How to evaluate a stock price? Is the process of evaluation easy or difficult? How long does it take to evaluate stocks? Is it really possible to arrive at some meaningful conclusion upon stock evaluation?

These are few common queries that we have, related to stock analysis. Let me give you a quick answer first. Stock evaluation is important before buying any stock. This step is unavoidable.

The process of stock evaluation is easy? Not really. Probably this is the reason why less people resort to a detail stock analysis. What makes it difficult is, ones inability to read and comprehend financial reports of companies.

Read financial reports like Warren Buffett…

How to become Warren Buffett? I will say, we should not try. Why? Because more effective will be to be oneself here. Why I say so?

Because reading and comprehending financial reports is a skill. It is a kind of skill which can be related to the coding skills of a software programmer.

So this closes the doors for we common men when it comes to stock evaluation? Why I say so? Because majority of us do not know how to read financial reports, right?

In this case, how we can evaluate a stock? There are ways. This is what I will explain in this article.

But one thing is for sure, if you want to build a product like Facebook, your coding skills should be like Mark Zuckerberg. If you want to pick stocks like Warren Buffett, scrutinising financial reports is a must.

Having said that, there are tools available for non-finance guys, which can help in stock evaluation. These tools can transform us into Warren Buffett in stock picking? No.

[One such tool is my stock analysis worksheet. It is simple excel based tool which can help us to frame a first impression about the stock.]

Are these tools effective. Yes, at least it builds a fair perception of the company in the minds of the investor. The decision taken by the investor, with this perception, can be fairly accurate.

So coming back to our topic, how to evaluate a stock price? Which tools a common man can use to evaluate a stock price? The easiest one is, use of “Financial ratios“.

But before we can move ahead and see which financial ratios we can use to evaluate a stock, allow me to make a point.

There is always a confusion among investors that, which stock to buy? Even when we buy a good stock, it seems to render loss. Why this happens?

I want to make this point that, why evaluation of stocks using financial ratios is necessary. Why even a good looking stock does not always show positive results. How stock evaluation process (financial ratios) can help us to deal with this fallacy.

Why it is important to evaluate a stock price using financial ratios?

To understand this, let’s take a real life example. Suppose you bought stocks of ITC which is known for its very good business fundamentals.

You bought stocks of ITC in Feb’15 at a price of Rs.264 per share. But a year later, ITC was trading @Rs.194 per share.

As an investor, will you not be worried and confused to see that? You took all care, and bought a good stock like ITC, still its price is falling. Such behaviour of stock’s creates a panic in ones mind, right?

But allow me to say this, “Our uninformed, panic reactions does more harm to us than the volatile market itself”. This is where the requirement to evaluate a stock price becomes very important. How?

When we buy a stock, we are actually buying a share on the companies profits. So the right way is to buy stocks which can generate more profit. Which are these stocks?

Stock’s of strong business bought at undervalued price levels.

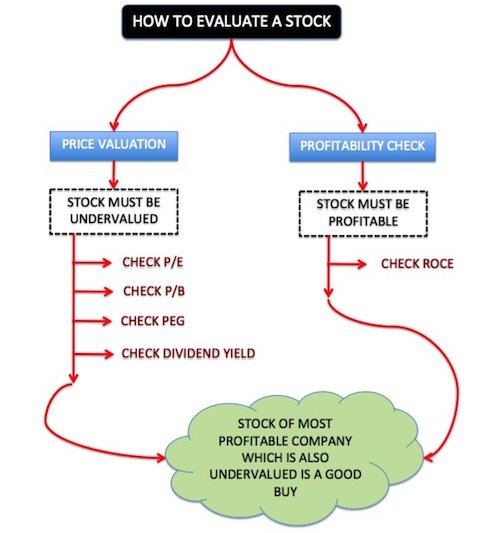

With this understanding, we can now say that there are two parts to stock evaluation:

- Evaluation of business health.

- Evaluation of stock’s price.

We will buy stocks of only those companies whose business fundamentals are strong. They must also be trading at undervalued price levels.

So how this explains our ITC fiasco? There could be two reasons for it:

- The shares of ITC was bought at overvalued price levels, or

- The price is falling due to normal price volatility.

If the shares were brought at overvalued price levels, then it is a problem. This is where evaluation of stock’s price becomes helpful. It will prevent such a misjudgement.

If the share’s price is falling just due to price volatility, no need to worry, it will bounce back with time. In fact, when price will fall, instead of getting worried, informed investors buy more of such stocks.

Hence, knowing how to evaluate a stock price helps investors not to panic when prices falls too much.

People can approach stock evaluation in two ways:

- Detail process: Intrinsic value approach.

- Easy process: Financial ratio approach.

#1. Intrinsic value approach…

Estimating intrinsic value of stock’s is a part of detailed stock evaluation. Why to care to go into details and estimate stock’s intrinsic value?

Because market price of a stock alone can never clarify if a stock is overvalued or undervalued. Neither it can say if the underlying business is healthy or not.

In fact, good stocks often trade at overvalued price levels. Hence if we intend of buy a good stock, there is a high chance that we will buy them at overvalued price levels. How to prevent oneself from committing this mistake? Know the stock’s intrinsic value.

But why good stock trade at overvalued price levels? Because good stocks attract attention of more buyers. Means, demand of good stock’s often exceeds its supply. Hence price of such stocks becomes overvalued.

Buying a good stocks at overvalued price levels is as dangerous as buying a bad stock. Trick is to know the intrinsic value of stocks.

But this is also a fact that estimating intrinsic value is not so easy for common men. So the best available alternative is to take the approach of financial ratios.

#2. Financial Ratio Approach…

If people do not want to go into so much detailing, then the easy way-out is to take the help of financial ratios.

Though use of financial ratio is not a fool-proof approach, but they can give a fair perception about the stock’s health and price valuation.

Let me suggest you a simple trick of finding your own list of top stocks, upon stock evaluation using financial ratios. Follow the below steps and get the results.

#2.1 Prepare a list of top stocks

Make a list of top 100 stock in terms of their market capitalisation in an excel sheet. Once this list is ready, add few new columns in the excel, and start adding following ratios against each stock:

#2.2 Rank the stocks

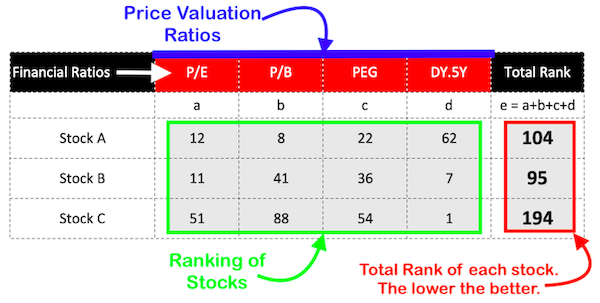

Start giving the ranks to all 100 stocks as explained below:

(1) Stock with the highest Market Cap should get a rank of 1. Similarly, stock with lowest market cap should get a rank of 100.

(2) The stock with the lowest P/E ratio should get a rank of 1. Similarly, stock with highest P/E ratio should get a rank of 100.

(3) Stock with the lowest P/B ratio should get a rank of 1. Similarly, stock with highest P/B ratio should get a rank of 100.

(4) The stock with the lowest PEG ratio should get a rank of 1. Similarly, stock with highest PEG ratio should get a rank of 100.

(5) The stock with the highest dividend yield (5Y) should get a rank of 1. Similarly, stock with lowest dividend yield should get a rank of 100.

#2.3 Screen Top 25 Stocks

After the ranking is done as explained in #2.2 above, next step is to start the screening process. How to do it?

Add the rank obtained by each stocks under head of “Market Cap, P/E ratio, P/B ratio, PEG ratio, and dividend yield”. This will the stock’s Total Rank.

Suppose a stock got the individual ranking as shown below. Its total rank will be like this:

Once the ranks of all 100 stocks are being added, use the filter to sort the column “TOTAL RANK” from lower to higher number.

Means, the stock with lowest cumulative rank will come first, and stock with highest cumulative rank will come last.

Top 25 stocks in this list would be in your watch list.

#2.4 Check Profitability of Business

Evaluate these stocks based on the profitability of its underlying business.

From the list of top 100 companies we have identified big companies whose market price looks fairly valued. But the evaluation process is not complete.

Still we have not checked the business fundamentals of the stocks. To do this, we stick to the basics. The basis is to check, how well the company is utilising its funds to to run its business.

Why to follow this approach to establish profitability of companies? There are some companies which make high profits for one year and then defaults the next year. Investors must be weary of such tricky companies.

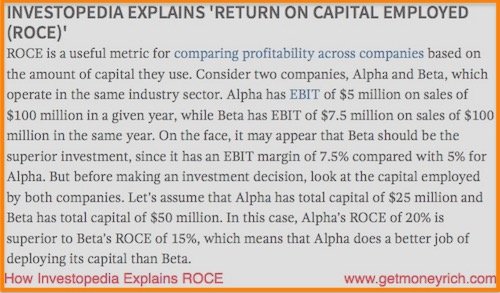

There are financial ratios which can help us to identify companies which are inherently profitable. One such financial ratio is RoCE (return on capital employed).

High ROCE means company is strongly positioned to produce the same levels of earnings in future.

Add another column in your excel sheet. Start adding ROCE figure against Top 25 stocks obtained above. Give these 25 stocks ranks in order of their ROCE.

The stocks with highest ROCE shall be ranked as one (1) and with lowest ROCE shall be ranked as hundred (100).

After the ranking of top 25 stocks is done, the stock getting RoCE rank of one (1) becomes the most preferred stock.

Conclusion:

From the list of 100 stocks, I target the final top 3 stocks in the list. This simple way to evaluate a stock is effective.

Upon application of these screening criteria’s, the stocks that emerge finally are fundamentally strong stocks which are trading at discounted price levels. How? They represent the following stocks:

- Strong stocks ? (high market capitalisation, high RoCE).

- Undervalued stocks? (P/E, P/B, PEG, Div Yield).

Have a happy investing.

Thank you for taking time out and explaining and sharing your knowledge

Content of your website seems to be really helpful, NOwhere I found such important information in such an easy way for eg. definition of the mutual fund.

I hope visitors on your website Increases because the effort you put in this website is worth visiting.

Your website is also underrated sir, it has a lot of gems.

Thank you for the awesome feedback.

Nice

I was looking for something like this. nicely explained. keep it up ?

Thanks for posting your comment. Good that the article was useful.

finally i found one best description to understand the basics of investing. As the disclaimer was very true, this might not be for experts but definitely a best way towards understanding value investing. Thanks Mr.Mani

Thank you for sharing your thoughts.

Hi Mani,

Love the way you’ve structured and optimized your blog.

My doubt is if ratios are blank for a particular stock in that case i can’t assign a rank for that particular ratio my entire calculation goes for a toss.

For eg – SBI today does not have a PE ratio and i can’t even calculate it since the EPS is blank.

What shall I do in that case?

There are two ways of doing it:

(1) Calculate the PE yourself.

(2) Search it is other websites like moneycontrol, economictimes, yahoo finance, etc.