Let’s discover which investment alternative is better for monthly income generation. Should we park our money in a 10-year fixed deposit with monthly payouts? Or is the allure of a rental income from a residential property more enticing? We’ll analyze these two investments using a rule of value investing. We’ll estimate their intrinsic value and conclude which is better, fixed deposit or residential property.

Introduction

Suppose one has Rs.50 Lakhs cash available for investing. The idea is to generate monthly income from this cash. Hence the first two obvious choices were either a 10-year bank deposit or residential property.

There are monthly income plans of mutual funds available, but when the investment amount is high and the focus is on monthly income, the choice is limited. This may be caused due to the mental set-up of the retail investors. But the fact of the matter is, fewer people will opt outside the FDs and real estate properties.

To know more about the dividend plans of mutual funds that pay regular payout, check this writeup on IDCW in Mutual Funds. These are mutual funds that are designed to give regular payouts. Monthly income plans are generally offered by insurance companies only or in collaboration with AMCs.

Truly speaking, the best monthly income generator is an annuity. But it is more suitable for retired senior citizens. To know more about the Annuity, check the link. Another two reliable monthly income generators for retired people are the Senior Citizen Savings Scheme (SCSS) and the Monthly Income Scheme (MIS) of the Indian post office.

For the moment, let’s focus our attention on the intrinsic value estimation of FDs and residential property.

Details of The Two Investment Options

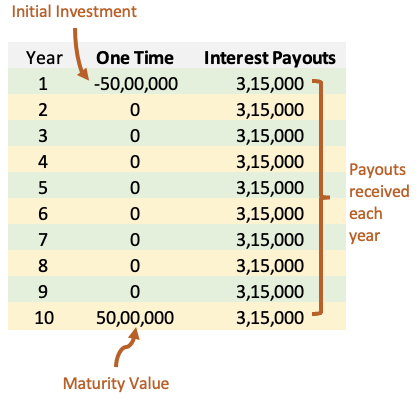

- Fixed Deposit (FD): A 10-Year FD will yield an interest rate of 7% per annum. The accrued interest will be paid out each month (monthly income). At the end of the 10th year, the FD will be broken and the final value of the FD will be Rs.50 Lakhs (no capital appreciation in 10 years).

- Residential Property: A residential property worth Rs.50 Lakhs will currently yield a rental income of Rs.20,000 per month. Let’s consider a 5% CAGR growth in property value over the next 10 years. We’ll also consider a modest 6% CAGR growth in monthly rent over the next 10 years. At the end of the 10th year, the property will be sold.

In the calculation, we’ll do the following:

- First, list down all the future (next 10 years) cash flows of both investments.

- Second, we’ll estimate the present value of all future cash in-flows. We’ll use a discount rate of 7.1% (as of today this is the yield of an Indian 10-year government bond).

- Finally, we’ll add the present values of both investments and reveal their respective intrinsic values.

In the end, we’ll conclude which is a better investment, fixed deposit or residential property.

Fixed Deposit (FD)

The initial investment in the FD is Rs.50 Lakhs. For the next 10 years, the FD will yield a 7% interest income. So let’s calculate the monthly income that this FD will generate for its investor.

- Initial investment: Rs. 50,00,000

- Monthly interest income: (7% of Rs. 50,00,000) / 12 = Rs. 29,167

But this monthly income will attract TDS (Tax Deducted At Source). As per the rules, the TDS will be deducted at a rate of 10% if the total interest income for the financial year exceeds Rs. 40,000. In this case, the total interest income for the financial year will be Rs. 3,50,000 (7% of 5000000). So, TDS will be deducted from every monthly payout.

Hence, after the TDS deduction, the next monthly payout from the FD will be as follows:

- Monthly Interest = 3,50,000 / 12 = Rs. 29,167

- TDS = 29,167 * 10/100 = Rs. 2,916.7

- Net Monthly Payout: 29,167 – 2916.7 = Rs. 26,250

#1. All Future Cash In-Flows (Next 10 Years):

| Year | Monthly Income | Income Per Year | Year | Monthly Income | Income Per Year |

| 1 | 26,250 | 3,15,000 | 6 | 26,250 | 3,15,000 |

| 2 | 26,250 | 3,15,000 | 7 | 26,250 | 3,15,000 |

| 3 | 26,250 | 3,15,000 | 8 | 26,250 | 3,15,000 |

| 4 | 26,250 | 3,15,000 | 9 | 26,250 | 3,15,000 |

| 5 | 26,250 | 3,15,000 | 10 | 26,250 | 3,15,000 |

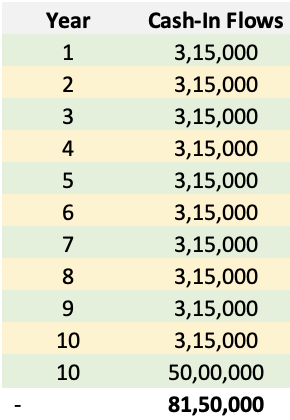

At the end of the tenth year, the principal invested amount will remain the same as Rs.50,00,000 (fifty lakhs). Hence, when the FD will mature, the payout of Rs.50 Lakhs will be credited into the bank account. So, the total cash flow of this investment will look like below:

#2. Present Value of Future In-Cash Flows (Next 10 Years):

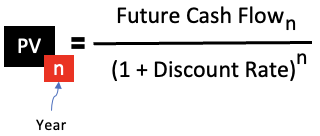

What you’ve seen in step #1 above are all the cash flows of investment in FD. All these cash flows are happening at a point in the future years. To estimate the intrinsic value of the FD, we must first calculate the present value of all future cash-in flows. To understand why we are doing this calculation, check this article on the concept of the present value.

