If you are new to investing and are curious about mutual fund tax rules, this article will help. The tax landscape can be overwhelming for beginners as different types of investments are taxed diversly. In this blog post, let’s break down mutual fund taxation in India with simple explanations and real-world examples. My approach to this article will be FAQ style.

In the last few years, income tax rules applicable to mutual fund investments have changed. From my perspective, it has become a tad bit more complicated. Over the past periods, I’ve received questions from my readers on mutual fund taxation. In this article, I’ll try to demystify the complexities of mutual fund taxation in India.

The article will take up a few key questions on dividend taxation, capital gains treatment, and tax benefits offered by specific funds.

Whether you’re a seasoned investor or just starting, this FAQ-style breakdown will explain this subject matter more clearly.

We’ll also explore tax implications for different types of funds.

Topics on Mutual Fund Taxation:

FAQ #1: How dividends are taxed in Mutual Funds?

Are dividends received from both direct equities and equity funds taxable for investors?

Yes, dividends from both direct equities and equity funds are taxed.

Until the Assessment Year 2020-21, shareholders receiving dividends from domestic companies were exempt from tax under section 10(34) of the Act. Though DDT (Dividend Distribution Tax) under section 115-O was payable by the company declaring the dividends. But this tax-free rule ended in 2020.

As per the Finance Act of 2020, the dividends are now taxed directly in the hands of the investors. The dividends received by the investors are taxed as per the applicable tax slab of the investor.

However, the handling of dividends in the hands of the person will change depending on whether the person is a trader or an investor.

- Traders: Dividends earned from trading activities are taxed as business income. For dividends taxed as business income, the person receiving the dividend can deduct certain expenses that were incurred in the process of earning that income. These expenses can be bank charges, brokerage charges, transaction costs, interest paid on loans associated with the investment, etc.

- Investors: Investments leading to dividend income are taxable under the head of income from other sources. For dividends taxed under income from other sources, only interest expenditure up to 20% of total dividend income is deductible.

As per Section 194, from 01-04-2020 TDS on dividends distributed must be deducted. Mutual fund companies deduct a 10% TDS for resident shareholders if the dividend exceeds Rs.5,000.

FAQ #2: How are long-term capital gains taxed for mutual funds?

What is the tax treatment for capital gains in both stocks and mutual funds?

Earlier, the tax liability arising due to long-term capital gains (LTCG) was zero. But now income tax must be paid on both long-term and short-term capital gains (STCG). Let’s see how.

- STCG – Short-term capital gains tax: On equity investments where STT (Securities Transaction Tax) is not applicable, the gains get added to our income. The cumulative income is then taxed as our applicable income tax slab. Examples of such investments are preference shares, debentures, derivatives, etc.

- STCG – Short-term capital gains tax (Stocks): On equity investments where STT (Securities Transaction Tax) is applicable (such as shares) STCG is taxed at a flat rate of 15%.

- LTCG – Long-term capital gains tax (Stocks). The gains are from equity, like direct stocks, they are taxed at a fixed rate of 10%.

The above tax rules apply to a few typical types of equity investments like stocks, preference shares, etc. The income tax rules are slightly different for equity and debt mutual funds.

| SL | Types of Mutual Funds | STCG | LTCG |

| 1 | Equity Funds (Equity Weight > 65%) | 15% | 10% if gains are more than Rupees One Lakh in a FY. |

| 2 | Hybrid Funds (35% < Equity Wt. < 65%) | As per one’s Income Tax Slab | 20% with indexation benefits |

| 3 | Debt Funds (Equity Weight < 35%) | As per one’s Income Tax Slab | As per one’s Income Tax Slab |

High-income earning individuals must also pay a surcharge on their income.

| Taxable Income | Max Surcharge |

| < Rs 50 lakhs | Nil |

| Rs 50 lakhs < Income ≤ Rs 1 Crore | 10% |

| Rs 1 Crore < Income ≤ Rs 2 Crore | 15% |

| > Rs 2 Crore | 25% |

| > Rs 2 Crore (LTCG or Dividends) * | 15% |

* From AY 2023-24, the tax surcharge payable for dividend or LTCG income and capital gain (Section 112) will be a maximum of 15%. Please note that the maximum 15% rule is only applicable for the component of income coming from LTCG and Dividends.

Suppose there is a person whose net taxable income is say Rs.5 crore. How will his income be taxed after applying the surcharge?

FAQ #3: What will be the tax liability when taxable income is Rs.5 Crore?

Step 1: Applying Tax Slabs

- Up to Rs. 300,000: Nil tax (exempt)

- Rs. 3,00,000 to Rs. 6,00,000: Rs. (6,00,000 – 3,00,000) * 5% = Rs. 15,000

- Rs. 6,00,000 to Rs. 9,00,000: Rs. (9,00,000 – 6,00,000) * 10% = Rs. 30,000

- Rs. 9,00,000 to Rs. 12,00,000: Rs. (12,00,000 – 9,00,000) * 15% = Rs. 45,000

- Rs. 12,00,000 to Rs. 15,00,000: Rs. (15,00,000 – 12,00,000) * 20% = Rs. 60,000

- Rs. 15,00,000 to Rs. 5,00,00,000: Rs. (5,00,00,000 – 15,00,000) * 30% = Rs. 1,45,50,000

Step 2: Calculate Total Tax

Total Tax = Sum of tax from each slab = Rs. 15,000 + Rs. 30,000 + Rs. 45,000 + Rs. 60,000 + Rs. 1,45,50,000 = Rs. 1,47,50,000

Cess @ 4% on Rs. 1,47,50,000 = Rs. 5,88,000

Step 3: Apply Surcharge

Since the net taxable income exceeds Rs. 2 Crore, a surcharge of 25% applies.

Surcharge = 25% * Rs. 1,47,50,000 (Total Tax) = Rs. 36,75,000

[Please note that in case the source of the said income is either a dividend or capital gain, the maximum surcharge applicable will be 15%]

Step 4: Calculate The Final Income Tax Payable

Income Tax Payable = Total Tax + Cess + Surcharge = Rs. 1,47,50,000 + Rs. 5,88,000 + Rs. 36,75,500 = Rs. 1,89,63,000

Therefore, the income tax payable by the individual with a net taxable income of Rs. 5 Crore is Rs. 1,89,63,000.

Step 5: Calculate The Effective Tax Rate

Effective Tax Rate = Rs. 1,89,63,000 / 5,00,00,000 = 37.93%

FAQ #4: How are short-term capital gains taxed for mutual funds?

How are short-term capital gains taxed for both equity and equity funds?

Short-term capital gains (STCG) in both stock and equity funds are subject to tax. If you sell your investment within a year, a 15% tax is levied on the gains.

Imagine buying shares or investing in an equity fund and selling them after just nine months. The profit made in this trade is say Rs.20,000. In this scenario, Rs.3,000 (15% of Rs.20,000) would be the short-term capital gains tax.

This tax on short-term gains is designed to encourage long-term investments. It nudges investors to stay committed and reap the benefits of lower taxes after holding an investment for more than a year.

STCG for fund types other than equity funds are taxed at one’s tax slab rates.

| Mutual Funds | STCG |

| – Equity Fund (> 65% Equity) | 15% |

| – Debt Fund (< 35% Equity) | Slab rate |

| – Other Fund (35%< Equity < 65%) | Slab rate |

| – Dividends (for all funds) | Slab rate |

[Note: Quick gains might be tempting. However, holding onto investments for longer periods can lead to more significant financial gains. How? Because tax treatment of LTCG is more advantageous (10%).]

FAQ #5: What are ELSS funds, and what tax benefits do they offer?

ELSS (Equity Linked Savings Scheme) funds are a special category of equity mutual funds with a distinct tax advantage.

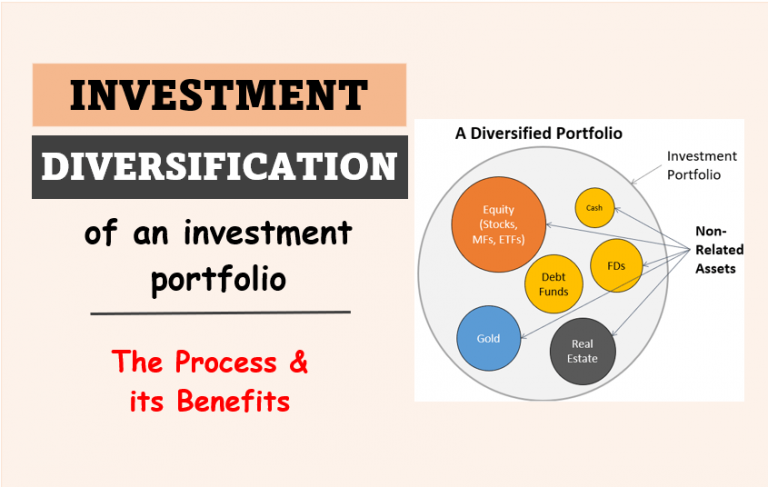

Investing in ELSS funds is similar to investing in any other regular equity mutual funds. Here also the investors buy a diversified portfolio of stocks. However, ELSS funds come with a unique benefit – tax exemption under Section 80C of the Income Tax Act.

- Tax Savings: Here’s what makes ELSS special over other equity funds: Investing in ELSS, we can enjoy a tax deduction of up to Rs.1,50,000 annually from our total income. This is a substantial advantage and makes ELSS a preferred choice for tax-conscious investors in India.

- What’s so special about tax savings: Picture this: you invest Rs.1,50,000 in ELSS, and at the same time, you can reduce your taxable income by an equivalent amount. Investing in equity mutual funds is advantageous, getting a tax advantage out of it gives it that extra wow factor.

ELSS funds come with a compulsory lock-in period of three years. During this period, we can’t redeem or withdraw our funds. While this might seem restrictive, it aligns with the broader rules of equity investing.

ELSS funds exemplify the dual benefit of wealth creation and tax savings. For beginners in the equity market, considering ELSS is a smart move. Remember, ELSS is a tax-saving tool that potentially brings financial growth.

FAQ #6: How do debt mutual funds offer a tax advantage compared to direct debt instruments?

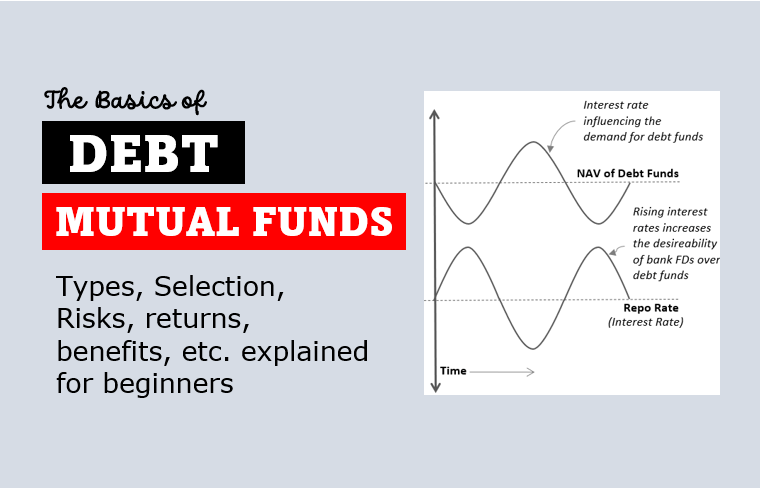

Earlier, all mutual funds whose equity weight was less than 65% (called debt funds) were more tax-efficient. Why? Because they could offer indexation benefits. But now (after 01-April-2023), only those funds whose equity weight is between 35% and 65% will get the indexation benefits.

Schemes, whose equity weight is less than 35% shall not be eligible for the indexation benefit. All gains from these funds will be considered as short-term capital gains irrespective of the holding period.

| Type of Funds | Before 01-Apr-2023 | After 01-Apr-2023 |

| Equity Funds (Equity weight >= 65%) | No Indexation Benefits | No Indexation Benefits |

| Hybrid Funds (Equity Weight Between 35% and 65%) | With Indexation Benefits | With Indexation Benefits |

| Pure Debt Funds (Equity weight <=35%) | With Indexation Benefits | No Indexation Benefits |

[Note: Debt funds (equity weight < 65%) that were purchased before 01-Apr-2023 will continue to get indexation benefits.]

So, does it mean that fixed deposits by banks and pure debt funds are now at par in terms of tax treatment? Yes, now pure debt funds, bonds, and fixed deposits have a level playing field.

To know more about the indexation benefits of debt mutual funds, read this detailed article.

FAQ #7: Do STT charges are Tax deductible?

Securities Transaction Tax (STT) applies to equity mutual funds when they are sold or redeemed. It’s important to note that STT doesn’t apply to the purchase of equity funds or to other types of mutual funds. Other types of mutual funds are those whose equity weight is less than 65% (like debt funds, hybrid funds, or some ETFs).

Here’s how STT is applied to equity funds:

- Rate: Currently, the STT rate for selling or redeeming equity funds is 0.001% of the transaction value.

- Payment: The STT is deducted automatically by the stock exchange at the time of the transaction. The STT so collected is deposited to the government by the exchange. One need not pay it separately.

- Impact on returns: The STT reduces our overall returns by a small amount. For example, if we sell Rs.10,000 worth of equity funds, the STT would be Rs.10 (0.001% of Rs.10,000).

[Note: STT is not deductible from our capital gains tax liability. STT is a transaction tax, not an income tax. It doesn’t affect your income tax bracket or tax calculations.]

Conclusion

Tax rules are dynamic and staying updated on changes is crucial. This article equips you with the knowledge to navigate the current rules.

Remember, tax-efficient investing is a marathon, not a sprint. By strategically choosing funds we can save more tax than we think. Leveraging tax benefits like ELSS, and holding our investments for the long term can do the trick. We can unlock the full potential of mutual funds only when we learn to minimize the tax burden.

Allow me to summarize how the mutual fund gains are taxed as compared to direct stocks:

| Investment Types | STCG | LTCG | Indexation |

| Mutual Funds | – | – | – |

| – Equity Fund (> 65% Equity) | 15% | 10% | Not Available |

| – Debt Fund (< 35% Equity) | Slab rate | Slab rate | Not Available |

| – Other Fund (35%< Equity < 65%) | Slab rate | 20% | Available |

| – Dividends (for all fund types) | Slab rate | Slab rate | Not Available |

| Stocks | – | – | – |

| – Equity (STT applicable like normal shares) | 15% | 10% | Not Available |

| – Equity (STT not applicable like preference shares, debentures, etc) | Slab rate | 10% | Not Available |

| – Dividends (for all stock types) | Slab rate | Slab rate | Not Available |

* ELSS are equity funds whose equity weight is higher than 65%. So its STCG and LTCG tax handling will be the same as any equity funds. However, investments in ELSS funds are tax deductible under section 80C up to a maximum limit of Rs.1,50,000.

I hope this article gave you an idea about how mutual funds are taxed in India.

Have a happy investing.

Suggested Reading: