Want to sell an under-construction flat? Pro investors do it all the time. But if people like us need to do it, how to go about it? Get an idea of the steps involved to execute this project. Selling an under-construction flat before the possession certificate is issued, is not the same work as a normal property resale.

Selling an under-construction property in India can be a complex process that requires careful planning and execution. As a seller, you need to navigate multiple legal and financial hurdles to ensure a smooth transaction.

This article will present to you the essential steps that one needs to follow to sell an under-construction property. Being aware of the steps will help you deal with multiple agencies better.

It will cover topics such as transfer fees, administrative charges, prepayment penalties, and income taxes liability that will come with the sale.

By the end of this article, the reader will have a better understanding of the typical steps involved to sell an under-construction property.

Video

Case Study

Recently I met a couple who wanted to relocate to a new city. They want to sell their under-construction flat for which the possession is due in the next 18 months. They have already paid the 25% self-contribution to the builder. Their bank has also disbursed 95% of the total loan amount to the builder.

The main idea of the couple is to sell their flat and make their loan outstanding zero. How they should go about executing this deal?

When I heard about their plan, I could feel that the method of selling this property will not be as easy as selling a normal resale flat. Why? Because there are a few moving ends here related to project completion, active loan, property registration, new buyers’ liability, and cash flows. We’ll touch base on all these points in this article.

So, here is an overview of the steps to sell an under-construction residential flat that is being developed by a respectable builder. I’m assuming that all necessary approvals are already taken by the builder from the relevant authorities.

Step #1: Meet Your Builder

This step involves meeting with the builder. It is to confirm the transfer rules, sale proceeds, transfer fees, and any additional charges or penalties associated with selling an under-construction flat before possession.

- #1. Transfer Rule: Check the agreement with the builder. Have a meeting with the builder to get their confirmation about whether the transfer of property is allowed before possession.

- #2. Sale Proceeds: Assuming that all payments to the builder, own contribution, and from the bank, are already made, the builder has no ask on the sale proceeds between the seller and the next buyer. Getting this confirmation from the builder is necessary.

- #3. Transfer Fees: Ask the builder, if there are any transfer fees that apply. If it is applicable, it is typically a percentage of the sale price of the property. This fee is charged for transferring the rights of the property from you to the next buyer.

- #4. Fees/Charges/Penalty: Ask the builder if they will charge any administrative fees, service tax, penalty, etc on this deal. It is kind of extra work for them to make provision for a new buyer instead of you. So better ask them for it at this stage itself.

- #5. Completion Date: The builder shall give a tentative date of completion of construction and the date of possession certificate. This information will be required while meeting the buyer (and his bank).

Quantify and make a note of all extra charges, as applicable, from your builder’s side.

At this stage, raising the point of stamp duty and registration expenses will be better. The idea is to know who will bear it. Generally, it is paid directly by the buyer using a government portal. In this case, the new buyer should bear these charges. But raise this point with the builder anyways.

Step #2: Meet Your Lender (Bank)

This step is about meeting the lender/bank. Idea is to get the NOC (No Objection Certificate) from the bank. The bank must also be informed about how you are planning to clear the home loan outstanding. This discussion will bring forth any charges, fees, and penalties that the bank would levy on the transactions.

- #5. Bank NOC: Approach your bank that has issued the home loan. Obtain a NOC (No Objection Certificate). Tell them why you want to sell your under-construction flat. Also, inform them that the outstanding loan amount will be repaid from the sale proceeds. The issued NOC will confirm that the bank has no objection to the sale of the property.

- #6. Loan Prepayment Penalty: Generally, banks do not charge a pre-payment penalty on a home loan issued to an individual. But if you have availed special offers from your lender (like the start of EMIs only on possession), they may impose a penalty. Get this confirmation from your builder.

Quantify and make a note of any extra charges, as applicable, from your bank’s side.

Step #3: Find and Meet A Buyer

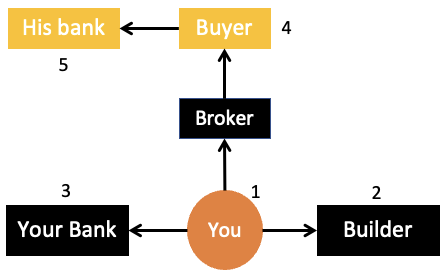

This step is about finding a broker who in turn will help to find a buyer and seal the final deal.

- #7. Find a Good Broker: Tell the agent about your under-construction flat. Tell him that you need him to find a potential buyer for your flat and execute the sale. Explain to him the status of the construction of the flat. Also, clearly emphasize your priority to use the sale proceeds to pay off the home loan. Finalize the brokerage fee with him. Ask him to include the lawyer’s charges in his fees.

- #8. Tripartite Agreement (buyer): Sign a tripartite agreement with the buyer and the developer. The buyer should agree to take over the property once the construction is completed and possession is handed over. Finalize the sale price with the buyer and the payment schedule.

- #9. Buyer’s bank: The buyer’s bank should also be aware of the tripartite agreement. It is critical, as some banks may not agree to finance such a property purchase. The buyer should get a confirmation from his bank about the loan disbursement schedule. The buyer’s bank must also be reiterated that the loan disbursement is NOT made to the builder but to the first buyer.

This is perhaps the most important step where the tripartite agreement is signed. It is also critical to evaluate the new buyer’s ability to pay for the property. Seek clarification about if the purchase will be self-financed or through a bank loan. If there is a bank loan involved, ask your broker to insert the clause of the loan sanction letter to be produced before the final signature of the tripartite agreement.

Step #5: Do The Math

This step is critical as here you’ll exactly know how much is your cash-inflow and how much is the outflow. At the end of it, you will approximately know what will your net gain from this deal.

- #10. Calculate Loan Outstanding: Once the sale price is finalized, calculate the amount of loan outstanding. Add any pre-payment penalty or other charges that may apply. This will give you a clear idea of the total cash-out that is required to make the loan zero.

- #11. Estimate The Income Tax Payable: In this case, the sale proceeds will attract short-term capital gain tax (STCG). The tax rate will be as per one’s tax slab (like 20%, or 30% as applicable).

- #12. Calculate Net Receivable Upon Sale: Calculate the net sale proceeds that you will receive after deducting all expenses, such as brokerage fees, taxes, transfer charges, income tax liability, and any other expenses (as applicable). This will give you a clear idea of the net cash-in you will have in your bank after adjusting for all related expenses.

The suggestion is to prepare a worksheet and keep updating it for every identified cash-ins and cash-outs. No matter how small is the cash flow, make sure to note it on the worksheet.

Step #6: Final Steps

The final step is about receiving payments from the buyer and home loan closure.

- #13. Ask For Payments: Request the buyer to start the payments as per the agreed payment terms. Suppose the payment term is 95% on the casting of the final floor slab and 5% on possession. So, if the final floor is already cast, ask for a 95% payment from the buyer.

- #14. Loan Prepayment: Get the funds from the buyer and use the full amount to prepay your home loan. If you’ve additional savings, use this opportunity to pre-pay 100% of the loan outstanding. Take the certificate from the bank that your home loan is closed.

- #15. Pay To Builder: As discussed in step #1, if there are any dues to be paid to the builder, pay them their dues.

- #16. Ask for the final payment: As soon as the new buyer gets the possession certificate, ask for the final payment (say 5%).

- #16. Final Documentation: As per the tripartite agreement, ask the buyer and the builder to release you from the liability of the property. Now, the new buyer and builder can go ahead and get the property registration formality done. The stamp duty and registration charges shall be paid by the new buyer.

Example

Let’s consider the case of Mr.Seller who bought a flat in a new development in Mumbai in 2019. The builder promised possession of the flat in June 2024.

Meanwhile, Mr.Seller‘s financial situation changed, and he found himself needing to sell the flat. He contacted a real estate agent who specialized in such deals and asked for their help in finding a buyer.

The agent got in touch with a prospective buyer, Mrs.Buyer, who was interested in purchasing an under-construction flat.

Mrs.Buyer had done her research and knew that buying this kind of under-construction flat could be riskier than buying a normal under-construction flat. But she was willing to take the chance for the sake of getting a good deal.

After inspecting the property and agreeing on a price, Mr.Seller and Mrs.Buyer entered into an agreement for sale (tripartite). The agreement outlined the terms and conditions of the sale, like the payment schedule, the completion date of the construction, and the penalty clauses in case of default by either party.

Since the flat was still under construction, Mr.Seller had to transfer the ownership of the flat to Mrs.Buyer through a sale deed, even though the possession and registration were yet to be completed.

The sale deed was executed and registered, and Mrs.Buyer paid a substantial portion of the sale price as per the payment schedule.

Need of the Power of Attorney

However, since the possession of the flat was yet to be handed over to Mr.Seller, he could not physically hand over the flat to Mrs.Buyer. So, as per the agreement, Mr.Seller provided Mrs.Buyer with a power of attorney (POA) to act on his behalf and collect the possession of the flat once it was ready.

Finally, in June 2024, the construction will be completed, and the builder will hand over the possession of the flat to Mrs.Buyer through the POA. After getting possession, Mrs.Buyer will get the flat register in her name, and then she will pay the remaining amount of the sale price to Mr.Seller.

Conclusion

Try to sell an under-construction flat before the possession certificate and registration, you will know how daunting is the task. This article aims to give some clarity about how people like us can execute this task.

Meeting with the builder and understanding the transfer rules, sale proceeds, transfer fees, completion date, and additional charges is the first step. It is essential to get a NOC from the bank, inform them of the sale, and repay the outstanding loan amount from the sale proceeds. The bank may impose a pre-payment penalty if special offers were availed on the loan. So it is crucial to get a confirmation on this.

Finding a good broker and signing a tripartite agreement with the buyer and developer is a critical step. The broker should be aware of the status of the construction of the flat. He must also know the seller’s priority of using the sale proceeds to pay off the home loan.

The tripartite agreement should be signed by the buyer agreeing to take over the property once the construction is completed and possession is handed over.

It is crucial to inform the buyer’s bank about the tripartite agreement and get confirmation about the loan disbursement schedule. The buyer’s bank must be clear that the loan disbursement is not made to the builder but to the first buyer.

Have a happy investing.

![Home Construction Loan: What is The Process To Get Such Loans [India]](https://ourwealthinsights.com/wp-content/uploads/2013/08/Home-Construction-Loan-image.jpg)

If Mr. Seller has registered sale agreement of Rs. 50 lakh and Mr. Buyer has purchased the flat by Rs. 70 lakh then What will be deed of conveyance value for ready to move flat?? Also will Mr. Seller execute the deed of conveyance or only developer will execute??

Very informative. Thanks for writing this. With respect to this statement – ‘buying this kind of under-construction flat could be riskier than buying a normal under-construction flat’. Will the new buyer be ready to buy the same flat at a higher price if it was registered by the first buyer?

I have bought an under-construction flat and am deciding when to sell it. Before registration or after registration. Which one would likely give me more profits?

I purchased a property worth 2cr last year (Under construction, on Loan) and this year I want to resale it to a new buyer. What is the procedure and how will I get my money which I paid as EMI and margin shortfall to bank.

Obtain the builder’s consent to transfer your rights to the flat to a new buyer. Execute a sale deed between the third party (buyer) and the builder, with you as a consenting party. The money paid as EMI and margin shortfall shall be recovered from the sale proceeds.

[Note: Ensure that the flat has not yet been registered in your name]

I have same question.. how can I ensure that we get back all the pre-emi’s I paid, as well as all other charges like GST, NOI etc

If the first buyer has paid GST , Will the 2nd buyer also have to pay GST as the property is still under construction

No, the second buyer will not have to pay GST again if the first buyer has already paid it during the initial purchase.

Hi,

If I am holding the under construction property for 2 years and selling it after 2 year completion, will it still attract STCG tax or will it go in LTCG?

The holding period is calculated from the date of possession of the property, not from the date of booking the property. In your case, the holding period will be 2 years, not 4 years.

– STCG will be applicable when property is sold within 2 years of possession.

– LTCG will be applicable when property is sold after 2 years of possession.

In your case, it should be LTCG.

Do Mr. Seller pay the TDS with Builder in this process? How TDS will play the role here and who will do that?

Hi what happened if own contribution was fully paid but builder is not ready to give NOC? Is there any alternative way to sell under construction flat.

If one’s own contribution for an under-construction flat is fully paid, but the builder is not willing to provide a No Objection Certificate (NOC) for the sale, it can present a challenging situation. I think the next logical step is to understand the builder’s perspective and concerns. If there are specific reasons for their reluctance to issue an NOC. Once the reason(s) is(are) known, one can approach the lawyer to plan the next course of actions. But under all this

Very informative for a new fish in this pond of real estate

Thanks