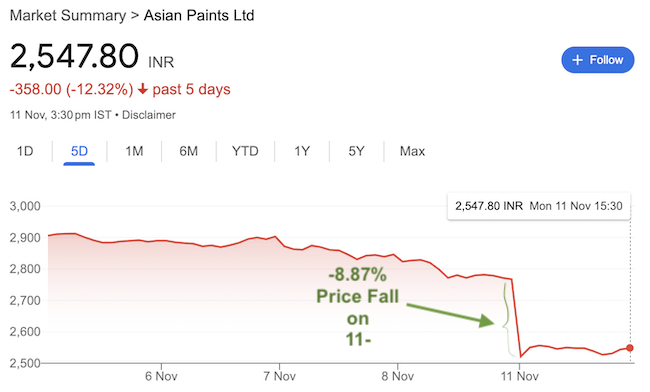

Asian Paints is a titan in the paints and coatings industry. It has been a subject of keen interest among investors and market watchers. It is especially been in the spotlight today (11-Nov-2024) in light of its price correction of -8%. Here’s a comprehensive look into the fundamental aspects of Asian Paints, explaining why it’s currently been in the investors attention.

Company Overview

Founded in 1942, Asian Paints Ltd. has evolved into one of the largest paint companies globally. It has a significant presence in Asia, the Middle East, Africa, and the South Pacific. The company’s primary business segments include decorative paints. It caters to the home improvement market, and industrial paints, serving sectors like automotive and infrastructure.

Financial Health

Revenue Growth: Over the past five years, Asian Paints has shown consistent revenue growth, with a CAGR of approximately 11.50% (from 20,516 Cr to 34,875 Cr). This growth is fueled by demand in the decorative paints segment. The pain sector is gaining strength by India’s construction boom and increasing urban household income.

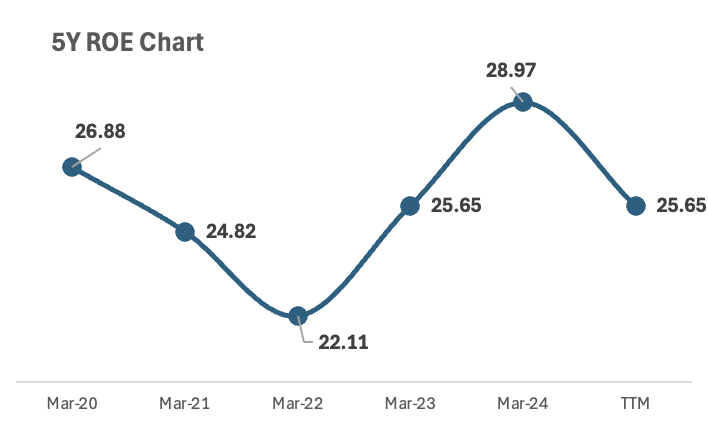

Profitability: The company also has a robust profitability metrics. The Return on Equity (ROE) for recent years has been impressive. In the last five years, its reported ROE has been in the range of 22-28%. Such ROE numbers is a good indicator of the efficient use of shareholder equity. However, recent quarters have seen some margin contraction. In the last TTM, its ROE has fallen from 28.97% to 25.65% levels. It is caused by higher raw material costs and competitive pricing pressures.

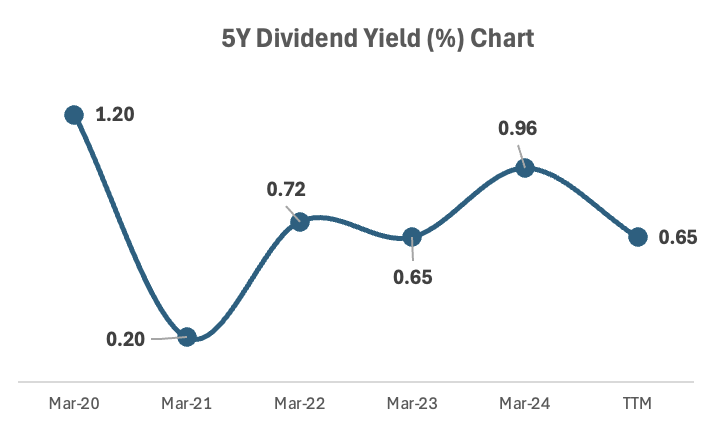

Dividend Yield: Asian Paints offers a dividend yield that has been attractive to investors. On an average, its shares has been yielding dividend of about 1%. This has been a significant factor for investors looking for stable returns alongside growth. Suppose there is an investor who bought Asian Paints shares five year back (at Rs.1500/share price levels). To such investors, Asian Paints would be giving a giving yield of about 1.75%.

Market Position & Competitive Edge

Market Share: Asian Paints commands a substantial market share in India, with over 60% in the decorative paints segment. This dominance is due to its extensive dealer network, brand reputation, and continuous innovation in product offerings.

The dominance of Asian Paints is such that it operates almost like a monopoly business. To highlight this point, allow me to show you the below metric:

In the listed space, Asian Paints has four main competitors: Berger, Nerolac, Akzo Noble, and Indigo Paints. The combined market cap, revenue, and PAT of all these companies comes out to be Rs.106,570 crore, Rs.24,066 crore, and Rs.2,887 crore respectively. Asian Paints is bigger than the combined size of of all these four competitors.

Birla Opus and JSW Paints are new entrants in the Indian paint industry. They are targeting significant growth but have not yet reached the revenue levels of industry leaders like Asian Paints, Berger Paints, or Nerolac.

- Birla Opus: Launched by the Aditya Birla Group in 2024. Birla Opus aims to achieve Rs.10,000 crore in revenue within three years. Presently, the company is scaling its production and distribution to reach the target levels. It has commissioned three plants and plans to expand to six, targeting both urban and rural markets. It will have an extensive range of products and customer-centric services. However, as of now, Birla Opus is still in its early stages and has not yet recorded significant revenues or profits.

- JSW Paints: Established in 2019 by the JSW Group. JSW Paints focuses on both decorative and industrial segment. It aims to create a strong market presence in the coming years. Compared its peers like Asian paint, Berger, or Nerolan, it is still has a small market share.

Both companies are making considerable investments to capture market share in India. But they will need time to build scale and profitability in this mature and highly competitive industry.

Recent Market Trends

As on 11-November-2024, Asian Paints has seen its stock price fall by about 8.85% following its Q2FY25 financial results. This drop brought the stock to a 52-week low. Hence, the stock is prompting a discussion on whether this presents a buying opportunity or there are signs of deeper issues within the paint sector itself.

The stock has been trading at a PE ratio around 53.5, which is below its 10-year average of 63.8. This data is suggesting that while it might be overvalued compared to some peers, it’s also at a historical discount. This could be a reason why we investors should consider re-evaluation of the stock’s worth.

I personally see the current price dip as an opportunity to buy into a blue-chip stock at a lower price. I think that Asian Paints has a long-term growth prospects. But people who will but now will have to hold this stock for a very long-time. A holding periods of 5 years of more, bought at the present price levels, can surely give the best CAGR number for the investors. This is my estimate.

The company has a very strong management and I think an even stronger business fundamentals. Asian Paints is a pro of the paint sector.

Challenges and Risks

The Indian paint market is becoming increasingly competitive with new entrants (Birla Opus and JSW Paints) and aggressive strategies from existing players like Berger Paints and Kansai Nerolac. This factor is putting pressure on margins and market share of Asian Paints.

Fluctuations in crude oil prices, a primary raw material for paints, can significantly impact profitability.

Being tied to the real estate and construction sectors, Asian Paints business fundamentals are very sensitive to economic cycles. interest rate changes, and consumer spending patterns. But I think that as India’s middle will grow and become more affluent, one company that is going to benefit the most from it is Asian Paints.

Conclusion

Asian Paints stands at a crossroads where its fundamental strengths clash with immediate market challenges.

The stock’s current trend is a reflection of this dynamic, where investors are weighing the company’s past performance, future growth prospects, and the immediate economic environment.

For potential investors, Asian Paints represents a case where due diligence on fundamentals, alongside an understanding of market sentiment, is crucial before making investment decisions.

In the world of stock markets, Asian Paints remains a narrative of resilience, innovation, and market leadership.

I personally like this stocks, but even during COVID times, I was unable to add it to my stock portfolio due to valuation bias (in April 2020, Asian Paints was trading at Rs.1550 levels). In those days its PE was at 63 levels.

In the last 1-Years, the stock has corrected by about 24% from its peak of Rs.3400 levels. After this massive negative price movement, the PE of Asian Paints has come down to PE 53 levels. In the last 10-years, it was below the PE53 levels only once.

I think, the stock might still see some downward price movement, but for me personally, I think Asian Paints at Rs.2530 levels is a value long-term buy.

Have a happy investing

I love and appreciate your wisdom Mr Many,

Thank you.

I feel proud and glad that I found your blog

Thank You