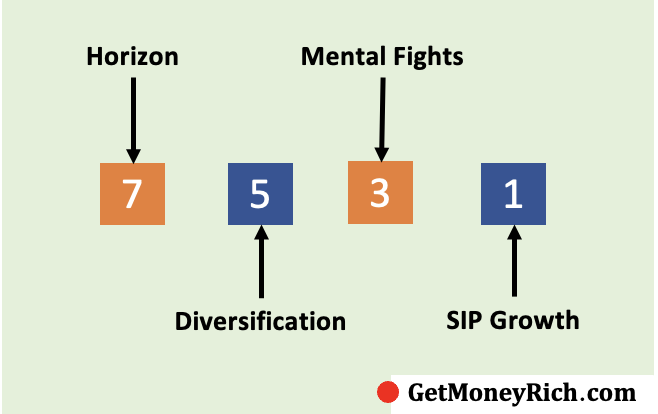

Investing in the stock market can be both thrilling and intimidating, especially for beginners. It’s like a journey with the promise of wealth creation. But it’s often fraught with uncertainty. Here I’ll share a time-tested strategy that is also very effective. This strategy is known as the 7-5-3-1 Rule of SIP.

Introduction

Imagine you’re embarking on a long road trip. You wouldn’t expect to reach your destination in just a few minutes, right? Similarly, equity investments require time to flourish. The heart of the 7-5-3-1 rule of SIP is a 7+ year investment time frame. This isn’t just a random number; it’s based on extensive historical data.

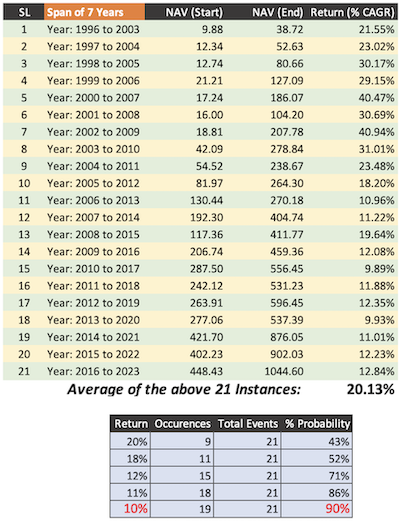

Consider this: HDFC Top 100 Fund could deliver 10% CAGR returns 90% times in the last 27 years. However, the scheme could deliver this return only if the holding period was at least 7 years. With the same holding periods, the funds could deliver 11% CAGR 86% times, 12% CAGR 71% times, 18% CAGR 52% times, and 20% CAGR 43% times. There were multiple instances (6 out of 21) where the fund could deliver about 30% returns in a 7-year time horizon.

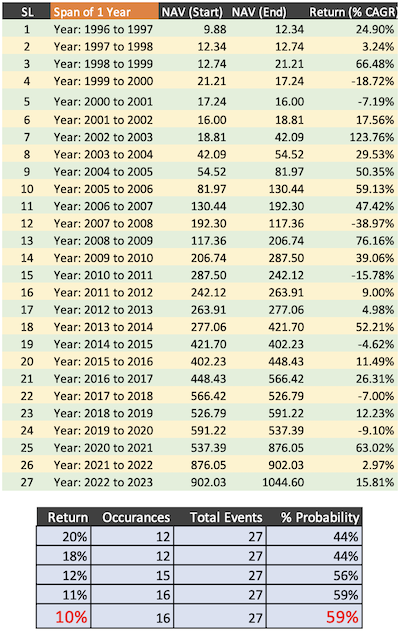

On the flip side, if the investment time horizon got reduced to 1 year, the scheme could deliver 10% CAGR returns only 16 times (59% times) out of 27 instances. The number of occurrences of 10% or more comes down from 90% to just 59%. This reveals the importance of long-term commitment for consistent returns.

Diversification is another key aspect we’ll delve into. We’ll get introduced to the 5 Finger Framework. It is a unique strategy for spreading our investments across various styles. Diversification can shield us from the inevitable ups and downs of the market.

Additionally, we’ll explore how to mentally prepare for the three (3) common mental fights. Beginners often face this hurdle during their equity endeavors.

We’ll also see the power of incremental growth. By increasing our SIP (Systematic Investment Plan) contributions each year, we can propel our wealth-creation journey.

So, fasten your seatbelts, we’ll break down the 7-5-3-1 rule of SIP and build a new perspective on equity investing.

Point #1: The Power of Patience (7+ Year Time Horizon)

In the world of equity investing, time is our closest ally. The 7-5-3-1 rule’s first fundamental principle is having a 7+ year investment time horizon. Allow me to paint a picture of why this extended horizon is not just a suggestion but a cornerstone of success.

We have already seen the example of the HDFC Top 100 Fund. It is one of the old mutual fund schemes in India. A person investing in an HDFC Top 100 fund scheme, for a 7-year time horizon, can be almost 90% sure to get a return of 10% per annum. However, if the holding time is reduced to 1-year, the chance of getting a 10% per annum return comes down to just 4.8%.

But it’s not only about the returns; it’s about the power of compounding. When we invest with a 7+ year horizon, our money gets the time to snowball. Think of it like a snowball rolling downhill, gathering more snow as it goes.

In the world of finance, this is known as compounding. It is a magical force that can turn small, consistent investments into a substantial corpus over time.

Now, let me draw from my personal experience as an equity investor since 2008. During this period, I’ve witnessed several market cycles and economic ups and downs. I can attest to the fact that, while the market can be unpredictable in the short term, it has consistently rewarded those who have the patience to stay invested over a 7+ year horizon.

So, for Indian beginners, the key takeaway is clear: embrace the power of patience. View your equity investments as a long-term commitment, and let the magic of compounding work in your favor. With time on your side, your financial future can be brighter than you ever imagined.

Point #2: The Art of Diversification (5 Finger Framework)

For equity investors, diversification is the secret sauce that can give volatile equity, a manageable stability. The 5 Finger Framework is what deals give the benefit of diversification. It is one of the second most vital concepts in the 7-5-3-1 rule of SIP.

The 5 Finger Framework is like assembling a team of experts in different fields. Just as we wouldn’t rely on a single skill set to solve all our problems, our investments should not be too focused on one asset class or an investment strategy.

When it comes to diversification of our equity portfolio, the following are the five areas where must spread our investments:

- First, Focus on Quality: High-quality stocks are like the foundation of your portfolio. They are stable, well-established companies with a history of solid performance, and they can anchor your investments during rough times. Read about blue-chip companies.

- Second, Look For Value: Value stocks are often underrated gems. They can provide a safety net by offering good value for your money, especially when markets are turbulent. Read more about undervalued stocks.

- Third, The go for GARP: These stocks are the rising stars, promising future growth. They add the potential for higher returns without excessive risk. Learn more about GARP investing.

- Fourth, Look for Mid/Small Cap: These companies have room to grow and can offer exponential returns. They introduce diversity into your portfolio by representing a different market cap segment. Read more on small-cap stocks.

- Fifth, Look for Global Stocks: Diversifying geographically protects your investments from local economic downturns. Investing globally can also open doors to exciting opportunities and a hedge against domestic risks. Read more on how to buy stocks of overseas companies.

By diversifying across these five areas, investors can consistently outperform the broader market. It’s like having multiple arrows in your quiver. Each serves a unique purpose thereby increasing our chances of hitting the target.

Think of diversification as an insurance policy for your investments. It’s an approach that’s stood the test of time and has been a crucial part of my own equity investing journey.

