However, we need to assess the next two rules before making a final conclusion.

- Rule#2. Savings vs Cost: It’s essential to have savings before making any purchases, including a phone, TV, furniture, vacation, car, or home. The savings accumulated for one item must not be used for another. If the cost of a TV, for instance, is Rs.100 and we have saved Rs.100 or more specifically for it, we can consider it an affordable purchase, even though the cost of the TV represents 100% of our income.

- Rule#3. Loan vs Cost: The ability to pay loan EMIs can also make an item more affordable. If the loan EMI is less than 5% of our income, we can consider it a financially viable purchase. For home purchases, the limit for loan EMI can be increased to 25%.

To buy an item, one can use all three heads: income, savings, and loan. But the maximum amount one can withdraw from each head is limited as shown above.

Affordability is a crucial factor when considering purchasing expensive items and is determined by three factors: income, savings, and borrowing capacity. These are the set of rules to simplify the decision-making process, including assessing the cost of the item against income, ensuring sufficient savings are in place, and evaluating the ability to pay loan EMIs. By following these guidelines, individuals can determine the financial feasibility of purchasing a desired item and make informed decisions.

An Application of The Rule [Example]

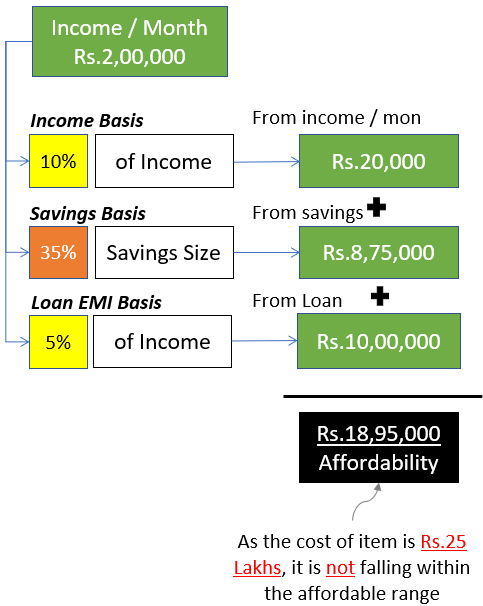

Consider a person with a monthly income of Rs.2 lakhs. Can he afford to purchase a car that costs Rs.25 lakhs? The person also has built savings worth Rs.8.75 lakhs for the car.

To determine the answer, we can follow the rules outlined in the above infographic:

- Present Income Basis: The maximum amount this person can spend from the income is Rs. 20,000 (20% of monthly income).

- Loan Affordability Basis: The maximum EMI the person can pay each month is Rs.10,000 (5% of monthly income). At the rate of 8.5% interest and a loan tenure of 13 years at Rs.10,000 EMI, the maximum loan the person can afford is Rs.10,00,000.

- Savings Basis: Considering the savings of Rs.8,75,000, it is about 35% of the required amount (Rs. 25,00,000). Hence, it is sure that he will need to dig into a loan and his monthly income.

So, let’s calculate if the sum of all three resources will be enough to make the purchase.

Adding the above three amounts gives us a total of Rs. 18,95,000 (= Rs. 20,000 + Rs. 8,75,000 + Rs. 10,00,000). This is the affordability number. Since the cost of the car is Rs. 25,00,000, the item is not considered affordable within the current limits.

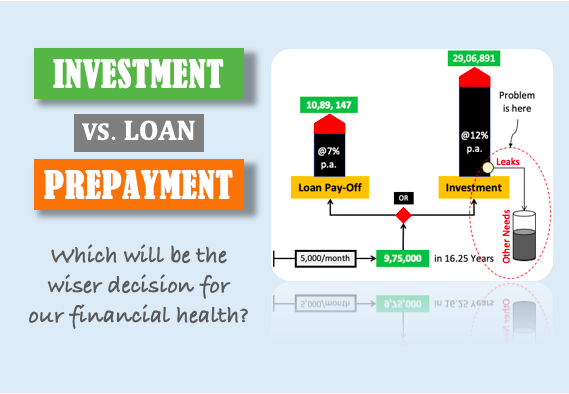

Loans Give A False Sense of Affordability

Here is an example of a deceptive perception of affordability.

The previous scenario highlighted how a person’s income, savings, and loan could not finance the purchase of a car. We could reach this conclusion because we followed our rule of affordability. These are the rules to avoid overspending in our day-to-day life.

It’s easy to fall into the loan trap, especially when one desires to purchase something that is out of reach (financially). Here, the loan becomes an easy solution to fulfill the desire immediately. But it must be avoided. Excess loan burden must be avoided.

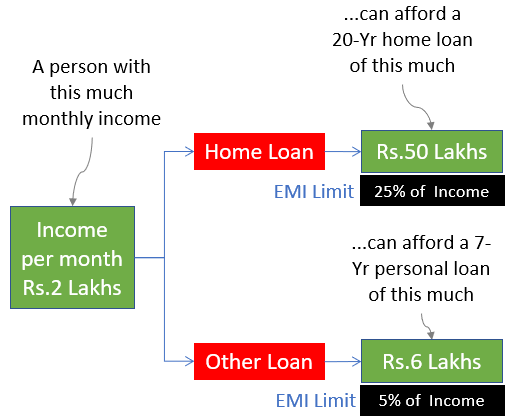

For instance, consider a person with a monthly income of Rs.2,00,000. Such a person will easily get a personal loan of Rs.60 Lakhs for 7 years, with an EMI of Rs.1,00,000 per month. Fifty percent of the person’s salary would go towards paying off the loan. The bank may be ready to disburse the loan because for them the requirement is met. But we as a borrower should not pay 50% of our salary as EMIs, especially on a personal loan. Why? It is not sustainable.

Many people make the mistake of assuming that if the bank is providing the loan, it must be affordable. It is a misconception.

To avoid overspending and falling into the loan trap, it’s important to follow our rule of affordability.

Additionally, if a person is already paying off a loan, their loan eligibility will decrease. For example, a person with Rs.2 lakhs monthly income is already paying an EMI of Rs.4,500 for a personal loan. How much more loan he can afford? He can only take a new loan with a monthly EMI of Rs.5,500 (Rule: 5% of monthly income).

Boost Your Financial Freedom with Loan-Free Living

When it comes to financial planning, experts often recommend living a loan-free life. However, this advice goes against what banks and governments promote. Why the discrepancy?

- The Banks have a vested interest in encouraging loans as they make money from loan interests. This is their business model.

- The government’s objective is to grow the country’s GDP as fast as possible. For this to happen, they want the citizens to spend more. To trigger spending they make loans cheaper and attract people and businesses to avail it.

So, banks and governments look at loans from a different perspective. From our perspective, loans are good but with limits. But we get confused into assuming that a loan is a good thing as both banks and the government is promoting it.

Example #2

When making purchases, it’s essential to stay within our means to avoid overspending. To do this, we must have clarity about our affordability. Let’s understand it with an example.

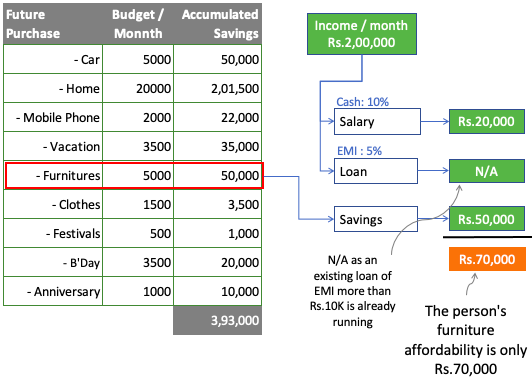

There is a person who earns a monthly income of Rs. 2,00,000 and is considering purchasing a sofa worth Rs. 1,20,000. He wants to know if he can afford it or not. Here’s how he analyzed his affordability:

- The person’s accumulated savings for furniture is Rs. 50,000.

- He also has an existing personal loan EMI of Rs. 10,000. So he cannot take more loans.

- The person can dig into his monthly salary and get Rs.20,000 from there.

In total, the total capital available for a furniture purchase is only Rs.70,000.

Please note that the person’s total saving is Rs.3,93,000. But on a furniture head, his saving is only Rs.50,000. He also cannot take a loan, as he has already exhausted the loan EMI limit of 5%.

With these limitations in place, we can conclude that the person cannot afford to buy furniture (sofa) for Rs.1,20,000. Though his monthly salary and savings will suffice, following our rule of affordability, he should not buy the sofa.

Conclusion

The concept of affordability analysis is a crucial tool for managing one’s spending habits and financial stability. By understanding one’s financial limitations and being mindful of loan obligations, individuals can maximize their budget and work towards their financial goals. Whether you’re looking to buy furniture, save for the future, or just maintain a healthy financial balance, affordability analysis can provide you with the guidance and information you need to make informed decisions. So, take advantage of this powerful concept and start enhancing your financial literacy today!

FAQs

Affordability analysis is the evaluation of a person’s ability to afford a particular item or service based on one’s income, savings, expenses, and debt obligations. It helps in budgeting and avoiding overspending.

Affordability analysis helps in managing finances by determining a person’s ability to purchase a particular item within their budget and avoiding overspending. It helps prioritize spending and make informed financial decisions.

Affordability analysis considers factors such as income, expenses, debts, and savings to determine the maximum amount one can afford to spend on a particular item or service.

Loan repayment can significantly impact affordability analysis by reducing the amount of money available for spending. It is important to consider loan EMIs when determining one’s affordability to purchase items or services

To analyze affordability for a major purchase, assess monthly income, expenses, existing loans, and savings, allocate a budget for the specific purchase, and determine the affordability amount based on these factors.

Analyzing affordability is determining how much can be spent on a purchase based on current income and expenses, while budgeting is creating a plan to allocate funds for various expenses over a specified period of time.

To increase affordability for a desired purchase, one can look for ways to increase their income, reduce expenses, pay off debt, and prioritize savings. It’s a combination of smart financial planning and budgeting.

Affordability analysis helps to assess one’s financial capacity for purchase, thereby avoiding overspending and potential debt by evaluating current income, expenses, and debts.

It’s recommended to perform an affordability analysis regularly, such as semi-annually or annually to ensure effective financial planning and avoid overspending and debt.

Keep reading and have a happy investing.