The Indian aviation sector has been facing turbulent times in recent years. On 02-May-2023, Go First Airlines (Founded as GoAir) voluntarily filed for Bankruptcy. On the date of writing this article. the airline company has canceled all flights till 12-May-2023. I’ll try to explain why in a buoyant and growing economy like India, Indian Airline companies are not able to survive.

With the rise of an emerging Indian middle class wanting to travel, many airlines have ordered billions of dollars worth of planes. Following is the likely composition of new planes ordered by Air India to Boeing and Airbus in February 2023.

| Description | Unit | QTY | Remark |

| Airbus A350s | Nos. | 40 | Widebody |

| Airbus A320/321 Neos | Nos. | 210 | Single Aisle |

| Boeing 787 | Nos. | 20 | Widebody |

| Boeing 777-9S | Nos. | 10 | Widebody |

| Boeing 737 MAX | Nos. | 190 | Single Aisle |

| Total | Nos. | 470 | – |

India’s biggest Airline company Indigo Airlies is also planning to order a few widebody airplanes for its international routes.

The recent ordering has created a cauldron of competition in what is now the world’s most populous nation.

However, this has not translated into profits, and the pandemic has only worsened the situation.

Let’s try to understand why Indian Airlines are struggling to stay afloat.

Recent History of a Few Airline Companies Going Belly Up

The history of airline companies in India is not so motivating:

- Kingfisher Airlines, founded by Vijay Mallya, ended operations in 2012 after failing to clear its dues to banks, staff, lessors, and airports.

- Jet Airways India Ltd, founded by Naresh Goyal, hasn’t flown since entering bankruptcy in 2019.

- Air Costa, a smaller regional carrier also folded in 2017 when it suspended all operations due to problems with financing. It was the same airline that surprised the aviation world in 2014 with an order for 50 Embraer SA jets worth $2.9 billion.

Go First Airlines Story

Go First Airlines this week (May 2023) became the latest victim in the battle of the skies over India. It isn’t the first high-profile carrier to fail, and sadly it looks like it won’t be the last. Even before the pandemic, the fight for survival was intense, and the pandemic only compounded the situation.

The reasons for airline failures in India vary, but it mostly boils down to a mix of low-cost fares, high taxes on fuel, and cut-throat competition. Needless to say that the majority of Indian domestic flyers are hypersensitive to changing prices especially when it comes to Airtravels.

Pratt & Whitney (P&W) effect

Go Airlines India Ltd. sought insolvency protection, blaming the American aircraft engine manufacturer Pratt & Whitney (P&W) for the mess.

The airline has said that the manufacturer has failed to supply parts and replacement engines needed for the Airbus A320neo jets. As this aircraft is the backbone of the GoAir’s fleet, the airline said, non-supply forced it to ground about half its planes. Even the arbitration court mandated Pratt & Whitney to supply the parts and the engines. The engine maker, a unit of Raytheon Technologies Corp., has disputed the claim.

GoAir has struggled in the past as well. It grew more slowly than rival IndiGo. Over the years, Indigo Airlines now controls over half the domestic market.

GoAir now has to borrow heavily to pay lease rentals, airport dues, and salaries during the pandemic when its jets were grounded.

Industry experts say that not all of Go First Airlines’ woes could be attributed to P&W alone. There are other issues attributed to the collapse of the airline. Suggested Reading: Why do Airline companies operate at a loss in India [detailed report]?

Why Indian Aviation Sector is Struggling

The reasons for the Indian aviation sector’s struggle vary. But it mostly boils down to a mix of dirt-cheap fares, high taxes on fuel, and cut-throat competition. All these reasons are compounded by the disruption from Covid.

- High Tax: The approximate price of aviation fuel as charged at Indian airports are about Rs.120 per liter. About 35-40% of this cost is tax paid to the central and state governments. As aviation fuel accounts for more than half of all expenses on the airlines, such a high tax burden hurts.

- Cheap Fares: Big players like IndiGo offer ultra-cheap fares on routes flown by rivals, using their reach to recoup costs on less-competitive legs and tapping economies of scale to lower overheads.

- Weak Rupee: In addition, the Indian rupee has fallen almost 20% against the dollar since the beginning of 2019, raising the cost of leasing planes from abroad. The strong dollar has also increased the fuel cost for India.

Government’s Role

The government has not been very helpful to struggling airlines as well. Successive and largely populist governments have shied away from offering direct support to struggling airlines.

- The previous administration allowed foreign airlines to invest in local carriers and urged states to reduce taxes.

- The current government (BJP) offered credit lines during the pandemic but stopped short of outright bailouts. The Government has committed to steer itself away from the airline business. They sold the perennially money-losing flag carrier Air India Ltd. to Tata Group last year.

Yet with BJP seeking a third term in elections next year, more airline failures could dent its reputation for championing the industry.

Indian Aviation Sector’s Potential

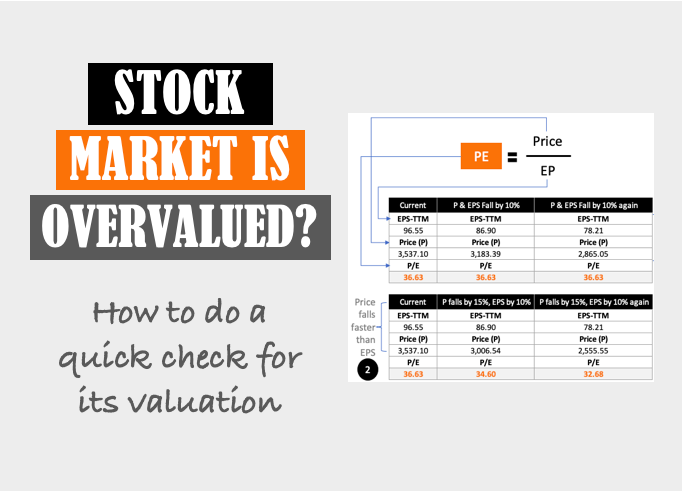

The Indian aviation market is an attractive one. Before Covid (2014 to 2020), the sector’s growth rate was about 10.6% per annum. The growth calculation is based on the number of travelers handled by Indian airports between the financial year (FY) 2014 and 2022. If we’ll consider only domestic travelers, the growth rate was even more impressive at 12.2% per annum (between 2014 to 2020)

We have seen two sides to the Indian aviation sector. On one side we have an example of Go First closing down its operations. On the other side, we are seeing new airlines entering the sector. Only last year, India approved the launch of a new airline called Akasa Air. Akasa began flying on 07-Aug-2022 last year.

The growth prospects are attracting companies to enter the aviation sector. But the high cost and cut-throat competition and extremely price-sensitive market are pushing weak companies toward collapse.

Conclusion

In a country where air travel has traditionally been limited to the rich, rising incomes and growing aspirations have opened up a new market of first-time fliers. These fliers are willing to trade the luxury of full-service carriers for the low-cost fares of budget airlines. This has led to a proliferation of airlines in India. But with the speed with which new players enter the industry, old players exit at the same speed.

Both established players and new entrants vying for a slice of the pie.

However, as the recent spate of airline failures has shown, the market is tough, and not everyone can make it. With cut-throat competition, high taxes on fuel, and low fares, airlines are finding it increasingly difficult to turn a profit. The pandemic has only made matters worse, with airlines facing a prolonged slump in demand and increased costs due to safety measures.

Despite the challenges, the allure of the Indian aviation market remains strong, and new players continue to enter the fray. Whether they will be able to survive the tough conditions and turn a profit remains to be seen.

[Note: How investors should look at these scenarios of the Indian Aviation sector? A sector/industry growing at 10-12% per annum in the long term a big thumbs up. But the high cost and weak pricing power are causing badly managed airline companies to bow out. But good airline companies, that will survive the test of time, can compound high returns in the long term (like 10-15 years). One such example is Interglobe Aviation (Indigo). In the last 1-year, its share price is up by 25%]