Kotak Mahindra Bank recently came under the scanner of the Reserve Bank of India (RBI). On April 24, 2024, the RBI took significant supervisory action against the bank due to concerns surrounding its information technology (IT) infrastructure. Let’s see the details of the RBI’s action and its potential impact on the shareholders. We’ll also look at the bank’s response. What’s the road ahead?

The Cause for Concern: Deficiencies in IT Infrastructure

The crux of the issue lies in Kotak Mahindra Bank’s IT systems. Following examinations conducted in 2022 and 2023, the RBI identified severe shortcomings in the bank’s IT infrastructure. These deficiencies included:

- Non-compliance with regulatory guidelines: The bank’s IT systems failed to meet the RBI’s mandatory standards.

- Inadequate data security: The RBI expressed concerns about the bank’s safeguarding of sensitive customer information.

- Frequent outages and disruptions: These shortcomings likely contributed to the major banking outage experienced by Kotak Mahindra Bank in April 2024.

- Unresolved issues: The RBI highlighted the bank’s failure to address previously identified problems despite warnings effectively.

These issues pose a major risk to the bank’s operations, data security, and ultimately, the financial well-being of its customers. The RBI, as the primary regulator of the Indian banking system, felt compelled to intervene to ensure the stability and security of the financial sector.

The RBI’s Action: Restrictions on Growth

In response to the identified deficiencies, the RBI imposed the following restrictions on Kotak Mahindra Bank:

- Ban on onboarding new customers via online and mobile banking: The bank can no longer acquire new customers through its digital channels.

- Prohibition on issuing new credit cards: Issuing new credit cards has been put on hold until the bank addresses the IT concerns.

It’s important to note that these restrictions only affect new customers and credit card issuance. Existing account holders can continue using all banking services, including existing credit cards.

Impact on the Bank and Its Investors

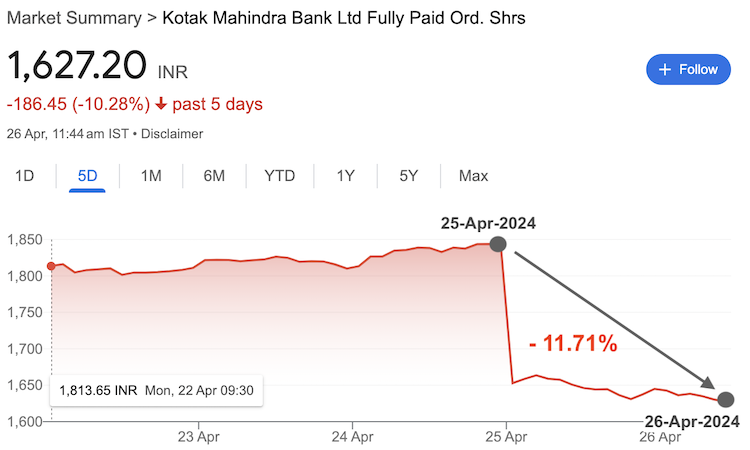

The RBI’s action on such a big bank was like a shockwave to the bank and its investors. Kotak Mahindra Bank’s stock price witnessed a significant decline following the news.

The restrictions on customer acquisition and credit card issuance could potentially hinder the bank’s ability to grow its business in the short term.

Kotak Mahindra Bank’s Response: Commitment to Improvement

Kotak Mahindra Bank has acknowledged the RBI’s concerns and is working diligently to address the identified IT shortcomings. The bank has assured its stakeholders of its commitment to complying with regulatory guidelines and strengthening its IT infrastructure. They are actively engaged with the RBI to resolve the issues and lift the restrictions as soon as possible.

A few facts related to the RBIs ban on Kotak Mahindra Bank that we must keep in mind:

- Period of the Ban: The ban is not likely to go away very soon. An external audit will be conducted after the prior approval of the RBI. If the audit report is as per the satisfaction of the RBI, only then the restrictions will be lifted. In the most likely case, as happened with HDFC Bank earlier, the period of the ban will be around 12 months from its effect.

- Credit Card Renewal: Till the ban is in effect, Kotak Mahindra Bank will not be able to issue new credit cards (online or offline). However, existing credit card users will be able to renew their expired cards as per existing rules. Operative valid credit cards issued by the bank will also continue to work as before.

- New Bank Accounts: If one wants to open a bank account with Kotak Mahindra Bank, one will have to physically walk into a branch to open the account. The ban is only on opening new accounts digitally (online system). For example, Kotak811 accounts are all digital accounts, such account openings will cease till the ban is in effect. However, the existing 811 account holder’s will continue to operate their bank accounts as before.

A Note For Investors Like Us

- Existing Investors: The near-term outlook for Kotak Mahindra Bank’s stock price might be volatile due to the ongoing developments. However, the bank’s previous track record is not so bad. Existing investors shall continue to monitor the situation closely. They must stay updated on the bank’s progress (status of the ban). A close watch is required on how the bank is addressing the RBI’s concerns.

- Prospective Investors: As a potential investor, I would prefer to adopt a wait-and-see approach. While Kotak Mahindra Bank is a big player in the Indian banking system, the IT issues and their resolution timeline require consideration.

The Road Ahead

As of reports published in News18 in 2023, branches and ATM networks of major Indian private banks are as follows:

| SL | Bank Name | Branches | ATM’s |

| 1 | HDFC Bank | 7,821 Nos | 19,727 Nos |

| 2 | ICICI Bank | 6,612 Nos | 17,037 Nos |

| 3 | Axis Bank | 5,100 Nos | 15,000 Nos |

| 4 | Kotak Mahindra Bank | 1,780 Nos | 2,963 Nos |

As you can see, compared to the other private banks, the number of branches and ATMs of Kotak Mahindra Bank is rather low. Most of the customers of the bank are acquired digitally. It means that the ban of RBI on the bank is going to seriously affect its future growth prospects.

The problem with online accounts is that they are mostly low-value accounts. However, the bank is still able to maintain a decent CASA ratio of 47.1% (Q3FY23). In earlier years, their CASA was above 50%. Just for your reference, the CASA ratio of HDFC Bank, and ICICI Bank is around 45% levels.

The absolute value of CASA is not a problem for Kotak Mahindra Bank, but the concern is its falling trend. Deposits drive growth for banks. The CASA ratio of the bank was already falling and now there is this RBI’s ban, Kotak Bank was more dependent on their online banking system to get new accounts and deposits. This door is now closed for the bank for the next 12 months or so. This will surely affect the bank’s future growth prospects.

For me, if the bank corrects by about 20% from its 25-Apr-2024 price of Rs.1,810, it will become interesting. I’ll give this bank serious consideration if it corrects to about Rs.1500 levels.

It is a good bank but it must keep its act together and stay away from the wrath of RBI. The way to do it is to follow the regulations and instructions of RBI more promptly.

Have a happy investing.