Nifty Price Movement (Last 5 Years)

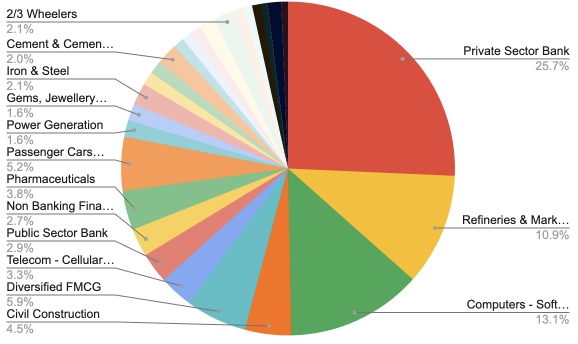

Nifty 50 Stocks by Weightage

| Company | Sector | Weightage (%) |

|---|

Introduction

The Nifty 50 is the most observed index of the Indian stock market. It is a barometer for market performance in India. For investors in Indian stocks, understanding the weightage of stocks in the Nifty 50 Index is crucial. In this article, we delve into the intricacies of Nifty Weightage. We’ll explore the methodology behind it. We will also know about free float market capitalization and the Investible Weight Factor (IWF). Both these terms are related to the calculation of Nifty 50 stock’s weightage in the index (see Nifty 50 stock list here).

Check the weightage of stocks in the Sensex.

The Nifty 50 Index is managed by the National Stock Exchange (NSE). The index comprises 50 of the largest and most actively traded stocks on the exchange.

As an indicator of the market’s health, the index reflects the overall performance of the Indian stock market. As a stock investor, we must know to comprehend how each stock contributes to the Nifty’s movement. The stocks with the highest weightage in the index contribute most to the index’s momentum.

Nifty Weightage is a measure that determines the relative importance of individual stocks within the Nifty 50 Index. This weightage is not arbitrary but is meticulously calculated. It uses a methodology that considers the free float of shares, known as Investible Weight Factors (IWFs).

Nifty 50 Listed Companies With Weightage

[Last Updated: January 03, 2025]

| SL | Name | Industry | Price | Mcap Full (Cr.) | M.Cap FF (Cr.) | WEIGHT(%) |

|---|---|---|---|---|---|---|

| 1 | HDFC Bank | Private Sector Bank | 1,797.85 | 1,374,945.30 | 1,361,195.85 | 12.74 |

| 2 | ICICI Bank | Private Sector Bank | 1,307.15 | 922,703.05 | 922,703.05 | 8.64 |

| 3 | RIL | Refineries & Marketing | 1,220.95 | 1,652,235.07 | 826,117.53 | 7.73 |

| 4 | Infosys | Computers – Software & Consulting | 1,916.50 | 795,782.39 | 692,330.68 | 6.48 |

| 5 | ITC | Diversified FMCG | 478.90 | 5,99,811.40 | 443,860.43 | 4.16 |

| 6 | Bharti Airtel | Telecom – Cellular & Fixed line services | 1,598.95 | 914,181.20 | 429,665.16 | 4.02 |

| 7 | L&T | Civil Construction | 3,611.00 | 496,559.67 | 422,075.72 | 3.95 |

| 8 | TCS | Computers – Software & Consulting | 4,152.00 | 1,502,229.94 | 420,624.38 | 3.94 |

| 9 | Axis Bank | Private Sector Bank | 1,077.85 | 333,590.76 | 306,903.50 | 2.87 |

| 10 | SBI | Public Sector Bank | 799.55 | 713,567.99 | 306,834.24 | 2.87 |

| 11 | M&M | Passenger Cars & Utility Vehicles | 3,050.10 | 379,288.73 | 269,295.00 | 2.52 |

| 12 | Kotak Mahindra Bank | Private Sector Bank | 1,758.25 | 349,568.96 | 258,681.03 | 2.42 |

| 13 | HUL | Diversified FMCG | 2,342.00 | 550,274.27 | 209,104.22 | 1.96 |

| 14 | Sun Pharma | Pharmaceuticals | 1,861.70 | 446,673.28 | 201,002.98 | 1.88 |

| 15 | HCL Tech | Computers – Software & Consulting | 1,891.65 | 512,814.86 | 199,997.80 | 1.87 |

| 16 | Bajaj Finance | Private Sector Bank | 6,910.10 | 427,732.65 | 192,479.69 | 1.80 |

| 17 | NTPC | Power Generation | 335.00 | 324,838.32 | 159,170.77 | 1.49 |

| 18 | Tata Motors | Passenger Cars & Utility Vehicles | 750.55 | 276,286.83 | 157,483.49 | 1.47 |

| 19 | TRENT | Speciality Retail | 7,118.80 | 253,064.41 | 156,899.94 | 1.47 |

| 20 | Maruti | Passenger Cars & Utility Vehicles | 10,946.30 | 344,154.49 | 144,544.89 | 1.35 |

| 21 | Power Grid | Power – Transmission | 309.55 | 287,900.19 | 141,071.09 | 1.32 |

| 22 | Titan Co | Gems, Jewellery And Watches | 3,305.05 | 293,417.76 | 137,906.35 | 1.29 |

| 23 | Ultratech | Cement & Cement Products | 11,375.05 | 328,395.49 | 128,074.24 | 1.20 |

| 24 | Tata Steel | Iron & Steel | 138.95 | 173,457.44 | 114,481.91 | 1.07 |

| 25 | Tech Mahindra | Computers – Software & Consulting | 1,711.80 | 167,548.77 | 108,906.70 | 1.02 |

| 26 | BEL | Aerospace & Defense | 292.15 | 213,555.19 | 104,642.04 | 0.98 |

| 27 | Asian Paints | Paints | 2,274.00 | 218,121.58 | 102,517.14 | 0.96 |

| 28 | BAJAJ-AUTO | 2/3 Wheelers | 8,946.50 | 249,837.82 | 99,935.13 | 0.94 |

| 29 | GRASIM | Cement & Cement Products | 2,488.00 | 169,328.45 | 94,823.93 | 0.89 |

| 30 | ONGC | Oil Exploration & Production | 236.85 | 297,963.91 | 92,368.81 | 0.86 |

| 31 | ADANIPORTS | Port & Port services | 1,233.00 | 266,345.13 | 90,557.34 | 0.85 |

| 32 | HINDALCO | Aluminium | 618.00 | 138,878.60 | 90,271.09 | 0.85 |

| 33 | Wipro | Computers – Software & Consulting | 309.10 | 323,563.06 | 87,362.03 | 0.82 |

| 34 | JSWSTEEL | Iron & Steel | 913.10 | 223,294.40 | 87,084.82 | 0.82 |

| 35 | COALINDIA | Coal | 380.65 | 234,584.25 | 86,796.17 | 0.81 |

| 36 | Bajaj Finserv | Holding Company | 1,580.35 | 252,328.49 | 85,791.69 | 0.80 |

| 37 | DRREDDY | Pharmaceuticals | 1,391.35 | 116,090.33 | 84,745.94 | 0.79 |

| 38 | CIPLA | Pharmaceuticals | 1,506.35 | 121,654.94 | 83,941.91 | 0.79 |

| 39 | SHRIRAM FIN | Non Banking Financial Company (NBFC) | 2,918.50 | 109,752.75 | 81,217.04 | 0.76 |

| 40 | Nestle | Packaged Foods | 2,165.40 | 208,932.86 | 77,305.16 | 0.72 |

| 41 | APOLLOHOSP | Hospital | 7,246.25 | 104,189.96 | 72,932.97 | 0.68 |

| 42 | HDFCLIFE | Life Insurance | 621.60 | 133,818.22 | 66,909.11 | 0.63 |

| 43 | EICHERMOT | 2/3 Wheelers | 4,868.65 | 133,465.50 | 66,732.75 | 0.62 |

| 44 | IndusInd Bank | Private Sector Bank | 953.55 | 74,286.47 | 63,143.50 | 0.59 |

| 45 | SBILIFE | Life Insurance | 1,398.25 | 140,117.09 | 63,052.69 | 0.59 |

| 46 | Adani Ent. | Trading – Minerals | 2,409.25 | 278,070.99 | 61,175.62 | 0.57 |

| 47 | TATA Consumer | Tea & Coffee | 907.40 | 89,783.47 | 58,359.26 | 0.55 |

| 48 | BPCL | Refineries & Marketing | 293.45 | 127,312.38 | 57,290.57 | 0.54 |

| 49 | BRITANNIA | Packaged Foods | 4,765.00 | 114,773.74 | 56,239.13 | 0.53 |

| 50 | HEROMOTOCO | 2/3 Wheelers | 4,239.50 | 84,888.80 | 55,177.72 | 0.52 |

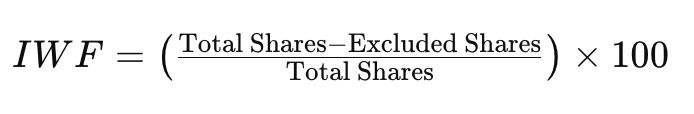

Investible Weight Factors (IWFs): The Core of Nifty Weightage Calculation

IWFs play a key role in calculating the weightage of stocks in the Nifty 50 Index. As the term suggests, IWFs measure the proportion of floating stock available for trading.

IWFs exclude shares held by entities with strategic interests in the company. Who are such shareholders? That includes promoters, depository receipts, associate/group companies, trusts, directors, and several other categories outlined by the NSE.

– The Formula To Calculate IWFs

The formula for calculating IWF and subsequently Nifty Weightage is straightforward but holds significant implications for investors.

Let’s break it down:

IWF =(Total Shares−Excluded Shares) / Total Shares × 100

Where “Excluded Shares” encapsulate shares held by promoters, depository receipts, associate/group companies, trusts, locked-in shares, and other categories specified by the NSE.

Example Of IWF Calculation

Consider a hypothetical company, ABC Ltd., with a total of 1 crore number shares (100%). Following are the list of shares that will fall under the “Excluded Shares” head:

- Promoter and promoter group: 19.75%

- Foreign Direct Investment (FDI): 0.50%

- Shares held through ADR/GDRs: 2.50%

- Equity held by associate/group companies: 0.13%

- Employee Welfare Trusts: 1.46%

- Shares under lock-in category: 14.79%

Using the formula, the IWF for ABC Ltd. is determined as 61%. Let’s see the calculation:

IWF = 100% – (19.75% + 0.5% + 2.5% + 0.13% + 1.46% + 14.79%) = 0.6087 = 60.87%

The IWF value indicates that, out of all 100% shares outstanding of the company, only 61% of the total shares are available for trading.

What is the significance of Nifty weightage?

Why a stock investor should be aware of this weightage? What is the utility of this information to a stock investor?

Nifty weightage holds value for stock investors due to its impact on the overall performance of the Nifty 50 index. The weightage can also influence individual stocks within it. Here’s why:

– Significance of Nifty Weightage:

- Reflects Market Influence: Nifty weightage represents the relative market capitalization of each constituent company. Companies with higher market values have a greater impact on the index’s movement. Understanding weightage helps investors gauge the influence of individual companies on the Nifty’s performance.

- Identifies Leading Players: By knowing the top-weighted companies, investors can identify potential market leaders. This way the investors can assess the impact of constituent companies on the broader market sentiment.

Note: No matter how small the weight of a company in the Nifty 50 list, if a stock is listed in this Index, it is surely a blue-chip company. Hence, one can be rest assured about their strong business fundamentals.

– Perspectives for Stock Investors:

- Portfolio Diversification: Knowing the weightage allows investors to assess their portfolio’s sectoral concentration. If their holdings are heavily skewed towards a single sector it might indicate a lack of diversification.

- Performance Analysis: By comparing the weightage of specific companies with their individual performances, investors can identify potential discrepancies. If a company with a high weightage is underperforming, it may indicate a drag on the entire Nifty, potentially impacting other holdings.

- Benchmarking: Investors who just want to replicate the Nifty, can hold Nifty constituent stocks in the same weightage. Alternatively, people who desire to outperform the index can give higher weights to aggressive stocks within the Nifty50 constituents.

Benefits of being a Nifty 50 Company

Inclusion in the Nifty 50 benchmark index is a significant milestone for any Indian company. It brings various advantages that enhance their visibility and attractiveness to both domestic and foreign investors. Being part of the Nifty 50 index impacts the visibility and investment prospects of constituent companies.

- Widespread Recognition: Inclusion in the Nifty 50 lends immediate recognition to a company. They become more prominent and are among the actively traded stocks. This heightened visibility attracts attention from market participants, analysts, and institutional investors.

- Higher Trading Volumes: Companies in the Nifty 50 typically experience increased trading volumes. These stocks are a part of the preferred basket for both retail and institutional investors. Higher liquidity often results in lower transaction costs and better price discovery.

- Institutional Investment: Being part of the Nifty 50 makes these stocks more appealing to institutional investors, both foreign and domestic. FIIs and DIIs often use benchmark indices as a reference for constructing their portfolios. Inclusion in the Nifty 50 can lead to higher investments from these institutional players, influencing stock prices positively.

- Inclusion in Passive Funds: The Nifty 50 serves as a benchmark for many index funds and ETFs. Companies included in the index automatically become part of these passive investment vehicles. This results in a steady inflow of money from mutual funds schemes that track or replicate the Nifty 50.

- Increased Research Coverage: Companies in the Nifty 50 index attract more attention from financial analysts and research institutions. The increased research coverage provides investors with more information and analysis.

- Easier Capital Raising: Companies in the Nifty 50 may find it easier to raise capital through equity issuances or debt instruments.

- Positive Impact on Share Price: The positive perception associated with being part of the Nifty 50 often leads to higher valuations. Investors may be willing to pay a premium for stocks included in a prestigious benchmark.

Conclusion

Understanding the Nifty Weightage is imperative for Indian stock investors. Factors like free-float market capitalization and Investible Weight Factors (IWFs) determine the relative importance of individual stocks within the Nifty 50 Index.

The listed companies, showcased with their respective weights, offer investors insights into market leaders and sectoral concentrations. For stock investors, Nifty Weightage holds significance as it influences the overall performance of the Nifty 50 index and individual stock movements.

The companies that are included in the Nifty 50 index give investors (like us) a quick list of fundamentally strong companies.

Moreover, investors can strategically outperform the Nifty 50 index by adjusting stock weights in their portfolios. While adhering to Nifty 50 constituents, allocating higher weights to promising stocks and sectors can enhance returns. This approach allows investors to capitalize on specific stock performances, potentially outpacing the index.

Careful analysis of individual companies can help people assign higher or lower weight to specific companies. Companies whose fundamentals are weak or are looking overvalued shall get less weight and vice versa. By leveraging the flexibility within the Nifty 50 framework, we can optimize our portfolios to outshine the overall index performance.

Have a happy investing.

Suggested Reading: