The Credit Utilization Ratio is a crucial aspect of credit scoring. It measures the percentage of available credit a person is using. It is calculated by dividing total credit card balances by the sum of credit limits. For instance, if someone has a credit limit of INR 100,000 and an outstanding balance of INR 30,000, their utilization ratio is 30%.

Its significance lies in determining creditworthiness. Lenders and credit bureaus use this ratio to assess a person’s ability to manage credit responsibly. A lower ratio suggests sound financial management and boosts credit scores. Such borrowers are more attractive to lenders. On the other hand, a high ratio may lower credit scores because it signals potential financial risk.

Understanding Credit Utilization Ratio is crucial for maintaining a healthy credit profile. A good credit profile gives access to better credit opportunities in the future. By keeping credit card balances low and using credit responsibly, individuals can improve their creditworthiness.

In the realm of personal finance, Credit Utilization Ratio is a crucial metric. It reflects the percentage of available credit one utilizes. Understanding and managing credit utilization can significantly impact credit scores. This score can influence lenders’ perceptions of our financial responsibility. By maintaining a low utilization ratio, we showcase prudent credit management, leading to improved creditworthiness. It eventually leads to better credit terms.

Let’s know about this topic.

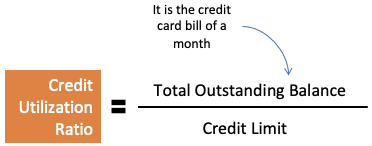

#1. Definition and Formula

The Credit Utilization Ratio is a key metric used in credit scoring that represents the percentage of available credit a person is currently using.

It is calculated by dividing the total outstanding balances on credit accounts by the sum of all credit limits. This ratio offers insights into an individual’s credit management habits and is crucial for evaluating creditworthiness.

A lower Credit Utilization Ratio, typically below 30%, is considered favorable as it indicates responsible credit usage and can positively impact one’s credit score. Understanding and managing this ratio is essential for maintaining a healthy credit profile and securing better financial opportunities.

Formula

Let’s use a simple example to explain the formula for calculating the Credit Utilization Ratio:

Example: Raj has only one credit card with a credit limit of Rs.100,000. Currently, he has an outstanding balance of Rs.30,000 on his credit card.

The formula for Credit Utilization Ratio: Credit Utilization Ratio = (Total Outstanding Balances) / (Total Credit Limits) * 100 = (30,000) / (100,000) * 100 = 30%

Explanation: In this example, Raj’s Credit Utilization Ratio is 30%. It means he is using 30% of his available credit limit (Rs.100,000). This ratio is calculated by dividing his outstanding balance (Rs.30,000) by the credit limit (Rs.100,000) and then expressed as a percentage.

A Credit Utilization Ratio of 30% or below is generally considered good. It will positively impact Raj’s credit score. It indicates that he is using credit responsibly and not maxing out his credit card. Keeping the Credit Utilization Ratio low is a prudent financial practice.

#2. Importance of Credit Utilization Ratio

Credit utilization is a crucial factor in credit scoring because it reflects how responsibly someone manages their credit. It’s simply the percentage of credit they’re using compared to the total credit they have available. A high credit utilization ratio, meaning they’re using a large portion of their credit, can negatively impact their credit score. This is because it suggests they may be relying too much on credit. The logic is that if a person’s income-to-expense ratio is low, he will have to dig into his credit to manage expenses.

On the other hand, a low credit utilization ratio, where they’re using only a small part of their credit, can positively affect their credit score. This indicates that the person has a high income-to-expense ratio. Lenders like to see low utilization because it shows they’re not taking on too much debt and are less likely to be a risky borrower.

Real Life Scenario

Statistics vividly highlight the importance of maintaining a healthy credit utilization ratio.

For instance, individuals with a low utilization ratio (below 30%) tend to have higher credit scores. It makes them more likely to qualify for favorable interest rates on loans and credit cards.

On the other hand, those with high utilization ratios may face difficulties obtaining credit or end up paying higher interest rates.

Statistics reveal a strong correlation between responsible credit utilization and improved financial well-being. This underscores the need to manage credit wisely to secure a brighter and more stable financial future.

3. How Does Credit Utilization Work With 2 Credit Cards?

Suppose there is a person who carries two credit cards. We’ll see how the credit utilization ratio is calculated in this case. Let me give you the actual case in consideration.

- The First Card has a credit history of 10 years. Its credit limit is Rs.10 Lakhs. Generally, the person maintains a credit limit of 15% on this card.

- The Second Card has a credit history of only a month. Its credit limit is Rs.1.4 Lakhs. Generally, the person maintains a credit limit of 70% on this card.

We’ll use this example to learn to calculate the credit utilization ratio of a person carrying multiple credit cards. Moreover, we’ll also use this example to bring forth the case of wise credit management.

But first, let’s learn to calculate the utilization ratio of multiple cards.

Calculation

To calculate the credit utilization ratio for a person carrying multiple credit cards, we’ll consider the combined credit limits and outstanding balances across both cards. Let’s calculate the credit utilization ratio for each card and then the overall ratio:

- First Card: Credit Limit: Rs. 10,00,000. Credit Utilization: 15% (Generally maintained by the person). Credit Utilization on First Card = 15% of Rs. 10,00,000 = Rs. 1,50,000.

- Second Card: Credit Limit: Rs. 1,40,000. Credit Utilization: 70% (Generally maintained by the person). Credit Utilization on Second Card = 70% of Rs. 1,40,000 = Rs. 98,000

Now, let’s calculate the overall credit utilization ratio:

- Total Outstanding Balances on both Cards: Rs. 1,50,000 (First Card) + Rs. 98,000 (Second Card) = Rs. 2,48,000

- Total Credit Limits on both Cards: Rs. 10,00,000 (First Card) + Rs. 1,40,000 (Second Card) = Rs. 11,40,000

- Overall Credit Utilization Ratio: Total Outstanding Balances) / (Total Credit Limits) = Rs. 2,48,000 / Rs. 11,40,000 * 100 ≈ 21.75%

In this example, the person’s overall credit utilization is approximately 21.75%. This means they are using around 21.75% of their total available credit across both cards.

Impact on Credit Rating

So now we know how the credit utilization ratio is calculated for a person, with multiple credit cards, for the purpose of credit rating evaluation. We’ve seen that for one credit card, the utilization ratio is much within the acceptable limits. But at times the second credit card gets overutilized. But the overall credit utilization of the person is 21.75%.

So the question is, in this case, does the credit rating of the person will be negatively affected?

Answer

In this case, while one credit card is getting overutilized (70%), the overall credit utilization of the person is still 21.75%. As the overall credit utilization ratio is relatively low and well within acceptable limits (typically below 30%), the negative impact on the person’s credit rating may be minimal.

Maintaining a low overall credit utilization is generally viewed favorably by credit scoring models and lenders. Even if one credit card has a higher utilization ratio, the fact that the overall utilization is still low suggests that the person is managing their credit responsibly.

It’s important to note that credit scoring models consider various factors when evaluating creditworthiness, and credit utilization is just one component. While a high utilization ratio on one card may have some influence on the credit score, the overall impact might not be significant if the person maintains a low overall utilization ratio. Though, other factors such as on-time payments and positive past credit history also have a major influence on one’s credit rating.

#4. Credit Utilization of 0% is Good?

While having a credit utilization of 0% may seem like a responsible approach, it may not necessarily be ideal for your credit score. Having some credit utilization, typically around 1% to 10%, is generally considered more favorable. A credit utilization of 0% indicates that you are not utilizing any of your available credit. As a result, it may not give creditors enough information to assess your creditworthiness.

Creditors want to see evidence that you can manage credit responsibly. Utilizing credit and making timely payments show that you can handle debts effectively. A small credit utilization demonstrates that you are using credit but not becoming overly reliant on it, making you a more attractive borrower.

Keeping your credit utilization low, but not at 0%, can help maintain a positive credit rating and enhance your financial standing. Regularly paying off credit card balances in full and managing your debts responsibly will help you achieve a healthy credit utilization ratio.

#5. Common Misconceptions Related To Credit Utilization

Allow me to address common misconceptions and myths related to credit utilization and credit scoring. Knowing these can help one make informed decisions about their credit management. Let’s clarify some misunderstandings to shed light on these crucial concepts:

- Misconception 1: Closing unused credit cards improves credit score. Clarification: Closing unused credit cards may actually harm credit scores. It reduces your total available credit, potentially increasing your credit utilization. Hence, one can keep old credit cards open, especially those with no annual fees. It will contribute to a longer credit history and eventually improves credit score.

- Misconception 2: Only high-income individuals have excellent credit scores. Clarification: Credit scores are based on credit history, not income. While a higher income can aid in managing debts, anyone with responsible credit habits can achieve an excellent credit score. Consistently paying bills on time and maintaining low credit card balances are key factors in building good credit, regardless of income.

- Misconception 3: Checking your credit score hurts your credit. Clarification: When you check your own credit score (a soft inquiry), it does not impact your credit. However, applying for new credit (a hard inquiry) may cause a temporary dip in your score. Regularly monitoring your credit is essential for detecting errors and staying informed about your credit health.

- Misconception 4: Carrying a balance on your credit card improves your credit score. Clarification: Carrying a balance does not improve your credit score. Paying credit card bills on time and in full each month can improve the score. Timely payment demonstrates responsible credit usage.

Conclusion

Credit card holders with multiple credit cards can take proactive steps to keep their overall credit utilization low. Thereby, it will enhance their credit ratings and overall financial health. The Credit Utilization Ratio plays a vital role in credit scoring, and maintaining a low ratio demonstrates responsible credit management to potential lenders.

To achieve this goal, people can do the following

- Monitor Credit Card Balances: Regularly monitor credit card balances and strive to keep them as low as possible. Avoid maxing out credit cards, even if it means spreading expenses across multiple cards.

- Pay Balances in Full and On Time: Always pay credit card bills in full and on time to avoid accruing unnecessary interest and late fees. Timely payments contribute significantly to a positive credit history and improved creditworthiness.

- Avoid Opening Multiple Cards Simultaneously: Opening several credit cards in a short period may lead to hard inquiries and reduced average account age. Instead, consider obtaining new credit as needed.

- Utilize Old Credit Cards Responsibly: Rather than closing old, unused credit cards, consider using them occasionally for small purchases and promptly paying off the balance. This approach helps maintain a longer credit history and positively impacts credit scores.

By adhering to these practices, credit card holders can proactively manage their credit utilization ratio and see positive results in their credit ratings. A low credit utilization not only improves credit scores but also opens doors to better financial opportunities. Opportunities in the form of lower interest rates, higher credit limits, and favorable loan terms can be enjoyed.

I hope you liked reading this article on the credit utilization ratio.

Have a happy investing.

Suggested Reading:

![Home Construction Loan: What is The Process To Get Such Loans [India]](https://ourwealthinsights.com/wp-content/uploads/2013/08/Home-Construction-Loan-image.jpg)