Does SIP actually work? This was the query posted by a reader on my blog. He further added to his query stating that. “if SIP is effective, then why don’t all people invest in mutual funds through SIPs.” I can understand his doubt. Whenever we hear about big investors like Warren Buffett, Rakesh Jhunjhunwala, Ramesh Damani, etc they are all investors in direct stocks. They have not made their fortunes investing in mutual funds through the SIP route.

So what is the answer to the question of whether SIP actually works? Yes, SIP in equity funds is effective and one of the best ways to build wealth over time.

So, why we do not hear statements from people like Warren Buffett etc praising SIP mode of investing in equity? The quick answer is that; investors like Warren Buffett know that SIP is not the best way to invest in equity. What is the best way? It is lump sum investing in direct stocks.

But lump sum investing in direct stocks has its own risks. Only those investors who have time to closely observe the market and can also do deep fundamental analysis should practice it. For others, SIP in mutual fund schemes is by far the best way to practice equity investing.

Let’s read more about it in this article.

#A. Does SIP actually work?

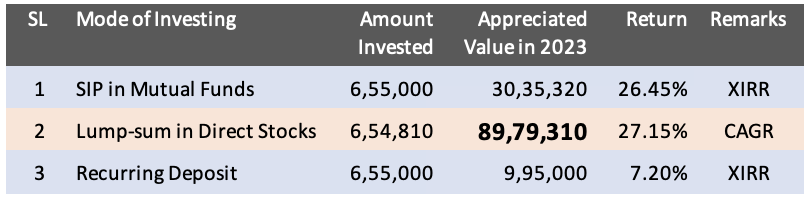

Yes, SIP actually works. Let me give you a real-life example. Suppose you are in Jan 2013. During this time, you decided to invest Rs. 5000 per month in the Nippon India Small Cap Fund (DP). You continue doing it till November 2023. During this 10.9-year time horizon, you have invested Rs. 6,55,000 in this mutual fund scheme.

As of today, the appreciated value of your invested capital is Rs. 30,35,320. It has compounded at a rate of 26.45% per annum (XIRR).

In the same period, a recurring deposit of Rs. 5,000 per month would have built a capital of about Rs. 9,95,000 at 7.2% per annum.

So it proves that SIP in a quality equity fund, has far outperformed our traditional debt-linked investments. Hence, SIP works and it performed extraordinarily.

But still, expert equity investors would not pick SIP in mutual funds. Why? We’ll know about it in this article. A quick hint, they know something better (jump here).

SIP has several advantages. I’ll list down a few here with which I also closely relate to:

#A.1 It helps investors to avoid market timing

Let’s understand this point using an example.

Let’s say you want to invest in the stock market. But you’re not sure when is the best time to do it. You could try to time the market by buying stocks when you think they’re undervalued. You can also try selling them when you think they’re overvalued.

However, this is a very difficult strategy to implement successfully. Even professional investors find it tough to time the market accurately.

For retail investors, a better approach is to invest regularly through SIP. This way, you’ll buy stocks at different prices, both at highs and lows. Over time, your average purchase price will be lower than if you had tried to time the market. Why? Because I’m assuming that retail investors will make mistakes in timing the market.

Let’s say you invest Rs. 1,000 per month in ABSL Nifty 50 Index Fund (RP) through SIP for 10 years. During this time, you invested Rs. 1,20,000 in the fund and the current value of the holding is about Rs. 2,23,847. This capital appreciation shows a return (XIRR) of 12.15% per annum. During this time, you must have bought some units when the market was at its all-time highs. Still, your return is 12.15% per annum.

#A.2 It allows investors to start small and gradually increase their investments over time

There are two main benefits of gradually increasing our investments over time:

- Compounding: Reinvesting your earnings can help your wealth grow exponentially over the long term. Read about the power of compounding.

- Rupee cost averaging: Rupee cost averaging is an investment strategy in which you invest a fixed amount of money at regular intervals, regardless of the price of the asset. This strategy helps to reduce the average cost of your investment over time. Read about rupee cost averaging.

How to gradually increase our investments over time?

Step-up SIP is the way to gradually increase our investments over time. A step-up SIP is a type of SIP where the investment amount increases automatically at regular intervals. For example, we can start with a SIP amount of Rs. 1,000 per month. Then, after the end of the year, we can increase it to Rs. 1,100 per month. Read more about step-up SIP.

Let’s take a few examples. Axis Small Cap Fund has a minimum investment requirement of just Rs. 500. This means that a beginner can start investing in this fund with just Rs. 500 per month to test the waters. After a year, when they build more confidence, the investment amount can gradually be increased. as per one’s comfort.

Mirae Asset Emerging Bluechip Fund is a mid-cap equity mutual fund. It has a minimum investment requirement of just Rs. 500.

Both mid and small-cap funds stay very volatile. Hence, beginners can start small (with say Rs.500 per month) and get accustomed to the volatility. After some period (like one year) the SIP amount can be increased.

#A.3 SIP helps to average out the cost of investment

Imagine you decide to invest in a mutual fund through a SIP with a monthly contribution of Rs. 500. The price of one unit of the fund at the start is Rs. 50. With your Rs. 500, you purchase 10 units of the fund in the first month. Now, suppose the market experiences fluctuations over the next few months:

- Second month: In this month the unit price falls to Rs. 45, so your Rs. 500 buys approximately 11.1 units. See, it is buying more units when the NAV falls.

- Third month: In this month, the unit price rises to Rs. 55, and your investment buys approximately 9.1 units. As the NAV is rising, it is buying fewer units.

- Fourth month: In this month, the price falls back to Rs. 40 levels. Hence, it allows you to purchase around 12.5 units.

By the end of these four months, you’ve accumulated a total of approximately 42.7 units.

Now, let’s compare this to what would have happened if you had invested a lump sum of Rs. 2,000 at the beginning when the unit price was Rs. 50. In that case, you would have purchased only 40 units.

SIP helps average out the cost of investment because, in the above example, your average purchase price per unit over four months is lower than the initial price of Rs. 50. As the unit price fluctuates, you are buying more units when prices are lower and fewer when they are higher.

Over time, this strategy reduces the impact of market volatility on your investment. In fact, the more volatile is the market, the better suited it is for the SIP mode of investing.

SIP ensures that you are acquiring more units when they are cheaper, which can potentially enhance your returns in the long run.

This averaging effect, known as rupee-cost averaging, is a key advantage of SIP.

#A.4 SIP inculcates the habit of regular saving and investing

Consider an individual, Mr. Sharma, who decides to start a SIP in an equity mutual fund. He opts for a monthly investment of Rs. 5,000. This decision marks the beginning of his journey towards regular saving and investing.

Here’s how SIP inculcates this habit.

Mr. Sharma set up an automated monthly deduction from his bank account. This ensures that he consistently allocates a portion of his income towards investments. This disciplined approach helps him control his temptation to spend the entire income.

It all starts with this one habit of allowing oneself to spend less, and instead use the funds for investment. As this habit starts to sink into one’s psychology, the next logical actions start to drip in.

- Financial Planning: Mr. Sharma will now start to think about future financial needs. He will begin to allocate money to SIP for every future need. As some of our future needs are uncompromisable Mr. Sharma will be forced to plan and budget his expenses accordingly.

- Compounding Benefits: As Mr. Sharma continues with his SIP, he starts to witness the compounding benefits. Over time, the returns generated from his investments contribute to significant wealth accumulation. This reinforces the importance of regular investing and encourages him to continue the habit.

So you can see, how SIPs are self energising phenomenon. If one practices it in a disciplined way, it can muster up substantial goal-specific wealth over time.

#B Why Expert Investors Do Not Do SIP?

Seasoned investors may not opt for SIPs due to their ability to time the market. Their ability to time the market more accurately can potentially fetch them superior returns.

Let’s explore this concept further.

Expert investors understand market cycles more deeply. They have developed this understanding by observing and investing in the market for years. Experts may invest in a lump sum when they believe markets are undervalued. They can also reduce exposure when they perceive overvaluation.

This tactical approach can lead to better returns than SIPs.

As expert investors closely follow the market, they know which sector is underperforming at the moment. For instance, they might foresee that the technology sector will continue to underperform in 2023. Hence, instead of SIPs in diversified equity funds, they can strategically allocate their capital in a lump sum to sector-specific funds.

This enables them to capture the full benefit of sectoral growth, potentially generating higher returns.

It’s important to note that while expert investors may have the potential to achieve higher returns. They do it through market timing and strategic investing. This approach also comes with higher risk and requires a deep understanding of the market.

SIPs, in contrast, offer a disciplined and low-risk approach that is well-suited for retail investors like me and you.

Example #1

Here is an example of an investor who will not invest in SIPs:

Warren Buffett: Warren Buffett is one of the most successful investors in the world. He is known for his buy-and-hold strategy. When he invests in companies that he believes have long-term value he will rather go all out and invest in them in a lump sum instead of gradual investing.

Not only this, Warren Buffett type of investors may ignore the mutual funds as a whole. They prefer investing in direct stocks because of their precise knowledge of the market and specific companies.

These types of investors keep a watch on the market and a few specific companies. They know a lot about the companies through their ability to analyze the fundamentals of the company. There are two benefits of it, they exactly know which companies are strong and which are weak. Secondly, they also know the fair price they must pay to buy shares of a company.

During times when the market is falling, they buy shares of their preferred companies in such moments. This is the way they increase their chances of getting bargain buys.

Example #2

One distinct advantage that professional investors have over retail investors is the availability of capital. Retail investors also have to take the SIP route as they can invest only in small amounts.

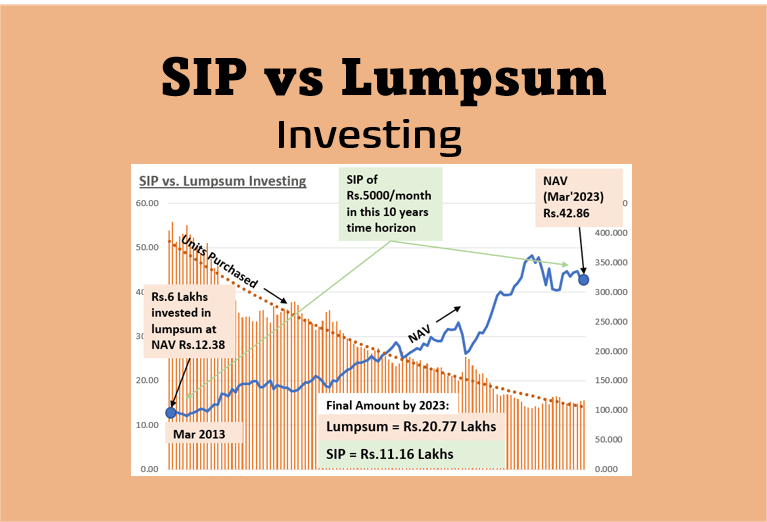

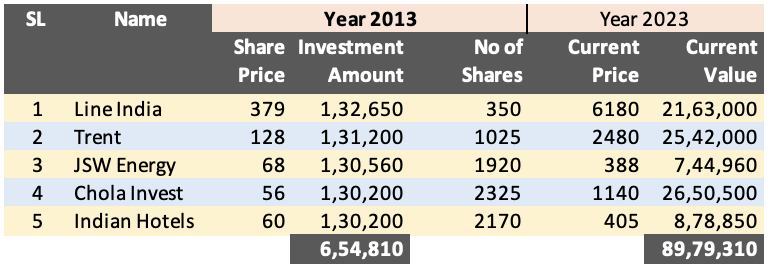

But for a moment, consider that you are a professional investor. You have the capital to invest Rs.6,55,000 in equity, like this SIP investor, but in a lump sum. You are in January 2013, and thinking that it is an optimum time to buy a few quality shares. Hence, you decided to distribute your capital in the following stocks:

You distributed your available capital of Rs.6.55 lakhs into five stocks. In November 2023, after about 10.9 years, your capital went on to grow from Rs. 6.55 lakhs to Rs. 89.79 Lakhs. This is a CAGR growth are 27.15% per annum.

Compare this with SIP investing:

Check the difference in the reported returns between SIP and direct stocks (26.45% vs 27.15%). The difference is not substantial, right? But see the difference in the appreciated value in the year 2023 (89 lakhs vs 30.35 lakhs). There is a major difference, right?

Do you know what has caused this distinction? It has been caused by lump-sum investing and also by staying invested for a long term (10.9 years).

Conclusion

SIP is a good investment option for most investors, especially beginners. It is a disciplined way to invest in mutual funds and helps to avoid market timing. However, expert investors may not invest in SIP. Why? Because they have the expertise, time, and resources to generate higher returns. They have other investment strategies (like lump sum investing when the market is undervalued) to generate better returns on investment.

It is important to note that SIP is not a magic bullet. It is important to choose the right mutual funds and to stay invested for the long term. SIP investors should also be prepared to face market volatility.

Have a happy investing.

Suggested Reading: