When we think of building wealth, the first image that often comes to mind is a rising bank balance or a growing investment portfolio. But true wealth-building goes far beyond the numbers. It’s a gradual, transformative journey that shows up in daily actions, smart habits, and subtle shifts in mindset.

Contrary to what we think, wealth isn’t just about accumulating assets. It’s also about making choices that prioritize long-term growth and financial security. From how we handle everyday expenses to how we approach learning new skills, these small but powerful indicators signal that we’re progressing in our journey to financial freedom.

Recognizing these signals early on can boost our motivation. It is necessary because wealth building is often a very long journey. Keeping oneself motivated towards the achievement of the goal is also necessary.

We must look out for signals that reveal areas where we’re making steady progress. Over time, these habits create a foundation for lasting wealth. It will transform our relationship with money forever.

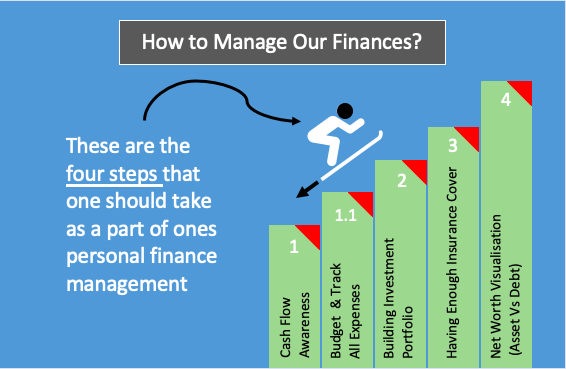

1. Do You Know What Depicts Your Wealth?

If you know the answer to this question and also realize its importance, possibly you are already on the course of becoming wealthy. The answer lies in this word “Net Worth.”

If you have an investment portfolio (with quality assets in it), and you also maintain a credit card, you have a Net Worth.

A positive and growing net worth is what you want to see if you want to get wealthy eventually.

Suppose you have a home loan of Rs.55 Lakhs (liability) and an investment portfolio worth Rs.90 Lakhs (assets) as of today. It means, your net worth is Rs.35 Lakhs.

Net Worth = Assets – Liabilities

An Ideal wealthy person will have near zero debt in his personal balance sheet and an a perpetually growing investment portfolio (asset base).

[Note: The asset base growth happens one way as the market value of the asset rise. How to make the market value of assets rise? By purchasing quality assets at a reasonable price (not at expensive price points). In another way, asset base grows when the income generated by the holding assets (interest, dividend, rental income, etc) are reinvested to buy more assets (like stocks, mutual funds, etc).]

If you are someone who already has a habit of tracking your net worth, it is a clear sign that you are getting wealthier. You can use mobile apps, web apps, or a simple Excel and Google Sheet to track your net worth.

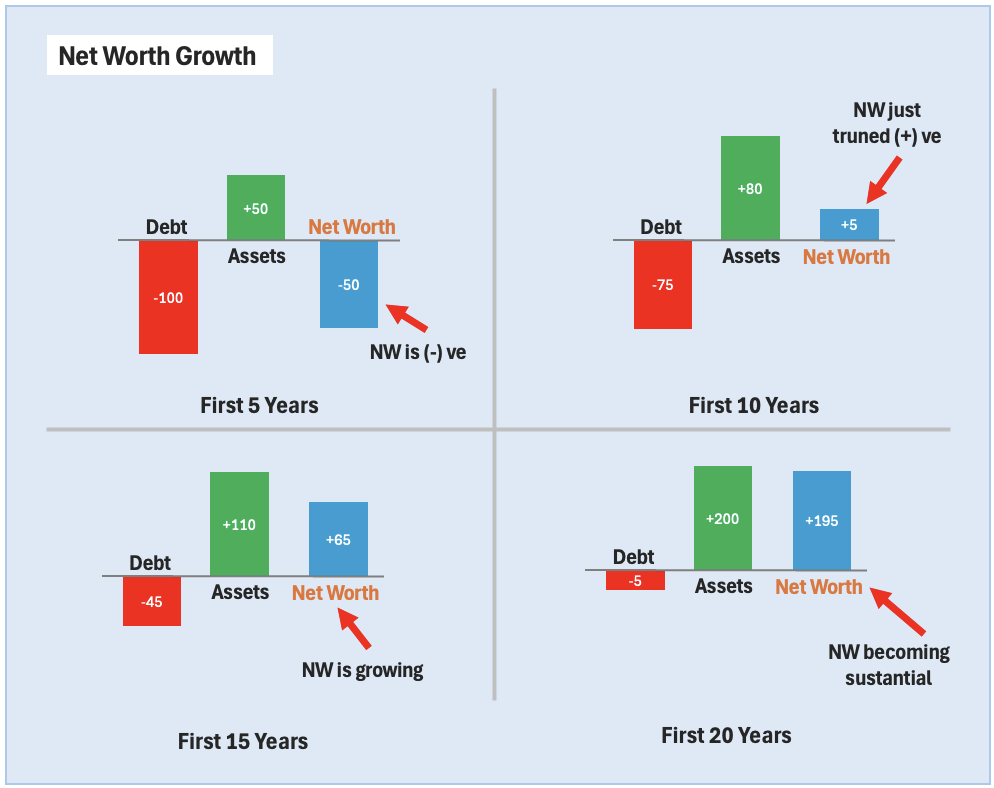

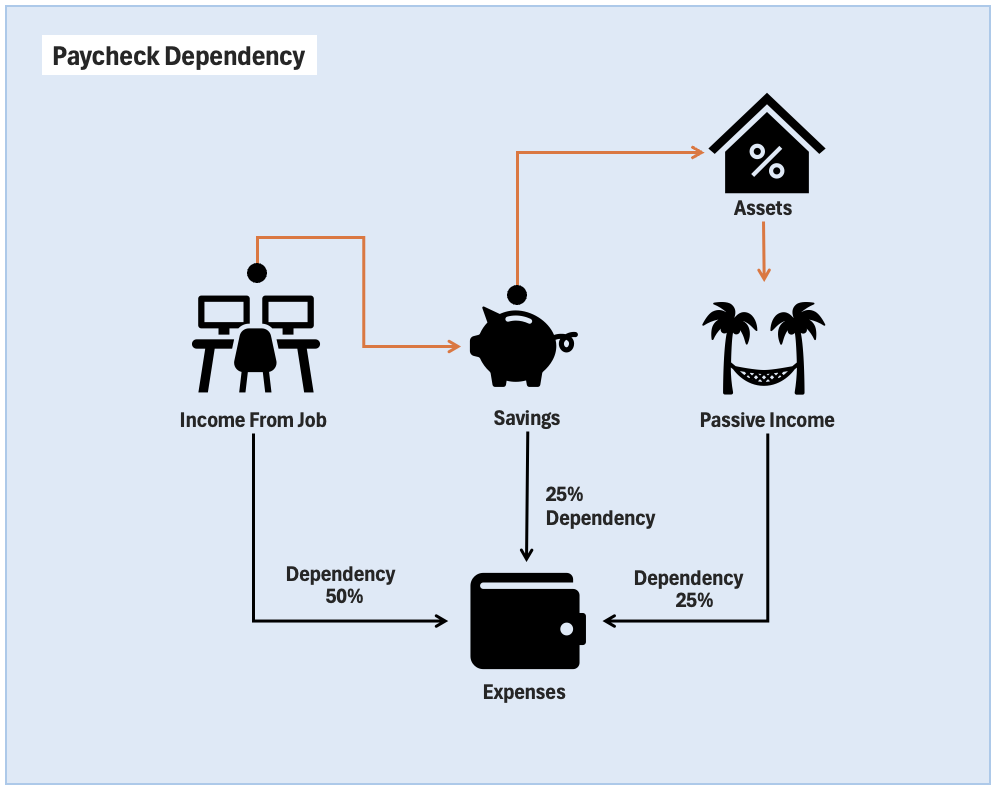

2. How Dependent Are You on Your Monthly Paycheque?

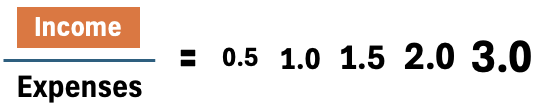

Suppose you earn about Rs.100,00,000 from your job and your essential expenses are only Rs.20,00,000. It means, you are earning about than five times your essential needs. The higher will be this multiple, the better. This is a clear sign that your dependency on your salary is bare minimum.

Generally speaking, a non-wealthy person will be like 100% dependent on his/her salary to pay for even the essential expenses. But a person who is getting wealthier will not maintain such high dependencies on his income from job.

In the above infographics, I have shown an example of a person who is only 50% dependent on the income from his job. Balance expense requirements are met by sourcing money from savings and passive income sources.

If you are someone who is slowly increasing the ratio between your income and essential expenses, it is a sign that you are getting wealthier.

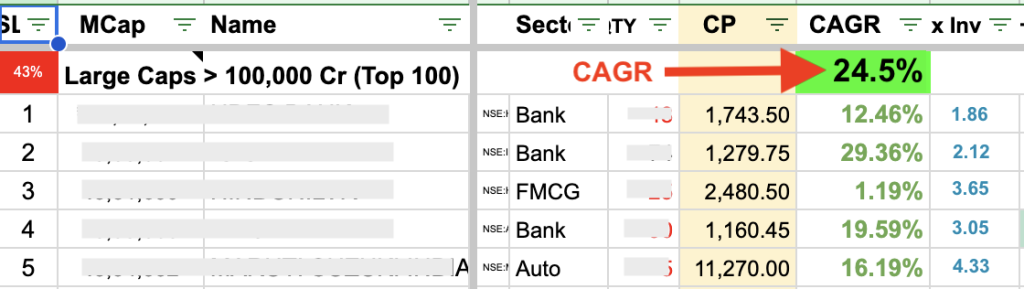

3. Have You Begin Tracking Compounding Returns?

When I first started investing in stocks in year 2008, for the first 12 months, I was happy to see the big return numbers. It was the absolute return numbers. But what will make us wealthy will be compounding returns (not absolute returns).

As the years passed by, the absolute return numbers which was initially showing as 50-60% returns, gradually started to tame down. I remember, during 2012-2013 periods, the compounded return (CAGR) numbers came down to as low as 10-12% per annum.

For a person who started with 40-50% return numbers, 10-12% was disheartening. But I soon realised that these are the real numbers. I should work hard and try to improve the CAGR numbers. That was my second phase of investing. In that phase I realized the power of quality blue chip stocks bought at corrected price levels.

Over all these years, I have realized that, these are the stocks (blue chips and quality mid-caps) that are most capable of yielding high and stable CAGR numbers when held for 8-10 years or more.

Small-cap stocks can also compound very fast, but the probability to pick a wrong one over a fast multi-bagger is very high. Hence, I generally keep 70% of my stock portfolio allocated to quality large and mid-caps.

4. Are You Obsessed With Generating Passive Income Streams?

A stage comes in our investment lifecycle, where the size of corpus, and investment returns are no longer the most critical aspect of investing. They are still important, but not on your top priority.

In this stage, you are also concerned about how much passive income your investment portfolio is generating. During this stage people start investing more in real estate properties, REITs, dividend stocks, bonds, and bank deposits.

When the percentage constitution of these passive income generating assets begin to rise in your portfolio, without you getting worried about your CAGR number, you are surely getting wealthier.

The next stage is even surprising. As people start to get wealthier, they tend to invest more in gold and also keep money in liquid funds. All these investment alternatives yield even smaller returns. In this stage, the mind-set is more tuned to capital protection. Generally, people in this stage have already built enough wealth (they are already rich).

5. Do You See Your Money As A Tool To Make More Money?

There are people who see money as a tool to buy things. I know a person who invariably buy’s a new car every time he gets a nice job. I think, mindset of such people are not tuned to accumulate wealth. No matter how much salary they may draw from their job, their brain-mapping is that of a poor guy. So, in most probability, such people will never built wealthy in their life till they change their mindset.

There are people who see money as a tool to make more money. Every lakh they add to their bank balance, they see it is a tool that can generate Rs.500 per month. There are two advantage of having this mindset:

- First, such people will realize easily that how many more lakhs (x100 times) they need to convert a Rs.500 per month income to Rs.50,000 monthly income.

- Second, such people will rather not see one lakh as a tool to buy their next iPhone. They will see one lakh as a stepping stone to reach the Rupee one crore milestone.

Conclusion

Wealth creation cannot happen till we learn to read the signals that show if we are actually building wealth consistently or not.

It is important to realize that the quantum of our income talks nothing about how wealthy we are becoming. Out ability to convert our income into compounding asset will decide if we are actually wealthier.

Have a happy investing.