Investors seeking a robust stock screening philosophy can turn to a comprehensive approach based on cash flow, growth, margin, and return. This strategy emphasizes the importance of positive cash flow from operations, high sales growth, strong gross margin, and superior return on equity (ROE). By evaluating stocks against these parameters, investors can identify companies with solid financials, growth potential, and profitability, enabling them to make informed investment decisions.

Finding the right stocks to invest in can be a daunting task. It is especially tough in a dynamic and ever-changing market. As investors, we seek a reliable and systematic approach that can guide us toward companies with long-term potential. In this pursuit, I’ll propose a robust stock screening philosophy in this article.

The philosophy revolves around the crucial elements of cash flow, growth, margin, and return. By analyzing stocks through these lenses, investors can gain a deeper understanding of a company’s fundamentals.

The first parameter, cash flow, serves as a critical measure of a company’s ability to generate cash from its core operations. If there is cash available for companies, even weak ones can survive. That is why in business parlance, cash is the king.

Next, we’ll delve into the significance of growth, particularly sales growth. Fast-growing sales not only indicate increasing demand for a company’s products or services but also increasing market share.

We’ll also explore the concept of margin. High margins signify a company’s ability to generate substantial profits from each unit sold. It is a reflection of the company’s pricing power and cost control measures.

Finally, our ultimate target is to identify and invest in high-ROE companies. These are companies that generate high returns for their shareholders. But the idea is to identify such companies which will continue to make high ROE in times to come. Hence, we must also analyze the cash flow, margins, and growth aspects of the companies.

Let’s start a mode detailed discussion explaining each of the four parameters in more detail.

Net Cash Flow From Operations

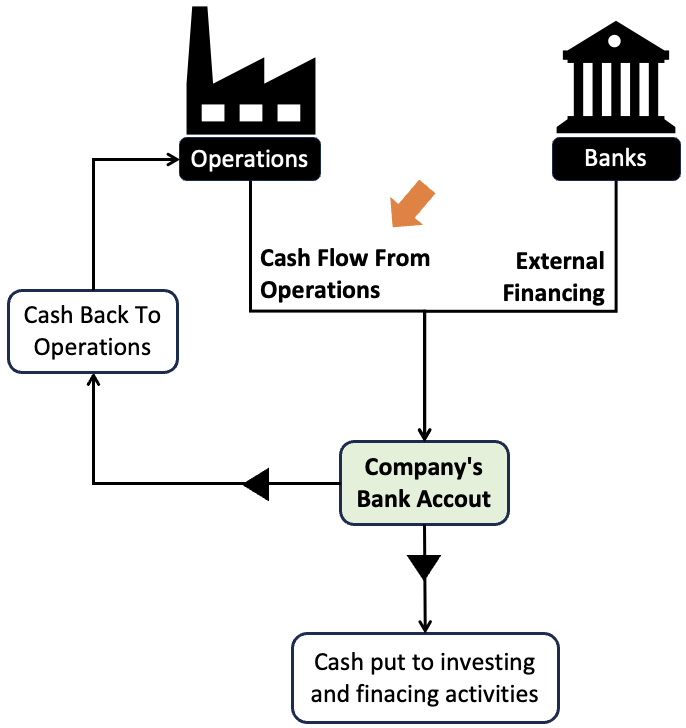

Positive net cash flow from operations is a fundamental indicator of a company’s financial health. It represents the cash generated by a company’s core operations. It is cash generated from the sale of goods and services, minus the cash paid for operating expenses.

A positive net cash flow from operations showcases the company’s ability to generate cash internally. This cash flow is vital for its day-to-day operations. Moreover, such cash flows can also be used for investing in growth opportunities and meeting financial obligations.

A company with a strong cash flow can fund its operations without relying heavily on external financing. This financial strength provides stability, as the company is less vulnerable to liquidity issues during challenging economic periods.

Companies with consistent cash flow from operations have shown greater resilience during economic downturns. Such companies often outperformed their peers in terms of stock performance.

So, as an investor, our search for fundamentally strong companies should start with the cash flow analysis. This is why, my stock screening philosophy gives it the first priority.

Quick Tip

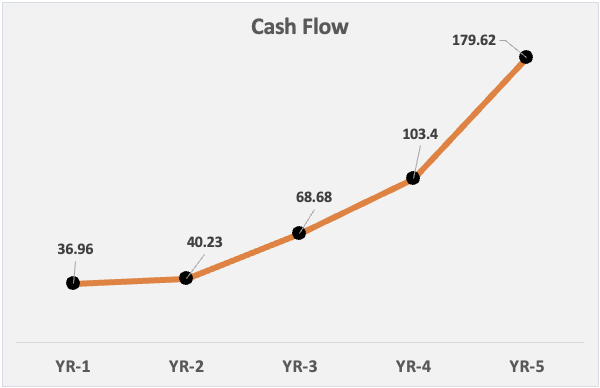

While analyzing the cash flows of a company, it is also essential to discount the quality of cash flows. A company that is constantly yielding positive and growing cash flows must score higher over other companies. For example, check the below cash flow trend chart of an example company. This is the kind of growing trend we would like to see in a company’s cash flows.

Sales Growth

Growth in sales reflects the demand for the company’s products or services. It also shows the company’s focus on its marketing and sales strategies. A combination of good products & services, and effective marketing and sales strategy builds the company’s competitive position. Such companies are more capable of capturing market share.

Companies with sustained high sales growth often exhibit strong business fundamentals. They possess attributes such as innovative products, effective distribution channels, and a strong brand presence.

They may have a competitive advantage that enables them to outperform their peers in terms of revenue expansion. High sales growth can be an encouraging sign for investors, as it suggests the potential for future earnings growth and capital appreciation.

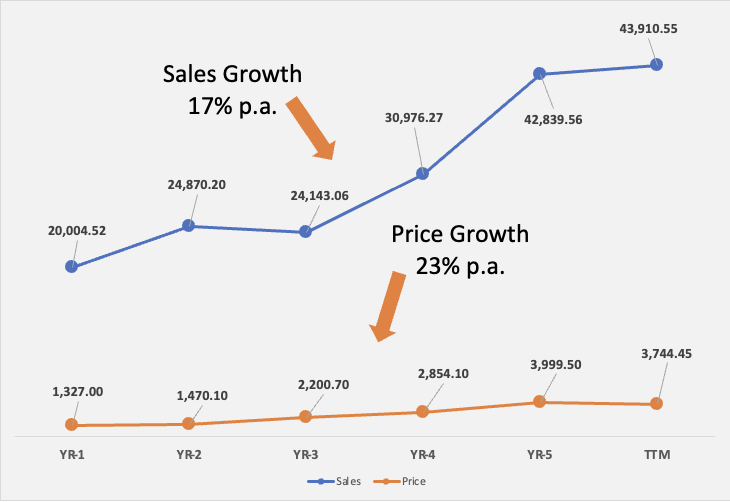

Companies with sustained high sales growth have, on average, experienced higher stock price appreciation and shareholder returns. For instance, D-mart (Avenue Supermart), a retail firm, has achieved an impressive annual sales growth rate of 17% per annum over the past 5-years. This has resulted in a significant increase in the market price of its stocks at the rate of 23% per annum.

Gross Margin

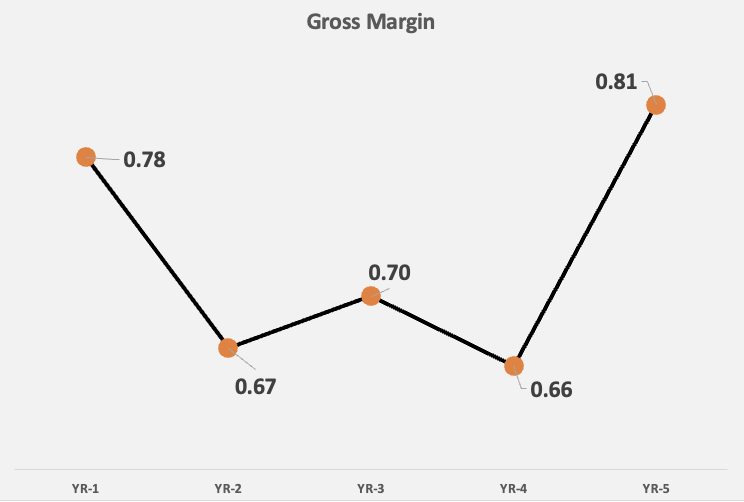

One key metric that holds immense importance in assessing a company’s profitability and operational efficiency is the gross margin. Gross margin is calculated by subtracting the cost of goods sold (COGS) from total revenue and then dividing the result by total revenue. It is expressed as a percentage. It represents the proportion of revenue that remains after accounting for the direct costs associated with producing goods or delivering services.

High gross margin is a strong indicator of a company’s ability to generate substantial profits from its operations. Companies with consistently high gross margins often possess a competitive advantage, enabling them to outperform their peers. Hence, high gross margin companies can create significant shareholder value.

Significance of high gross margin:

1. Operational Efficiency: A high gross margin suggests that the company is adept at controlling its production costs, optimizing its supply chain, and managing its input expenses effectively. By maintaining a high gross margin, companies can allocate more resources toward research and development, marketing, or expanding their business. It thereby can bolster their long-term growth prospects.

2. Pricing Power: High gross margin often goes hand in hand with a company’s pricing power. Companies that possess unique or differentiated products, strong brand recognition, or a competitive edge in the market. This way they can command higher prices for their offerings. This pricing power allows them to generate more revenue per unit sold, leading to higher margins.

3. Resilience During Economic Downturns: During economic downturns or periods of increased competition, high-margin companies show more resilience. The ability to maintain a healthy margin even in challenging times demonstrates the company’s ability to remain afloat and profitable at all times.

It is important to note that while high gross margin is a valuable indicator of profitability. But it should be considered in conjunction with other financial metrics and industry dynamics. Comparing a company’s gross margin to its peers within the same industry can provide further insights into its competitive position and pricing power.

Companies with high gross margins have a competitive advantage and are better positioned to weather industry downturns. A case in point is Grasim Industries, a cement manufacturer. It consistently maintains a gross margin of 65%, above the industry average. This strong gross margin is a result of their premium pricing strategy and operational efficiency. It leads to robust profitability and shareholder value creation.

Return (ROE, ROCE)

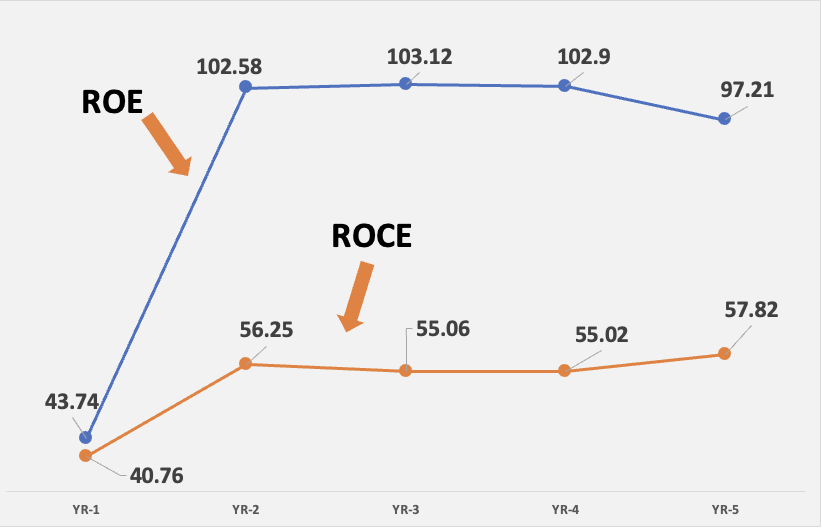

From the perspective of investors, both Return on Equity (ROE) and Return on Capital Employed (ROCE) are important return ratios. They provide insights into a company’s profitability and efficiency. I personally prefer the use of ROCE. But ROCE is not so easy to calculate and comprehend. Hence, people may also use ROE to do the return analysis.

For me, ROCE and ROE are not only return ratios, they are also a yardstick to judge the quality of management of a company. Good managers always keep their return ratios (ROCE and ROE) well above their industry averages. So, if we can find a company that has maintained or improved its ROCE or ROE over a 10-year horizon, it’s best.

As an investor, our first preference should be to invest in high ROE and ROCE companies. But some industries have inherently low ROE and ROCE. Does it make these companies bad? No. But if high ROE and ROCE companies are available at better valuation levels, I’ll pick these companies first.

Return on Equity (ROE)

ROE is particularly useful for investors who focus on the returns they receive as shareholders. It helps investors assess how efficiently a company is generating profits and creating value for its owners. A high ROE suggests that the company is generating significant returns on the capital invested by shareholders. It, therefore, points towards potentially attractive dividend payouts and capital appreciation.

Return on Capital Employed (ROCE)

ROCE is useful for investors who want to evaluate a company’s ability to generate returns on the total capital employed. It helps determine how efficiently the company utilizes both equity and debt financing to generate profits. ROCE considers the cost of debt and factors in the impact of interest expenses on profitability. This makes it a relevant ratio for assessing the efficiency of capital utilization and overall financial health.

Studies have demonstrated that companies with consistently high ROE and ROCE tend to deliver superior long-term investment returns. An example is Nestle India. The company maintains consistently achieved an ROE of 85% and an ROCE of 50% or higher over the past five years. This remarkable performance is a testament to their efficient capital allocation.

Conclusion

By screening stocks based on the above four metrics, investors can identify companies with strong financials, growth potential, and profitability.

Users can use the Stock Engine’s Big Screener to apply some of the filters discussed above. For example, the big screener can screen stocks on the basis of the following metrics:

- Positive Net cash flow from operations

- ROE and ROCE above 20%

- Income growth above 15%

Soon, we’ll launch a pre-build screener theme that will exactly filter stocks based on the above four metrics. We’ll name that theme the “4 BIG FILTER.”

I hope you enjoyed reading this article.

Have a happy investing.

Suggested Reading: