Aarti Industries is one of the prominent players in India’s growing specialty chemicals sector. As an investor focused on long-term potential, I’ve been following the company closely for a while. Over the years, Aarti has expanded its footprint in various chemical segments. It is a part of several industries like pharmaceuticals, agrochemicals, and polymers. But what does this mean for investors with a long-term horizon? Here are a few points that I consider important when evaluating the company’s growth potential.

1. Diverse Product Portfolio and Market Leadership

One of Aarti Industries’ key strengths is its product diversity. The company operates across multiple chemical chains, including benzene and toluene derivatives. These two chemicals have a wide range of end-use applications. This diversification reduces the risk of relying too much on one product or sector. It also enables Aarti to adapt more easily to shifts in global demand.

The company’s is placed well in a niche segments of mono methyl aniline (MMA). This provides Aarti a competitive edge. MMA is widely used in energy and automobile applications, and Aarti has built a strong position in this market. This segment could become even more critical as industries continue to look for advanced chemicals to boost efficiency and performance.

| Key Products | End-Use Industries | Market Position |

|---|---|---|

| Mono Methyl Aniline (MMA) | Energy, Automobiles | Leading Indian Producer |

| Para Di Chloro Benzene | Agrochemicals, Pharmaceuticals | Strong Domestic and Global Demand |

| Nitro Toluene | Dyes, Pigments, Additives | Expanding Capacity |

2. Growth Potential Amid Challenges

While Aarti Industries has shown consistent growth, it hasn’t been without challenges. Like many companies in the chemical sector, Aarti faces volatility due to global factors like fluctuations in crude oil prices. A major performance impact also comes from low-cost Chinese manufacturers. But it would not be an overstatement to sat that the company’s management has historically managed these challenges reasonably well. Aarti Industry’s focus on long-term capacity building and cost optimisations have helped it ride through the storm.

One of the major growth drivers for the future could be the recovery in the agrochemical segment. This market segment has been delayed but is now showing signs of a rebound. This, coupled with the company’s capacity expansion in Nitrotoluene and other key areas, suggests that the long-term outlook remains strong. Though it is also true that the short-term picture is still a bit unclear.

| Growth Driver | Expected Impact | Time Horizon |

|---|---|---|

| Agrochemical Segment Recovery | Higher Revenues from Agrochemicals | Mid-Term (FY25-26) |

| Capacity Expansion (Nitrotoluene) | Increased Volume Growth | Long-Term (5-10 Years) |

| Reduced Chinese Competition | Improved Margins in Core Segments | Gradual Over 2-3 Years |

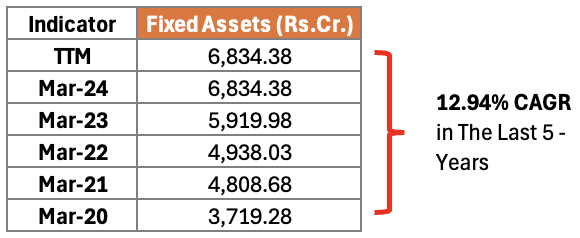

3. Strategic Capex for Future Growth

A key factor that I look at when evaluating Aarti Industries for long-term investment is their capital expenditure (Capex). The company has reinvested in expanding and upgrading its facilities, which positions it well for future growth.

A significant portion of their Capex has gone into asset replacement and building newer capacities that are expected to generate strong returns in the coming years.

This reinvestment strategy, though may look costly in the short term, should lead to improved efficiencies and higher margins. As these investments will start contributing to the company’s revenues, margins will improve.

For long-term investors, this can be an attractive prospect, as the benefits of these capital investments could unfold over the next 5-10 years.

Strong Relationships and Global Presence

Another aspect that stands out for me is Aarti’s long-standing relationships with global clients.

The company has built a reputation for delivering quality products at competitive prices. It’s worth noting that Aarti is less dependent on China compared to other chemical companies. The credit goes to its integrated supply chain. This aligns well with the ‘China+1’ strategy many global manufacturers are adopting.

[What is China+1? It is strategy that involves diversifying supply chains beyond China . I is done to mitigate risks associated with geopolitical tensions, trade disputes, and potential disruptions. This strategy aims to reduce reliance on China as the sole manufacturing hub. Nevertheless, countries also want to maintain access to China’s vast market and competitive pricing.]

Financial Health and Cash Flow Management

| Financial Metric | FY23 | FY24E | FY25E | FY26E |

|---|---|---|---|---|

| Revenue (Rs mn) | 66,186 | 63,720 | 77,447 | 94,578 |

| EBITDA (Rs mn) | 10,890 | 9,760 | 12,545 | 16,400 |

| Net Debt/EBITDA (x) | 2.5 | 3.1 | 3.1 | 2.5 |

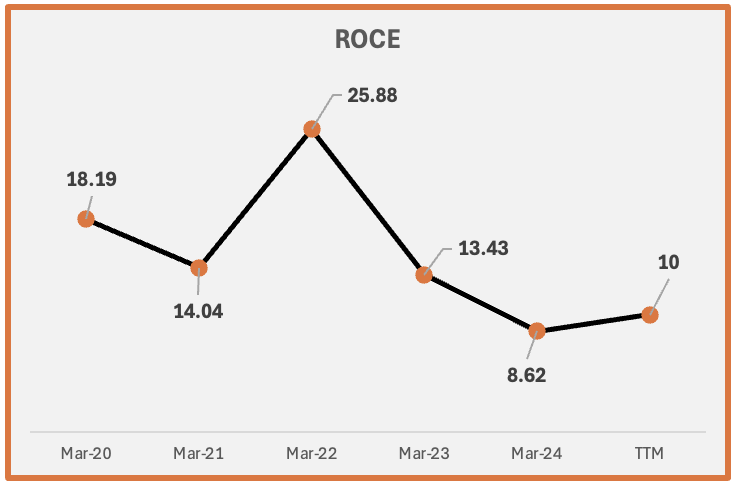

| ROCE (%) | 10.5 | 7.5 | 9.0 | 11.3 |

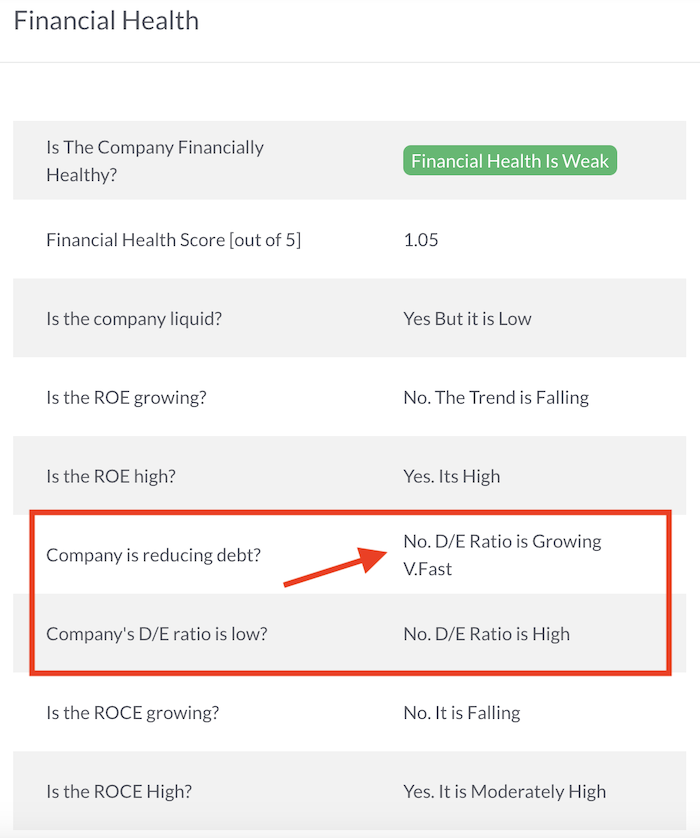

From a financial perspective, Aarti Industries has maintained a reasonable balance between growth and financial discipline.

- The company has faced some pressure on its return ratios due to recent Capex cycles. In the last 5-Years, its ROCE has reduced from 18% to 10% levels. But as these investments mature, I expect these metrics to improve.

- The company’s ability to generate strong operating cash flows, even during challenging periods, is a positive sign for long-term investors.

One thing I keep in mind, though, is the company’s rising debt levels, which are tied to its capex plans. However, as long as these investments start delivering returns, the debt should be manageable. For long-term investors, it’s essential to watch how the company manages this debt in the future.

Final Thoughts

Aarti Industries presents an interesting case for long-term investors in the specialty chemicals space. While the company is facing some near-term headwinds, its strong fundamentals, diverse product range, and strategic investments provide a base for future growth.

For me, Aarti Industries is a case where I can stay invested through market cycles. My focus is on the bigger picture rather than short-term volatility.

Having said that, it is also true that Aarti Industries is also not without risks. It becomes especially more concerning to the impact of China pricing on our speciality chemical industry. Volatility in blobal crude oil prices also effects this industry a lot as it is very energy dependent sector.

But I think, Aarti Industry’s strengths is innovation, market leadership, and strategic Capex allocation. These factors make it a company worth watching closely (with a long-term horizon).

It is not a recommendation. I’m just sharing my thoughts on this company. Do you own analysis before taking any step.

Suggested Reading: