In this article, I’ll try to use the method proposed by Mr. Aswath Damodaran to calculate the Equity Risk Premium of an Index. I’ll use the S&P BSE 500 index for our calculations. We can apply the same method of calculation to the equity risk premium (ERP) of individual stocks.

But before proceeding further, allow me to tell you a bit about the concept of equity risk premium.

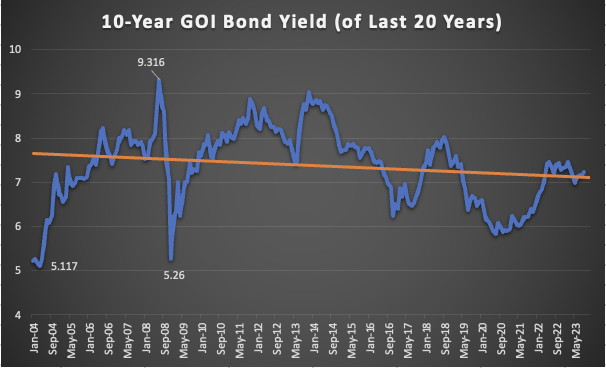

The risk-free rate (Rf) in India is 7.2% per annum as of today. It is the yield of a 10-year GOI bond. Now, how much average return we expect from our stock market? Suppose a person who invests in a Nifty-50 index ETF or Sensex ETF will expect a minimum return of 12% per annum in the long term. This is our market return (Rm).

The difference between our expected market return and the current risk-free rate becomes the risk premium.

Formula (ERP) = Expected Market Return (Rm) – RiskFree Rate (Rf)

In the example we have considered above, the expected market return was 12% and the current risk-free rate was 7.2%. Hence, the equity risk premium in this case is 4.8% (= 12% – 7.2%). Generally speaking, Indian investors expect about 4.5%-5.5% risk premium when they invest in equity.

Implied Equity Risk Premium

In the above example, we have generally assumed that the Nifty-50 index or Sensex will yield a 12% return. But consider this, as of September 2024, the Nifty (19,500) and Sensex (65,800) are at close to their all-time highs. Buying the index at these levels, may not yield a 12% return in the next 5-6 years.

The point is, that the price that we pay to buy an asset (equity) is important. Buying an undervalued stock will yield higher returns. But if the same stock is bought at overvalued price levels, it will yield lower or sometimes even negative returns.

Hence, the question that we investors always ask before investing in equity is, Is this the right price to buy the stock, index, or an equity mutual fund?

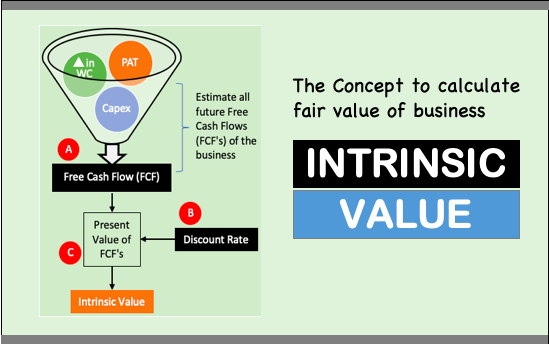

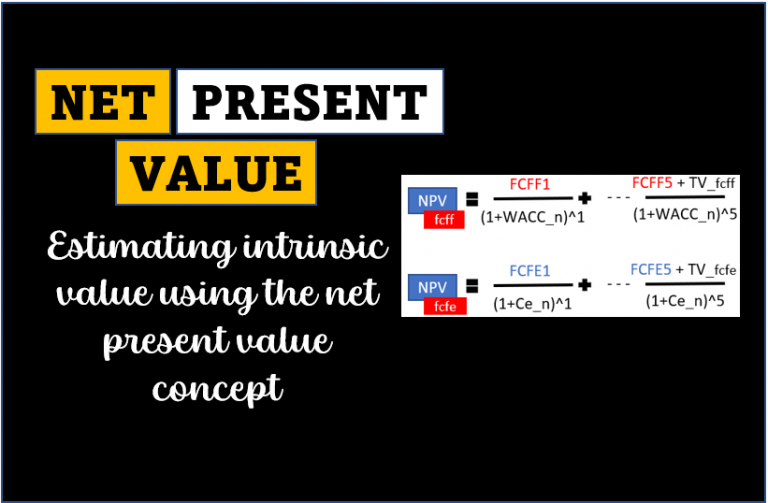

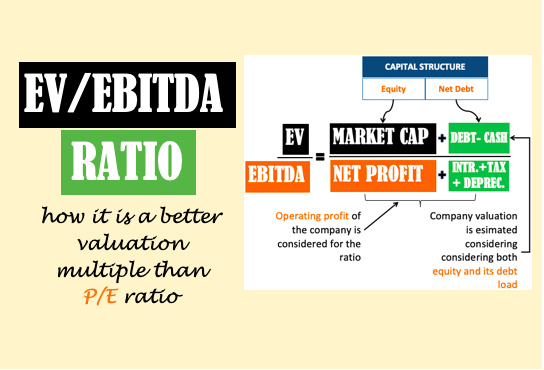

How to answer this question? We generally do this by the use of financial ratios or by estimating the intrinsic value of stocks. Both are the methods to value stocks.

Similarly, implied equity risk premium is a valuation method using which we can tell if a stock, index, or equity fund is worth investing or not.

Let’s use the method of Mr. Aswath Damodaran to estimate the Implied Equity Risk Premium (IERP) of the S&P BSE 500 Index.

Implied Equity Risk Premium of S&P BSE 500 Index

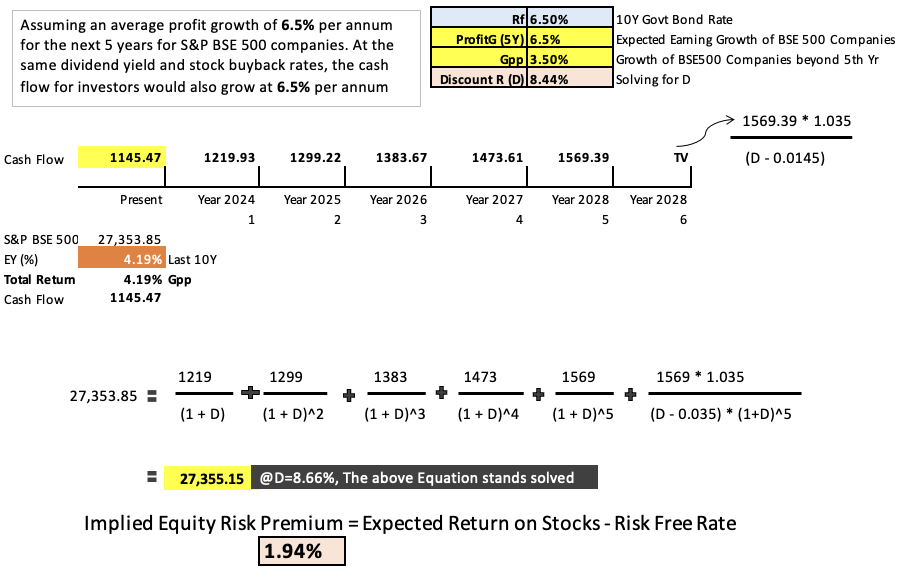

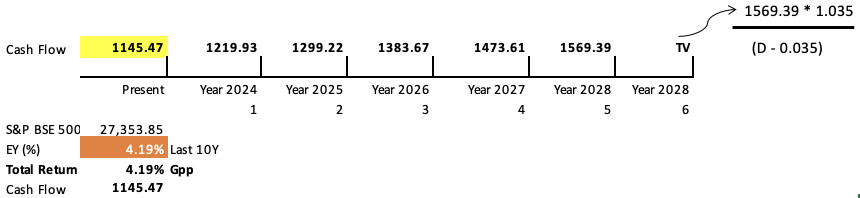

As of today, the S&P BSE 500 Index is trading at 27,353 levels. We are trying to justify whether the market is overvalued or undervalued at these levels of the index.

How we’ll do it? Let’s check the steps:

Step #1: Current Earnings of the Index

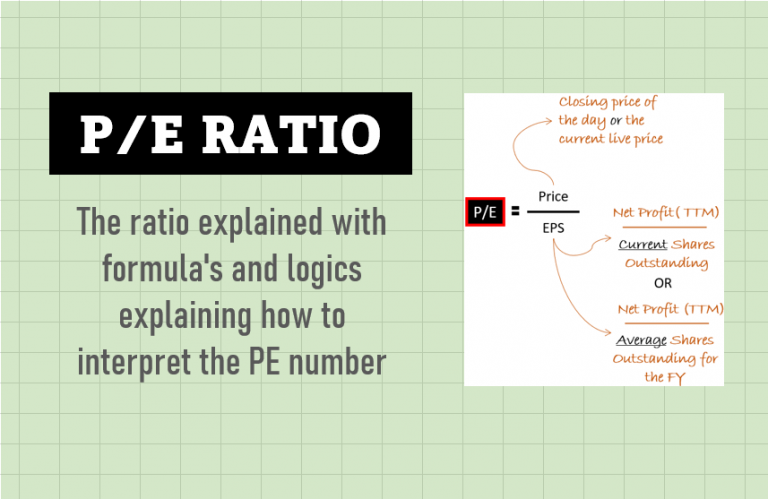

We’ll first try to estimate the current earnings of the index. It can be done by estimating the cumulative earnings (net profits) of all the constituent companies of the BSE 500 index. It can be easily estimated. Just go to the web page of the S&P BSE 500 index. On the page, you will see the price earning ratio (P/E) of the index (currently it is 23.88).

Take the inverse of the P/E ratio, it is called earnings yield. It represents the net profits generated by all constituent companies of the index per unit price paid for the index.

- P/E Ratio: 23.88

- Earning Yield: 4.19% (=1/23.88*100)

- Current Level of S&P 500: 27,353.85

- Cumulative Earnings (Cash Flow): 1,145.47 (=4.19% * 27,353.85)

The value of Rs.1145.47 represents the earnings the S&P BSE 500 index is currently generating.

Step #2: Estimate Future Earnings

Here, we’ll have to assume a suitable earnings growth rate that we can apply on average to all BSE 500 companies. As we are doing it for 500-odd companies, we must be careful with the assumed number. We cannot be overoptimistic as all companies will not grow at an even pace.

We shall also not be too pessimistic because, otherwise it will break our valuation calculations.

As we are dealing with a large number of companies altogether, it will carry some great, average, and low-quality companies. In India, our average inflation is around 6%. These being a group of BSE’s top 500 companies, I’ll assume a safe growth rate of 6.5% per annum for the next 5 years [ProfitG (5Y)].

Beyond the fifth year, I’ll assume a perpetual growth rate of (Gpp) of 3.5% per annum.

Once we have these numbers in place, we are now ready to estimate the future earnings of the BSE 500 Index.

The future set of earnings for the next 5 years and beyond (terminal value) will look like this:

- Current Earning: 1145.47

- Next 5 Years Earning Growth Rate (ProfitG): 6.5% p.a.

- Perpetual Growth Rate (Gpp): 3.5% p.a.

- 2024_Earning: 1219.93

- 2025_Earning: 1299.22

- 2026_Earning: 1383.67

- 2027_Earning: 1473.61

- 2028_Earning: 1569.39

- 2028_Earning (TV): 1569*(1.035)/(D-0.035)

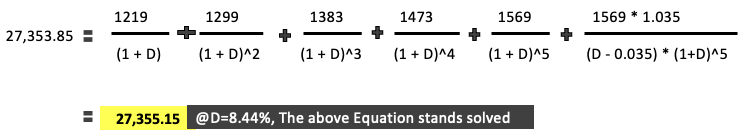

Step #3: Calculate Expected Return (D)

All future cash flows that we’ve calculated in step #2 must be discounted, at a suitable rate (D), to their present values. The sum of the present values of all future cash flows must be equal to the present value of the S&P BSE 500 Index (27,353.87 Points).

It is represented by this formula:

Solving for “D”, the above equation will give the answer 8.44%.

Inference: Investing at current levels (27,353.87) in the S&P BSE 500 Index can give a long-term return of 8.44%.

Step #4: Implied Equity Risk Premium

The formula for equity risk premium is this:

Formula (ERP) = Expected Market Return (Rm) – RiskFree Rate (Rf)

- Expected Market Return (Rm) = 8.44%

- RiskFree Rate (Rf) = 6.5%

- Equity Risk Premium ERP: 1.94%

- Note: As of Sep-2023, the yield of the 10-Y government bond rate is 7.2%. In the last 20 years, the yield of the government bond has changed a lot. The average yield in this period was 7.37%. But looking forward, I am assuming that inflation in India will be cooler. Hence, a 6.5% bond yield will be more relevant.

Conclusion

At the beginning of this article we have roughly estimated that, in India, people expect to earn a risk premium of around 4.5% to 5.5% per annum on their equity investments. It means that, if the current risk-free rate is 6.5%, investors would be satisfied if they earn a minimum return between 11% to 12% from equity.

We have also calculated that at the current levels of the BSE 500 Index (27,353.85 levels), the equity risk premium possible will be only 1.94% higher than the risk-free rate. It is a clear indicator that the S&P BSE 500 is overvalued at these levels.

These are the calculated implied equity risk premium of other indices:

| Index | Date | Current Value | Market Returns (D) | RiskFree Rate (Rf) | Equity Risk Premium (ERP) |

| S&P BSE SENSEX | 06-Sep-23 | 65,880.52 | 8.50% | 6.50% | 2.00% |

| S&P BSE SENSEX 50 | 06-Sep-23 | 20,559.33 | 8.70% | 6.50% | 2.20% |

| S&P BSE LargeCap | 06-Sep-23 | 7,454.00 | 8.55% | 6.50% | 2.05% |

| S&P BSE MidCap | 06-Sep-23 | 32,122.06 | 8.10% | 6.50% | 1.60% |

| S&P BSE SmallCap | 06-Sep-23 | 37,948.61 | 7.35% | 6.50% | 0.85% |

| S&P BSE 500 | 06-Sep-23 | 27,401.79 | 8.38% | 6.50% | 1.88% |

| S&P BSE AllCap | 06-Sep-23 | 7,961.72 | 8.30% | 6.50% | 1.80% |

At the current levels, all indices look overvalued. So, it is better to avoid investing in the market for now.

The equity risk premium of the SmallCap Index is the lowest. Out of all other stocks, it is the smallcap stocks that will be most overvalued for now. So, for value investors, small-cap is currently a no-go space.

A Key Takeaway

The most important aspect of the Equity Risk Premium (ERP) is that it represents the potential reward for taking on the inherent risks associated with investing in stocks. In other words, it quantifies the additional return investors can expect to receive from the stock market compared to risk-free investments (like a bank FD).

This concept is crucial because it underpins many investment decisions. Investors need to understand that the level of risk they are comfortable with should align with their expected returns.

- A higher ERP suggests the potential for greater rewards but also higher volatility and uncertainty.

- A lower ERP implies a more conservative, lower-risk investment with commensurately lower expected returns.

In essence, the ERP serves as a fundamental metric that helps us to strike a balance between risk and reward. It guides us in making informed decisions about asset allocation, stock selection, and long-term financial planning.

By comprehending the significance of ERP, we will be better equipped to navigate the complexities of the financial markets and develop strategies that align with our investment goals and risk tolerance.

Have a happy investing.

Suggested Reading: