Every balance sheet transactions recorded by the company, alters its Balance sheet.

For investors, it is interesting to understand balance sheet transactions of companies.

Though the understanding of balance sheet transactions is not essential, but its knowledge helps.

It will greatly help value investors to read and interpret companies financial reports.

When I started learning about balance sheet entries, I developed a lot of respect for the accountants.

Recording of balance sheet transactions is basically job of an accountant. But some basic knowledge of it, can help the top managers as well.

Similarly, an investor must also know how balance sheet transactions are recorded.

Here in this article, we will use few simple examples to understand balance sheet transactions.

Normally, balance sheet is published at end of a financial year.

The cumulative affect of all transactions made in last 12 months gets accumulated in balance sheet.

But the report is published only on FY closing (31st March).

But this does not mean that balance sheet figures remains same for all year, and they change only on 31st March.

Balance sheet is as dynamic as other financial reports.

Companies accounts department keeps updating balance sheet line-items on daily basis.

Balance sheet represents ‘Account Balance’ of company at a specified moment of time.

The account balances of the following is maintained in a balance sheet:

- Assets,

- Liabilities &

- Shareholder’s Capital.

The balance sheet formula can be expressed like this:

Assets = Liability + Owner’s Equity (Accounting Equation)

Balance sheet transactions explained using simple examples

The financial strength of a company is represented by it balance sheet. The quality of balance sheet is determined by its composition.

Suppose there are two companies A & B whose assets are worth say $100,000 & $100,000 respectively. Looking from the weightage of Asset it may look like Company A & B are same. But judging the companies like this will not be correct.

To cross check the strength of balance sheet one must simultaneously look at Liability & Equity.

As per accounting rules, assets must be balanced by Liabilities & Equity.

Here are my observations on asset balancing with liability and equity:

- If Asset (on left) is balanced more by liability(on right), it is not good.

- If Asset (on left) is balanced more by equity(on right, like by retained earnings), is considered very good.

Balance sheet transactions which adds to assets (on left) and simultaneously adds to equity (on right) is considered perfect.

[Read more about “double entry system” here…]

We will see more about this in our examples.

So lets practice some balance sheet transactions examples now.

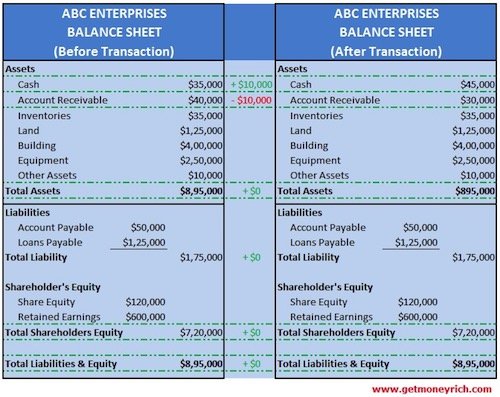

#1. Example: Collection from a Customer.

A Company named ABC collects $10,000 from its customer.

But this collection was not a result of a new sale. The sale has already happened 2 months back.

In this case how this transaction is recorded in Balance Sheet?

As this is only a collection activity, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The Cash(asset) increased from $35,000 to $45,000 due to collection of $10,000 from its existing customer.

- But it was not a new order, account receivables was correspondingly reduced from $40,000 to $30,000.

Due to this adjustment, the accounting equation remained balanced.

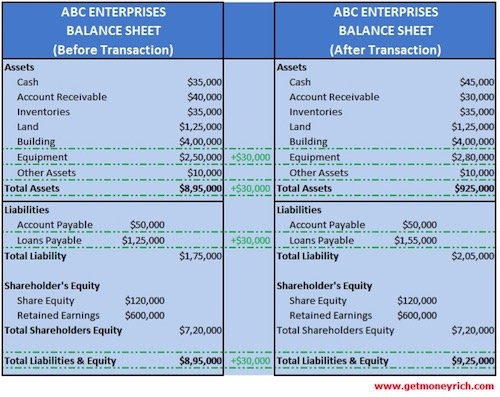

#2. Example : CAPEX Purchase on Credit

Company named ABC vide its CAPEX plan, purchased new machine for its plant worth $30,000.

The equipment was purchased on credit from the manufacturer.

In this case how this transaction is recorded in Balance Sheet?

As the equipment purchase is done on credit, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear, how balance sheet transaction has been recorded.

- The Equipment(asset) increased from $250,000 to $280,000 due to new equipment purchase vide its CAPEX Plan.

- Accordingly the total asset increased from $895,000 to $925,000.

- As it was a credit purchased, loans payable increasedfrom $125,000 to $155,000.

- Accordingly the total liability plus owner’s equity also increased from $895,000 to $925,000.

Due to this adjustment, the accounting equation remained balanced.

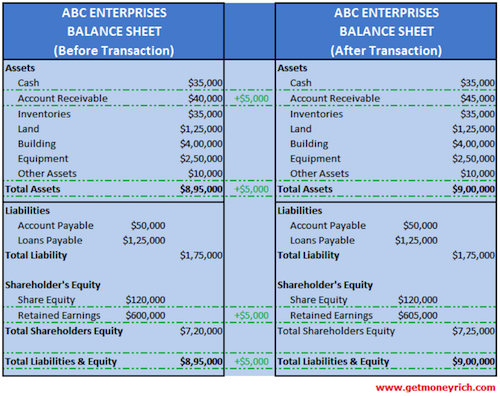

#3. Example : Receipt of a New Order from Customer

Company named ABC received order worth $5,000 from its customer in exchange for an expert supervision services.

In this case how this transaction is recorded in Balance Sheet?

As it is a new service order, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The Account receivable(asset) increased from $40,000 to $45,000 due to new order received from customer.

- Accordingly the total asset increased from $895,000 to $900,000.

- As it is a new order, the retained earningscolumn increased from $600,000 to $605,000.

- Accordingly the total liability plus owner’s equity also increased from $895,000 to $900,000.

Due to this adjustment the accounting equation remained balanced.

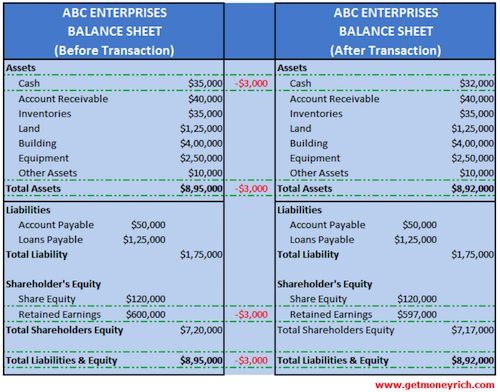

#4. Example : Payment Made to a Vendor

Company named ABC made an expense worth $3,000 to pay a vendors bill.

In this case how this transaction is recorded in Balance Sheet?

As it is solely an expense transaction, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The Cash(asset) decreased from $35,000 to $32,000 due to the payment made to the vendor.

- Accordingly the total asset decreased from $895,000 to $892,000.

- As the transaction was of a simple expense type, the retained earningscolumn decreases from $600,000 to $597,000.

- Accordingly the total liability plus owner’s equity also decreased from $895,000 to $892,000.

Due to this adjustment the accounting equation remained balanced.

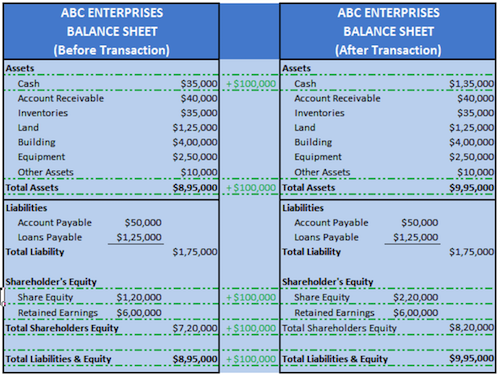

#5. Example : Shares issued to public

Company named ABC raised capital by issuing shares to public.

The shares issued was worth $100,000.

In this case how this transaction is recorded in Balance Sheet?

As it is solely a funding transaction, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The Cash(asset) increased from $35,000 to $135,000 due capital raised by company by issuing shares to public.

- Accordingly the total asset increased from $895,000 to $995,000.

- As the transaction is related equity funding, the share capitalcolumn has been simultaneously increased from $120,000 to $220,000.

- Accordingly the total liability plus owner’s equity also increased from $895,000 to $995,000.

Due to this adjustment the accounting equation remained balanced.

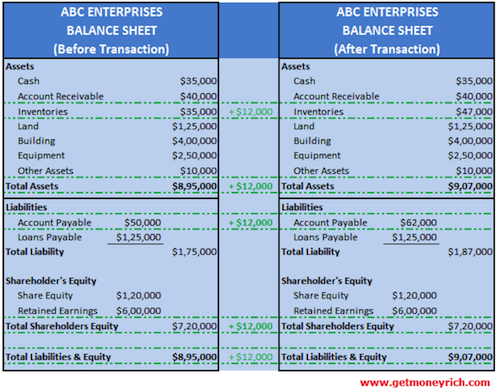

#6. Example : Purchase of Raw Material on Credit

Company named ABC purchased raw material on credit to produce its goods and services.

Raw material purchased was worth $12,000.

In this case how this transaction is recorded in Balance Sheet?

As it is solely a raw material expense, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The inventories(asset) increased from $35,000 to $47,000 as new raw material gets added to the existing inventory.

- Accordingly the total asset increased from $895,000 to $907,000.

- As it is also credit expense transaction, the account payablecolumn has been simultaneously increased from $50,000 to $62,000.

- Accordingly the total liability plus owner’s equity also increased from $895,000 to $907,000.

Due to this adjustment the accounting equation remained balanced.

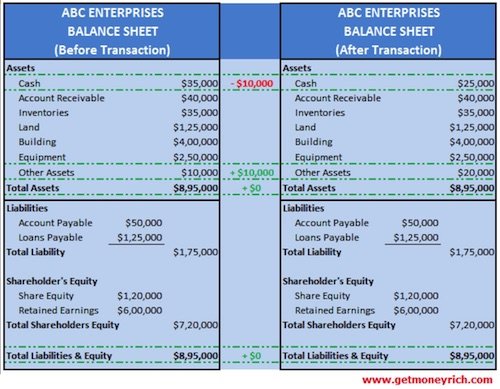

#7. Example : Purchase of office equipment with cash

Company named ABC purchased an office equipment.

The equipment was purchased was worth $10,000.

In this case how this transaction is recorded in Balance Sheet?

As it is solely an asset purchase, how this transaction is recorded so as to keep the equation (Asset = Liability + Owners Equity) true?

Please see the below picture.

From this simulation it will be clear how balance sheet transaction has been recorded.

- The cash(asset) decreased from $35,000 to $25,000 due equipment purchase of worth $10,000.

- Simultaneously the Other Assetscolumn also increased by $10,000 from $10,000 to $20,000.

- Accordingly the total asset remained at the same level at $895,000.

Due to this adjustment the accounting equation remained balanced.

आप हेल्प करेंगे ? आपकी फ़ीस कितनी होगी लिखें मेरी वट्स app पर 9991958264