This article is for the Gold enthusiasts. Over the past year, the price of this timeless precious metal has skyrocketed by about 15.8%. Surprisingly, both gold and the stock market (Nifty 24%) have done well in this period. This rise has left many investors scratching their heads. A few people are wondering what’s fueling the fire. Let’s try to shed light on the key factors driving this golden surge.

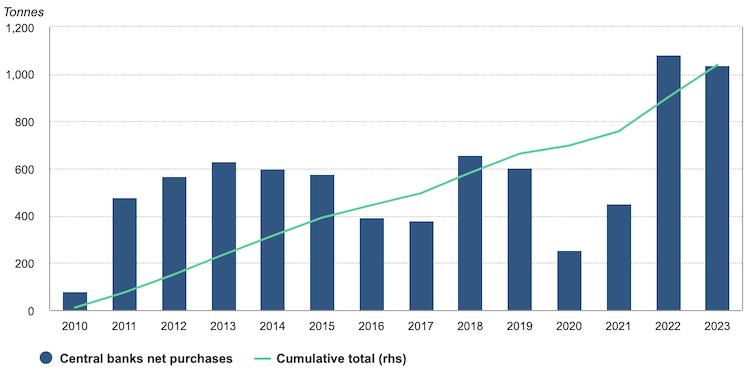

Data from the World Gold Council reveals a global phenomenon. In 2023, central banks across the globe purchased a staggering 400 tonnes of gold. It was the highest level since 1967. This appetite for gold by major financial institutions hints at a deeper strategic play. What is that? It’s possibly a hedge against potential future inflation or a weakening US dollar (the world’s reserve currency).

Meanwhile, geopolitical tensions continue to simmer across the globe. The ongoing Russia-Ukraine conflict has disrupted supply chains. In these uncertain times, investors naturally seek stability. Gold, with its historical reputation as a “safe haven“, has emerged as a popular choice.

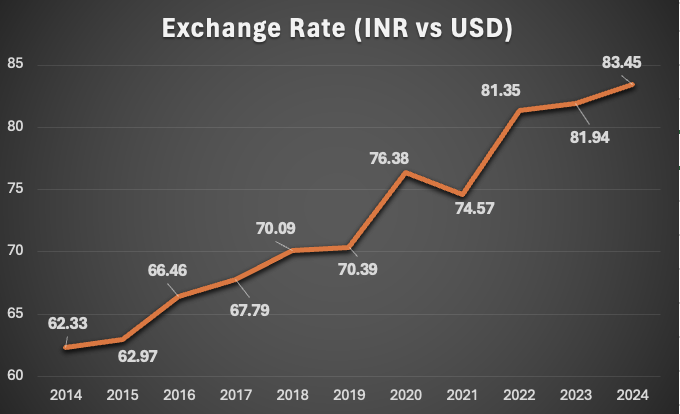

The Indian market presents a unique perspective. Here, the price of gold is influenced not only by global trends but also by the value of the rupee. If the rupee weakens against the US dollar (a historical trend), it translates to a higher price tag for gold imports. This means that even if the global price of gold remains flat, Indian consumers might see a domestic price increase due to currency fluctuations.

The story behind the gold price surge is multifaceted.

Let’s delve deeper into these key drivers and explore what they mean for our investment decisions.

Safe Haven in Stormy Seas

Let’s talk about the historical appeal of gold during times of economic turmoil.

Stocks and bonds can fluctuate wildly based on company performance or interest rates. However, gold’s value has a proven track record of stability over millennia. This stability stems from several factors.

Gold has a finite supply: Unlike currencies that can be printed at will by governments, there’s only a limited amount of gold readily available on Earth. This limited supply, coupled with its enduring global demand (from jewelry to electronics), creates a natural hedge against inflation. When inflation erodes the purchasing power of currencies, gold’s value tends to rise proportionately.

This historical performance is backed by data.

According to a study by the World Gold Council, gold has delivered positive returns in 12 out of the last 15 years when global equities (stocks) experienced negative returns. This track record of stability during economic downturns is precisely why investors turn to gold as a safe haven.

Weak Rupee

There is a unique situation for Indian investors. The price Indians pay for gold is heavily influenced by the exchange rate between the rupee and the dollar. Here’s why:

- Import Reliance: India is the world’s second-largest consumer of gold. It relies heavily on imports to meet its domestic demand. Since these imports are priced in US dollars, a weakening rupee directly translates to a higher cost for gold imports. This means that even if the global price of gold remains flat, the rupee’s depreciation can inflate the domestic price tag for Indian consumers. Data from the Reserve Bank of India (RBI) shows that over the past decade, the rupee has depreciated by an average of 3% annually against the US dollar.

- Psychological Impact: Another factor to consider is the psychological effect of a weakening rupee on gold prices in India. When the rupee falls, there’s a perception that gold becomes a more valuable asset. This further fuels the demand and pushes the domestic prices even higher.

By understanding this intricate relationship between the rupee and the global gold price, Indian investors can make more informed decisions about buying gold.

The Interest Rate

There is also an interplay between interest rates and gold prices. Traditionally, a negative correlation exists between the two. Here’s how it works:

- Opportunity Cost: When interest rates are high, investors can earn better returns on fixed-return investments like fixed-deposit schemes or bonds. Gold doesn’t generate any interest or dividends. This can lead to decreased demand for gold when interest rates are rising. This can potentially push the gold price down.

- Real vs. Nominal Returns: Another key factor to consider is the impact of inflation on interest rates. Interest rates are often quoted in nominal terms, meaning they don’t take inflation into account. If inflation is high, even a seemingly attractive interest rate might not be enough to outpace rising prices. In such scenarios, gold, which historically acts as a hedge against inflation, becomes a more appealing option. Investors flock to gold as a way to preserve the purchasing power of their wealth, potentially driving up its price.

This relationship isn’t always straightforward, and other factors can influence gold prices.

Central Banks

Central banks haven’t been sitting on the sidelines during this gold rush. In fact, they’ve emerged as major players. They have been aggressively accumulating gold reserves in recent years. Data from the World Gold Council paints a clear picture: 2022 and 2023 witnessed record-breaking years for central bank gold purchases, exceeding 1,000 tonnes each year.

This insatiable appetite for gold by the world’s financial institutions can strategically push the gold price up. But why do central banks buy gold? Several reasons might be driving this central bank gold rush:

- Diversification: Central banks traditionally hold a significant portion of their reserves in US dollars. However, some might be looking to diversify their holdings and reduce their dependence on the dollar. Gold offers a unique advantage. Its value is not tied to any one economy or government. Hence, it potentially works as a hedge against currency fluctuations.

- Hedge Against Inflation: Central banks are tasked with maintaining price stability within their economies. As inflation concerns rise globally, central banks bulk up their gold reserves as a long-term hedge. Historically, gold has shown a positive correlation with inflation. Its value tends to rise when inflation increases. This allows central banks to potentially offset the eroding purchasing power of their other reserve assets.

While the specific motivations of each central bank might vary, the surge in their gold purchases is a significant development in the global gold market.

Is Gold Right for You?

The recent surge in the gold price in 2022 and 2023 is certainly tempting. But before diving in, it’s crucial to consider gold’s role within your investment portfolio. Here are some key facts to keep in mind:

- Long-Term Play: Gold is best suited for long-term investors with a horizon of at least 8-15 years. While it has recently experienced a significant rise, historically, gold’s returns have been lower compared to stocks. Data from investment research firms shows that over the past decade, the average annual return for gold has been around 7-8%. Whereas stocks (Nifty 50 and Sensex) have delivered closer to 14%.

- Low Liquidity: Unlike stocks or bonds, gold isn’t readily traded on exchanges. If you invest in physical gold, selling it quickly might involve finding a buyer and potentially facing lower prices due to dealer margins.

- Storage Costs: Storing physical gold securely can incur additional costs. You might need to rent a safe deposit box or invest in home security measures.

Here is an article that suggests better ways to invest in gold.

Conclusion

The recent surge in gold prices has undoubtedly captured investor attention. By unpacking the key drivers that push gold prices we can gain valuable insights. However, remembering these crucial considerations is essential:

- Know Your Risk Tolerance: Gold is generally considered a lower-risk investment compared to stocks. However, it also comes with potentially lower returns. Assess your comfort level with market fluctuations and how gold aligns with your overall risk profile.

- Investment Goals: Are you saving for a short-term goal like a down payment or planning for a long-term horizon like retirement? Avoid gold. Gold is a suitable addition for long-term wealth preservation. But, here equity-linked investments offer better growth potential. So, gold is neither a good short-term nor a long-term investment vehicle (if the focus is on growth).

- Portfolio Diversification: The key to a healthy portfolio lies in diversification. Considering gold in our investment portfolio for the sake of diversification makes sense.

Have a happy investing.

Suggested Reading: