Understanding of Debit and Credit transactions is essential for accountants.

But these days, “this rule” is taught even to Business Schools.

Debit and Credit transactions are used for accounts management of company. It is also known as “double entry system“.

Why double-entry system is called so?

As the name suggests, every transaction is recorded in journal at least twice.

One entry will be recorded as ‘debit’. The other entry will be recorded as ‘credit’.

Why I am writing about debt and credit transactions here in my blog?

Generally I blog about personal finance and investment of money.

So, debit and credit transactions may seem out of place, right?

But I had to learn about this concept as I was refining my skills to read and interpret balance sheet.

During this learning process, I was decided to learn about balance sheet transaction.

To learn this skill, I got exposure to the rule of debt and credit transactions.

Hence I decided to share my learnings related to the rules of debit and credit transactions.

How “double entry system” works

Double entry system looks to be easy in the beginning.

But the problems comes in realising which ‘account’ to be credited and which account to be debited.

Before we know more about debit and credit, we must first know the various account types.

‘Accounts’ are tool for accountants that helps them to categorise all type of transactions.

Following are the type of Accounts:

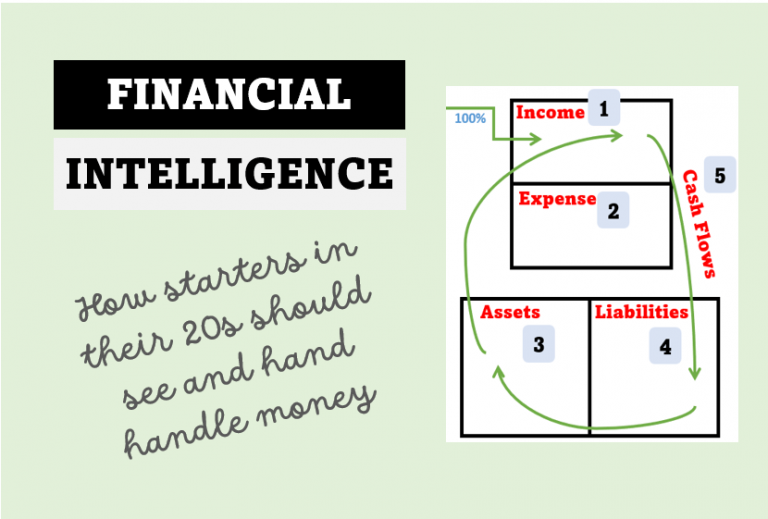

- BALANCE SHEET (Asset = Liability + Equity)

- Assets – (Debit increases it, Credit decreases it)

- Liabilities – (Debit decreases it, Credit increases it)

- Stockholder’s Equity (Debit decreases it, Credit increases it)

- PROFIT & LOSS A/C (Expense = Revenue – Gain > Dividend)

- Expense & Loss- (Debit increases it, Credit decreases it)

- Revenue – (Debit decreases it, Credit increases it)

- Income & Gain – (Debit decreases it, Credit increases it)

- DIVIDEND

- Dividend (Draws) – (Debit increases it, Credit decreases it)

Notes related to debit and credit:

In Balance sheet equation, item on left is Asset. Item on tight is equity and liability.

Assets = Liability + Owner’s Equity (Accounting Equation)

Item on Left:

- Values of item appearing on left of equation increases due to debit.

- Hence debiting asset means its value increases.

- Crediting asset means its value decreases.

Item on Right:

- Values of item appearing on right of equation decreases due to debit.

- Crediting liability means its value increases.

- Debiting liability means its value decreases.

Lets see few easy examples of debit and credit transactions:

#Example One: of Debit and Credit Transactions

Company named XYZ CORP started doing business on 6-Jan-2014.

The cash in hand of XYZ Corp is $300,000.

Following transaction happened in the January’14.

How these transactions are recorded in companies Journal as Debit & Credit.

All transactions are entered maintaining the accounting rule, which says, “every credit will equal one corresponding debit“.

Lets see how these transactions are recorded by the accountant as per “double entry rule”:

Check this link to see the details of all transactions recorded as stated in example 1 in tabulated form…

#Example Two: of Debit and Credit Transactions

Company named XYZ CORP was established on Jan 1, 2014.

Starting balance is $1,500,000.

It also has 10,000 number common stocks @ $50 par value.

The company made the following transactions in a month.

Lets see how these transactions are recorded by the accountant as per “double entry rule”:

Check this link to see the details of all transactions recorded as stated in example 2 in tabulated form…

Conclusion

Double entry bookkeeping may look like a cumbersome task initially, but it is a fool-proof way of accounting.

Every transaction should be recorded in such a way that the equation remains true always: