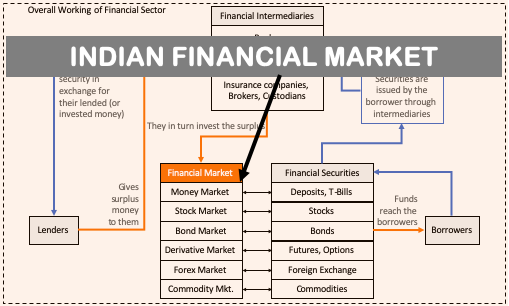

The Indian stock market is influenced by various factors influencing investor sentiment and hence the market trends. The Indian stock market has witnessed significant historical transformations, reflecting the nation’s economic evolution. Economic indicators like GDP growth and inflation rates play pivotal roles, impacting the stock metrics and hence the overall market.

For instance, during periods of robust GDP growth, post-1991 globalization in India, stock markets experienced bullish trends. This is an example of the correlation between economic health and market performance.

Government policies introduced reforms that directly impacted specific sectors. The biggest of those reforms was the liberalization measures in the 1990s.

Corporate earnings reports serve as crucial barometers. Companies like Infosys exemplify market reactions to stellar earnings, driving stock prices upward. Global factors, including international market trends, demonstrated interconnectivity, such as the market fluctuations during the global financial crisis of 2008.

Understanding these influences requires monitoring interest rates, currency movements, etc. For instance, the impact of rising oil prices on inflation rates and fiscal deficits is evident.

Factors That Affect The Indian Stock Market

The Indian stock market is influenced by a range of factors, categorized into economic, political, and market-specific reasons. Economic indicators, such as GDP growth and inflation rates, act as crucial core factors. Any change in the market after GDP and inflation numbers reflects the market’s responsiveness to the nation’s economic health.

Political stability and government policies, like majority government, budgetary announcements, and regulatory reforms, have a significant impact on the stock market.

Market-specific factors, like corporate earnings reports and valuations, further contribute to the changes in the Indian stock market.

Understanding these interconnections is vital for investors to understand what factors affect the Indian stock market.

Topics

#1. Economic Indicators

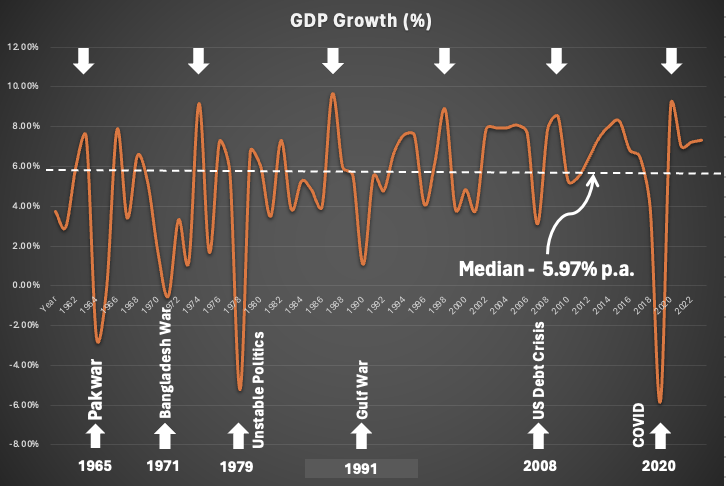

#1.1 GDP Growth

The Indian stock market is significantly swayed by GDP growth, a key economic indicator. During periods of robust GDP expansion, such as the late 1990s and early 2000s, the stock market experienced notable bullish trends. Investors witnessed this correlation as a flourishing economy translated into increased corporate profits, propelling stock prices upwards.

Conversely, economic downturns, like the slowdown in the late 2000s, often coincided with bearish market conditions, demonstrating the market’s sensitivity to GDP contractions.

Examining the historical context, India’s economic liberalization in the early 1990s led to accelerated GDP growth. This period witnessed a surge in stock market activity, with notable companies like Infosys capitalizing on the expanding economic landscape.

Furthermore, after the global financial crisis of 2008, concerted efforts to stimulate economic growth contributed to a recovery in stock market performance.

Therefore, understanding the nuances of GDP growth is crucial for investors to preempt what effects it will have on the market movements.

#1.2 Inflation Rates

Inflation rates also exert a significant influence on the Indian stock market. Moderate inflation is generally conducive to a healthy market environment, ensuring stable pricing and encouraging consumer spending. However, high inflation can erode purchasing power and impact corporate profitability, leading to market uncertainties.

For instance, during periods of elevated inflation in the mid-2010s, the stock market experienced volatility as investors grappled with the implications of rising prices.

The early 2000s witnessed moderate inflation, contributing to bullish market sentiment. Contrastingly, the mid-2010s, marked by inflationary pressures, demonstrated a more cautious investor approach.

Government measures to control inflation, as seen in the early 2010s, influenced market dynamics positively.

Comprehending the relationship between inflation rates and market trends is essential for investors. Because unexpected changes in inflation rates can cause the market to slip or jump.

#1.3 Currency Movement

Currency movement significantly influences the Indian stock market. Fluctuations in the exchange rates of the Indian Rupee against major currencies can have profound implications for various sectors.

A depreciating rupee can impact industries dependent on imports, leading to higher costs for raw materials and impacting profit margins. Conversely, an appreciating rupee may benefit import-dependent sectors but could pose challenges for export-oriented industries.

Historical examples highlight the impact of currency movements on the stock market. During the global financial crisis of 2008, the Indian Rupee depreciated sharply against the US Dollar. This depreciation, while challenging for importers, benefited export-oriented sectors like information technology and pharmaceuticals. Hence, stocks of these companies outperformed in the stock market.

Additionally, periods of currency stability, as observed in the mid-2010s, have provided a conducive environment for investor confidence. However, sudden currency volatility, such as during geopolitical uncertainties, can lead to cautious market sentiments.

Pro Investors keenly monitor currency movements as part of their risk assessment and decision-making processes. The currency market and the stock market are deeply related. Hence, understanding the dynamics between exchange rates, corporate earnings, and their economic impact on the nation is crucial.

#1.4 Employment Rate

The employment rate serves as a critical factor influencing the Indian stock market, reflecting the overall health of the economy. A high employment rate is indicative of robust economic activity, positively impacting consumer spending and corporate profits.

During the economic liberalization in the 1990s, rising employment rates paralleled a surge in economic growth, contributing to a bullish trend in the stock market.

Conversely, periods of high unemployment can lead to reduced consumer spending, affecting demand for goods and services and, subsequently, corporate earnings. The global economic slowdown in the late 2000s saw increased unemployment, contributing to cautious investor sentiments and market challenges.

Government policies and economic reforms also influence employment trends. For instance, initiatives focusing on skill development and job creation, such as the ‘Make in India‘ campaign in the mid-2010s, contributed to positive market responses.

The link between employment rates and the stock market is an important factor that we retail investors must learn to watch and comprehend.

#2. Government Policies

#2.1 Interest Rate (Repo Rate)

It holds considerable sway over the Indian stock market. The Repo Rate, the rate at which the Reserve Bank of India (RBI) lends money to commercial banks, directly influences borrowing costs in the economy.

A lower Repo Rate encourages borrowing and spending, stimulating economic activity, and potentially boosting corporate earnings. Conversely, a higher Repo Rate can lead to increased borrowing costs, potentially dampening economic growth and affecting stock market performance. Read about the business model of banks.

Examining historical instances, during the early 2000s, the RBI adopted a series of rate cuts to stimulate economic growth, coinciding with a bullish trend in the stock market. Conversely, in the mid-2010s, the RBI initiated a tightening cycle with rate hikes to combat inflation, contributing to a more cautious market sentiment.

The RBI’s broader policy stance, encompassing measures beyond the Repo Rate, also shapes market dynamics. For example, during the economic liberalization in the 1990s, policy shifts towards openness contributed to increased foreign investment, impacting stock market trends positively.

Pro investors keenly monitor RBI policy decisions as they signal the central bank’s stance on economic conditions.

#2.2 Budgetary Announcements

Government budgetary announcements wield significant influence over the Indian stock market. The Union Budget, presented annually, outlines the government’s fiscal policies, expenditure plans, and taxation measures.

Positive budgetary announcements, such as tax cuts or increased infrastructure spending, can boost investor confidence and contribute to a bullish market sentiment. For instance, in the early 2000s, the reduction in corporate tax rates announced in the budget positively impacted stock prices, as this decision was considered pro-business.

Conversely, budgetary measures perceived as unfavorable, such as increased taxes or fiscal deficits, can lead to market uncertainties and potential declines.

The mid-2010s witnessed a cautious market response to fiscal challenges outlined in the budget, signaling investor concerns.

Monitoring budgetary announcements is crucial for investors to anticipate potential market movements and align their investment strategies accordingly.

#2.3 Reforms and Regulations

Government reforms and regulatory changes play a pivotal role in giving direction to the Indian stock market. Structural reforms aimed at improving the business environment and fostering economic growth often result in positive market reactions. For example, in the 1990s, economic liberalization measures opened up the Indian economy, attracting foreign investments and contributing to a surge in stock market activity.

Conversely, regulatory changes that introduce uncertainties or restrictions can impact specific industries and dampen investor sentiment. Instances of regulatory challenges in sectors like banking or telecommunications have led to short-term market volatility.

Government initiatives addressing these concerns, however, have demonstrated the potential for market recovery.

Historical examples underscore the market’s responsiveness to government policies. It emphasizes the importance, for equity investors, of staying informed about the evolving economic and regulatory landscape.

#2.4 Infrastructure Spendings

Government-led infrastructure development plays a pivotal role in influencing the Indian stock market. Infrastructure initiatives, such as the Golden Quadrilateral project launched in the late 1990s, have historically spurred economic growth and positively impacted related sectors.

The construction, engineering, and cement industries, among others, witnessed significant market activity and stock value appreciation during these periods.

For example, the mid-2000s saw increased government focus on infrastructure, including the National Highways Development Project (NHDP), contributing to a bullish trend in the stock market. Companies involved in road construction, transportation, and allied sectors experienced notable gains.

Conversely, delays or disruptions in infrastructure projects can have adverse effects on the stock market. Instances of stalled projects or funding challenges can lead to market uncertainties. The mid-2010s, marked by a push for infrastructure development, demonstrated positive market responses.

When the government emphasized investment in areas like highway construction, smart cities, and affordable housing, it provided a great boost to the realty sector.

#3. Market Specific Factors

#3.1 Corporate Earnings

Corporate earnings have a substantial influence over the Indian stock market. The financial performance of companies, as reflected in their earnings reports, serves as a crucial barometer for investors.

When companies report strong earnings, it often translates into higher stock prices, reflecting positive investor sentiment. Historical data from the late 1990s showcases this correlation, with the IT sector, led by companies like Infosys, experiencing a surge in stock prices due to robust earnings in the backdrop of the technology boom.

However, periods of economic downturn or challenges faced by specific industries can result in lower corporate earnings. This can trigger declines in stock prices. For instance, during the global financial crisis of 2008, many companies across sectors reported diminished earnings contributing to a bearish market sentiment.

After the crisis, concerted efforts to revive economic growth positively influenced corporate earnings and, in turn, the stock market.

Expert investors keenly analyze earnings reports to gauge the financial health and growth potential of companies. Positive surprises or disappointments in earnings often lead to immediate market reactions.

#3.2 Valuation of The Market

Overvaluation, marked by a prolonged bull run, and undervaluation, characterized by a sustained bear market, are critical factors impacting the stock market.

When stock prices surge beyond the intrinsic value of companies, it signals overvaluation and raises concerns of an impending market correction. In the late 1990s, the Indian IT sector experienced a prolonged bull run, exemplifying a situation of overvaluation. Subsequently, the early 2000s witnessed a correction as stock prices adjusted to more realistic valuations.

On the flip side, undervaluation occurs when stock prices remain persistently low, often driven by economic downturns or negative sentiment. The global financial crisis of 2008 resulted in a sustained bear market, affecting various sectors in India and leading to undervaluation.

Undervaluation can present buying opportunities for investors, as was evident during the recovery period after the 2008 crisis and the 2020 COVID crisis.

Both scenarios emphasize the importance of market valuations in guiding investment decisions. Investors must be vigilant to identify signs of overvaluation or undervaluation. We can consider historical instances like the 2000 dot-com bubble and the 2008 financial crisis to pre-judge the movements of the stock market.

#4. Other Factors

#4.1 Global Events

Global events wield a substantial impact on the Indian stock market, reflecting the interconnected nature of the global economy. International market trends and geopolitical events can reverberate across borders, influencing investor sentiment and market dynamics.

For instance, during the dot-com bubble burst in the early 2000s, global market uncertainties had a cascading effect on the Indian stock market, leading to a period of correction.

Similarly, the global financial crisis of 2008 had profound implications for India’s stock market, with widespread sell-offs and economic challenges. Conversely, periods of global economic growth, such as the mid-2010s, provided a favorable backdrop for the Indian stock market, contributing to positive investor sentiment.

Moreover, trade tensions between major global economies, like the US-China trade dispute in the late 2010s, had ripple effects on the Indian stock market. The imposition of tariffs and uncertainties surrounding international trade impacted sectors reliant on global markets, shaping market trends.

Understanding these global influences is essential for investors, as events beyond national borders can significantly affect the performance of the local stock market.

#4.2 Political Environment

The political environment, characterized by either stability or instability, exerts a significant influence on the Indian stock market. Political stability fosters investor confidence and positively impacts the stock market. For example, the economic liberalization policies initiated in the 1990s brought about a stable political environment. It contributed to a surge in foreign investments and robust stock market performance.

Alternatively, periods of political instability can lead to market uncertainties and volatility. Instances of coalition governments and policy uncertainties have historically resulted in cautious investor sentiments.

The early 2000s witnessed a shift towards more stable political conditions, coinciding with a bullish trend in the stock market.

On the other hand, political events such as the 2019 general elections, where a decisive outcome emerged, alleviated uncertainties, leading to positive market responses.

Political stability is particularly crucial for policy continuity and economic reforms. A stable political environment enhances the ease of doing business, contributing to a favorable climate for investors.

#4.3 Commodity Prices

Commodity prices play a crucial role in influencing the Indian stock market, impacting various sectors tied to commodities. Fluctuations in the prices of commodities such as oil, metals, and agricultural products can have widespread consequences on the performance of related industries. For instance, during the oil price shocks in the early 1990s, the Indian stock market experienced volatility in sectors like transportation and energy.

A substantial portion of India’s imports comprises commodities, making the economy susceptible to global price movements. During periods of rising commodity prices, sectors reliant on imports, like manufacturing and infrastructure, face increased costs, potentially impacting profit margins. Conversely, falling commodity prices can benefit industries dependent on raw material imports.

Historical examples, such as the global economic slowdown in the late 2000s, showcase how a decline in commodity prices can lead to reduced inflationary pressures. It positively impacts the stock market.

#4.4 Force Majeure

Force majeure events, encompassing natural disasters and pandemics, wield a profound impact on the Indian stock market. It disrupts economic activities and investor sentiment. For instance, during the global financial crisis of 2008, a financial force majeure, the Indian stock market experienced significant declines. It reflected the widespread impact of the crisis on global economies.

Natural disasters like earthquakes, floods, or cyclones can disrupt supply chains, affecting industries such as manufacturing and infrastructure. The COVID-19 pandemic in 2020 serves as a stark example of a health-related force majeure event. The strict lockdown measures to curb the virus’s spread resulted in economic disruptions, leading to a temporary market downturn.

Investors, during force majeure events, often adopt a risk-averse approach, impacting market liquidity and valuations.

Government responses, policy measures, and the resilience of specific industries determine the market’s ability to recover.

Conclusion

Understanding the factors that affect the Indian stock market is crucial for equity investors. Economic indicators like GDP growth and inflation rates, exemplified by the robust growth during the early 2000s, are integral in shaping market trends. Government policies, such as budgetary announcements and regulatory reforms, play a pivotal role, as seen in the positive market response to economic liberalization in the 1990s.

The interplay of global factors, illustrated by the impact of the 2008 global financial crisis, highlights the interconnected nature of markets. Corporate earnings, exemplified by the technology sector’s success in the late 1990s, are paramount, directly influencing stock prices. Factors like the Repo Rate and RBI policy, as showcased in the mid-2010s, underscore the importance of monetary measures in market dynamics.

Moreover, external influences like currency movements and unforeseen events, including force majeure instances like the COVID-19 pandemic, have far-reaching consequences. Overvaluation and undervaluation, demonstrated by the dot-com bubble and the 2008 financial crisis, further emphasize the need for vigilant market analysis.

For both seasoned and novice investors, recognizing and adapting to these factors ensures informed decision-making. It helps in successfully navigation through the ever-changing terrain of the stock market.

Have a happy investing.

Suggested Reading: