Deciphering the factors that influence company valuations is crucial for investors. Two key metrics that play a pivotal role in valuations are profitability and growth rate. We’ll understand how profitability and growth collectively affect the valuations of companies. We’ll use examples to get a hold of this correlation.

Effect of Profitability (Example #1)

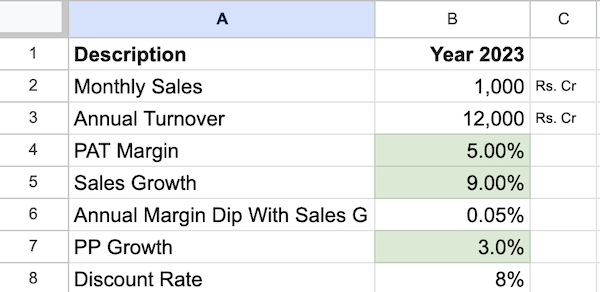

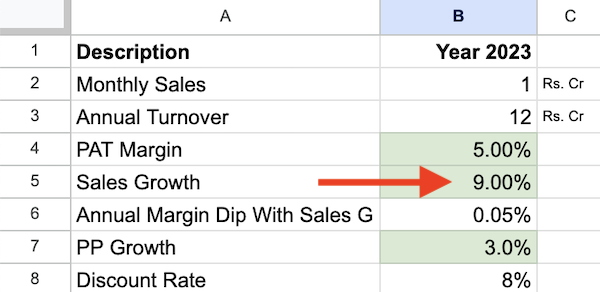

Suppose there is a company that makes an average annual sales of Rs.12 crores. The company operates at an average Net Profit Margin (PAT Margin) of 5%. It is expected that in the next five years, the company’s sales and profit will grow at a rate of 9% per annum. As the company grows in size, I’ve assumed a 0.05% dip in profit margin.

Beyond the fifth year onwards, the company is expected to grow at a perpetual growth rate (PP Growth) of 3% per annum.

I’ve also assumed a discount rate of 8% per annum. Why I’m considering 8%? I’m thinking from the perspective of a potential investor. If I do not invest in shares of this company, I can easily earn a return of 8% per annum from near-risk-free options like debt funds, etc. Read more about using discount rates here.

Now, I will apply these numbers to my Discounted Cash Flow (DCF) Model, to estimate the future value of all future cash flows of the company.

Using these values as my reference, the estimated price valuation (Intrinsic Value) of the company comes out to be Rs.14.15 Crore. Just for our reference, we can express this valuation as follows:

- Price To Sales Ratio (P/S): 1.18

- Price To Earnings Ratio (P/E): 23.59

Effect of Profitability Enhancement

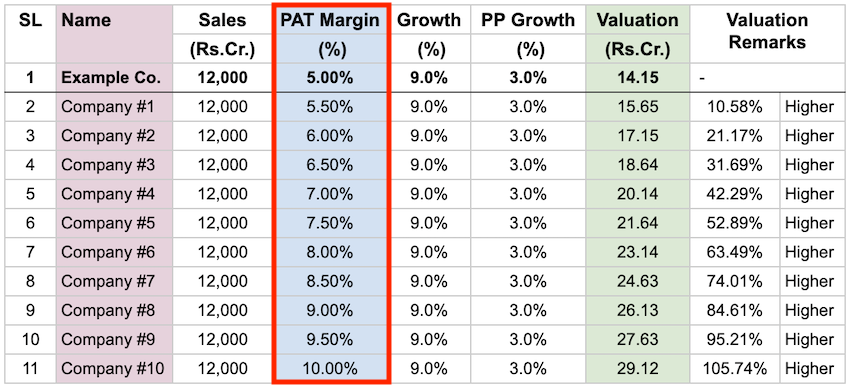

Now let’s consider a hypothetical situation. Suppose, there are 10 other companies with a similar kind of business models operating in the market. Each of these companies has a profitability number higher than our example company. I’ll assume the other metrics to be the same.

Let’s examine the impact of high profitability on the company’s price valuation:

Here is the observation:

Observation: For a 1% enhancement in PAT Margin, the price valuation of the company increases by about 20%. So we conclude that even small increments in profitability can dramatically enhance the company’s valuations.

Effect of Growth Rate (Example #2)

We’ll again start with the same example company.

The company reported sales of Rs.12 crores and operates at a PAT Margin of 5%. The company is expected to grow, in the next five years, at a rate of 9% per annum. For valuation purposes, I’ve also assumed that the company’s margins will dip by 0.05% as it grows over time.

Beyond the fifth year onwards, the company is expected to grow at a constant perpetual growth rate (PP Growth) of 3% per annum. Again, as per the Discounted Cash Flow (DCF) Model, the estimated intrinsic value of the company comes out to be Rs.14.15 Crore.

Effect of Growth Rate (Type #1) Enhancement

There are two types of growth rates assumed in the DCF model, the first is called the “normal period growth rate” and the second is the “perpetual growth rate.” This section talks about the ‘normal period growth rate.’

[Note: Normal period growth rate is assumed for a period next 5 years. Beyond the fifth year, the perpetual growth rate is considered for calculation.]

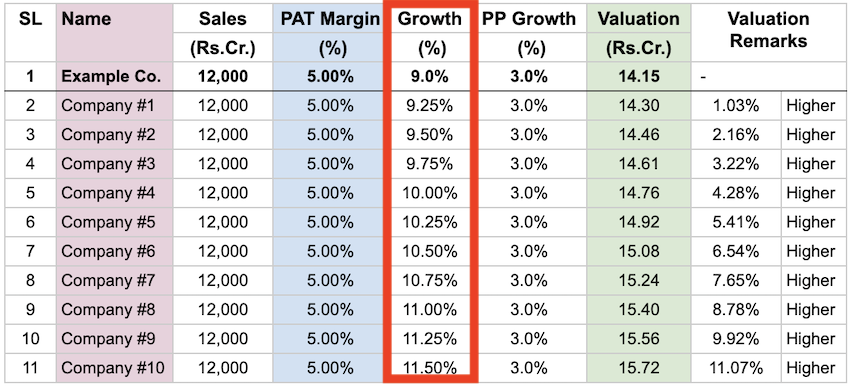

Again, let’s consider the hypothetical situation of 10 other companies with similar kinds of business models. Each company has a future growth rate higher than our example company. I’ll assume the other metrics to be the same.

Let’s examine the impact of growth rate on the company’s intrinsic value:

Here is the observation:

Observation: For a 1% enhancement in the normal period growth rate, the price valuation of the company increases by about 4%. So we conclude that though this growth rate metric affects the company valuation its impact is only limited.

Effect of “Perpetual Growth Rate” (Example #3)

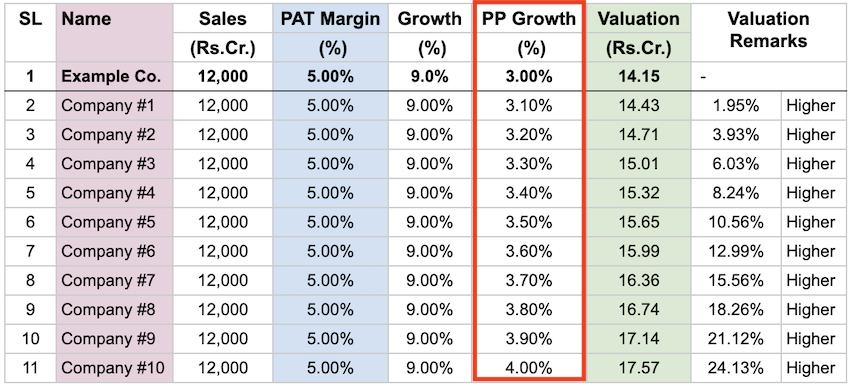

The perpetual growth rate in the DCF model represents the sustainable, long-term growth rate. It is the rate at which a firm’s free cash flows are expected to grow indefinitely. Perpetual growth rate assumes that the company will maintain consistent growth beyond the explicit forecast period.

In a company price valuation, the perpetual growth rate is one of the most critical metrics. Even a small degree of over or underestimation of this metric can change the valuation by a lot.

As we have done earlier, we’ll again consider a hypothetical situation of 10 other companies with similar business models. For each company, we’ll assume a perpetual growth rate higher than our example company. I’ll assume the other metrics to be the same.

Let’s examine the impact of perpetual growth rate on the company’s intrinsic value:

Here is the observation:

Observation: For a 1% enhancement in the perpetual growth rate, the price valuation of the company increases by about 24%. So, compared to other metrics like ‘PAT Margin’ and ‘normal period growth rate’, intrinsic value is most sensitive to the perpetual growth rate.

Conclusion

The article tries to meticulously dissect the intricate relationship between company valuations and two fundamental metrics – Profitability and Growth Rate.

Employing a practical example, the article navigates through the profit margin, normal period growth, and perpetual growth rate. Using a Discounted Cash Flow (DCF) model for valuation, it tries to quantify the impact of these metrics on the intrinsic value. We say how even subtle shifts in these metrics can impact the intrinsic value.

The first scenario emphasizes the effect of profitability enhancement, showcasing a direct correlation between higher PAT Margin and augmented valuations. The analysis points out that a mere 1% increase in PAT Margin translates to a substantial 20% surge in the company’s valuation.

Moving to the Normal Period Growth Rate, the observation suggests a relatively limited impact compared to Profitability metrics. A 1% increment in the growth rate leads to a moderate 4% rise in valuation.

Finally, the perpetual growth rate takes the spotlight. It reveals its outsized influence on intrinsic value. It was observed that a 1% enhancement in the perpetual growth rate propels the company’s valuation by a staggering 24%.

This article can be our strategic guide emphasizing the critical importance of Profitability and Growth Rate in shaping company valuations.

Have a happy investing.

Suggested Reading: