[14-Nov-2024] The Indian stock market has always been dynamic. It has been influenced by both domestic and international factors. As we’ve observed through recent trends and historical data, Foreign Institutional Investors (FIIs) play a pivotal role in shaping market sentiment and liquidity. Here’s an analysis (my point of view) of when we might see FIIs returning to Indian stock market.

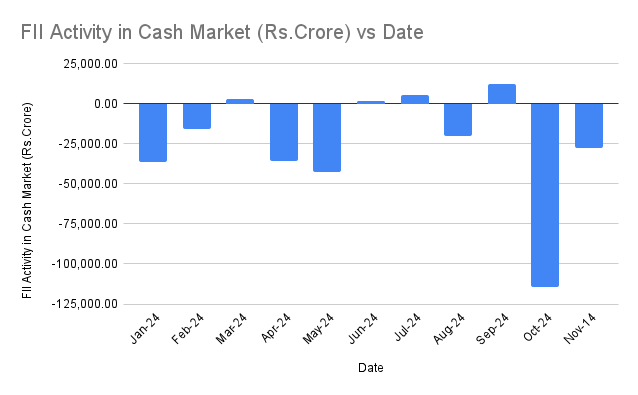

FII Data (Jan to 13-Nov-2024)

| Date | FII Activity in Cash Market (Rs.Crore) | Remark |

| Jan-24 | -35,977.87 | Net Seller |

| Feb-24 | -15,962.72 | Net Seller |

| Mar-24 | 3,314.47 | Net Buyer |

| Apr-24 | -35,692.19 | Net Seller |

| May-24 | -42,214.28 | Net Seller |

| Jun-24 | 2,037.47 | Net Buyer |

| Jul-24 | 5,407.83 | Net Buyer |

| Aug-24 | -20,339.26 | Net Seller |

| Sep-24 | 12,611.79 | Net Buyer |

| Oct-24 | -114,445.89 | Heavy Selling |

| Nov-14 | -27,683.30 | Heavy Selling (First 13 Days of Nov) |

Historical Context

FIIs have historically shown a pattern of entering or exiting markets based on global and local economic conditions, political stability, and market valuations.

For instance, periods of strong economic growth, political stability, and attractive valuations have often led to increased FII participation.

When other major economies like China introduce stimulus measures, investors often look for alternatives where returns might be more lucrative. FIIs funds looks for markets where the investment climate is (as they perceive) as more stable.

This scenario has played out multiple times in the past. In the past, we’ve seen India often becoming an attractive destination. These are times when investors seek to diversify or when other markets underperform.

Suggested Reading: Top Indian stocks FIIs may buy when they return to the Indian market.

Current Economic Climate

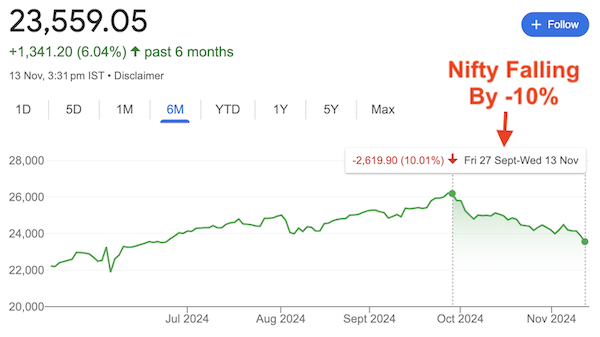

The Indian market in October and November 2024 has experienced significant FII outflows. In these two months, the Nifty50 index have fallen by about -10% from its Sep’24 peak.

This could be due to several reasons including high valuations in some sectors, global economic uncertainty, or the allure of other emerging markets.

With high inflation rates impacting consumer spending and potentially slowing economic growth, FIIs might be cautious.

However, if there’s an expectation of rate cuts from major economies like the USA, which could reduce the cost of borrowing globally. This activity of rate cuts in USA will make India appealing again due to its growth potential.

The Donald Trump Factor & Strength of USD

Donald Trump’s policies and the anticipation of his economic agenda have had a noticeable impact on the USD’s strength and eventually impacts FIIs inflows in India. How?

Let’s under first, how Donald Trump factor is strengthening the USD.

- Trump’s advocacy for tax cuts, increased fiscal spending, and a more protectionist trade policy generally leads to higher inflation expectations.

- Higher inflation typically leads to higher bond yields in the US. Why? Because the Federal Reserve may raise rates to curb inflation. It boosts the bond yields, as new bonds must offer higher returns to attract buyers.

- Higher bond yields attracts foreign capital seeking better returns. This influx of investment strengthens the dollar in the short term.

- It is point worth nothing that, though investors are chasing the higher yields here, but in the long-term risk of inflation is also building.

- What is the result? In short term, the USD will strengthen (due to bond investments) but in long term, its purchasing power (globally) will go down (due to inflation)

- This scenario often results in a stronger dollar in the short term due to higher bond yields as investors seek to capitalize on these returns.

These tariff policies of Trump, if enacted, could eventually lead to global trade slowdowns. It will lean to inflationary pressures. If there will be higher inflation in USA, it will undermine the dollar’s strength in the long term.

Now, let’s understand how stronger dollar effects FIIs flows in India.

- The strengthened USD can indeed influence FII behavior regarding investments in India.

- A stronger dollar makes investments in emerging markets like India less attractive due to currency risk. When the dollar appreciates, the value of returns from markets like India, in USD terms, decreases.

- Additionally, if investors anticipate that Trump’s policies will bolster the US economy more than others, there’s an incentive for them to reallocate capital to the US.

Therefore, the strengthened USD under Trump’s influence could be contributing to FIIs exiting the Indian market. These investors are seeking better yields or less risk in their home currency.

Predictions for FII Return

Should the US Federal Reserve pivot towards rate cuts as anticipated by some market observers, this could lead to a reevaluation of investment strategies by FIIs. Lower rates often mean cheaper borrowing costs, which could encourage investment in high-growth markets like India.

The current political set-up in India, especially with the new NDA government in place for the next 5 years, is positive signal for foreign investors. But it is not enough to bring the traction of funds flows back to India. New pro-reform policies can be a green light for FIIs looking for long-term investment opportunities.

Indian private banking, FMCG, and Pharma space currently looks better valued as compared to other sectors. If FIIs decided to return back, they have these three reasons to park their funds in. These sectors will continue to perform as India grows over time. In turn, these sectors might attract FIIs seeking specific sector exposure rather than broad market investments.

If the Indian market undergoes further correction, it will make stocks more attractively priced. This could act as a catalyst for FII return.

When Might We See FIIs returning to India?

- Short Term (April 2025):

- The return of FIIs in the short term could be influenced by immediate economic or political catalysts.

- For instance, if the US Feds unexpectedly cuts rates, this would reduce the attractiveness of US assets due to lower yields. It will redirect capital towards markets like India.

- Additionally, a favorable outcome in the forthcoming Indian state elections will signal political stability. It is also a sign of pro-business environment. This political action may restore FIIs confidence in India’s growth story.

- Moreover, if there are signs of easing global tensions or a resolution to ongoing trade disputes, this could also prompt a swift return of capital to emerging markets.

- Medium to Long Term (End of 2025 or into Q1 2026):

- For a sustained return, several structural factors need alignment.

- Continued economic reforms in India, such as improvements in business regulations, infrastructure development, and fiscal discipline, would enhance India’s appeal.

- If inflation in India is managed well, maintaining economic stability, it would provide a reassuring environment for long-term investments.

- Global economic recovery, particularly in major economies, could lead to increased liquidity and risk appetite among investors. As India is generally viewed as a high-growth destination, the FIIs flows will come into India.

- Additionally, if global interest rates remain low due to ongoing economic recovery efforts worldwide, the search for yield would naturally drive investments towards markets offering higher returns like India.

Conclusion

The return of FIIs to the Indian market will hinge on a mix of global economic cues, local policy effectiveness, and market valuations.

Historical patterns suggest that after periods of selling, FIIs do return. But the timing remains speculative. Potentially within the next few months to a year, FIIs will eventually start buying Indian market.

There are some FIIs who have left India for China. I personally do not think that China story will continue to attract FIIs for ver long. As their hidden agendas (for their own goods) will eventually start becoming visible. This is the time when FIIs will start diverting their funds back into alternative countries like India.

We must keep our eyes on global interest rate trends. It is a strong signal of when FIIs might come back with renewed vigour.

Have a happy investing.

FII participation is highly influenced by global economic shifts, and periods of market volatility can lead to significant outflows, as seen in India’s recent dip. While this creates short-term challenges, it also presents opportunities for market correction and long-term growth as investor sentiment stabilizes.

Appreciate your comment