In recent trading sessions, shares of Honasa Consumer, the company behind the popular beauty brand Mamaearth, have experienced a significant downturn. It has left many investors puzzled and concerned. In this blog post, I will try to delve deep into the reasons behind this drastic fall. At the end of this post, I’ll talk about my personal take on this share as a long term investor in Indian stocks.

The Disappointing Financial Performance

The immediate trigger for the fall in Honasa’s share price was the release of its Q2FY25 earnings.

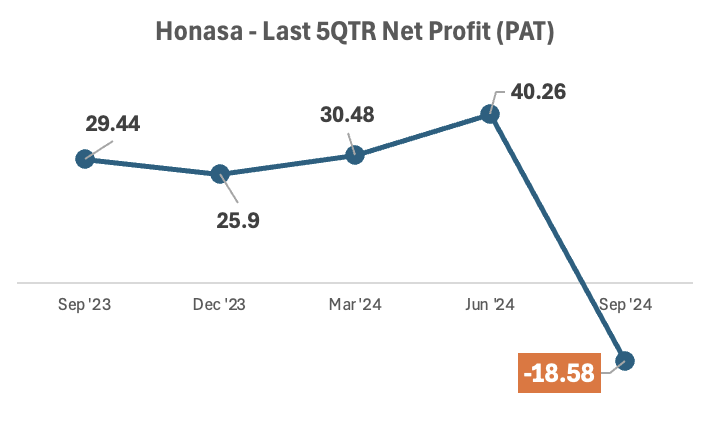

The company reported a consolidated loss of Rs.-18.58 crore, a sharp reversal from the profit of Rs.29.44 crore in the corresponding quarter of the previous fiscal year. Even in the last QTR (Q1FY25) ending June’24, the reported profit was Rs.40.26 crore.

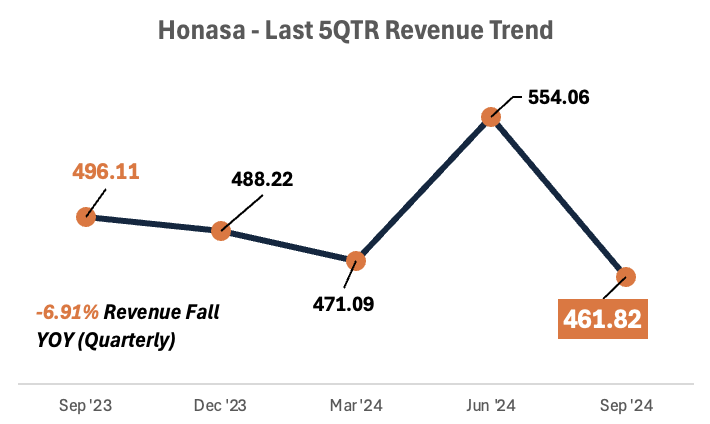

This financial underperformance was not just about profits; revenue also decreased by -6.91%% year-on-year to Rs 462 crore.

Such numbers were a stark contrast to investor expectations. Hence, it lead to a rapid erosion of confidence.

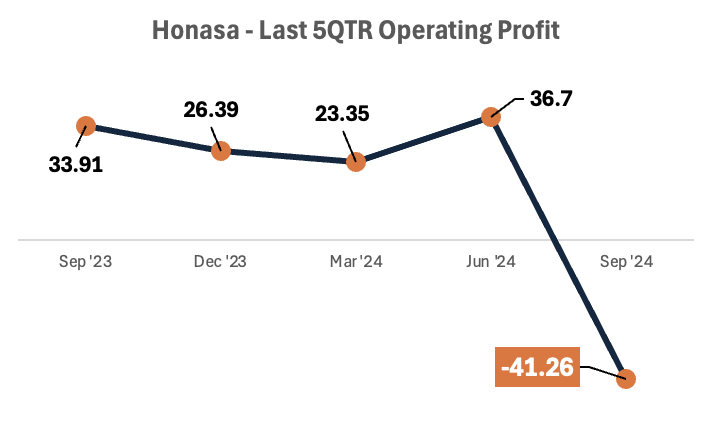

The decrease in operating profit of the company, I think, is the main concern of the investors. Operating profit going in the negative further highlighted inefficiencies or unexpected costs. This inefficiency, perhaps, was further highlighted by revenue contraction.

2. Strategic Transition Challenges

Honasa’s shift towards a direct-to-consumer (D2C) distribution model through its initiative, Project ‘Neev’, has introduced temporary disruptions.

This strategic pivot aims at streamlining operations but has resulted in inventory management issues. It seems, this is the main reasons, affecting the company’s short-term revenues.

The transition, while potentially beneficial for long-term growth, has immediate negative impacts due to the costs associated with restructuring.

The uncertainty it brings regarding future profitability and market share has caused a current in shift in the business fundamentals.

3. Market Sentiment and Valuation Concerns

The market’s reaction to Honasa’s earnings wasn’t just about the numbers but also about broader sentiments.

Honasa went public with its IPO getting listed on 10-Nov’23 with high expectations. But the recent earnings have placed it below its IPO price. It is a signal of a loss of investor trust in its valuation.

The beauty and personal care sector is increasingly competitive. There are low entry barriers that allows new brands to emerge rapidly. This competition, combined with changing consumer preferences towards more online and direct purchasing, pressures existing players like Honasa to adapt quickly or risk losing market share.

The stock’s fall reflects a reassessment of Honasa’s growth prospects.

Personal Point of View as a Long-term Investor

As a long-term investor with a 5-10 year horizon, the current situation with Honasa Consumer presents both risks and potential opportunities.

Here are my considerations:

- Market Leadership and Brand Strength: Mamaearth has built a recognizable brand identity. People know it as a natural and eco-friendly beauty segment in India. The company’s ability to adapt and innovate could still lead to substantial growth. If it successfully navigates its distribution challenges, it can grow in future.

- Innovation and Expansion: Honasa’s portfolio includes multiple brands. It is a confirmation showing diversification potential of the company. If the company can leverage this portfolio to capture more market segments effectively, there’s a case for future growth.

- Valuation: The current dip in share price might have corrected some of the overvaluation from its IPO. I think, potentially it presents a buying opportunity for someone who believes in the company’s long-term strategy.

- Risks: The sector’s low entry barriers mean that Honasa must continuously evolve to stay ahead, which adds to the investment risk. Moreover, at present, the sentiments for this stock is too low. I think, price may still see further correction in times to come.

Conclusion

Given these points, I would cautiously consider buying Honasa shares at this juncture.

For me personally, the dip in price does offer a chance for long-term gains if the company can stabilize and grow.

However, I would keep a close watch on their recovery strategies, particularly how they manage costs and expand their market presence.

If Honasa can demonstrate a clear path to profitability and operational efficiency in the next couple of quarters, it might merit a position in a diversified long-term investment portfolio.

But, for now, my investment would be a small. It will be kind of a speculative stake rather than a significant portion of my capital. But most likely, I will wait for further price corrections expected in next few weeks.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.