Investing in mutual funds is popular among investors seeking to diversify their portfolios. It is especially suitable for people with long-term financial goals in mind. One type of mutual fund that has gained traction in recent years is the fundamentally weighted index mutual fund. The concept is still not as popular in India, but with the way index investing is getting popular, its value will unfold in times to come. For quick answers, read the FAQs.

Introduction

Fundamentally weighted index mutual funds have gained popularity in recent years. They are especially gaining pace in developed markets like the United States and Europe. While these funds are available in India, they are not as popular.

To date, the traditional market capitalization-weighted index funds or actively managed funds are more subscribed in India. Indian investors are still getting familiar with the concept of passive investing and the benefits of index funds. As the investors mature, the next stage of index investing is fundamentally weighted index funds.

Two Indian mutual funds that resemble the concept of a fundamentally weighted index fund are these:

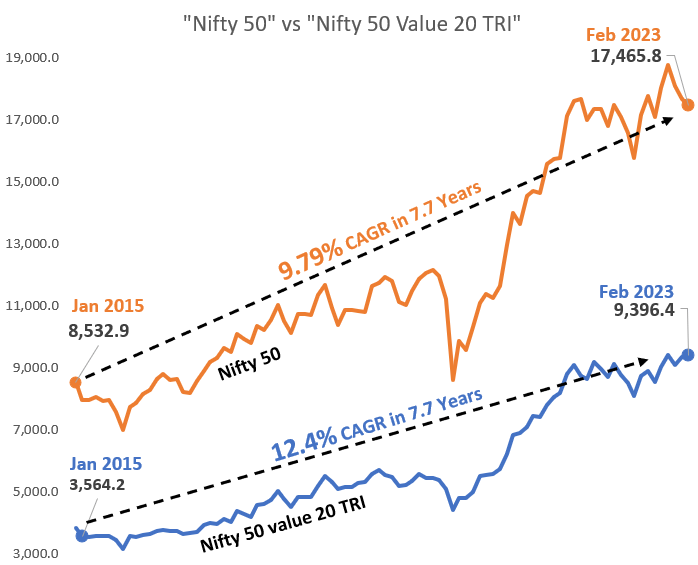

- Kotak Nifty 50 Value 20 ETF: The index is designed to track the performance of the benchmark index called the Nifty 50 value 20 TRI. The benchmark reflects the performance of top-value companies (20 numbers) that are a part of the Nifty50 Index. These are the most liquid blue chip companies with strong fundamentals. The AUM of this fund is Rs.38.18 Crore.

- SBI Nifty 200 Quality 30 ETF: The index is designed to track the performance of the benchmark index called the Nifty 200 Quality 30 Index. The benchmark index has the top 30 companies from its parent Nifty 200 index. These companies are selected based on their ‘quality’ scores. The weights of the stocks are derived from their Quality scores. The AUM of this fund is Rs.29.71 Crore.

Video

The Concept

Fundamentally weighted index mutual funds buy stocks of only strong companies an index. The idea behind fundamentally weighted index funds is that companies with strong fundamentals tend to provide better returns over the long term.

By investing in a fundamentally weighted index mutual fund, an investor is indirectly building a diversified portfolio of fundamentally strong stocks. A collection of such stocks can potentially yield better returns compared to traditional index funds.

Expense Ratio

The expense ratio of such mutual funds is a bare minimum. For example, these two mutual funds, Kotak Nifty 50 Value 20 ETF and SBI Nifty 200 Quality 30 ETF has an expense ratio of 0.14% and 0.5% respectively. Such focused funds typically have an expense ratio of 1% and above. Why? Because they are actively managed.

The concept of a fundamentally weighted index fund sounds like they are actively managed funds, right? In reality, they are passive funds. How? Because they are designed to track the performance of specific indices like the Nifty 50 Value 20 TRI or the Nifty 200 Quality 30 Index. They invest in the constituent of these indices in the same proportion as the index. Hence, the need for active management goes away.

These mutual funds do not aim to outperform their index, but rather to deliver returns that are similar to the index. The fund managers of these passive funds do not engage in frequent buying and selling of securities in an attempt to generate higher returns. Instead, they follow a buy-and-hold strategy, which is less costly and more tax-efficient than active management.

Hence, passive funds, like fundamentally weighted index mutual funds, tend to have lower expense ratios and turnover than actively managed funds. That is what makes them more cost-effective for their investors.

The Difference between a fundamentally weighted fund differs & a normal index fund

A fundamentally weighted mutual fund scheme differs from a normal index fund in how it constructs its portfolio and weights its holdings.

- Normal index fund: These funds are capitalization-weighted index funds. They track an index that weights its holdings based on their market capitalization. The larger the market capitalization of a company, the higher its weight in the index. As a result, a market capitalization-weighted index fund will have a higher allocation to larger companies.

- Fundamentally weighted fund: It weights its holdings based on fundamental factors such as revenue, earnings, dividends, or book value, instead of market capitalization. The idea is to identify and invest in stocks that are fundamentally strong regardless of their market cap.

Fundamentally weighted mutual fund schemes, therefore, tend to have a different portfolio composition compared to normal index funds. They may even include an allocation to small or mid-cap stocks. For example, an index like SBI Nifty 200 Quality 30 ETF, has a combination of large and mid-cap constituents.

As the focus is on fundamentally strong stocks, market capitalization-weighted funds may have a lower allocation to overvalued or overhyped stocks.

| Parameters | Index Fund | Fundamentally Weighted Fund |

|---|---|---|

| Investment approach | Passive | Passive |

| Constituent Weight | By Market capitalization | By Fundamental factors |

| Expense ratio | Very low | Low |

| Turnover | Very Low | Low |

| Stock Types | Mostly High Cap | High, Mid-Cap, & Small-Cap |

| Value Stock’s Presence in Portfolio | Less Likely | More Likely |

Difference between a focused fund and a fundamentally weighted mutual fund

The key difference between a focused fund and a fundamentally weighted fund is its investment approach. A focused fund is an actively managed fund that aims to outperform its benchmark index. A fundamentally weighted fund that aims to track the performance, not outperform, its benchmark index.

- Focused fund: It is a type of actively managed mutual fund. Its portfolio is concentrated to typically around 20-30 companies. The stocks are held in these schemes for a more extended period of time than in other mutual fund schemes. The objective of a focused fund is to generate higher returns than the market by investing in a small number of high-conviction stocks.

- Fundamentally weighted fund: It is a type of passive mutual fund. Its portfolio is also concentrated but the selection criteria are only fundamental factors. These factors can be profits, dividends, book value, price to earning ratio, rather than market capitalization. The objective of these funds is to provide investors exposure to a specific factor, such as value, quality, or low volatility, and deliver returns. They track a fundamentally weighted index, like the Nifty 50 Value 20 TRI, and deliver similar returns to its investor as its index.

| Parameters | Focused Fund | Fundamentally Weighted Fund |

|---|---|---|

| Investment approach | Active | Passive |

| Stock selection | Focused on a limited number of stocks | Based only on fundamental factors |

| Diversification | Less diversified | More Diversified |

| Returns | Dependent on the performance of the selected stocks | Designed to capture a specific factor or strategy |

| Expense ratio | High | Low |

| Turnover | Generally high | Low |

| Example & Benchmark Index | SBI Focused Equity Fund (Benchmark: Nifty 50) | Kotak Nifty 50 Value 20 ETF (Benchmark: Nifty 50 Value 20 TRI) |

Fundamentally Weighted Indices Available in India

There are multiple fundamentally weighted indices in the Indian stock market. Here are some of the most popular ones:

- #1. Nifty 50 Value 20 TRI: It is a fundamentally weighted index that selects and weights its constituents based on value factors such as price-to-earnings and price-to-book ratios.

- #2. Nifty 200 Quality 30 Index: It selects and weights its constituents based on quality factors such as profitability, earnings stability, and financial strength.

- #3. Nifty 100 Enhanced ESG Index: It selects and weights its constituents based on environmental, social, and governance (ESG) factors. It brings forth companies with strong ESG practices. It is designed for socially responsible investing.

- #4. Nifty 50 Equal Weight Index: It assigns equal weight to each of the 50 constituents of the Nifty50 Index. It provides diversified exposure to the Nifty50 stocks, without a bias towards larger companies.

- #5. Nifty Midcap 150 Quality 50 Index: It selects and weights its constituents based on quality factors such as ROE and debt-to-equity (D/E) ratio. It provides exposure to high-quality mid-cap companies that are financial stability and have growth potential.

- #6. Nifty Smallcap 250 Quality 50 Index: It also selects and weights its constituents based on quality factors such as ROE and debt-to-equity ratio. It provides exposure to high-quality small-cap companies in India, with a focus on financial stability and growth potential.

- #7. Nifty Low Volatility 50 Index: It selects and weights its constituents based on low volatility factors such as beta and standard deviation. These stocks have lower price volatility and hence tend to offer a more stable return profile over the long term.

Benefits of Investing in Fundamentally Weighted Index Funds

There are several unique benefits of investing in a fundamentally weighted index fund (FWIF) over a normal index fund. Here are a few points that immediately come to mind:

- Less concentration risk: Fundamentally weighted index funds (FWIFs) tend to have a lower concentration risk than market-cap-weighted index funds. How? Because FWIFs are not overexposed to a small group of large-cap stocks. Their portfolios include multiple strong stocks, so they are also better diversified.

- Long-term performance: These funds tend to outperform market-cap-weighted index funds over the long term. It does so by avoiding the negative effects of bubbles and crashes in overvalued stocks.

- Better Exposure to value stocks: Traditional index funds inherently gives more weight to a high market cap that tends to be more overvalued. Hence have a lower potential for growth. On the contrary, investing in FWIFs during a market correction or a crash gives better exposure to quality value stocks.

Conclusion

While there are clear benefits to investing in Fundamentally Weighted Index Funds (FWIFs), some investors may prefer traditional index funds.

Traditional index funds are more straightforward in their investment strategy. They are typically designed to track the performance of a specific market index, such as the Nifty50, and are weighted by market capitalization. This means that the largest companies in the index have a higher weight in the fund.

Additionally, traditional index funds because they typically have lower expense ratios compared to FWIFs. The additional research and analysis required to create and maintain a fundamentally weighted portfolio lead to higher expense ratios of such funds.

Overall, both traditional index funds and FWIFs have their pros and cons, and investors should carefully consider their investment goals and preferences before making a decision.

FAQs

Such funds are a type of passive investment fund that uses a different methodology to weigh the underlying stocks in the index. Traditional index funds use the method of market capitalization to weigh stocks in their portfolio. Fundamentally weighted index mutual funds weight stocks based on their fundamental strengths.

These funds use fundamental factors such as sales, profits, dividends, book value, etc to weigh the underlying stocks in the index. Traditional index funds use market capitalization to weigh the stocks in the index.

The benefits of investing in such a fund include better diversification, lower concentration risk, exposure to value stocks, and potentially higher returns over the long term.

These funds are suitable for those index investors who want exposure to a different type of index. Investors who like the idea of investing in companies that are comparatively fundamentally stronger would find FWIFs more suitable.

When choosing FWIFs, investors can consider factors such as expense ratios, asset allocation, the underlying index methodology, and the fund’s historical performance.