For your quick information, the present value (PV) formula looks like this:

In this formula, there is an element called the discount rate. The discount rate is used to adjust the value of a future cash flow to reflect what that money is worth as of today. What is the logic of doing it? It is based on the concept that Rs.100 in hand today is worth more than Rs.100 one year hence. To know more about the concept of discount rates, check this article.

In this example, we are using the discount rate of 7.1%. The reason why this specific value is picked is because it is the current yield of a 10-year government bond (Indian).

Now, let’s calculate the present value of all cash-in flows:

| Year | Cash-In Flows | Discount Rate | Present Value (PV) |

| 1 | 3,15,000 | 7.10% | 2,94,118 |

| 2 | 3,15,000 | 7.10% | 2,74,620 |

| 3 | 3,15,000 | 7.10% | 2,56,414 |

| 4 | 3,15,000 | 7.10% | 2,39,416 |

| 5 | 3,15,000 | 7.10% | 2,23,544 |

| 6 | 3,15,000 | 7.10% | 2,08,725 |

| 7 | 3,15,000 | 7.10% | 1,94,888 |

| 8 | 3,15,000 | 7.10% | 1,81,968 |

| 9 | 3,15,000 | 7.10% | 1,69,905 |

| 10 | 3,15,000 | 7.10% | 1,58,641 |

| 10 | 50,00,000 | 7.10% | 25,18,113 |

| – | – | SUM OF PV = | 47,20,351 |

#3. The Sum of All Present Values (The Intrinsic Value)

The present value of all future cash flows in Indian Rupees is shown in the above table. The sum of present values of all future cash-in flows is coming out as Rs.47,20,351. We will also calculate the intrinsic value of residential property in the same way. Then we’ll compare both the intrinsic values, the one that will come higher will be regarded as a better investment.

- Another Way of Interpretation: Hypothetically speaking, suppose the investor is keeping all the future cash in-flows in a piggy bank. By the end of the 10th year, there will be Rs. 81,50,000 in the piggy bank. We will also calculate the value in the piggy bank for the residential property. Then we’ll compare both the values, the one that will come higher will be regarded as a better investment.

Residential Property

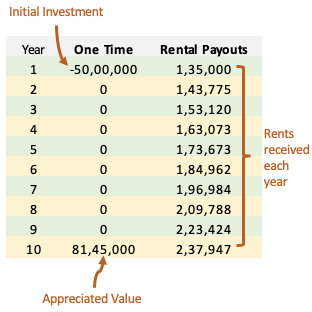

The initial investment in the property is Rs.50 Lakhs. For the next 10 years, the property will yield a monthly rental income. Currently, this property is yielding a monthly rent of Rs.12,500. I’m also assuming an average rental income growth of 6.5% per annum. So let’s calculate the monthly rent that this property will generate for its investor.

- Initial investment: Rs. 50,00,000

- Monthly Rent: Rs.12,500, and annual growth rate @6.5%.

I’m assuming that the property is let-out to an individual, hence the TDS deduction is not applicable. But we’ll consider an average maintenance expense of 10% per annum. So let’s understand the calculation for the net cash in hand at the end of the year:

- Monthly Rent: Rs.12,500

- Annual Income: Rs. 1,50,000

- Maintenance Expense: Rs. 15,000.

- Net Annual Income = Rs. 1,35,000

#1. All Future Cash Flows (Next 10 Years)

| Year | Monthly Rent | Income Per Year | Year | Monthly Income | Income Per Year |

| 1 | 12,500 | 1,35,000 | 6 | 17,126 | 1,84,962 |

| 2 | 13,313 | 1,43,775 | 7 | 18,239 | 1,96,984 |

| 3 | 14,178 | 1,53,120 | 8 | 19,425 | 2,09,788 |

| 4 | 15,099 | 1,63,073 | 9 | 20,687 | 2,23,424 |

| 5 | 16,081 | 1,73,673 | 10 | 22,032 | 2,37,947 |

- Value Appreciation of Property: @5% per annum

At the end of the tenth year, the property value will appreciate from Rs. 50,00,000 to 81,45,000. I’ve considered an average value appreciation of 5% per annum. Ideally, this value should be closer to 6.5% per annum. In a Metro or Tier-I city, in a decent society, the market value of a good residential property can grow at this rate. But I’ve assumed other contingencies (like time factor, etc) and kept the growth rate at 5%.

Hence, at the end of the tenth year, when the property will be sold, it will fetch a cash-in of approximately Rs. 81,45,000 to the owner.

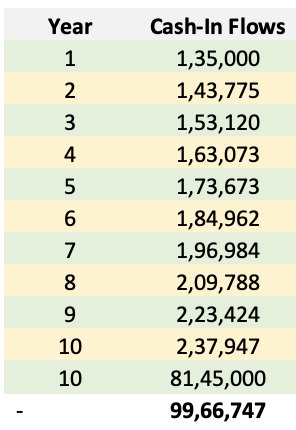

So, the total cash flow of this investment will look like below:

#2. Present Value of Future In-Cash Flows (Next 10 Years)

What you’ve seen in step #1 above are all the cash flows of the investment in a residential property. All these cash flows are happening at a point in the future years. To estimate the intrinsic value of the property, we must first calculate the present value of all future cash-in flows.

In this example, we are using the discount rate of 7.1%. The reason why this specific value is picked is because it is the current yield of a 10-year government bond (Indian).

Now, let’s calculate the present value:

| Year | Cash-In Flows | Discount Rate | Present Value |

| 1 | 1,35,000 | 7.10% | 1,26,050 |

| 2 | 1,43,775 | 7.10% | 1,25,344 |

| 3 | 1,53,120 | 7.10% | 1,24,642 |

| 4 | 1,63,073 | 7.10% | 1,23,944 |

| 5 | 1,73,673 | 7.10% | 1,23,249 |

| 6 | 1,84,962 | 7.10% | 1,22,559 |

| 7 | 1,96,984 | 7.10% | 1,21,872 |

| 8 | 2,09,788 | 7.10% | 1,21,190 |

| 9 | 2,23,424 | 7.10% | 1,20,511 |

| 10 | 2,37,947 | 7.10% | 1,19,836 |

| 10 | 81,45,000 | 7.10% | 41,02,007 |

| – | SUM OF PV = | 53,31,204 |

#3. The Sum of All Present Values (The Intrinsic Value)

The present value of all future cash flows is shown in the above table. The sum of present values of all future cash-in flows coming out from the residential property is Rs.53,31,204. We have also calculated the intrinsic value of the bank’s FD. In the conclusion we’ll compare both the intrinsic values and finally declare this is a better investment between the two.

- Another Way of Interpretation: Hypothetically speaking, suppose the investor is keeping all the future cash in-flows in a piggy bank. By the end of the 10th year, there will be Rs. 99,66,747 in the piggy bank. We’ve also calculated the value in the piggy bank for the fixed deposit. In the conclusion section, we’ll compare both the value to get a final perspective.

Conclusion

We’ve estimated a valuation for both investments, fixed deposits, and residential property. Now, we’ll compare the valuations of both. The purpose of this analysis is to understand, in a real-world scenario, which investment is better.

If someone has an investible surplus cash of Rs. 50 Lakhs, the easiest investment for him will be to put this money into FD. If the goal is to earn regular income from investment, then the option of a bank’s fixed deposit (FD) looks even more tempting. But if the person goes out of this comfort zone and invests his money in a good residential property, will it be worth it? This is what we’ve tried to answer in this article.

The final valuation of the two investments looks like this:

| Description | Fixed Deposit (FD) | Residential Property |

| Initial Investment | 50,00,000 | 50,00,000 |

| Present Value (Intrinsic Value) | 47,20,351 | 53,31,204 |

| Piggy Bank Value (after 10 years) | 81,50,000 | 99,66,747 |

The initial investment for the options was the same at Rs. 50 lakhs. The present value of all future cash in-flows for the FD is Rs. 47,20,351 and for the property is Rs. 53,31,204. So, in terms of intrinsic value (present value), the residential property looks like a better investment.

We’ve also hypothetically assumed that all future cash in-flows are saved by the investor in a piggy bank. So now we’ll compare, at the end of the tenth year, the value that will be there in the piggy bank for both investments. In the FD piggy bank, the value is Rs.81.5 Lakhs. In the property piggybank, the value is Rs. 99.67 Lakhs. So, in terms of piggy bank analysis also, the residential property looks like a better investment.

Important note: In our example, the capital used to invest in a residential property is all self-financed. But as soon as the component of home-loan creeps in, the same investment will start looking poor. So, investment in a real estate property is lucrative only till it is self-financed.

I hope you liked reading this article.

Have a happy investing.

Suggested Reading:

![ROI Formulas: CAGR and XIRR, Meaning, Full Form, Use in Excel [Mutual Funds]](https://ourwealthinsights.com/wp-content/uploads/2018/04/How-to-measure-investment-returns-Image.jpg)

You also need to invest in some form of maintenance of property which further reduces the future value. Can you kindly make a calculator with loan and maintenance options for folks to assess?

Maintenance cost has been in-built into the future growth rates envisaged. The calculator’s algorithm also considers this cost.

After home loan, there are hardly any property investments that can yield a positive cash flow. So no point in building a calculator for it.

Nice Article..keep it up…

Thanks