Point #3: The Three (3) Mental Fights

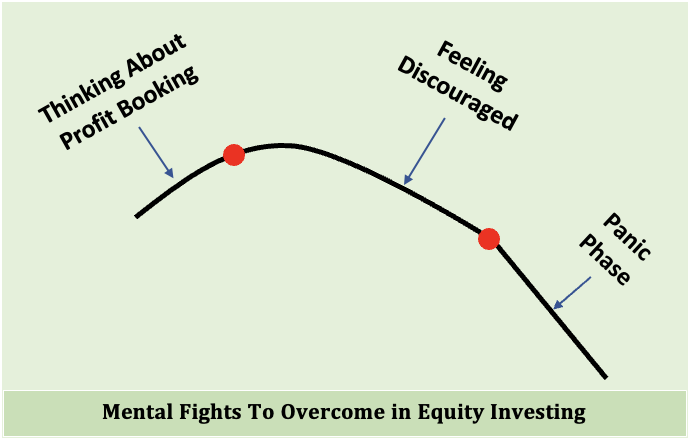

As you embark on your equity investment journey in India, it’s essential to be prepared for the inevitable phases of failure. It is a reality that I’ve personally encountered and conquered several times. The feelings of failure come in phases. At times, there will be euphoria, and at other times there will be a sense of failure. I call them mental fights.

#3.1 Hurry To Book Profits

Equity investors often experience the temptation to book profits quickly. This especially happens when they witness a substantial price surge, like a 30% jump in a stock’s value. However, it’s essential to understand the significance of acquiring quality stocks at attractive valuations.

The primary objective for investors should be to identify and secure undervalued stocks, offering the potential for substantial long-term growth.

Booking profits too soon, upon witnessing short-term gains, can impede the realization of the bigger investment goal: wealth accumulation through compounding. Compounding is the phenomenon where an initial investment, allowed to grow over time, can build substantial wealth. The way to do it is by holding onto quality stocks. One must not think to sell just because the price has jumped substantially. Read more about the concept of multibagger stocks.

Let them compound for years or even decades. This way, we can harness the power of time, which plays a crucial role in wealth creation.

#3.2 Feeling Discouraged

People get discouraged when their expectations are not met. In India, equity investments yielding single-digit returns of 7-10% may arouse the feeling of discouragement. An equity portfolio showing such returns can happen when the market is in a bearish phase. During such times, the market remains volatile and goes south ways.

But during such time, it is needless to feel discouraged. The equity market is like that, they move in cycles between euphoria and despondency.

Let me give you this data. Between the years March 2003 and Oct 2023 (20 Years), I have data of 82 numbers three-month-periods. For example, one such period is between March’03 and June’03. In these 82 number periods, there were 32 number periods, where the Sensex growth was 1% or below (even negative).

For example, between Dec’03 and Mar’04, Sensex fell from 5,838 to 5,590 levels (down by -4.25%). Similarly, there were 32 number such instances where the Sensex growth was either negative or it was flat.

What is the point? The fluctuations in the equity market are part and parcel of investing. But here’s the encouraging part – they are temporary. The market has consistently rebounded, and returns improved significantly within the next 1-3 years.

My personal experience has taught me that during these times, staying calm, and reframing my perspective as a long-term investor helps. I try hard not to get swayed by short-term fluctuations. It’s a mindset shift that can make all the difference.

#3.3 The Panic Phase

This phase strikes when our portfolio is already not doing well, and the markets crash. The returns turn even more negative. This is the time when the real equity investor inside us must start speaking.

We must consider it as a test of our resolve. We must also keep in mind that these severe downturns (a crash) are rare. They occur every 7-10 years.

My personal experience during these times has shown that the market has always bounced back. For example, consider the recovery following the 2008 global financial crisis or the recent COVID-19-induced market drop. These were undoubtedly panic-inducing moments, but those who held steady were ultimately rewarded with substantial rebounds.

To navigate these challenging periods, it’s vital to focus on the long term. Remember that these phases are temporary. Continuously educate yourself, maintain a diversified portfolio, and stick to your investment plan. Read about investing large sums of money for a long-term horizon.

Point #4: SIP Growth (Stepping up the SIP Once Each Year)

I’ve written a separate article on Step-Up SIPs, I’ll request you to read it through to get deeper insights. Nevertheless, allow me to touch base on this topic in brief here.

For beginners in equity investing, step-up SIP is a powerful strategy that can substantially boost wealth over time. You can also check for yourself the difference between a ‘normal SIP’ and a ‘step-up SIP’ using this calculator.

Imagine yourself as a marathon runner. You are somebody who can easily complete full marathons. But it takes you about four hours to do so. This is an example of a normal SIP.

But consider this, you started doing more strengthening exercises of your core and legs. You are also trained to keep your heart rate low during your marathons. What is the result, the same full marathons you were initially completing in 4 hours, were now getting finished in under 3 hours. This is an example of a step-up SIP.

Increasing our SIP amount (annually) is like boosting the capacity of your equity portfolio. You are doing more to get better results.

Here’s why this strategy matters:

- Reach Financial Goals Faster: By incrementally increasing our SIP amount, we accelerate our journey towards financial goals. For instance, if your aim is to accumulate a down payment for a 3 BHK instead of a 2 BHK, increasing your SIP contributions each year can help you achieve this target in the same time period.

- Expanding Financial Goals: As you experience the power of incremental growth, you may find that your financial aspirations expand. You might start to think also about getting financially independent instead of focusing only on retirement corpus building.

To demonstrate the impact, let’s consider a hypothetical example:

Suppose you start with an SIP of ₹5,000 per month and increase it by 0% each year (normal SIP). Over 25 years, you will accumulate about ₹1.64 Crores. This is equivalent to today’s ₹34 lakhs.

Now suppose, you decided to increase your ₹5,000 per month SIP by 10% each year (Step-up SIP). Over 25 years, you will accumulate about ₹2.81 Crores. This is equivalent to today’s ₹58 lakhs.

Imagine your bank account has an FD worth ₹34 lakhs. How do you feel about it? Just note this feeling. Now, consider this ₹34 lakhs becoming ₹58 lakhs upon the click of a button.

Yes, this is the power of Step-Up SIP.

For people like me who predominantly invest directly in stocks, an equivalent to step-up SIP is buying regularly (when the opportunity comes) from a watchlist of stocks.

Conclusion

The 7-5-3-1 Rule of SIP is very powerful. I can attest to the transformative power of this rule.

It teaches us the significance of patience by asking us to stay invested in for at least 7 years in equity. It also tells us to diversify and how to diversify. There is a specific suggestion on what lines we must think about diversifying our equity portfolio (here).

The rule then goes further and guides us on how to manage potential failures in equity investing. It addresses three common mistakes (of investors) that trigger failures in equity investing (here).

To make the whole equity investment more rewarding, it also includes the concept of Step-up SIP. It highlights, how simply allowing our SIP contributions to grow over time can build a substantially bigger corpus (as compared to normal SIP).

Equity investing’s future is bright. For us, it is filled with potential.

Have a happy investing.

[Note: I originally read this article in The Hindu, and I thought to put the concept through to my readers as well.]

Suggested Reading:

I am a retired fauzi of age 72!yrs draw.a.pension of rs rs 27 k pm pls advise sip plan for me to add some money . .. can contribute rs 5000 pm. Pls advise

Informative article. Looking forward to more such readings. Thank you Mani

Thank you. Appreciate your feedback

Very in-depth analysis and ideas of investment both in mutual funds and equity market delineated in the article. Feel fortunate to read it and convey my thanks.

Thank you

Very informative and helpful information. Thank you Mani

Thank you.

Nice analysis… This will give anyone a good train of thought how the arithmetic appreciation of market happens when you stay invested for a longer time frame..

Awesome rule, nicely explained 👌 Kudos 👏

Thank you Sailesh

There is calculation mistake in the investment time horizon of1 year.

Let take example of 1996-1997-

Start nav : 9.88

End nav : 12.34

The absolute return is 24.89 %, since the time period is 1 year so the CAGR will also be 24.89%.

Look like the CAGR mentioned in the blog is calculated considering 24.89% in 7 years.

Thanks Shivansh for point the mistake. It has been corrected.

Cheers for taking the time out to comment 👍

Keep reading.

Hlo,

Thanks for sharing such a important informative topic with us. I had read it thoroughly & it’s very helpful.i hope in future we will get more like this .

Regards,

Sourav

Sure. I’ll keep posting such article. Thanks.

Thank you very informative

Pleasure is mine. Thanks

Excellent concept .

It is an appropriate explanation of why SIP is effective how we should practice it.

Sir,

Hats of to you sir. You have created powerful presentation and explained very informative and complex concept in very simple way.

Thank a lot for creating such a nice content for us. God bless you sir🙏

Thank you for the feedback. Keep reading.