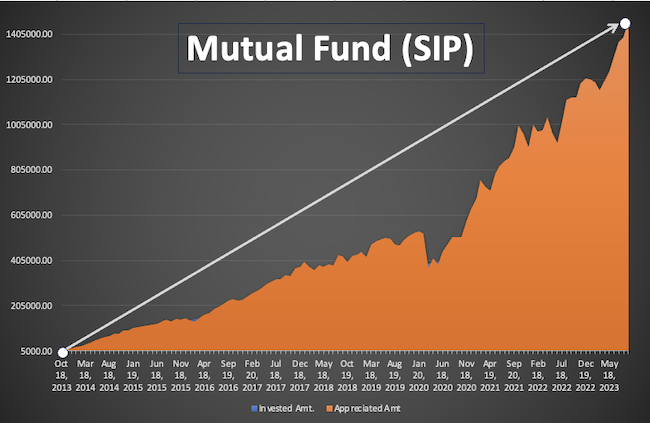

Systematic Investment Plan (SIP), stands as a cornerstone strategy for wealth creation and financial stability. For nearly two decades, one steadfast investor embarked on a remarkable journey through the landscape of SIPs, refining strategies, embracing volatility, and reaping the rewards of consistent, disciplined investment. Let’s learn from the two decades of SIP investments.

The purpose of this article is to take you on a guided tour of this investor’s 20-year SIP journey—a voyage that began in the early 2000s and led to financial independence and substantial wealth creation. As we delve into this compelling narrative, you’ll discover the evolution of an individual’s approach to mutual fund investments, key takeaways from their experiences, and invaluable insights gained along the way.

Beyond the numbers and statistics, this journey reflects the enduring power of SIP investments. It underscores the significance of maintaining asset allocation, the wisdom of allowing time for compounding, and the art of navigating market fluctuations with unwavering resolve. This article will also shed light on the transition to debt fund investments, emphasizing the importance of capital preservation and its role in shaping a holistic investment strategy.

Join us as we embark on a journey of discovery, learning, and financial empowerment. It is a journey that epitomizes the essence of SIP investments as a tool for building a secure financial future.

Let’s explore this remarkable two-decade odyssey. We’ll get insights that can inform your own investment endeavors.

Section #1: The Early Years

In the opening segment of our investor’s 20-year SIP journey, we delve into the early years, a crucial period that laid the foundation for what was to come. It all began in 2005, a time when equity investments held an air of mystique, promise, and uncertainty.

1.1 The Initial Foray into Equity

In March 2005, our investor took the first step into the world of equity investing by purchasing units in the Tax Saver Mutual Fund. It marked the birth of a financial adventure that would span two decades and lead to financial independence. This initial choice of an equity mutual fund was driven by the fund’s impressive governance and historical performance. However, as the years unfolded, the journey would take unexpected turns and shifts.

1.2 The Gradual Transition to SIPs

From this initial purchase, our investor gradually transitioned into the world of Systematic Investment Plans (SIPs) as a means to gain experience and hone their investment strategy. SIPs, characterized by disciplined monthly investments, offered the investor a valuable opportunity to learn the ropes of equity investing while managing risk.

During these early years, lessons were learned, strategies were refined, and the portfolio began to take shape. It was a period of experimentation and discovery, as the investor sought to identify the most effective path to wealth creation. Mistakes were made, and lessons were learned, all contributing to the investor’s growing expertise in the realm of mutual fund investments.

1.3 Gaining Experience and Refining Strategy

The early years were characterized by a steep learning curve, punctuated by trial and error. The investor’s willingness to gain experience and adapt to changing circumstances plays a pivotal role in shaping their investment journey. It’s during these formative years that the seeds of discipline, patience, and long-term thinking were sown. It’s a mindset that would serve as the bedrock for future success.

The journey of a thousand miles often begins with a single step. This initial foray into equity investing and the gradual transition to SIPs represented the beginning of a remarkable financial odyssey.

As we move forward in this narrative, we’ll explore how these early experiences set the stage for a transformative two decades of SIP investments.

Section #2: The Journey to Financial Independence

This segment of our 20-year SIP journey delves into the investor’s remarkable transition to financial independence, underpinned by critical decisions, asset allocation, and the power of compounding.

2.1 Investing Surpluses

In 2007, a pivotal decision marked a turning point in the investor’s journey. Recognizing the potential of equity mutual funds, they committed to investing all monthly surpluses in these instruments. This move signified a shift from merely experimenting with SIPs to a wholehearted embrace of equity investments as the primary vehicle for wealth creation.

Family contributions also played a crucial role. From 2008, the entire family surplus was directed towards these funds, further bolstering the investor’s commitment to wealth building. This collective effort underscores the family’s alignment with the goal of financial independence.

2.2 Asset Allocation and Consistent Investments

The journey towards financial independence was characterized by a deliberate approach to asset allocation. The investor recognized the importance of striking a balance between equity and other assets. This discipline helped ensure that their investments were in harmony with their risk tolerance, income stability, and overall financial objectives.

Consistency was key. The investor diligently adhered to their investment plan, making monthly contributions without fail. Over time, this commitment to regular investments became a cornerstone of their success. By maintaining a steady approach, they not only mitigated the impact of market volatility but also harnessed the power of compounding to their advantage.

2.3 Avoiding Unnecessary Withdrawals

Compounding, often referred to as the “eighth wonder of the world,” played a substantial role in the investor’s journey. Over the years, their wealth grew exponentially as their investments generated returns, and those returns, in turn, earned more returns. This compounding effect was a testament to the patient and consistent approach that the investor had adopted.

Equally significant was the avoidance of unnecessary withdrawals. The investor’s discipline and understanding of the compounding phenomenon led them to refrain from tapping into their investments for non-essential expenses. Instead, they allowed their investments to grow unhindered, knowing that time was on their side.

As we move forward in this narrative, we’ll uncover more insights and lessons from this remarkable journey.

Section #3: Lessons Learned

In this section, we dive deep into the invaluable lessons learned over the course of the investor’s 20-year SIP journey. It offers insights that can benefit all who seek to achieve financial independence through the mutual fund route.

3.1 Embracing Market Volatility

One of the central takeaways from this journey is the significance of embracing market volatility. The investor experienced their fair share of market ups and downs, and instead of shying away from these fluctuations, they recognized them as an inherent part of the equity landscape. Volatility is the price equity demands for its premium returns.

To attain financial independence, one must be willing to endure market drawdowns and market swings. In doing so, the investor was able to reap the rewards of a 15% XIRR, leading them to financial freedom.

This lesson underscores the importance of a steadfast, long-term approach, irrespective of market turbulence.

3.2 Preference for Passive Funds for the Long Term

The investor’s journey also highlights the preference for passive funds, particularly for long-term investments. As the years passed, the wisdom of embracing index funds became apparent. Passive funds are known for their low expense ratios and consistent tracking of benchmark indices.

For an investor with a long-term perspective, this approach aligns with the goal of steady, cost-effective growth.

The investor’s transition to index funds, such as Nifty Fifty and Nifty Next 50, reflects a belief in the power of compounding through a simple, low-cost strategy.

3.3 The Role of Knowledge and Resources

To navigate the complex world of mutual fund investments, they tapped into educational resources like books. The investor also started his own online blog where he could share his learnings.

This commitment to learning and staying informed allowed them to make well-informed investment decisions. It’s a reminder that in the era of information, investors have access to a wealth of resources that can empower them to make intelligent financial choices. Knowledge and resources provide the tools for sound decision-making while investing.

As we proceed through this narrative, we will explore further aspects of this enriching journey.

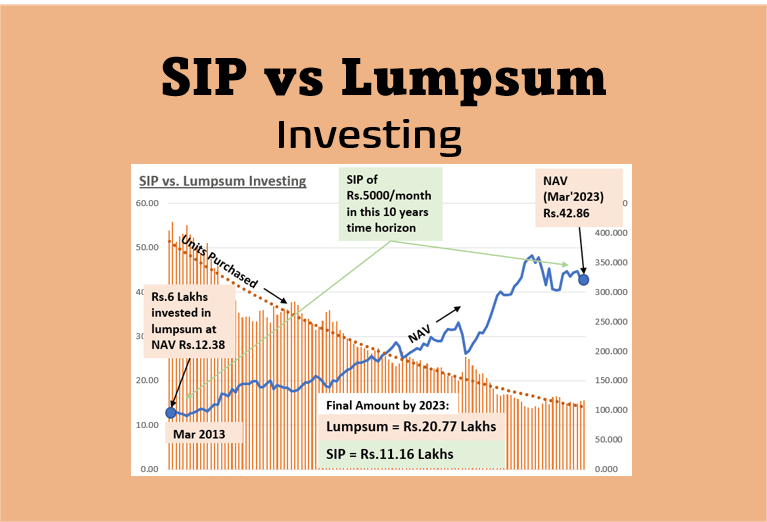

Section #4: Lump Sum Investments

In this section, we delve into the investor’s experience with lump sum top-up investments during significant market events. This way, we’ll explore the effectiveness and challenges of this strategy. We also highlight the recommendation for a more consistent investment approach based on asset allocation.

4.1 Experience with Lumpsum Top-Up Investments

The investor’s journey was not without experimentation, and a notable facet of their approach was lump sum top-up investments during major market events.

Two significant instances stand out: the demonetization period and the COVID-19 pandemic.

During these times of heightened market turbulence and uncertainty, the investor adopted an incremental approach, purchasing small quantities of funds every week while the market was in a downturn.

4.2 Effectiveness and Challenges of Lump Sum Investments

In hindsight, this strategy appears to have been effective, allowing investor to capitalize on lower market prices and potentially amplify their returns. However, this approach is not without its challenges. First, the investment amounts, when compared to the overall corpus, remained quite insignificant.

In the grand scheme of the portfolio, these lump sum investments may have had a limited impact.

Furthermore, the approach heightened anxiety due to the challenge of timing the market accurately. Trying to pinpoint the perfect moment to invest during market downturns can be a stressful endeavor, and it introduces room for error.

Making investment decisions based on market fluctuations can also increase the risk of making premature exits or overcommitting funds when better opportunities may arise.

4.3 Recommendation for a More Consistent Investment Approach

The investor’s journey offers a valuable lesson for those considering Lump sum investments. While they may provide short-term gains, a consistent investment approach based on asset allocation is often a more prudent strategy for long-term financial growth. Asset allocation involves determining the ideal mix of assets, such as equity and debt, based on individual risk tolerance, income stability, and financial objectives.

By adhering to a consistent asset allocation plan, investors can strike a balance between risk and reward, maintaining a long-term perspective and avoiding the pitfalls of trying to time the market. It fosters discipline and helps investors stay on course during market fluctuations, ultimately contributing to a more stable and successful investment journey.

As we continue to navigate through this journey, we will uncover further insights that can guide your own investment decisions.

Section #5: Current Portfolio and Investment Journey

In this section, we provide a snapshot of the investor’s current portfolio as of August 23 (hypothetical). It sheds light on the evolution of their investments, including fund changes and the rationale behind these adjustments.

- PPFAS Long Term Equity (G) DP – The sole active fund.

- HDFC Nifty Fifty 50 Index (G) DP – Mirrors the top 50 stocks on the Nifty in terms of market cap.

- ICICI Prudential Nifty Next 50 Index (G) DP – Mirrors stocks ranked 51 to 100 on the Nifty by market cap.

- Motilal Oswal Midcap 150 Index (G) DP – Mirrors stocks ranked 101 to 250 on the Nifty by market cap.

- Motilal Oswal Small 250 Index (G) DP – Represents stocks ranked 251 to 500 on the Nifty by market cap.

G = Growth, DP = Direct Plan.

Investment Journey Details

The investor’s journey through mutual fund investments has been a dynamic one, marked by several changes and adjustments. The evolution of their portfolio reflects a commitment to learning and adapting to changing circumstances.

Fund Changes and Reasons for Adjustments:

The Start

- Tax Saver Fund: Initially chosen for its impressive governance and history, this fund was eventually redeemed due to acquisition, with the funds reallocated to HDFC Equity and HDFC Top 200.

- HDFC Equity and HDFC Top 200: The two HDFC funds were merged, and the investor shifted from HDFC Equity due to underperformance, reallocating funds to ICICI Focused Bluechip and ICICI Discovery.

- ICICI Focused Bluechip: SIPs were discontinued, the fund was redeemed, and the funds were reallocated to Quantum Long Term Equity after unfavorable experiences with focused funds.

- IDFC Premier Equity: Initially started due to the manager’s expertise, the fund was discontinued after the manager left, and the funds were reallocated to Quantum Long Term Equity.

Middle Phase

- Franklin India Bluechip: This fund was ended due to underperformance and high charges, with the funds reallocated to ABSL Frontline Equity.

- ICICI Value Discovery: Initially promising, this fund ended due to corpus size affecting performance, with the funds reallocated to Aditya Birla Sun Life Frontline Equity.

Recent Years

- ABSL Frontline Equity: SIPs were discontinued due to underperformance, and the funds were reallocated to ICICI Prudential Nifty Next 50 Fund, marking the start of passive investing.

- Quantum Long Term Equity Fund: Impressed but discontinued due to issues with Yes Bank stock, the funds were reallocated to PPFAS Long Term Equity and HDFC Index Fund.

- HDFC Mid Cap Opportunities: Discontinued due to underperformance, with funds reallocated to Motilal Oswal Mid Cap 150 Index Fund and Motilal Oswal Small Cap 250 Index Funds.

- Motilal Oswal S & P Index Fund: This fund was suspended due to an RBI ban, to be redeemed when indexation benefits qualify for debt securities.

The investor’s journey through various mutual funds, active and passive, reflects a continuous quest for a strategy that aligns with their financial independence goal. From actively managed funds to the embrace of passive index funds, the transitions were made based on performance, fund changes, and evolving market conditions.

This portfolio’s evolution underscores the importance of adaptability and the investor’s dedication to their long-term financial objectives.

Let’s explore another important aspect of this two-decade-long investment journey.

Section #6: Asset Allocation Strategy and Debt Fund Investment

The investor was an avid reader of the book called “The Intelligent Investor.” We delve into their shift towards debt mutual funds, considering the importance of tax implications and how it contributed to the evolution of their investment journey. We also share insights into the critical aspect of capital preservation.

6.1 Asset Allocation Strategy

Benjamin Graham, the author of “The Intelligent Investor”, emphasized the importance of defining a specific equity allocation range and adhering to it, irrespective of market fluctuations. This range is determined by individual factors like investment objectives, personal risk tolerance, income stability, and temperament.

The investor’s objective centers around prudent wealth creation with controlled risk. As a result, they established an equity allocation range of 40% to 80%. This strategic framework serves the purpose of avoiding exceeding 80% or dipping below 40% in equity allocation, thereby ensuring enduring market participation.

6.2 Shift Towards Debt Mutual Funds

The investor’s investment journey saw a pivotal shift towards debt mutual funds. In the early 2000s, a significant portion of their debt investments resided in EPFO (Employees’ Provident Fund Organization) and fixed deposits. However, the need for an alternative to fixed deposits became evident as their income propelled them into the 30% taxable bracket.

A watershed moment emerged in 2006 when they undertook the task of filing their own tax returns. This endeavor unveiled the unfavorable tax implications associated with fixed deposits, rendering them less attractive for debt investment.

As a result, the investor pivoted towards leveraging debt mutual funds for their debt-focused investments.

6.3 Importance of Tax Implications

The pivotal moment of realizing the advantages of indexation for debt funds held beyond a year prompted the investor to embrace debt mutual funds. Indexation allows investors to adjust the purchase price of their investments for inflation, effectively reducing the taxable gains.

This discovery fundamentally altered their approach to debt investments, allowing for enhanced tax efficiency and, consequently, higher post-tax returns.

6.4 Capital Preservation in Debt Funds

As the investor ventured into debt mutual funds, they recognized a fundamental principle that guided their approach: the principal aim of debt funds is capital preservation, not wealth generation. These funds should bear minimal risk of capital loss, with durations aligned with future capital needs.

The investor’s journey was marked by a keen understanding of the paramount risks associated with debt mutual funds, particularly duration risk and borrower default risk. This recognition led them to create a cardinal rule for their debt mutual fund investments:

Debt funds are primarily for capital preservation, not wealth generation.

Conclusion

The 20-year SIP journey of this investor has been a remarkable odyssey marked by patience, discipline, and a relentless pursuit of financial independence. With a diversified portfolio that underwent strategic changes and adjustments over the years, the investor achieved an impressive 15% XIRR, leading to their financial independence.

The key takeaways from this journey resonate loudly. Patience and a long-term perspective are paramount in the world of mutual fund investments. The ability to withstand market volatility and avoid unnecessary withdrawals paves the path to success. The embrace of passive funds for long-term wealth creation and the importance of gaining knowledge from reliable resources further underscore the investor’s success.

This journey serves as a testament to the enduring power of systematic investment plans. It reinforces the idea that wealth creation through mutual funds is not an overnight endeavor. It is a journey that rewards those who commit to it with unwavering patience and discipline.

As you embark on your own investment journey, consider these lessons and experiences as guiding stars to illuminate your path to financial success.

Author’s Note:

The investor’s journey, insights, and experiences offer a wealth of knowledge to those seeking to navigate the world of mutual fund investments. As with any investment, it’s crucial to remember that past performance does not guarantee future results, and individual circumstances and risk tolerances can vary.

I encourage you to learn from this journey, conduct thorough research, and consider consulting with financial professionals before making investment decisions. Mutual funds, while offering significant potential for wealth creation, also come with inherent risks. The investor’s disciplined approach and constant learning underscore the importance of ongoing engagement with your investments.

Ultimately, as with any investment, your approach should align with your financial goals, risk tolerance, and time horizon. May your investment journey be as rewarding as the one shared here, and may you find success in achieving your financial aspirations.

Have a happy investing.