Imagine you have two jars: one is labelled as Income, and the other is called Wealth. The Income jar gets fill-up regularly – daily, monthly, or yearly. This is the money we earn from job, business, etc. It keeps coming in, but it also gets spent. Now, the Wealth jar is different. It’s like our traditional “Gullak” where we used to keep our coins (savings). It takes extra-work (though simple) from our part to convert our income into wealth. Income does not get converted to wealth automatically. Which is more important, income or wealth?

If you focus only on income, you’ll have money in your hands, but it will disappear as soon as you spend it. On the other hand, if you’ll focus also on building wealth, you will become richer every passing day.

Most of us are taught in a way that our focus is mostly on income, which is not wrong. But this income-only focused mindset has a downside, it let’s us ignore wealth. Actually, instead of stopping just at income we must remember this complete process flow: Earn (Income) → Save → Invest → Build Wealth. This is the way to become rich.

Topics:

1. Understanding Income vs. Wealth: A Simple Perspective

Let’s talk about two important players in the money game: Income and Wealth. Though people often think they’re the same, but they are as different as a flowing river and a still lake.

1.1 What is Income?

Think of income as water flowing into a bucket. This flow comes from various taps – your job, your business, or maybe even investments like fixed deposits or stocks (example dividend). It’s the money you earn regularly, like a monthly salary from job.

1.2 What is Wealth?

Now, wealth is like the water stored in a tank. It includes all the buckets of water you’ve saved over time. Your wealth grows when you don’t let the income flow drain away through unnecessary expenses. It builds up accumulating assets like a fixed deposits, mutual fund units, stocks, house, gold, etc.

Here’s the big idea: income is about earning, while wealth is about keeping and growing.

1.3 Why Understanding This Matters

Knowing the difference between income and wealth is like learning how to manage your pocket money.

For example, suppose you get Rs.500 every month (income). If you spend Rs.450 on snacks and toys, what’s left? Just Rs.50! Now, if you save that Rs.50 every month and put it in a Gullak (piggy bank) or invest it, you’ll slowly build wealth.

We focus too much on earning more and forget to think about saving or investing wisely. But income alone won’t make us rich – it’s what you do with that income that matters.

1.4 A Visual Example

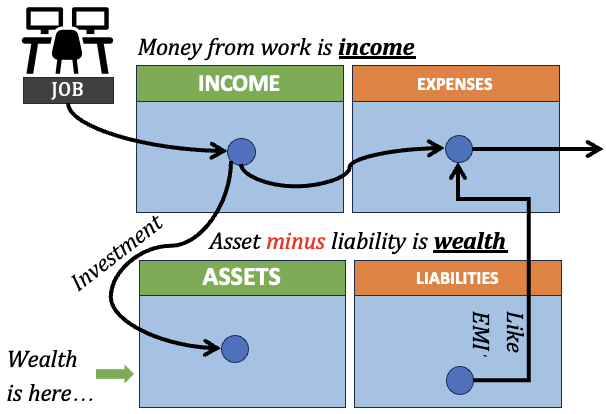

Consider for example, you have a notebook with two dedicated pages in it. The first page is for your Income and second is for Expenses. This is the page where you note what you earn and spend.

The leftover money (savings) moves to your third page: Wealth. This page has the things you own that grow in value, like fixed deposits, mutual funds, stocks, or house.

Important: If your spending list grows too big (like loans or unnecessary expenses), you’ll have less money to move to your wealth list.

In technical terms:

- Your Profit and Loss Account (income and expenses) shows the flow of money in and out.

- Your Balance Sheet (assets and liabilities) shows what you own and owe.

1.5 Why Income and Wealth Are Both Important

Income is your fuel. It helps you buy groceries, pay rent, and even invest in things you love, like travel.

But it’s wealth that ensures you won’t have to worry about the future. For example, if you buy a piece of land or invest in stocks today, its value might multiply over time.

I will say: Treat income as the seed and wealth as the tree. Water your seed with good habits – spend wisely, save consistently, and invest intelligently. Over time, your tree will grow, giving shade and fruits that last a lifetime.

A Word of Caution: Beware of loans (liabilities). They are like holes in your bucket – leaking water you could’ve used to build wealth. If you borrow too much, you might end up spending all your income on repaying loans, leaving little to save or invest.

So, don’t just focus on earning; start building your wealth today! Remember, income is temporary, but wealth can last forever.

2. Why is it important to distinguish between income and wealth?

Consider for example that there are two friends: Ravi and Sunita. Ravi earns ₹2 lakhs every month, while Sunita earns ₹50,000. Most people would assume Ravi is better off. But is that true? Not always. Let me explain why.

2.1 It’s Not About What You Earn—It’s About What You Keep

Think of income like a pipe bringing water into your home. Ravi has a bigger pipe (high salary), but he also has many leaks in his house. He spends a lot on luxury gadgets, vacations, and fancy restaurants. Sunita, on the other hand, has a smaller pipe, but she fixes her leaks—saving money, spending wisely, and investing regularly. Over time, her savings turn into wealth.

2.2 The Lifestyle Trap

Ravi lives a lavish lifestyle. He drives an expensive car, owns a big house, and travels abroad every year. But to maintain this, most of his income is spent on monthly EMIs and bills. He’s left with little to save or invest. Ravi may look rich, but he isn’t building wealth.

What I think: In India, many high earners fall into this trap. They think earning more means they’re financially secure, but high expenses can quickly eat away at their income.

2.3 The Danger of Debt

Ravi also takes big loans. Why? Because he can afford the EMIs. Let’s say Ravi buys a house worth ₹1 crore by taking a ₹95 lakh loan. His EMI is ₹1 lakh, which fits his salary. But here’s the problem: his bank balance is only ₹5 lakhs. If something unexpected happens—like losing his job or a medical emergency—Ravi could struggle to manage his expenses.

Many of us fall into this trap because society tells us that being able to pay EMIs means we’re financially stable. But in reality, too much debt can slow wealth creation.

2.4 Wealth is About Long-Term Planning

Sunita, on the other hand, lives simply. She rents a small house and doesn’t buy things she can’t afford. She saves consistently and invests her money in stocks, mutual funds, or even a fixed deposit. Over time, her investments grow.

Here’s an important lesson: wealth isn’t built overnight. Even if you earn less, you can grow rich by:

- Saving a portion of your income.

- Making smart investment decisions.

- Avoiding unnecessary loans.

- Letting your money grow over time.

2.5 Are You Wealthy or Just Earning Well?

Now, take a moment to reflect. Are you like Ravi—earning a lot but saving little? Or like Sunita—earning less but steadily building wealth?

Remember, it’s not about how much you earn. What matters is how much you save, invest, and grow over time. Moderate-income earners with good financial habits often end up wealthier than high earners with poor money management.

So, the next time you think about your salary, also ask yourself: How much of it am I using to build my wealth?

3. Who Are Wealthy in India? [My Definition]

I have a theory that I use to distinguish a normal person from a wealthy person.

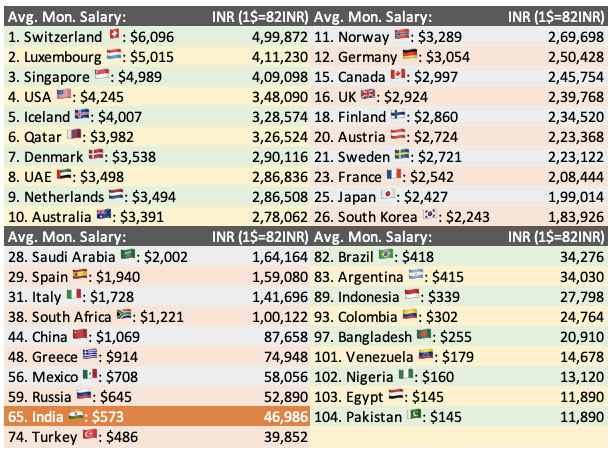

As per data published by the World of Statistics, on average, professionals in India earn an income of about Rs.46,900 per month. We’ll use this figure as our basis to define who is wealthy in India. Please note that I’m assuming Rs.46,900 as the net take-home salary and not the CTC (Cost to the Company). It means Rs.46,900 is the amount that gets credited to one’s bank account each month.

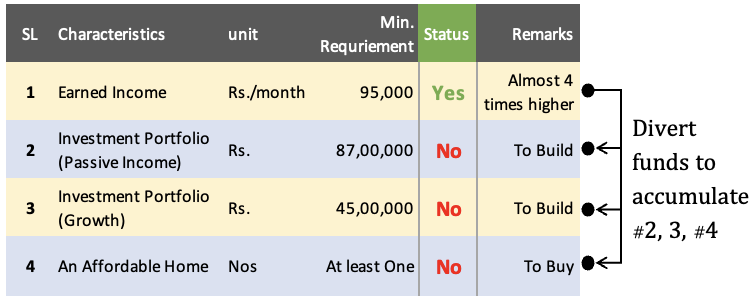

Let’s define the minimum characteristics of a wealthy Indian person. A person who is starting to show these first characteristics is beginning to become wealthy.

- Characteristic #1 (Earned Income): The minimum earned income of the person should be at least two times the average world data (Rs.46,900). It means, if the person is earning an average take-home salary of about Rs.95,000 per month, he is satisfying the first parameter of being wealthy. Please note that by earned income I mean income from job, business, etc.

- Characteristic #2 (Passive Income): The minimum passive income of the person should be at least equal to the average world data (Rs.46,900). It means, the person must have an investment portfolio that consists of enough passive-income-generating assets. Assuming an income yield of 6.5% per annum, the size of the asset base should be at least Rs.87,00,000. To know the difference between earned income and passive income, read this article.

- Characteristic #3 (Growth Portfolio): There are two components of an investment portfolio. The first takes care of the passive income (#2 above). The second takes care of the necessary growth that makes a person wealthier time after time. The minimum size of this growth portfolio should be at least 50% of the passive income portfolio. As we’ve fixed the minimum asset base in #2 as Rs.87 lakhs, the minimum size of the growth portfolio is Rs.45,00,000.

- Characteristic #4 (Own A House): The person should also own at least an affordable house for self. It can be a self-occupied house or otherwise. One can use this house affordability calculator to check the size of the required house.

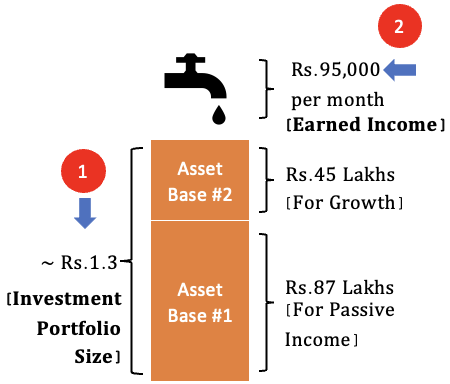

For me, these are the four characteristics that become a starting point for a person to be tagged as wealthy. Pictorially, a wealthy Indian individual should at least look like this:

Who can be called as wealthy in India? A person is wealthy if he/she is showing at least these two characteristics in tandem. First, his/her investment portfolio size is at least Rs.1.3 crore. Second, his monthly earned income is at least Rs.95,000 per month.

So, taking this as our basis for being wealthy, let’s try to answer a tricky question.

4. A person who earns Rupee four (4) lakhs per month is wealthy?

Suppose there is a fresh graduate (Mr.ABC) whose starting salary is Rs.4,00,000 per month. Can he be treated as a wealthy individual? As we have already seen, to become wealthy, the person must fulfill the following four characteristics.

As a starter, earning four times as much as the requirement is great for Mr.ABC. But considering that he does not fulfill other characteristics, he cannot be called wealthy. No matter how high is one’s monthly paycheck, if all requirements are not met, a person is not wealthy.

But a high monthly income can assist in building the required investment portfolio faster. Such a person can also buy a small home as per his affordability very early in life. This way, his path to a wealthy life becomes a tad bit easier.

Compare it with a person whose earned income is Rs.1,00,000 per month. This person will find it harder (compared to Mr.ABC) to climb up the wealth ladder and eventually become wealthy.

But I would like to clarify a point here. Here, the above explanation may give the impression that a high paycheck is the only key requirement to becoming wealthy faster. A higher paycheck is certainly helpful, but it does not mean that people with lower incomes cannot become wealthy.

5. How lower-income people can become wealthy

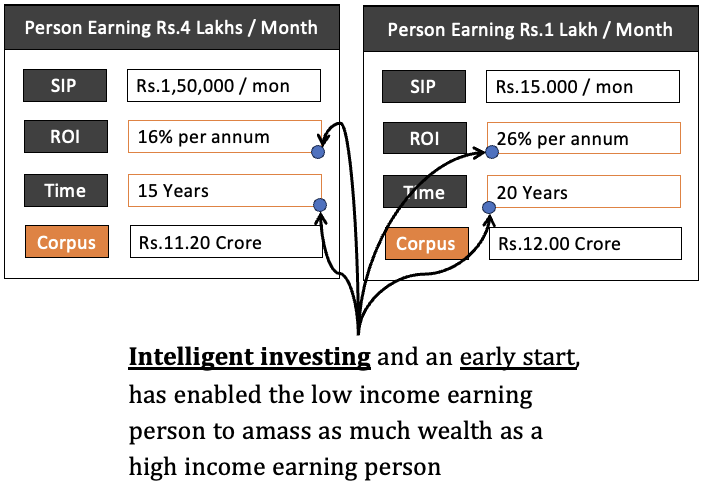

Here is an example of two people. First is the high-earning person who makes about Rs. 4 Lakhs per month income. Second is a normal average person who earns an income of about Rs.1 Lakhs per month.

Let’s study these two individual’s investing habits and how it accounts for their long term wealth creation.

- High Income (Rs.4 Lakhs / Month): The person invests about Rs.1.5 Lakhs per month. As he is not very conversant with investments, he found it better to invest in a diversified equity mutual fund through the SIP route. This mutual fund scheme yielded a return of close to 16% per annum in 15 years. At the end of the 15th year, he built a corpus of about Rs.11.2 Crores.

- Average Income (Rs.1 Lakhs / Month): The person invests about Rs.15,000 per month. The person is conversant with investments, hence he invested directly in quality shares. As this person was wiser in investing, he also started investing five years early than his peer. He very carefully built his stock portfolio which yielded him a return close to 26% per annum in 20 years. At the end of the 20th year, he built a corpus of about Rs.12.0 Crores. Read: Test your knowledge of stocks.

What we can conclude from this comparison? A smart investor can use his refined investing skills to earn a high return on investment. I know few people who regularly invest in quality mid-cap and small-cap stocks. These stocks have the potential to grow at a massive rate (like 25%+ per annum) and become multi-baggers over time.

But it is also true that the majority of mid and small-cap stocks are of low quality. Hence, identifying quality stocks among this lot is a very precise skill. Learning this skill gives the ability to even low-income earners to become wealthy over time.

The idea is to use one’s intelligence and knowledge to identify quality stocks. Investing one’s money into such stocks and staying invested for the long term can help one become wealthy over time.

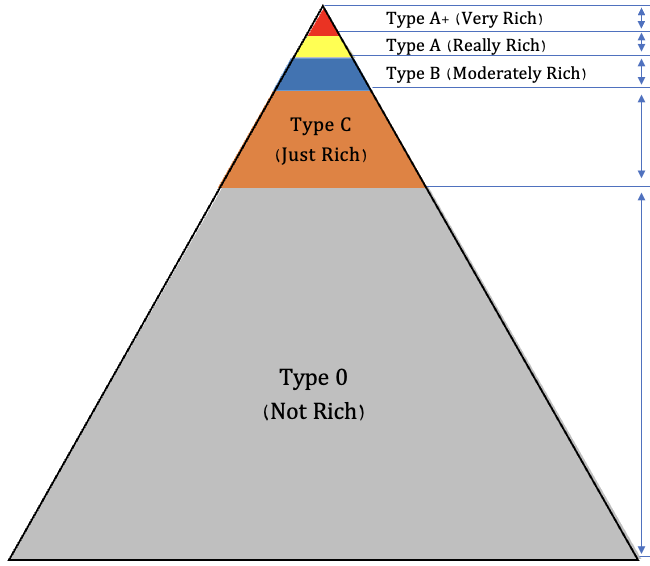

6. Degree of Wealth [Not Rich to Ultra Rich]

Out of all people in a nation, only a handful of people are rich.

In order to judge how wealthy is a person, we can use this scale to judge the degree of wealth one has accumulated. What is the requirement to be tagged as wealthy? Check here.

- Grade 0 – Not meeting the criteria

- Grade C – Just Rich (Just meeting the criteria).

- Grade B – Moderately Rich (Income and Assets at least 10 times the requirement).

- Grade A – Really Rich (Income and Assets at least 50 times the requirement).

- Grade A+ – Filthy Rich (Income and Assets at least 100 times the requirement).

Conclusion

Understanding the difference between income and wealth is crucial for achieving financial success. Income refers to the money earned regularly, while wealth represents the accumulated assets and net worth.

While income is important for meeting day-to-day expenses and maintaining a comfortable lifestyle, wealth is more stable and accumulative in nature.

Differentiating between income and wealth is essential to avoid common misconceptions. Simply having a high salary does not guarantee wealth, as expenses, lifestyle choices, and debt can hinder wealth creation. There are people who earn a very high salary but spends all if it on needless things. Such people have no spare money for investment and wealth creation.

It is important to manage expenses effectively, make wise investment choices, and practice diligently saving to build wealth over time.

Moreover, it is essential to recognize that wealth can be achieved by individuals with moderate incomes as well. By making informed financial decisions, focusing on savings, and investing wisely, anyone can accumulate significant wealth.

I’ve also provided a practical definition of wealth in the Indian context, based on specific characteristics such as earned income, passive income, a growth portfolio, and property ownership. These criteria serve as a starting point to assess one’s progress toward wealth accumulation.

Higher income can facilitate wealth creation, it is not the sole determining factor. Even individuals with lower incomes can become wealthy by leveraging their investing skills, making informed investment choices, and focusing on long-term growth.

By understanding the distinction between income and wealth and implementing effective financial strategies, individuals can pave their way to financial prosperity and secure their long-term financial well-being.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.